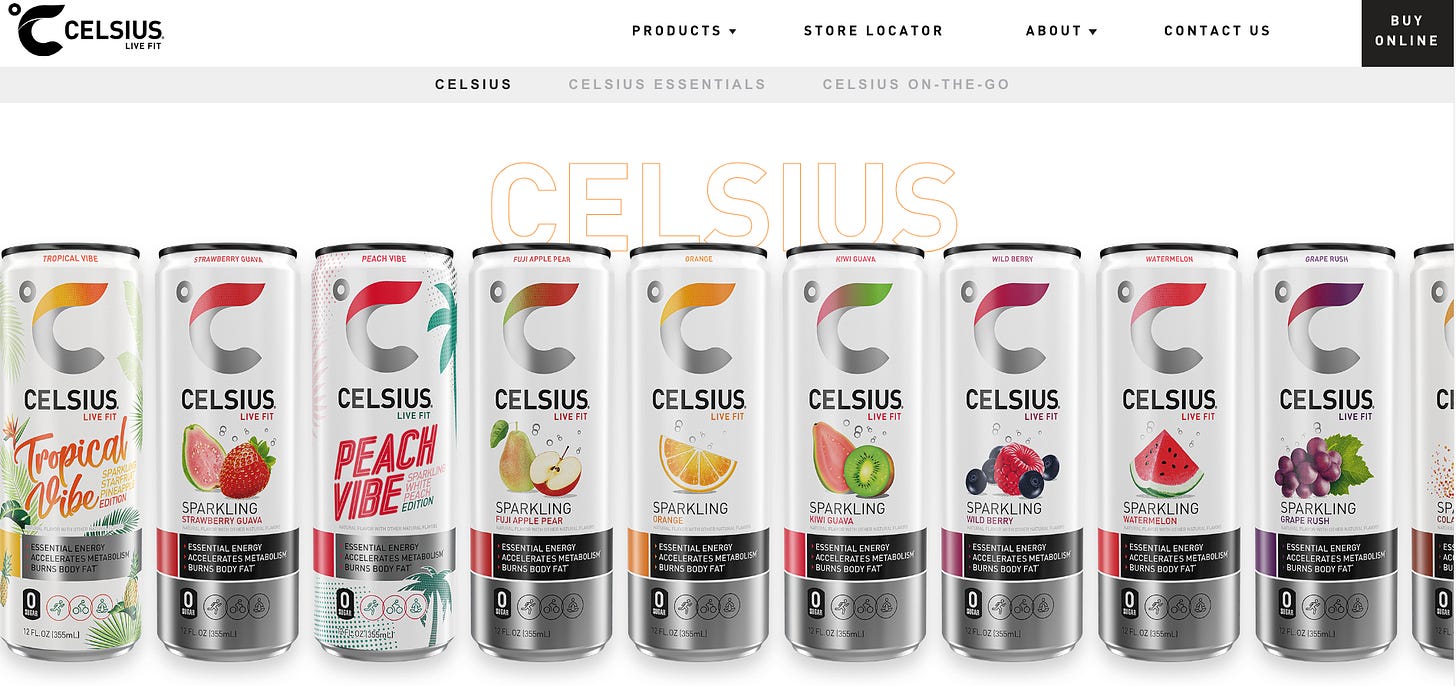

Celsius Holdings CELH 0.00%↑, founded in 2004 and headquartered in Boca Raton, Florida (US), is a fast-growing energy drink company focused on health and recognized as a lifestyle brand. It offers a diverse range of energy drinks tailored to different consumer preferences, including its core product line, Celsius Originals, available in a variety of fruity flavours.

Following a rebranding, Celsius now primarily targets health-conscious consumers, fitness enthusiasts, and those looking for a healthier alternative to traditional energy drinks. The brand's unique selling proposition (USP) lies in its functional benefits, promoting its ability to boost metabolism, support fat burning when combined with exercise, and provide varying levels of vitamins, minerals, and high amounts of caffeine.

But, does Celsius still offer a good investment opportunity?

Celsius focus on development and marketing, outsourcing manufacturing, and leveraging multichannel sales with partners like Amazon and PepsiCo has driven remarkable growth. Over the past five years, the company has achieved an impressive annual growth rate of over 100%.

Given that the global energy drinks market was estimated at around USD 92 billion in 2022 and is anticipated to expand at a CAGR of 8.3%, potentially hitting USD 178 billion by 2030, Celsius, with a LTM revenue of USD 1,489 million, is only scratching the surface of this considerable market opportunity.

It's worth noting here that in 2022, the company closed an 8.5% stake deal with PepsiCo, which included distribution support and served as one of the primary revenue drivers for 2022/23. However, during an investor conference in September 4, Celsius’s CEO announced a significant inventory reduction by PepsiCo due to overestimated demand for Celsius. So, it’s fair to conclude, that the revenue increase in 2022/23 was not really driven by exceptional consumer demand but rather by a miscalculation from PepsiCo, raising concerns among investors.

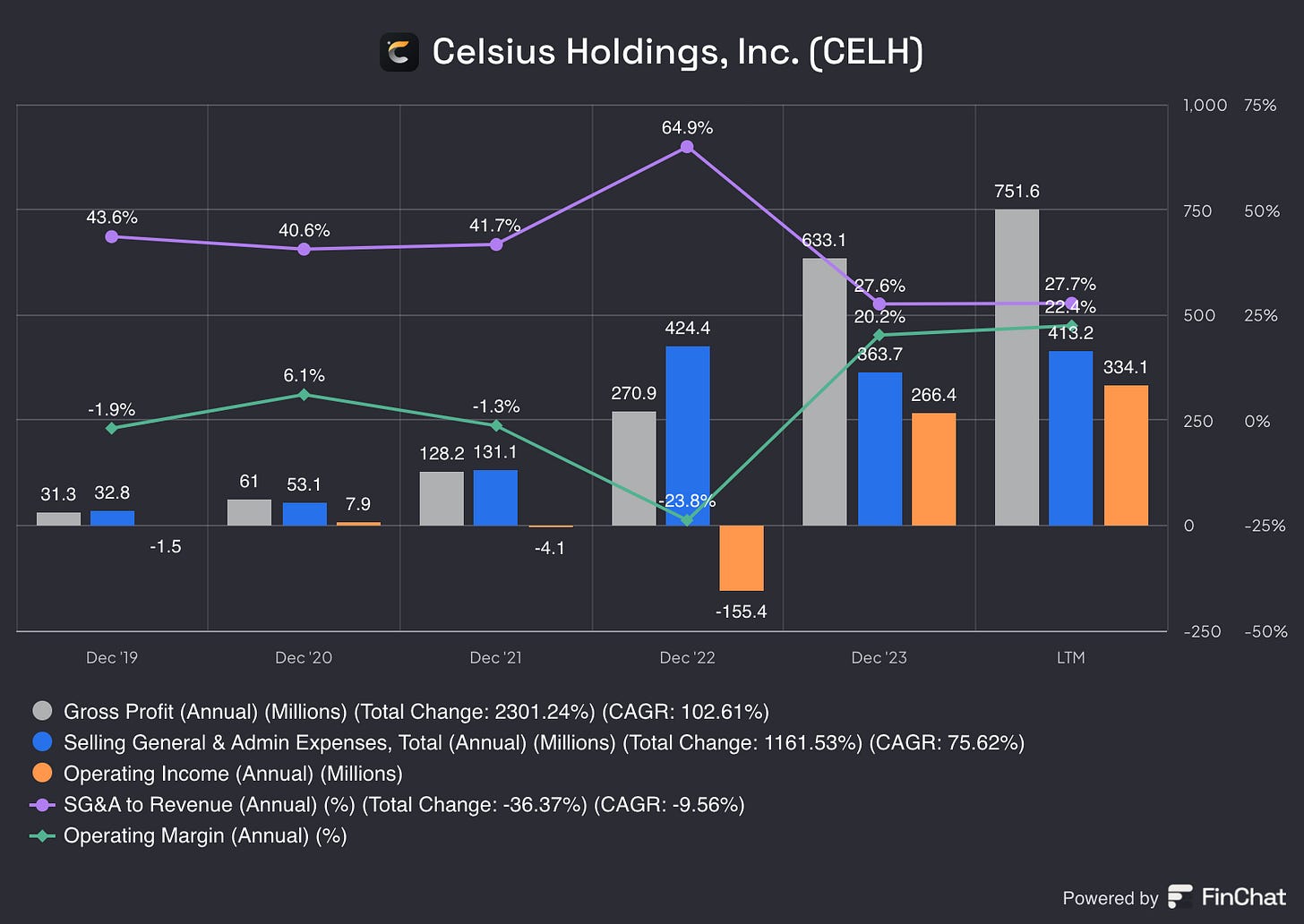

In terms of profitability, in 2Q24, Celsius reported improved operating margins of about 23%, while Monster Beverage maintains margins between 28-33%. In comparison, Monster is 5x the size of Celsius in both revenue and market cap.

So, for Celsius to follow in Monster Beverage's footsteps, it has a long way to grow, with following key catalysts to watch

New Products: As CEO Jon Fieldly has noted, Celsius could explore new market segments like protein supplements and water, both of which are also multi-billion dollar markets

Expand Market Share: Continue to disrupt the energy drink industry and increasing its 11.5% market share by capturing shares from the duopoly of Red Bull and Monster Beverage, further positioning itself as a “healthy” and lifestyle-focused brand

Enter New Markets: Celsius currently generates approximately 95% of its sales from North America (compared to 65% for Monster Beverage) highlighting significant growth potential in untapped non-US markets, which is supported by its partnership with Suntory, a Japanese beverage giant with global operations, targeting markets such as the UK, France, and Australia.

All of these strategies will require increased investment in marketing and R&D, not just to grow market share but also to uphold and enhance the brand image, which may compress margins in the short to mid-term.

Additionally, despite offering sugar-free products backed by clinical studies, Celsius may be affected by potential tax increases stemming from regulatory changes in the energy drinks industry, which could ultimately lower overall profits.

Valuation

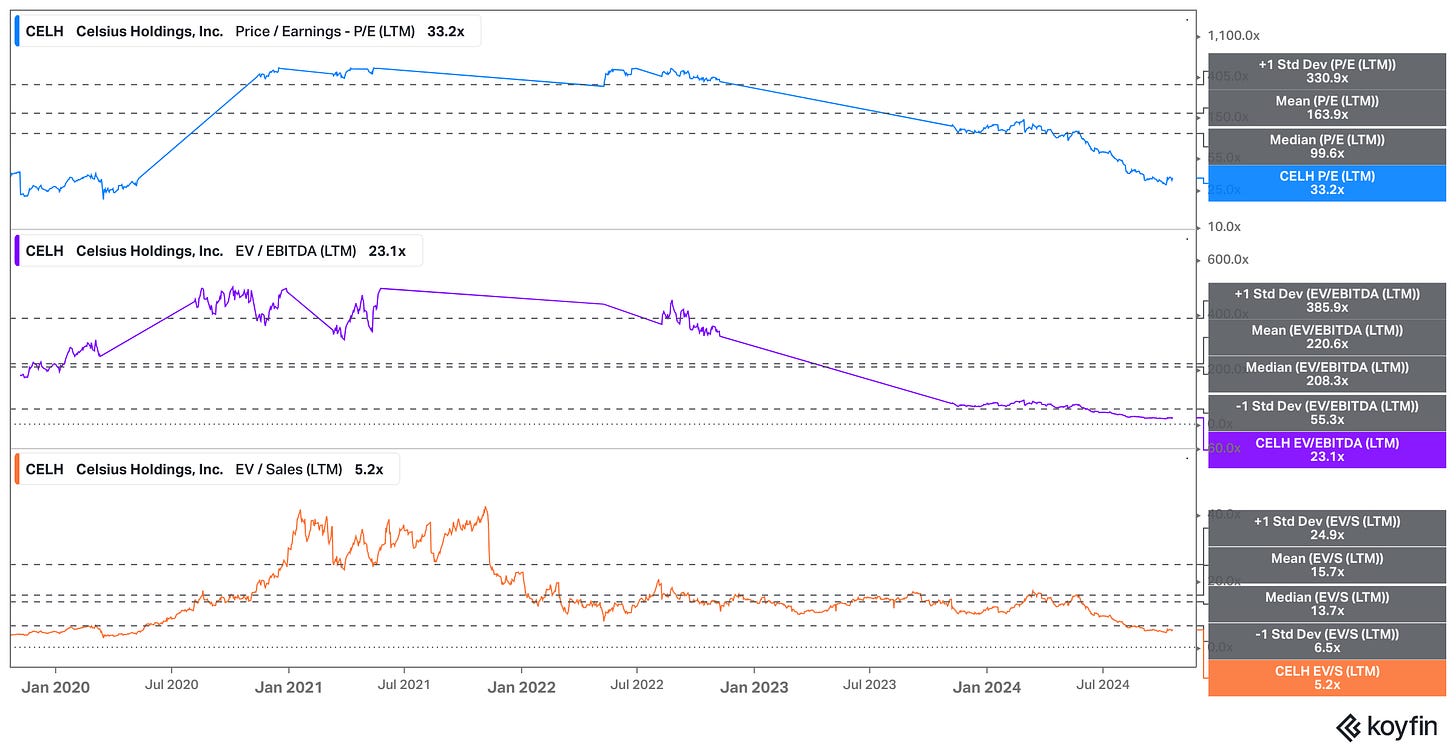

I believe the historical valuation, particularly from 2020 to 2022, is self-explanatory and stands as another prime example of Dream Investing. So, no further comments!

Interestingly, although the stock price has dropped over 60% from its peak in early 2024, it still delivered monster returns for early investors like CleverLongboat from MicroCapClub, with gains of over +3,000%.

Reverse DCF Analysis

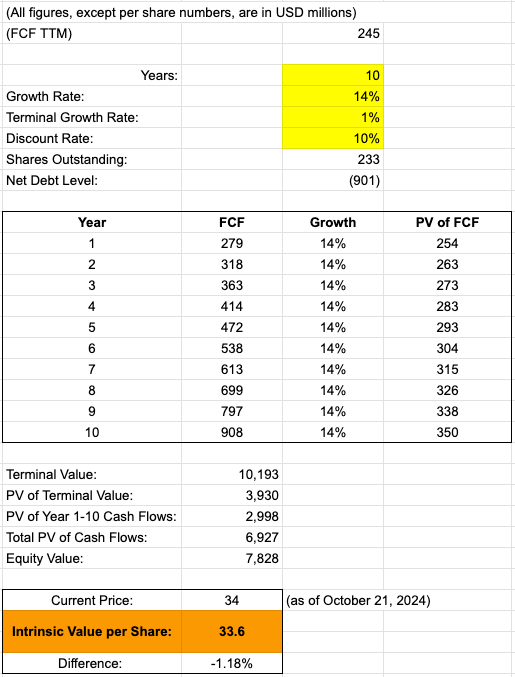

A simple reverse DCF valuation shows that, to justify the current price of around USD 34 per share, and meet the target return of 10% per year, Celsius needs to grow its FCF by 14% annually for the next decade and then at 1% per year thereafter.

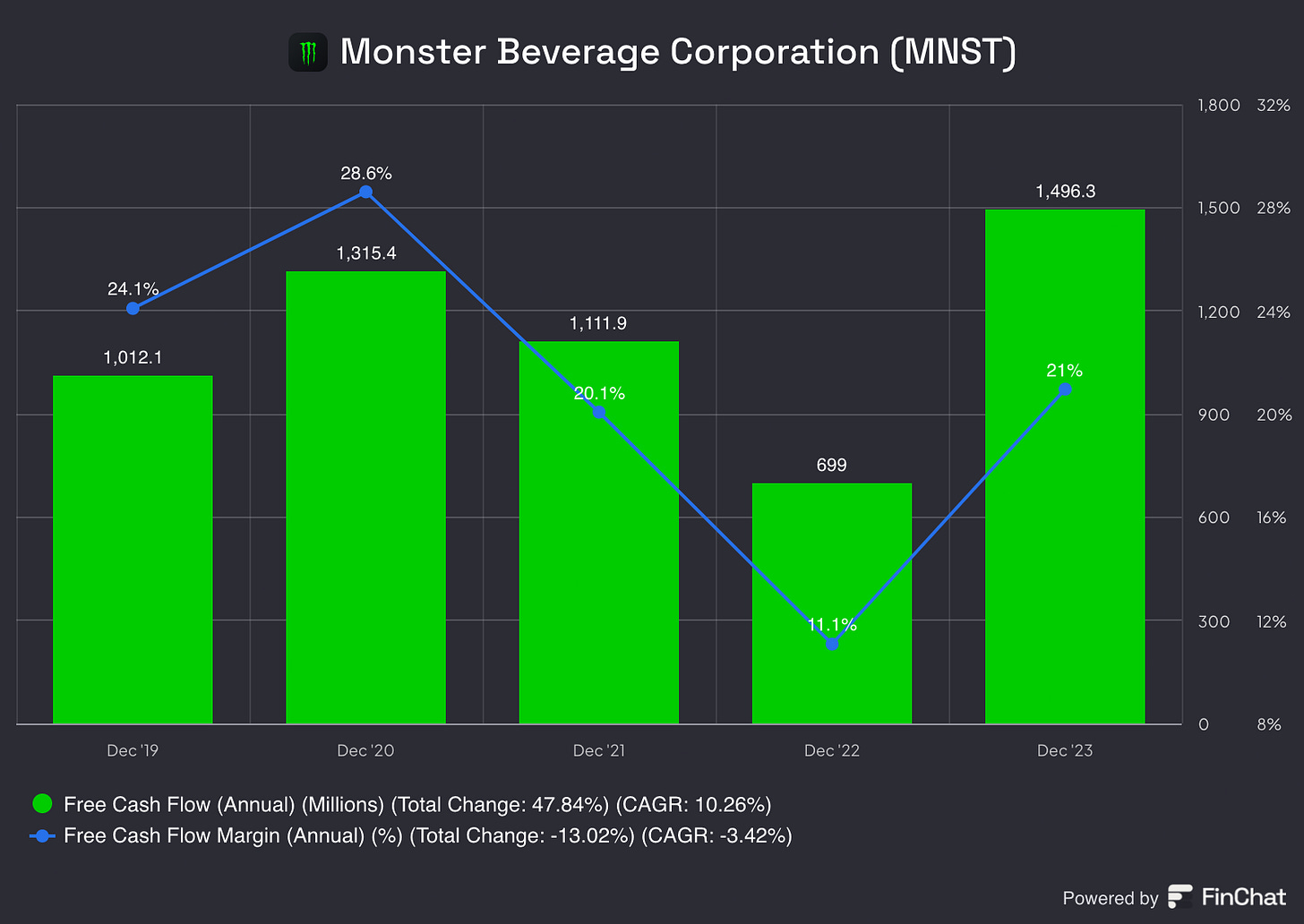

Just in comparison, Monster Beverage MNST 0.00%↑ has a FCF-CAGR (5y) of 11% and an average FCF-Margin of 20% over the past decade.

If the FCF-growth follows the Monster Beverage’s average rate of 11% over the next ten years and one seek a 10% annual return, then the stock could be considered as overvalued by around 20% at its current price.

An additional security layer is offered by Celsius’s strong balance sheet, which features a net cash position of about USD 900 million (or USD 3.90 per share).

Conclusion

Although the overall market is expanding and Celsius has shown strong past performance, it may not be a Monster Beverage 2.0.

However, if the stock were to decline further, potentially due to an economic downturn affecting consumer spending, it could become a more attractive option with a larger margin of safety. Additionally, it's important to consider that PepsiCo's nearly 10% ownership raises the possibility of a future acquisition, though Pepsi is not known for overpaying in such transactions.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.