Jungfraubahn Holding (JFN): A Timeless Investment Opportunity

High quality company from Switzerland with big moat and strong fundamentals, flying under the radar of most investors

🔈 Announcement

As I shared on X and Substack Notes, I've recently launched rhinoinvestory.com, a directory of stock research reports. Now you can easily search for any stock analysis and access a wide range of write-ups from investors worldwide.

This is just the beginning! I’m continuously adding new reports to the database and will be launching more features soon 👇

Introduction of Jungfraubahn Holding

Jungfraubahn Holding is a leading Swiss tourism company, renowned for its iconic mountain railway that takes visitors to the Jungfraujoch, the “Top of Europe,” situated at 3,454 meters above sea level. Operating since 1912, this historic trip on the Jungfrau Railway has been one of the Swiss Alps major tourist attractions for over a century and continues to be a key driver of the company's success, attracting over a million visitors each year.

With its breathtaking views and snow-capped peaks, it especially appeals to international travelers, including those from Asia and India, who are keen to experience the beauty of the Alps. Over the past decades, Jungfraubahn has perfected this experience in every way. It operates the railway that takes visitors to the summit and provides a range of other attractions in the area, including ski slopes, restaurants, and shops. It’s a complete mountain adventure, all seamlessly integrated under one roof.

On a personal note, I recently hosted an old friend from China who was on a business trip to Germany and then planned a few days in Switzerland to visit me. Of all the things to do in Switzerland, his number one priority was the ride on the Jungfraubahn to the Top of Europe. And this wasn’t the first time I experienced this!

Financials

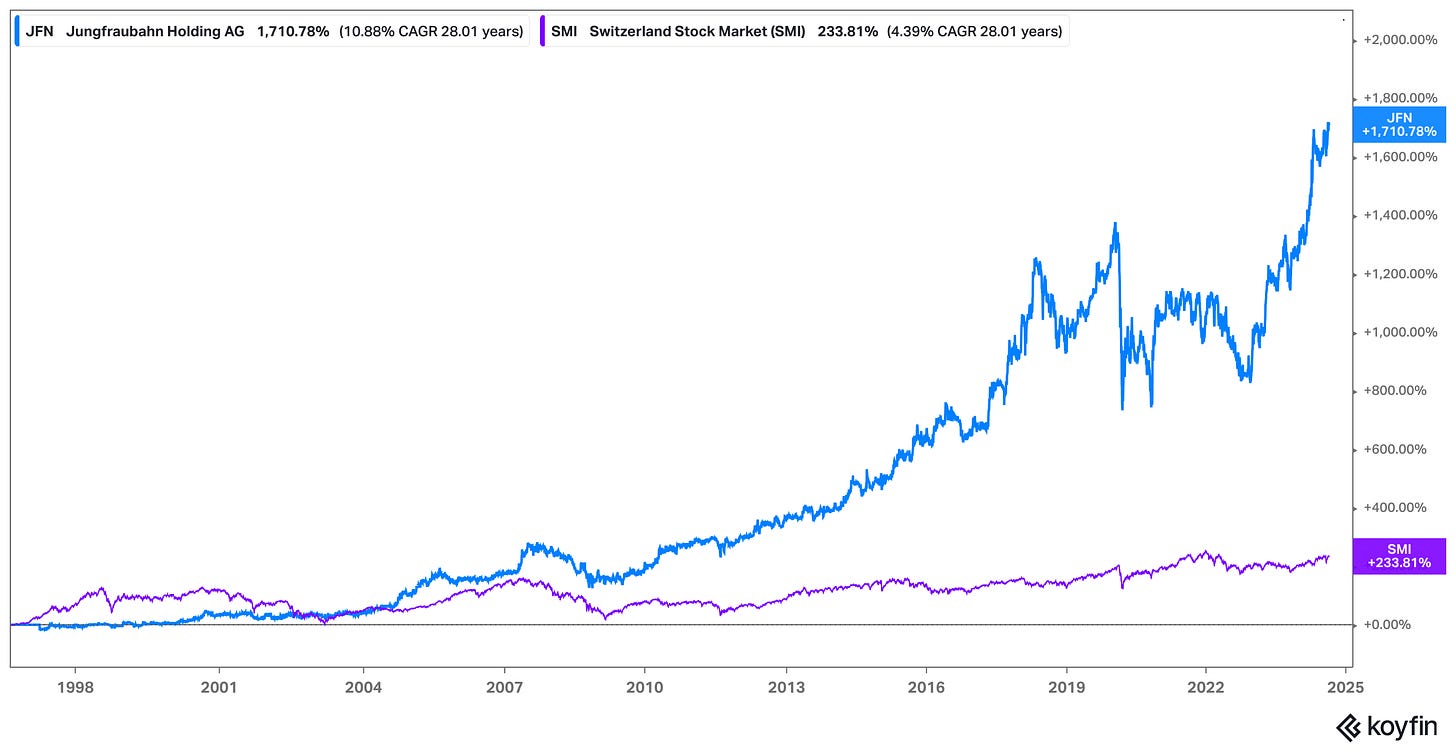

You might be thinking, “Sure, the scenery is stunning, but how about the business performance?” Since its IPO in 1996, Jungfraubahn Holding shares have generated a total return of 1,700%.

To put that into perspective, the Swiss Market Index (SMI), which tracks the top 20 blue-chip stocks in Switzerland, achieved a total return of "just" 233% over the same period.

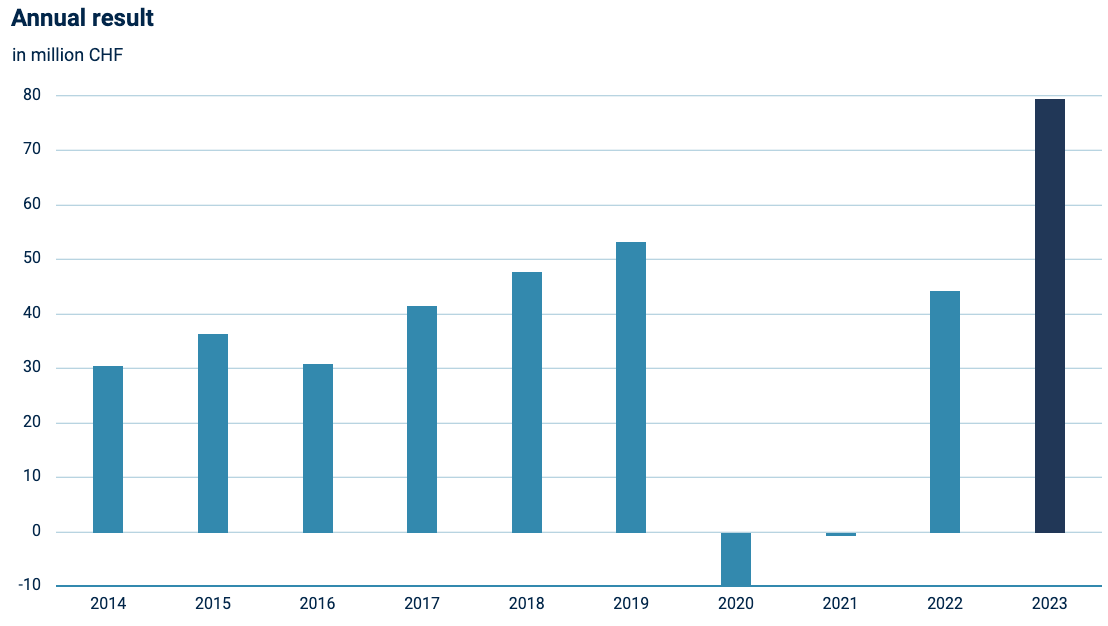

Over the past decade, Jungfraubahn has thrived as a major tourist attraction in the heart of the Swiss Alps, driving revenue growth of over 70% and earnings growth of 160%.

As the rise in operating expenses was very well controlled (increase of +17% below the pace of revenue growth), the EBITDA margin reached a record +50% in FY23. Annual profit surged by +79%, surpassing pre-pandemic levels from 2019 and marked the highest in the company's history. This comes after the challenging years of COVID-19, which included temporary shutdowns in 2020 and reduced international traffic in 2021.

The Jungfraujoch - Top of Europe continued to be the main revenue driver, with a +46.9% increase CHF 188 million. Visitor numbers reached 1,007,000, up 61.1% from the previous year and close to the record of 1,067,000 visitors in 2018.

But the "Top of Europe" isn't carrying the load alone. Other segments include the Adventure Mountains business, which includes excursion transport to Harder Kulm, First and Winteregg-Mürren. The Winter Sports segment, once a major concern, has improved significantly in the last two years, supported by the completion of the V-Cableway mega-project in 2020. This project, with new terminals and cableways, is designed to secure the long-term tourism future of the Jungfrau Region, boost Jungfraujoch's global competitiveness, and elevate the winter sports destination to a leading international position.

It’s worth noting, that the long-serving CEO who has been with the company for over 30 years, was the key driver behind this long-term project and described his successful leadership in a 2018 interview as follows:

“Think for the long term, decide early, adjust continually, innovate and invest in values and quality as the basis for long term success”

After revising its dividend proposal in 2020 due to the unexpected pandemic and skipping dividends in 2020 and 2021 because of uncertain outlook, the company’s strong recovery enabled it to reward shareholders with an increased dividend of CHF 6.50 per share (up 80% from CHF 3.60), yielding 3.2% at today’s share price.

Additionally, it repurchased CHF 41.8 million worth of shares in FY23, reducing the share count by approximately 4%.

In addition to the dividend, Jungfraubahn also offers a special bonus for shareholders holding 250 shares or more, including benefits, like a 50% discount on tickets across the Jungfrau Railways network, and other offerings.

Following substantial capital investments in recent years, particularly the investments of CHF 340 million into V-Cableway project, the company has improved its ROIC to 9-10% and effectively restored its strong cash generation capabilities, with free cash flow margins of 27.3% in FY22 and 21.4% in FY23.

Jungfraubahn’s historical median CAPEX-to-sales ratio of 20% over the past two decades, reflects the company's focus on stable operations and cash flow generation.

However, with the completion of the V-Cableway project in 2020, and the management's latest plans for new large projects, “First Glance” at Jungfraujoch (CHF 100 million) and the “First Gondola renewal” (CHF 100 million) by 2030, it’s questionable whether the company will achieve its long-term financial goal of accumulating CHF 200 million or more in FCF over the next years.

Sensitivity to International Tourism remains as the main Risk Factor

Tourist demand is influenced by several factors often beyond the control of businesses and management, such as the COVID-19 pandemic, which led to travel restrictions across the globe. This poses a significant risk for Jungfraubahn, as a large portion of its visitors come from Asia, primarily China.

Additionally, fluctuations in exchange rates and a strong Swiss Franc can create challenges for international travellers, especially amid current geopolitical tensions with uncertain outcomes.

However, Jungfraubahn’s conservative financing strategy has been key to its operating stability, to minimize economic risk and strengthen independence from external funding. This approach left the balance sheet in excellent condition by the end of FY23, with just CHF 116 million in long-term debt (primarily non-interest-bearing loans from the confederation and canton) and over CHF 600 million in equity, resulting in a low debt-to-equity ratio of 0.18x.

Valuation

Aside from the exceptional circumstances in 2020/21 due to the pandemic, shares currently trade for P/E (LTM) ratio of 14.9x and EV/EBIT (LTM) of 12.3x, which is slightly below the historical median over the past decade.

A quick comparison with its peers shows that JFN Holding outperforms its local Swiss competitors in nearly every metric.

Reverse DCF Analysis

A simple reverse DCF valuation shows that, to justify the current price of around CHF 204 per share, and meet the target return of 10% per year, Jungfraubahn needs to grow its FCF by 9-10% annually for the next decade and then at 1% per year thereafter.

Considering the planned large-scale infrastructure projects with investments over CHF 200 million and the historical free cash flow growth, achieving an annual 10% FCF growth rate for the next ten years seems highly unlikely.

Final Thoughts

The stock is not currently cheap, but it has strong growth potential for the coming years. However, the business’s volatility, especially due to international tourism (mainly from Asia) or other unforeseen events like those in 2020, could create a more favourable entry point in the future, and would offer a higher margin of safety for acquiring shares in a unique Swiss company with a significant competitive moat.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference

Company Website - Investor Relations

https://www.jungfrau.ch/en-gb/corporate/investor-relations/jungfraubahn-holding-ag/business-reports/V-Cableway opens at Grindelwald part of World's biggest lift project

https://snowaction.com.au/v-cableway-opens-at-grindelwald-part-of-worlds-biggest-lift-project/

Further Readings

Interview with CEO Uwe Kessler (only in German)

https://www.prestige-business.ch/der-bergmeister-vom-jungfraujoch/«CEO Talk» mit Urs Kessler, CEO Jungfraubahn-Holding

https://www.telezueri.ch/ceo-talk/ceo-talk-mit-urs-kessler-ceo-jungfraubahn-holding-155966427

Even though Jungfrau is a stronger brand and the difference in recent stock price performance might confirm that, I believe Titlis (TIBN.SW) current valuation makes it more attractive that Jungfrau, might be interesting for you to have a look at and compare

I just ran an ultramarathon there and checked out the train and attractions on the trip. It is terrific. Tons of Asian tourists enjoying the sights. 10/10 would recommend. I didn't realize it was a public company until I got back and read about it!