123fahrschule SE (123F): Distributing the German Driving School Business

A highly successful digital-driven driving school chain digitalizing the german driving school industry

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Summary

123fahrschule (Ticker: 123F) is a nanocap (market capitalization below €50 million) operating in the german driving education business and achieved a 116% increase in revenue, surpassing €16 million in 2022

EBITDA has been trending upwards recently turning from negative €-556k (in Q1 2022) to €155k

German driving school market is projected to reach a substantial market volume of around €3.2 billion by 2025 with an average profit margin of 32% in 2018, highlighting the profitability of the industry

Key opportunities arise from the advantages of 123F’s in-house developed digitalization platform, facilitating consolidation from small to mid-sized school owners to larger entities in an highly fragmented market which presents favourable conditions for further mergers and acquisitions

Key challenges for the overall industry is regulatory unclarity regarding online theory driving education, the shortage and aging of driving instructors. 123F has already taken steps to address this issue with the acquisition of FahrerWerk GmbH in 2021

Introduction of 123fahrschule SE

123fahrschule SE is a digital-driven driving school chain based in Germany that offers a wide range of digital solutions. The company's core competence is the digitally supported training of private individuals for the B-segment driving licenses wither further expansion into professional driving education for the C and D-segment licences. 123F, with around 55 physical driving schools nationwide it is already the largest driving school chain in Germany. The founder and CEO, Boris Polenske, brings a track record of expertise in digitalization, with previous successful experiences in digitizing Gelbe Seiten (Yellow Pages) and co-founding pkw.de. He is also the founder and CEO of Klick-Ventures, a venture capital firm that holds a 16% stake in 123F.

123F's operational business can be categorized into three main pillars

driving education for private customers (german driving license classes A, B) which accounts for more than 80% of the company's revenue

driving education for professional drivers (german driving licenses C, D)

training programs for driving instructors via the acquisition of FahrerWerk GmbH in 2021

With its innovative, in-house developed platform and digital approach to driving education, 123F stands out from traditional analog driving schools, offering a unique selling proposition in the industry. Streamlining operations through an integrated online platform, including the Meine 123fahrschule mobile app, it provides students with an efficient and digital driving education experience. From online registration and theory exam preparation to progress tracking and bookings management, 123F offers a comprehensive suite of services that enhance the learning journey.

Combining their digital online business with a growing portfolio of owned driving schools, 123F has expanded to 55 locations as of December 2022, positioning themselves for remarkable growth and success in the driving education industry.

A significant development indicating positive progress for the online driving education industry is the recent decision by the Conference of Transport Ministers in Germany, which signals a willingness to approve e-learning on a permanent basis, provided that the quality requirements are met as with the previous face-to-face instruction. This would allow 123F to continue providing online theory education after the COVID pandemic period and expand market share.

Industry & Business Model

Note: The information provided in the following overview about the driving school industry is based on the latest available MOVING industry report from 2021. This report is updated every two years and offers valuable insights into the industry's trends and projections. The report is only available in German and therefore, any charts or data used from the report would be in German as well.

According to the latest MOVING industry report from 2021, the German driving school market will reach an estimated volume of approximately €3.2 billion in 2025, rising from €2.5 billion in 2020 (5.22% CAGR). This upward trajectory presents a golden opportunity for 123F with a current market cap of €24 million to secure a significant share of the industry's revenue potential.

An encouraging trend within the industry is the substantial rise in the average revenue per driving school. From 2015 to 2018, the average revenue per driving school increased by 24,0%, climbing from €168,785 to €209,216 and according to the estimates of MOVING, it will reach €330,000 in 2025. This positive trajectory underscores the growing demand for driving school services and creates a favorable environment for sustained revenue growth for 123F.

In 2018, the average profit margin for a driving school was 32% of the annual revenue, amounting to approximately €66,000 based on the average revenue of €209,418. This robust profit margin showcases the financial viability and potential profitability of driving schools in the market. It is noteworthy that this high margin is achieved even without or with minimal digitalization cost benefits as the majority of driving schools operate with a more traditional, less digitalized business model. This situation presents significant opportunities for 123F to achieve even higher margins once it attains scalability and operational efficiency by leveraging its growth strategies and capitalizing on market consolidation.

Interestingly, the largest driving school companies with annual revenue exceeding €500,000 have an average profit margin of 20%. Despite higher revenue, these schools face higher personnel costs, accounting for 39% of revenue, while driving schools with revenue below €100,000 have personnel costs at around 5.7% and those with revenue between €100,000 and €500,000 have personnel costs around 29.0%. As a result, the average profit margin decreases with increasing revenue, emphasizing the importance of managing personnel costs effectively for sustained profitability within the driving school industry.

The driving school market is highly fragmented, with a significant portion generating of the market being dominated by driving schools generating revenue between €17,500 and €250,000. These schools collectively represent more than 50% of the market. Furthermore, 98% of all companies in the industry generate an annual revenue of less than €1 million.

Another observable in the past years is that the number of driving schools with revenue below €100,000 is decreasing, while the number of driving schools with revenue greater than €100,000 is increasing which indicates a further consolidation within the driving school industry and allows 123F to expand its presence and gain a larger market share.

One of the key challenges the industry faces is the ageing of driving instructors with high average age at 53.8 years (2019) that impacts business owners in many ways including the fact that driving school owners will consider selling their businesses in the coming years due to the lack of succession planning.

However, the lack of driving instructors also presents opportunities for 123F to capitalize on M&A by targeting particularly small driving schools where the succession process can be more challenging. Recognizing the importance of qualified driving instructors for their organic growth, 123F has strategically addressed the issue by acquiring FahrerWerk GmbH in 2021, a subsidiary responsible for training driving instructors in their own training facilities. By incorporating FahrerWerk GmbH into their operations, 123F can enhance their organic growth and maintain a competitive edge in the industry.

Despite the acquisition of the largest driving school chain in Germany, Rettig-Gruppe, by the Finnish CAP-Group in 2021, which resulted in a combined annual revenue of around 40 and a workforce of approximately 550 employees, the market still remains highly fragmented and dominated by small size driving schools. Given the projected addressable market volume of over 3 billion euros by 2030, the driving school market still presents opportunities for a few dominant players to emerge.

Bull Case

123F's in-house developed digitalization solution gives them a competitive advantage by streamlining operations and enhancing efficiency, allowing them to outperform smaller competitors in the fragmented market

The highly fragmented nature of the driving school market presents favorable conditions for 123F to consolidate smaller to mid-sized driving schools into larger entities, creating synergies and paving the way for potential mergers and acquisitions that can fuel further growth for the company

The projected industry size of €3.2 billion by 2025, coupled with the historically high average profit margin of 32% in 2018, underlines the significant profitability potential for 123F and positions it favorably to capture a substantial share of the market.

Bear Case

Despite the projected substantial market volume of the German driving school market by 2025, regulatory uncertainties surrounding online theory driving education pose a significant risk to 123F's growth potential and its ability to consolidate the market, should the regulatory environment become more restrictive or unfavorable to online education

Additionally, the highly fragmented nature of the market, although presenting opportunities for mergers and acquisitions, also poses challenges. Competition from other players, both small and large, could limit 123F's ability to gain significant market share and sustain its growth trajectory

Financials & Key Figures

123F has experienced remarkable financial performance since the IPO. Its revenues have been steadily increasing, reaching €16.7 million in 2022, showcasing a remarkable growth rate of 114.8% compared to the previous year's revenue of €7.8 million. The driving education business for private customers accounted for approximately €13.47 million, representing a significant percentage of the company's total revenue.

As for 2022, 123F has shown significant improvement in its EBITDA performance. The EBITDA loss decreased to €-2.6K from €-3.8K in 2021, marking an improvement of almost 30% year-on-year.

While there is still room for further improvement to achieve positive margins, the positive trend indicates steps towards enhanced profitability and financial performance. In addition, it's important to note that personnel costs amount to approximately €12 million, representing around 67% of the company's revenue which is mainly driven by 123f’s focus on expanding its operations through the acquisition of new driving schools and other investment. These acquisitions entail costs related to integrating the acquired schools into the 123f network and providing education and training to the staff members.

In terms of its balance sheet, 123F had €2,614 million in borrowings as of December 2022, with €1,910 million classified the current portion of long-term debt, while holding €0.3 million in cash and deposits. With a quick ratio of 0.66, 123F lacks a comfortable liquidity position, indicating an insufficient degree of liquidity. Furthermore, the cash ratio paints an even bleaker picture, revealing a dire liquidity position where only €0.05 of total cash & cash equivalents is available for every €1 of current liabilities.

Financial leverage, however, appears to be at comfortable levels, with total-debt at only 12,8% of equity and only 8,7% of assets financed by debt.

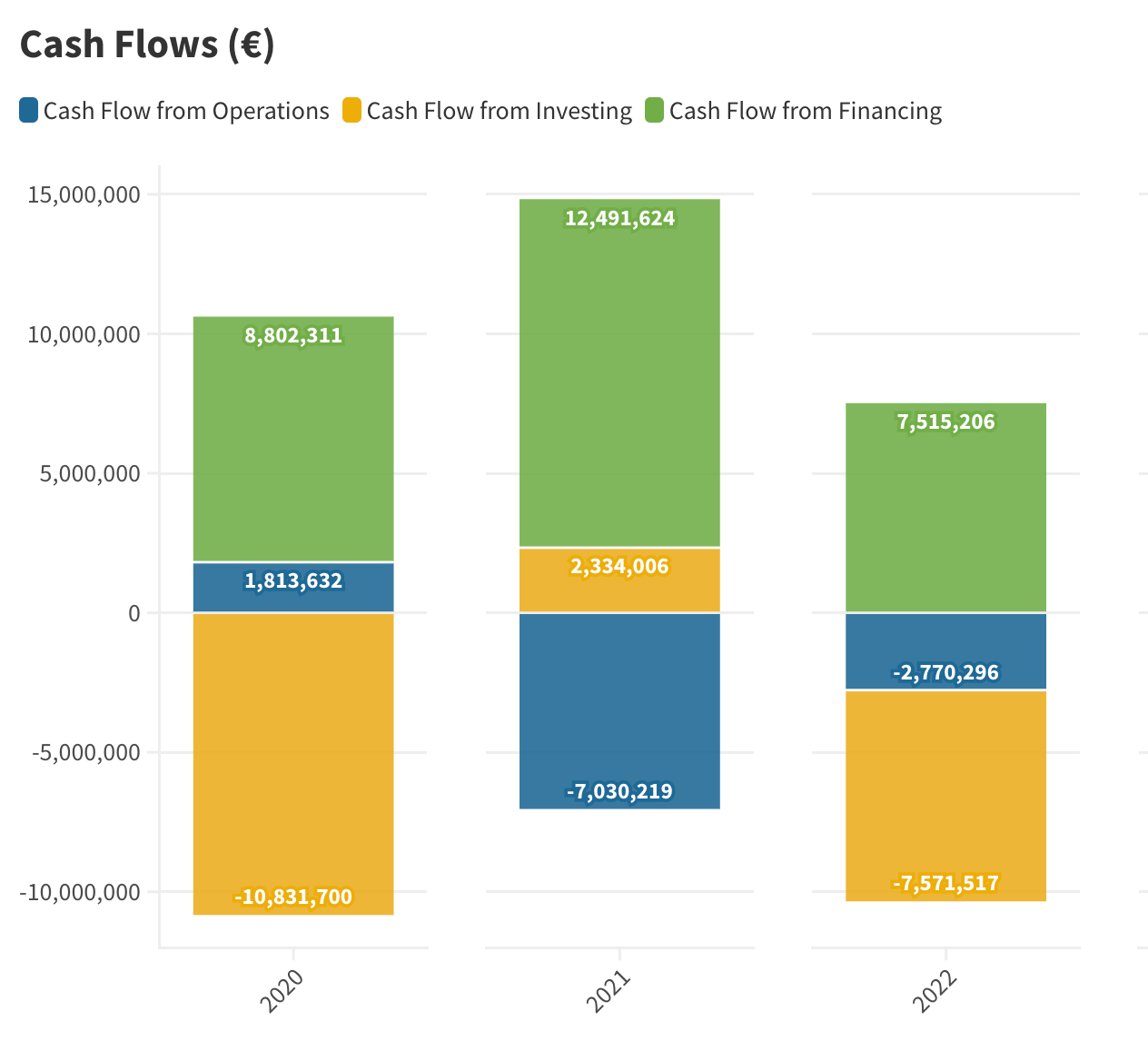

In addition to the provided balance sheet information, it is essential to examine the cash flow statement. As of 2022, 123F has not achieved operational profitability, as indicated by its operating cash flow of €-2.7 million.

Furthermore, due to the continued investments, the cash flow from investing activities stands at €-7.85 million, contributing to a net negative change in cash when combined with the cash flow from financing activities. The available cash balance is a critical measure, particularly for smaller enterprises without significant cash reserves. In the case of 123F, it underscores the continued reliance on external financing for the company's growth and investment activities. However, given the phase of the company as a startup, it is not entirely unusual to experience negative cash flow in the early stages and needs to be closely monitored over the next quarters and years.

Shareholders

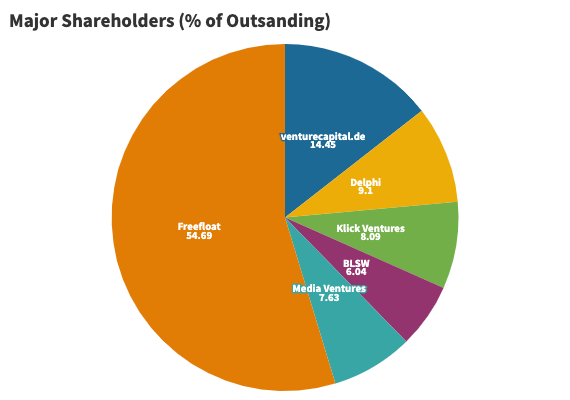

As of the end of April 2022, the company had 3,107,354 shares issued, with no shares in treasury. Free Float accounted for approximately 47,5% of total.

The largest shareholder Venturecapital.de, Delpi, Klick Ventures (founded by Boris Polenske), Media Ventures and BLSW are venture capital firms/funds., and approx. half of the shares are attributed to the free float or public ownership.

One crucial aspect to highlight is that 123F primarily finances its expansion strategy through capital increases. This approach allows the company to raise funds needed for growth and investment in key areas such as technology, infrastructure, and market expansion.

Depending on the specific terms and conditions of the capital increases, existing shareholders may face dilution of their ownership stake as new shares are issued. However, this financing strategy also offers potential benefits to shareholders. The additional capital injected into the company can support accelerated growth, increased market share, and potentially enhance long-term shareholder value.

Outlook

As highlighted in the annual report 2022, the management's clear focus and outlook for 2023 are centred around achieving profitability and positive EBITDA. In Q1 2023. Consequently, the company has decided not to pursue any planned acquisitions in 2023 until the profitability goal is reached. According to the latest Q1 2023 results, 123F achieved a record-breaking revenue of €5.1 million in the first quarter of 2023, representing a 45% YoY (previous year: €3.5 million) and a significant improvement in EBITDA from €-556k (in Q1 2022) to €155k, an increase by €711k. For the full year 2023, 123F anticipates sales to reach at least €20 million, along with positive EBITDA. With a promising projected market size, favorable profit margins, and M&A opportunities, 123F is poised for success, solidifying its position as a prominent player in the driving school industry.

Valuation

In light of the unique characteristics and challenges faced by 123F, a nanocap company in its early lifecycle stage, traditional valuation methods may not yield realistic numbers or accurately capture its potential. Thus, a valuation using Prof. Damodaran's Top Down Approach for early stage companies was employed to assess 123F's intrinsic value. For a comprehensive understanding of this methodology, please refer to the paper linked here.

Key assumptions made for steady state of 123F (expected in ten years from now)

Market share of 3%

Profit Margins of 20%

Tax rate of 30%

Reinvestment based on revenues to capital ratio of of 1.0 (based upon revenues and capital invested in 2022)

Cost of Capital of 10% (average estimate based on two analyst coverage of the company)

In conclusion, with quite conservative assumptions and multiples, the calculated intrinsic valuation of approximately €11 per share suggests a potential upside of around 42% from the current price of €7 per share. Incorporating an additional margin of safety of 40%, the estimated value of €5 per share aligns closely with the closing price observed in May of this year.

Reference

123F’s Annual Report 2022 https://www.unternehmen.123fahrschule.de/_files/ugd/ece538_e04a6e39667944d5b5577a66785f9eab.pdf

123F’s Company Presentation from June 2022 https://www.unternehmen.123fahrschule.de/_files/ugd/ece538_051b1a36d5574a27b71c02a8c413316f.pdf

MOVING Industry report 2021

https://www.moving-roadsafety.com/veroffentlichungen/branchenreport/Acqusition of FahrerwerkGmbH News https://www.marketscreener.com/quote/stock/123FAHRSCHULE-SE-120976460/news/123fahrschule-SE-acquired-Das-Fahrer-Werk-GmbH-for-128-0-6-million-37412540/

Acqusition of Rettig Gruppe by CAP News

https://groblin.de/neues/mehr-umsatz-und-gewinn-fahrschule-rettig-gruppe-setzt-starken-wachstumskurs-fort/123F’s Q1 2023 Result News

https://www.eqs-news.com/news/corporate/123fahrschule-expects-positive-ebitda-for-q1-2023-revenue-expected-to-increase-by-40-to-e5-million/1782937