🧰 An Investor's Digital Toolbox

Exploring the best 10 (free) tools for in-depth investment research, including some use cases

In today's digital age, the world of finance and stock market investing is at our fingertips. But with an abundance of tools and platforms, the challenge is picking the right ones to guide our decisions. Whether you're a seasoned investor or a newcomer, having the right set of tools can make all the difference.

Now, let's delve into my personal top 10 go-to tools and platforms that have earned a permanent spot in my investment research process.

1️⃣ Koyfin

Koyfin is a comprehensive financial data platform, delivering detailed analytics and visualizations for stocks, ETFs, and other securities. It's highly customizable, featuring a useful screening tool. By combining market data with resources like news, filings, and transcripts in one location, Koyfin simplifies the process for investors seeking to track and make informed decisions.

Use Case:

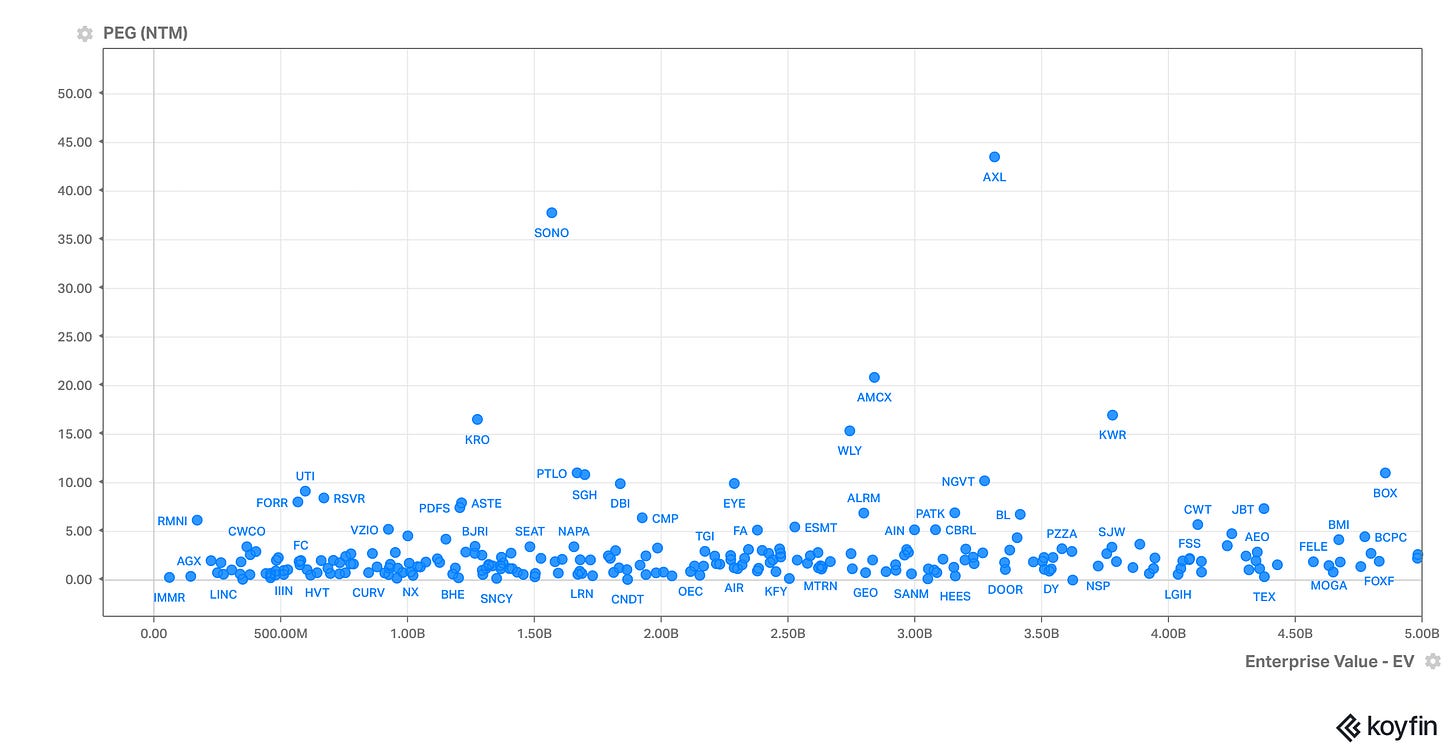

Use the Market Scatter function from the Analytics bar to visualize the relationship between two metrics by creating a scatter plot.

For example, select the Russel 2000 index and plot Enterprise Value (EV) vs. Price/Earnings to Growth (PEG) ratio. This scatter plot provides a perspective that combines the total value of a company (including its debt and cash) with its earnings growth prospects.

2️⃣ Finviz

Finviz is a comprehensive stock screening tool that enables investors to scan and screen over 10,000 of stocks. It's one of my go-to for quick market screening.

Use Case:

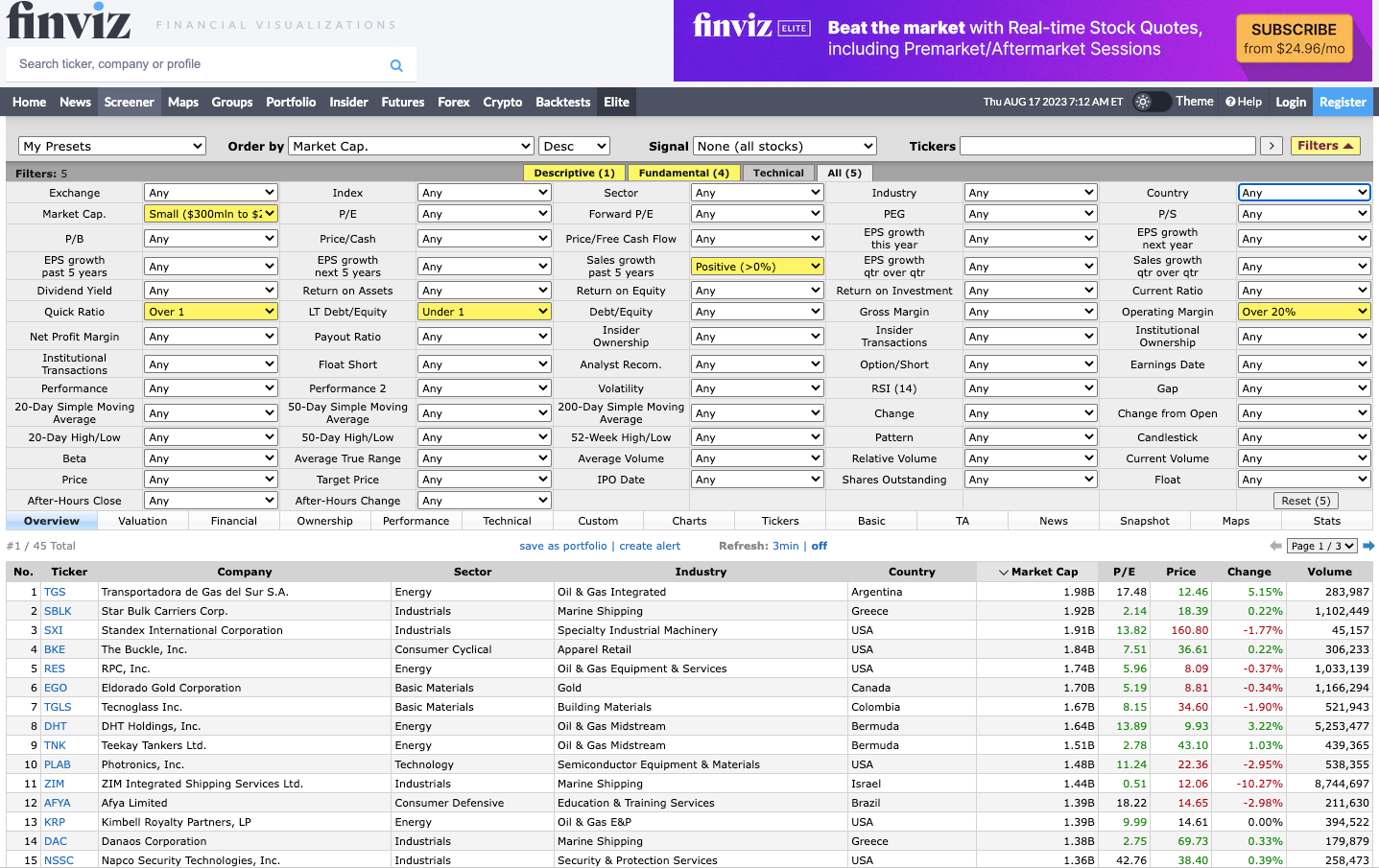

Build a quick small-cap quality screener using some profitability and efficiency metrics.

3️⃣ Stratosphere

Stratosphere provides a platform allowing users to dive deep into a company's financials, visualize key data, and screen for new investment opportunities. Their Segment & KPI data provides investors with insights that go beyond standard financial reports and tools, distinguishing Stratosphere from others.

Use Case:

Analyze a company/business specific KPI such as daily active users or segment revenues, gaining insights deeper than most market tools provide.

4️⃣ Dataroma

If you are curious, where the world famous investors are investing, Dataroma is the right place to look.

Use Case:

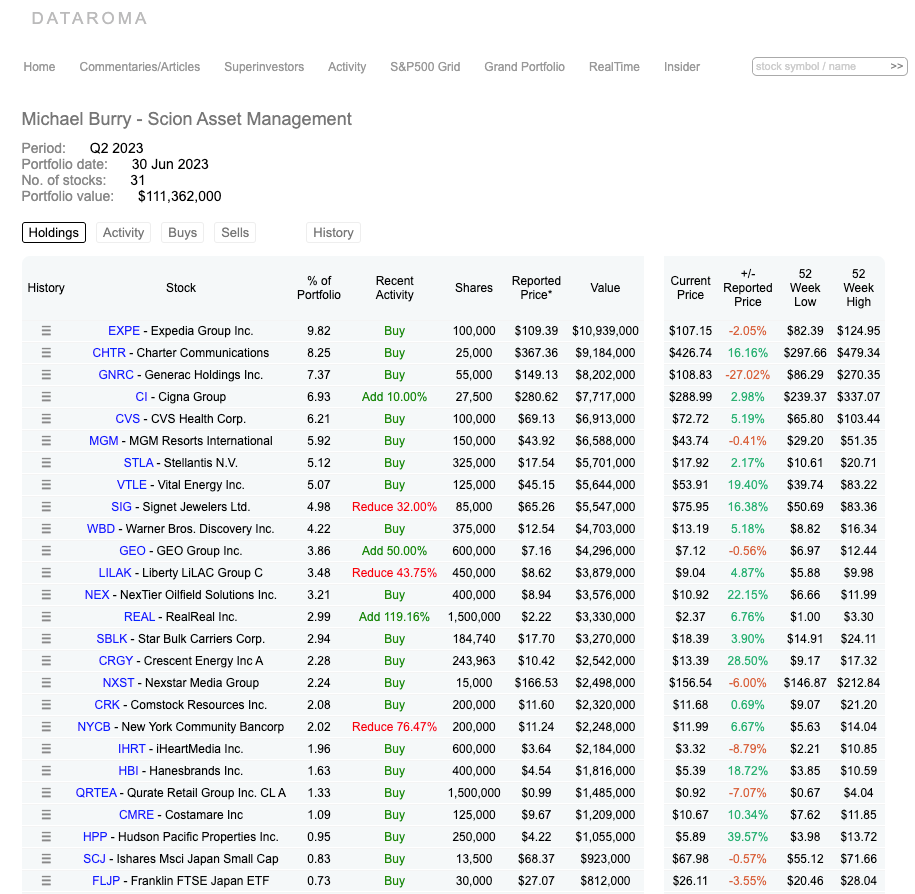

Check the latest additions to the portfolios of renowned investors like Warren Buffett and Michael Burry.

5️⃣ ROIC.ai

ROIC.ai provides key financial metrics, transcripts, a tracker of the biggest 1,000 stocks on one page and.

Use Case:

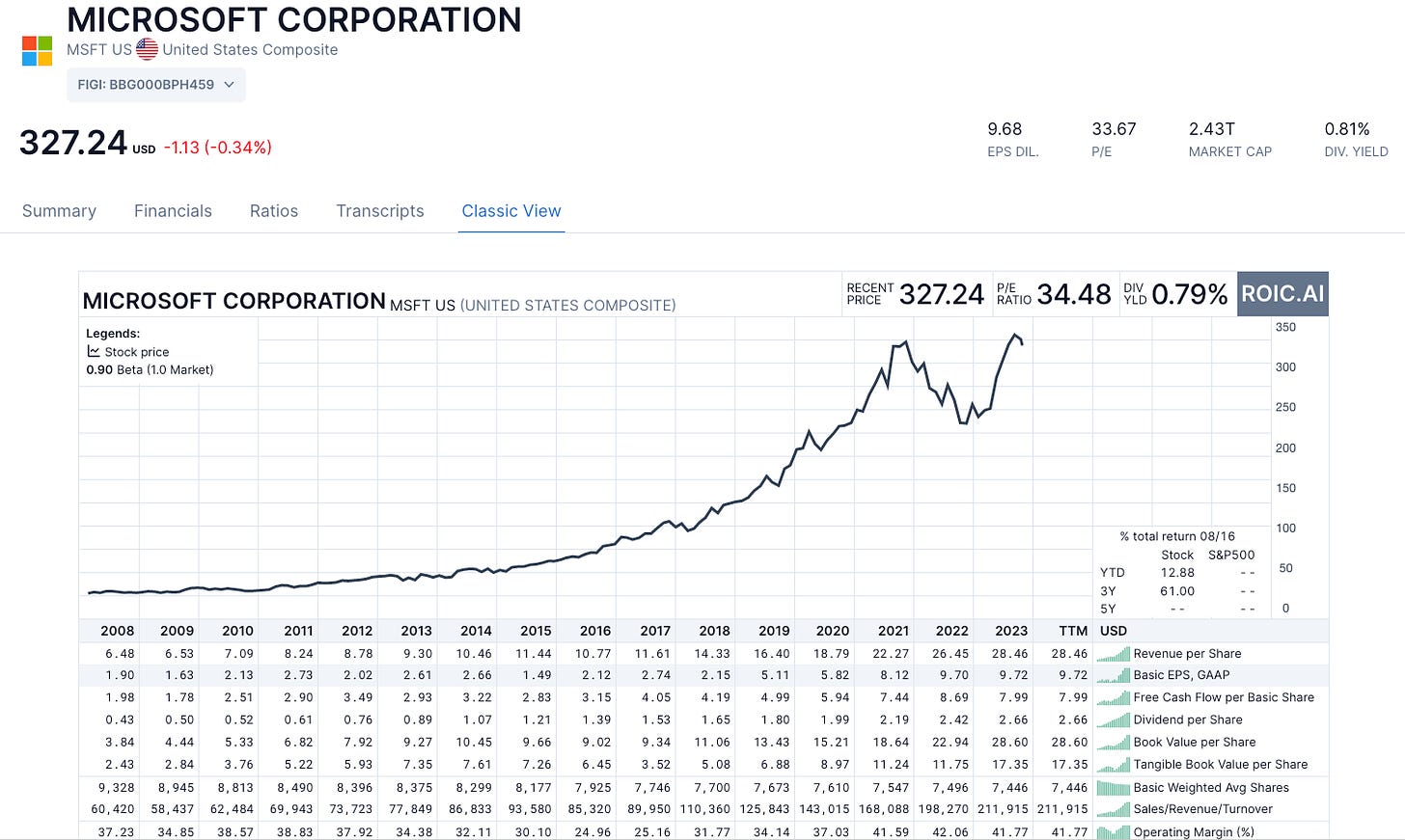

Get a comprehensive overview of company financials, spanning up to three decades, all conveniently available on a single page

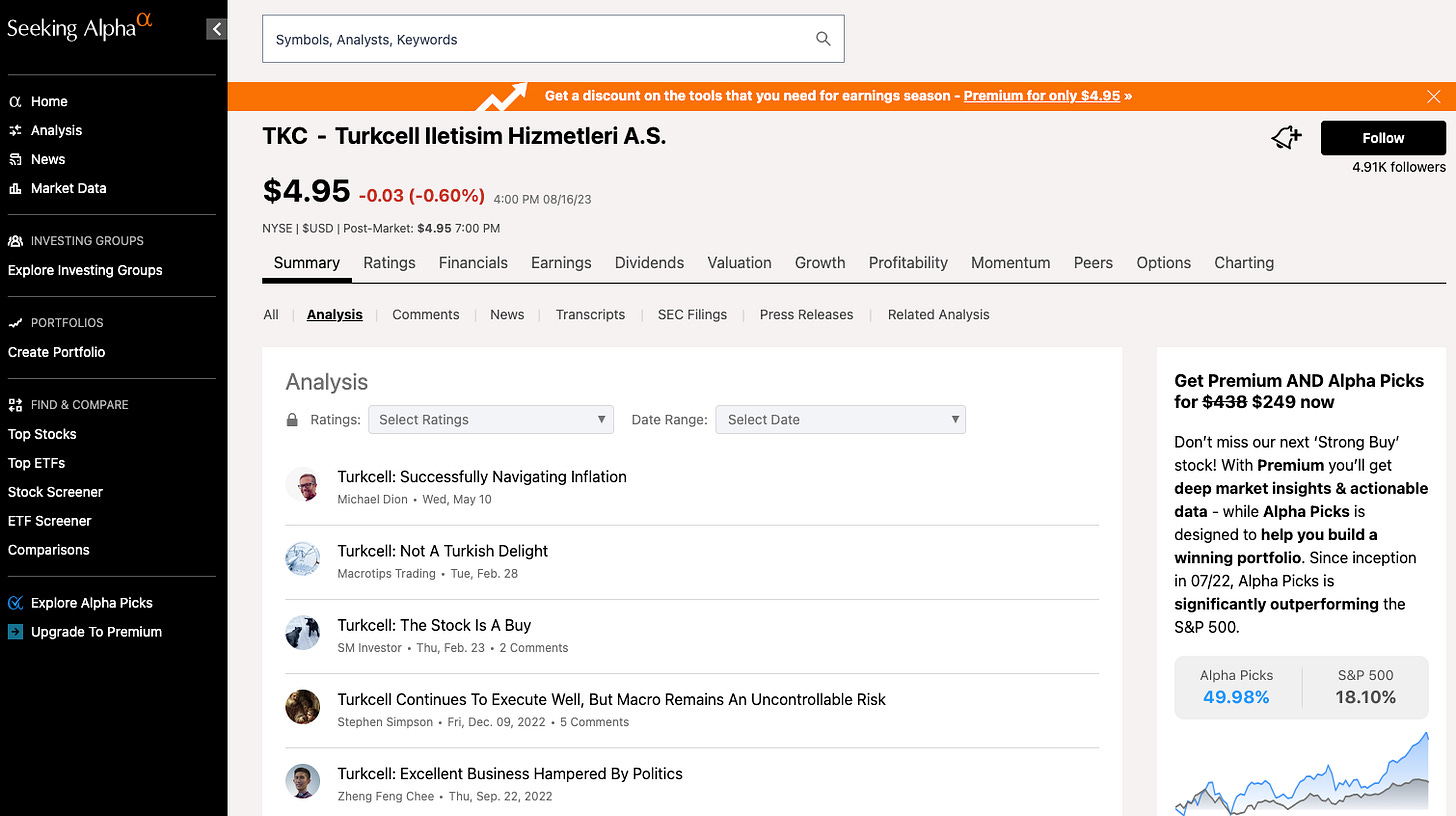

6️⃣ Seeking Alpha

A platform that offers crowd-sourced content on stocks, markets, and economic trends, along with earnings call transcripts and investment ideas.

Use Case:

Before making an investment in a new company, read multiple articles on Seeking Alpha to gain diverse viewpoints on the company's potential growth and associated challenges.

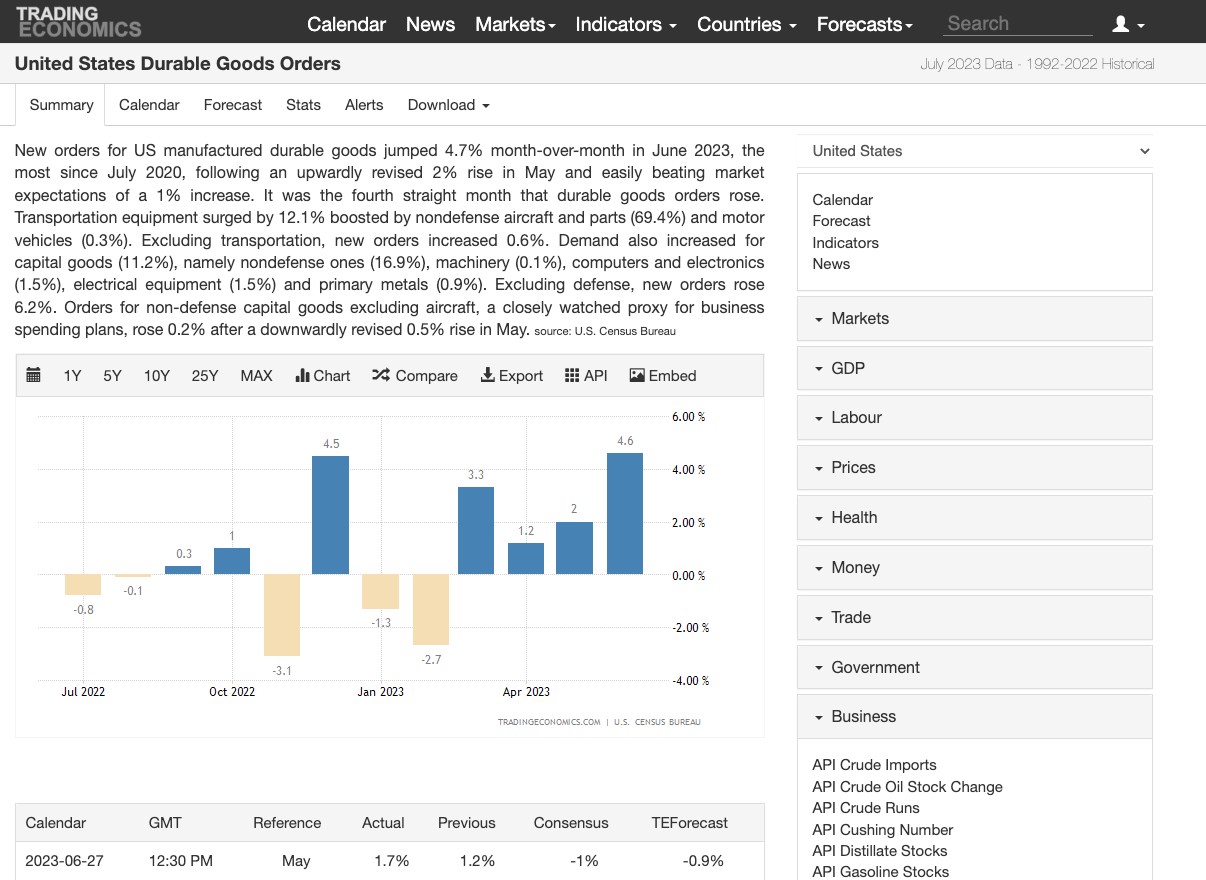

7️⃣ Trading Economics

A place for accessing over 20 million global economic indicators, Trading Economics provides data for 196 countries. This includes historical and projected economic indicators, exchange rates, stock market indexes, bond yields, and commodity prices.

Use Case:

Keep an eye on the U.S. monthly reports about durable goods to see how industry is doing. Analysts and economists closely follow these reports to gauge industrial activity in the United States, given that the significant fund allocations for such purchases directly reflect economic strength.

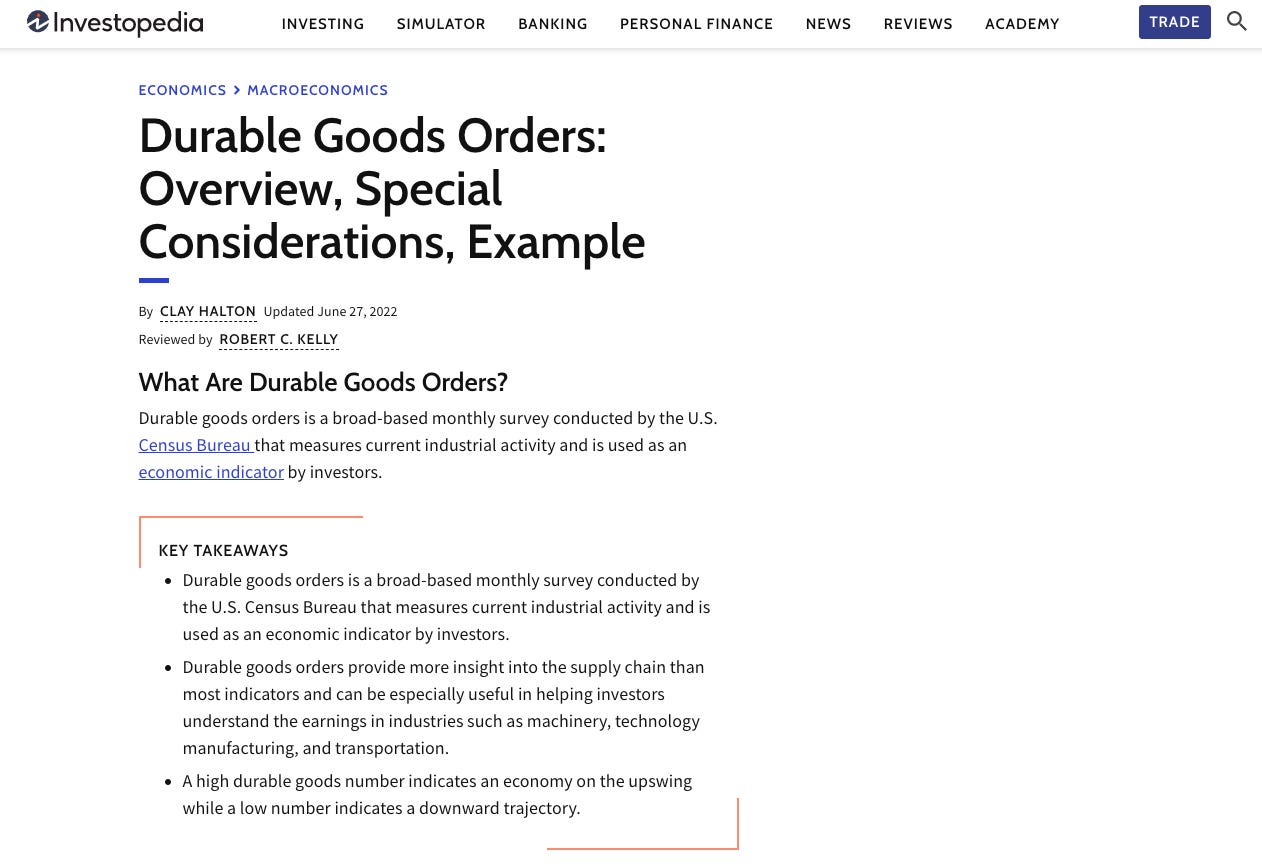

8️⃣ Investopedia

A comprehensive resource for all things finance, offering detailed explanations, tutorials, and guides on various financial topics and terms.

Use Case:

If you come across a term you're unfamiliar with, such as "durable goods report", a quick search on Investopedia provides a clear definition and context to enhance your understanding.

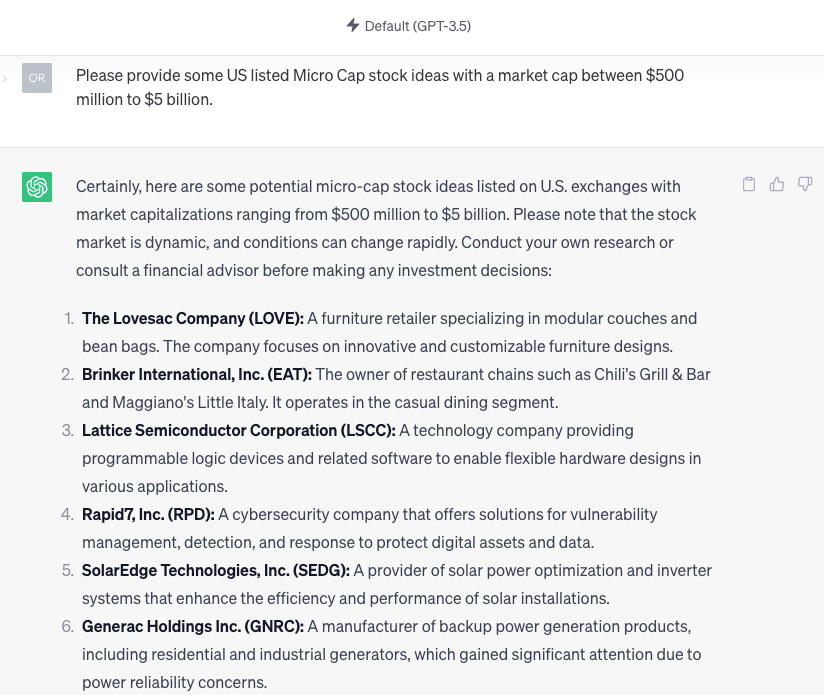

9️⃣ ChatGPT

Accessible through its user-friendly web interface, ChatGPT is an AI chatbot developed by OpenAI that is designed to provide human-like conversational interactions. Additionally, the chatGPT application programming interface (API), provides expanded opportunities for finance professionals who code.

Use Case:

Feed ChatGPT with structured data on your company's financials, and receive a textual summary highlighting essential metrics, patterns, and insights. Alternatively, brainstorm some investment ideas like US-listed Micro-Caps (please keep in mind ChatGPT's knowledge cutoff date of September 2021).

It's worth mentioning that ChatGPT Plus (the premium, paid version) boasts enhanced features and provides real-time, updated data access through plugins and other functions. I've shared some finance and investing use cases in my recent Friday Round Up’s here and here. I'll provide a deeper dive into the overlap of ChatGPT and investment research in an upcoming detailed piece, highlighting its ability to handle a wealth of textual information, from filings and transcripts to news articles, simplifying data processing for investors.

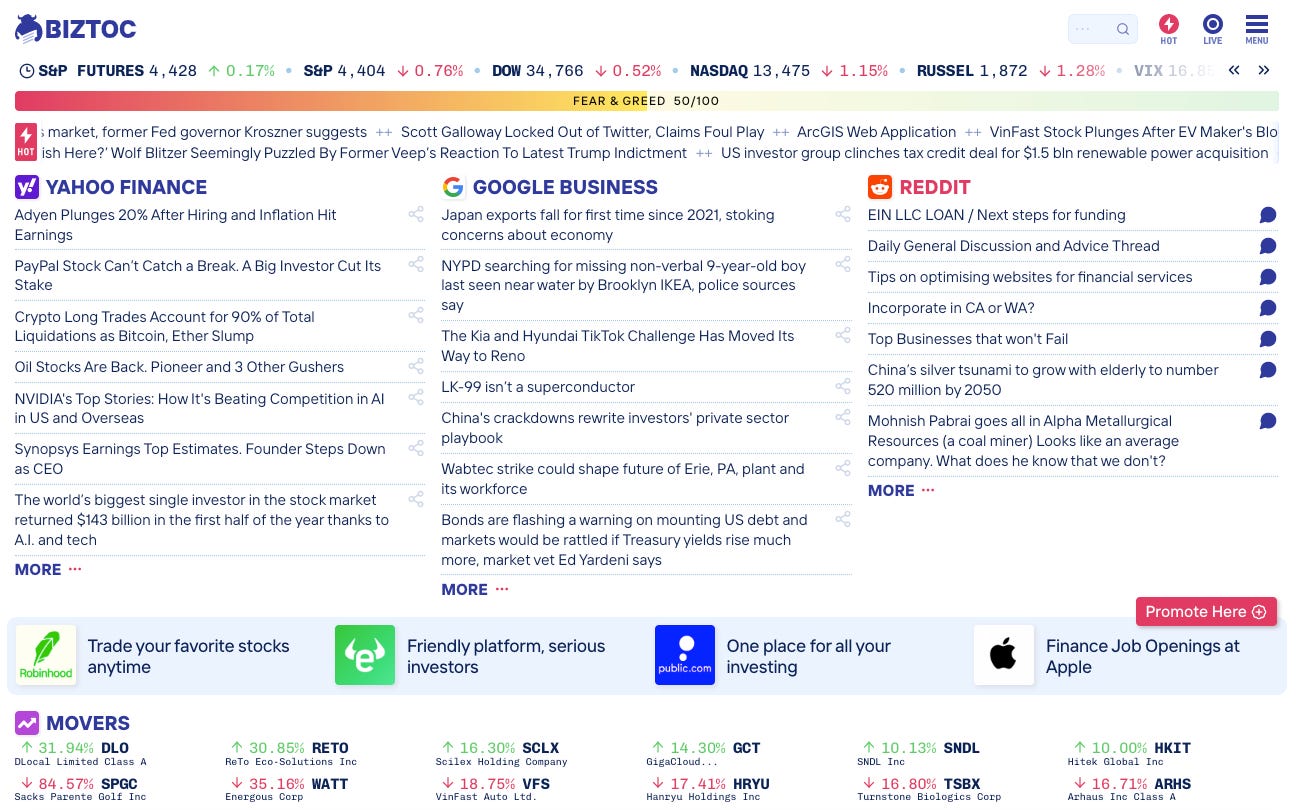

🔟 BizToc

Biztoc consolidates top business sources like Yahoo Finance, Google Business, The Wall Street Journal, Reuters, Marketwatch, ZeroHedge, Youtube or Reddit into one comprehensive news hub.

Use Case:

You can spot a breaking news story on Reuters and instantly cross-reference it with related Reddit discussions and YouTube analyses, all on a single page.

Quick Reflection on Tools, Data and Lifelong learning in a Rapidly Changing Landscape

While the tools mentioned above are some of the best in the industry, it's essential to remember that they are just tools. Your intuition, research, and understanding of the market landscape will always be invaluable assets. Welcome and leverage the tools available, but trust your judgment and never stop learning. After all, in the world of investments, knowledge truly is power.

Which tools do you use ? Which are your favorites? Please, let me know in the comments.

Thanks for the BizToc plug — Glad you like it!

great coverage, thank you!