Knorr-Bremse (Ticker: KBX): Time To Reveal the Brake?

World’s leading manufacturer for brake systems in rail and commercial vehicles with high-margin aftermarket business

Summary

Global Leader: Knorr-Bremse maintains strong market shares in both its rail and commercial vehicle divisions, which are exposed to diverse economic cycles and market drivers supported by a large customer base, balanced end-markets, broad geographical and customer diversification

Record high Order Books: Despite a modest revenue CAGR (5y) of only 2%, a continuously rising order intake has resulted in a record high order book of EUR 7.2 billion in 3Q23, up 4.6% from the previous year.

Attractive Aftermarket Business: Around 38% of revenues come from the less cyclical and higher-margin aftermarket business in FY22 based on the large installed base

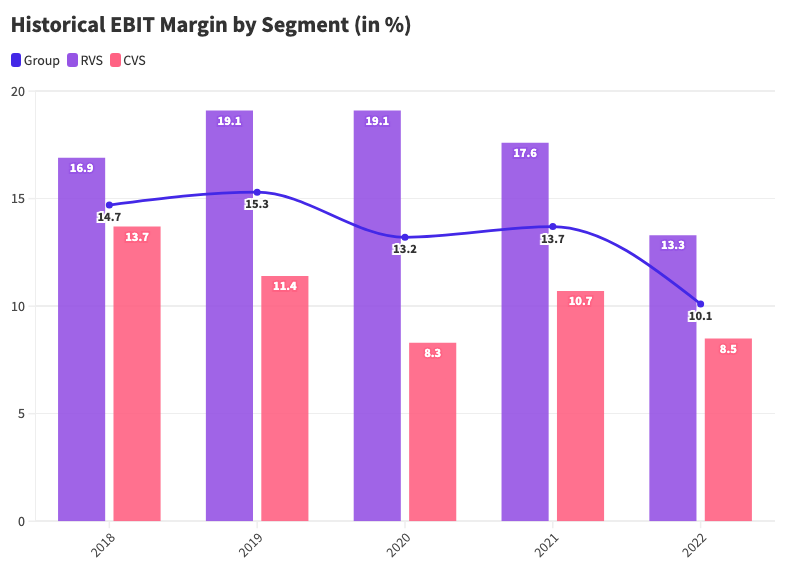

Shrinking Margins and Profitability: Deteriorating EBIT margins from 14.7% to 10.1% between 2018-2022, along with decreasing ROCE due to inflationary cost pressures and numerous acquisitions, are areas of focus for the upcoming years

Competitive Moat: High barriers to entry and significant switching costs, owing to substantial initial capital investments and extensive homologation requirements, particularly in the RVS segment, which takes 4-8 years

High Management Turnover: Presence of four CEOs within just three years is definitely a significant red flag

Structural Growth Drivers: Megatrends like automated driving, connectivity, urbanization, and electrification, are likely to sustain demand for Knorr-Brems’s products an services

Introduction of Knorr-Bremse

Knorr-Bremse AG is the world’s leading manufacturer of brake systems and a supplier of additional safety-critical sub-systems for rail and commercial vehicles. The Germany-based company has been contributing to the safety on rail and roads worldwide for over 110 years.

Georg Knorr founded Knorr-Bremse in 1905, establishing a legacy in rail vehicle brakes. However, it was Heinz Hermann Thiele, known as one of Germany’s leading entrepreneurial personality, who truly transformed the company. He joined Knorr-Bremse in 1975, at the age of 28 as a patent department clerk and worked his way up until in 1979 he was appointed to the company’s Executive Board, where he served for 28 years. He significantly influenced the direction of Knorr-Bremse, particularly in 1985 when he took over during a financial crisis and navigated the company to become a profitable, globally recognized leader in braking systems for trucks and railways.

Under Thiele's stewardship, Knorr-Bremse honed its focus on braking technology, culminating in a successful public listing on the Frankfurt Stock Exchange in 2018, in Germany's second-largest IPO that year. With a net worth of $20.2 billion, Thiele was one of Germany's richest person and a major shareholder in both Knorr-Bremse, who unfortunately passed away in 2021.

Product and Services

The company's focus is divided into two primary segments:

Rail Vehicle Systems (RVS)

Commercial Vehicle Systems (CVS)

Rail Vehicle Systems (RVS)

The RVS division contributes to nearly half of its revenues, with braking systems accounting for approx. 66% of RVS sales. Additionally, the company provides entrance solutions as well as heating, ventilation, and air conditioning (HVAC) systems for passenger comfort. The segment is complemented by a strong emphasis on modernization, support, and a comprehensive aftermarket business.

Knorr-Brems’s RVS customer base is global and characterized by leading OEMs and rail operators, with the top 10 customers accounting for 52% of total RVS sales in FY22.

Commercial Vehicle Systems (CVS)

The other half of the revenues are generated in the CVS division, where brake systems and vehicle dynamics comprise around 71% of its sales.

More importantly, Knorr-Bremse's extended customer relationships, often surpassing 20 and in some cases 90 years, illustrate the company's esteemed reputation in the industry for innovative and dependable products. Concurrently, these longstanding relationships emphasize its competitive edge, bolstered by the substantial switching costs faced by customers.

Competitive Moat

The competitive strength of Knorr-Bremse lies in a mix of regulatory barriers, rigorous quality demands, and its strong foothold in the market. The firm's offerings, characterized by long product life cycles, help in building enduring customer loyalty and an extended duration for aftermarket products. These aspects effectively raise the barriers for new entrants in the RVS and CVS markets. Consequently, only a few companies, including Knorr-Bremse, have maintained their leadership status in the industry since its inception over a hundred years ago.

According to Knorr-Bremse, it stands out as the only supplier worldwide that meets all these diverse RVS standards, illustrating the company's commitment to quality and safety. The vast array of product variants, exceeding 100,000 active brake articles, necessitates extensive homologation efforts, which can take 4-8 years, creating a time barrier for competitors.

Strategic Acquisitions and Mergers

Knorr-Bremse, in its strategic pursuit of expanding and strengthening its digital solutions and connectivity in the global market, has made significant acquisitions in the past few years.

With the acquisition of the commercial vehicle steering systems business unit of Hitachi Automotive Systems, Japan, in spring 2019 (for EUR 164.8 million) and the purchase of Sheppard (for USD 149.5 million), a leading North American manufacturer of commercial vehicle steering systems, Knorr-Bremse has taken a crucial step toward becoming a supplier of highly integrated systems. Some of the most recent M&A activities in 2022 include:

Cojali Group Acquisition:

Knorr-Bremse expanded its aftermarket business and digital, connected solutions by investing in Cojali Group

Acquired 55% of shares in Cojali S.L. for around EUR 230 million (EUR 171.25 million paid in cash)

Nexxiot AG Acquisition:

Nexxiot AG, specializing in IoT technology for train cars and containers, aligns with Knorr-Bremse's vision of improving connectivity in the rail industry

Acquired 33.4% of shares in Nexxiot AG for EUR 62.8 million (paid in cash)

These acquisitions significantly underscore the company's dedication to enhance the company's capabilities and leading in megatrends like automated driving and connectivity. Through strategic investments, Knorr-Bremse is not only expanding its market reach but also adapting to the evolving demands of the digital era, thereby reinforcing its position in a rapidly changing industry.

Management

Knorr-Bremse's management team, boasting diverse experience and long-serving members like Bernd Spies (8 years) and Nicolas Lange (23 years), demonstrates a wealth of experience within the company’s core units.

As of 2023, Knorr-Bremse's management team is headed by CEO Marc Llistosella, who joined at the beginning of 2023. Llistosella brings a wealth of experience in business administration and leadership, having held high-ranking positions at Daimler Truck. However, the company has experienced significant CEO upheavals in the last three years, as highlighted below:

In April 30, 2019: The abrupt departure of CEO Klaus Deller due to disagreements in leadership and colobration marked the start of a turbulent period in leadership, especially as Deller was part of the Board of Management of Knorr-Bremse AG from 2009 until 2019; from 2015 as the CEO

In August 31, 2020, Bernd Eulitz left the company after only ten months due to profound differences of opinion against leadership and the active shaping of strategic corporate development, which also led to a growing strain on the relationship between Mr. Eulitz and the Chairman of the Supervisory Board and made it impossible to continue the cooperation.

In April 30, 2022, after becoming the third CEO within three years, Dr. Jan Mrosik, who joint in Januaray 2021, left the company by mutual agreement. Prior to Llistosella's appointment, the CFO (Frank Weber) had also temporarily taken on the responsibilities of CEO on an interim basis.

In January, 2023, Knorr-Bremse AG voted unanimously to appoint Marc Llistosella as CEO of the company for a period of three years

The high management turnover in the company’s top positions and the frequent changes in leadership have raised concerns among investors in recent years, as maintaining effective leadership is essential for ensuring investor confidence and sustaining the company's stability.

Industry & Business Model

The following overview is aimed at providing a clear understanding of the market environment and industry dynamics in which Knorr-Bremse operates. It covers the current state, future opportunities, and potential risks in the rail and commercial vehicle sectors, along with an examination of the key markets.

In the market evaluations, the company's internal analyses are complemented by external studies from LMC Automotive. Furthermore, these evaluations are enhanced with additional insights from leading market players and consultancies.

Global Rail and Commercial Vehicle Markets

Both the rail and commercial vehicle markets, while distinct, are interconnected sectors within the broader transportation industry, primarily driven by the need for efficient and safe transportation in both public and private sectors. A critical element in these transportation systems is the braking system, essential for safety and a standard feature in all rail and commercial vehicles.

Global Rail Vehicle Market

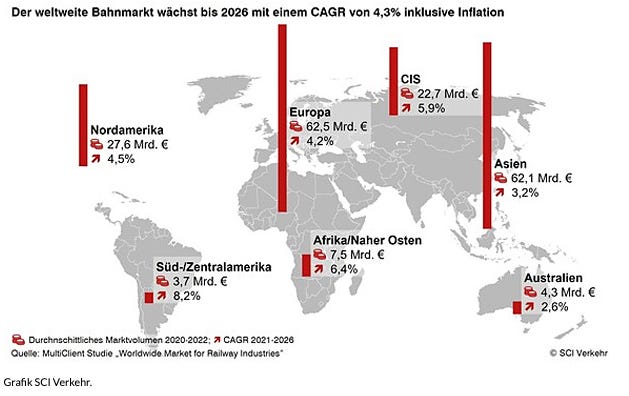

Driven by considerable investments such as in rolling stock and infrastructure over the past years, the market volume of the global rail industry was estimated at around EUR 190 billion in September 2022 by SCI Verkehr.

Especially, the Asian rail vehicle market showed significant growth over the past years, driven in particular by positive developments in China, which already has 40,000 km of high-speed rail — more than twice as much as the rest of the planet combined.

Despite challenges from disrupted supply chains and the COVID-19 pandemic, the rail vehicle market is projected to continue growing. SCI Verkehr forecasts that the global market for rail technology will expand by 4.3% annually to 236 billion euros by 2026, with a 1.4% growth rate even after adjusting for high inflation. This growth is driven by urbanization, digitalization, climate protection measures, and changes in urban mobility. Furthermore, government stimulus programs like the European "Green Deal" and other rail investment programs are expected to further stimulate demand for Knorr-Bremse's brake and system solutions.

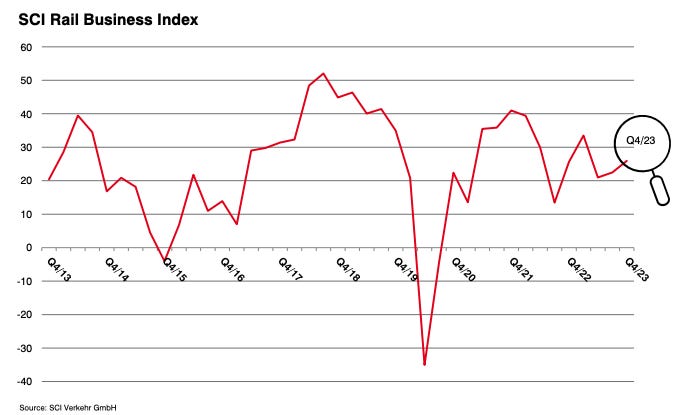

According to the latest survey result by SCI Verkehr GmbH, the railway industry is characterized by a high degree of uncertainty. The SCI Rail Business Index, which compiles insights from around 100 reports by representative companies in the global rail industry about on their current business status and six-month outlook, indicates a generally declining demand for the fourth consecutive time, positioning itself in the negative range. The last time this occurred was in the second quarter of 2020 – at the beginning of the global coronavirus crisis.

The survey also reveals insights from top railway industry managers worldwide regarding their 2024 strategic goals. Similar to the previous year, digitalization emerged as the top priority, significantly influencing both internal processes and product development, emphasizing the urgency of digital transformation. The focus on digital transformation highlights additional opportunities for suppliers like Knorr-Bremse, as essential partners for train manufacturers and operators, particularly in the aftermarket business.

Global Commercial Vehicle Market

The commercial vehicle market is thriving, driven by the rise in e-commerce and logistics, necessitating more light and heavy commercial vehicles for transport and delivery. Public transportation demand, especially in urban areas, is boosting the market for a variety of trucks.

The global commercial vehicle market was valued at USD 819.3 billion in 2022 and is estimated to reach more than USD 1.3 billion in 2027, growing at a CAGR of 10.4% from 2022 to 2027.

With around 11.3 million commercial vehicles, USA was the leading region in the production of commercial vehicles in 2022, accounting for the largest market share of commercial vehicles sold, followed by China in second place. Despite facing multiple headwinds from the second and third wave of CoVID-19, and high raw material prices, the Indian commercial vehicle industry, by contrast, performed much better and recorded over 100% growth in 2022 compared to lows in 2020.

Knorr-Bremse's prominence in disc brakes, specifically designed for the heightened load and stopping requirements of heavy goods vehicles weighing between 6 and over 44 tonnes, positions the commercial vehicle segment in China, the world's largest market for heavy trucks (>15 tonnes), as vital for its business and aftermarket prospects. However, according to Knorr-Bremse, this segment also saw a significant drop from historic highs of 1.6 million units in 2020 to about 0.7 million units in 2022.

Technologically, the sector is evolving with autonomous driving, electric vehicles, and connected vehicle technologies, influenced by environmental concerns and safety needs.

Competition & Peers

Knorr-Bremse’s markets are characterized by relatively concentrated supply, where only a few players dominate. This is the result of high barriers to entry: especially in safety-critical products in RVS, regulation is tight and the process to obtain the required certifications (homologation) is time-consuming (4-8 years), costly and requires deep technological know-how.

Knorr-Bremse holds market leadership in all relevant product categories led by around 50%-market share in its core business of brakes.

The main competitor of the RVS division is Wabtec Corporation (which acquired Faiveley), an American company that provides equipment, systems, and services for the freight rail and passenger transit industries worldwide.

In the CVS division, Knorr-Bremse's primary competitor is Wabco Holdings Inc., which manufactures and sells braking and other systems for commercial vehicles. Wabco, with origins tracing back to the Westinghouse Air Brake Co., established nearly 150 years ago, was acquired in 2020 by ZF Friedrichshafen AG for USD 7 billion. ZF is a globally recognized German technology company that provides systems for passenger cars, commercial vehicles, and industrial technology.

Knorr-Bremse and WABCO are the leading competitors in the CVS market, significantly dominating this space. In Brake Systems & Vehicles, as well as in the Energy Supply Chain market, Knorr-Bremse is ahead of WABCO at a global level. Due to the consolidated nature of the industry, there is very limited number of publicly-listed companies with comparable industry and product exposure.

*Due to WABCO's merger with ZF Friedrichshafen AG, the latest stock price and financial data from May, 2020 will be used as the reference point for the peer valuation.

Besides Wabco, a few other smaller players serve as global competitors in the field of braking products, including Haldex and Meritor, the latter of which was acquired by Cummins, and competes with Knorr-Bremse in disc brakes.

Financials & Key Figures

All of the graphs and financials will refer to FY2022 because that way I can see how the company has progressed throughout recent years, which may show more of a trend than looking at every quarter that may fluctuate quite a bit. I will include some of the most recent numbers if they are necessary for extra color.

Key Figures 2022

The FY22 was shaped by the strict zero-Covid policy in China that applied until year end, the ongoing Russian-Ukraine war, and the price rises driven by inflation. In this difficult global environment, the group revenue increased to EUR 7.1 billion (PY: 6.7 | +6.6%) due to the strong customer demand, primarily in Europe and North America.

To combat inflation and market challenges, the company implemented a Profit & Cash Protection Program (PCPP) at the beginning of 2022, focusing on stringent cost and price management. However, this strategy couldn't fully counter the negative impacts from Russia and China, along with inflation-related input cost increases. Consequently, the cost of materials increased by 11.5% YoY, surpassing revenue growth and reducing the gross profit margin to 47% from 49.5%.

Significant increases in operating costs, notably wages, contributed to a drop in operating profit to EUR 732.9 million (PY: 895.3), resulting in a lower EBIT margin of 10.1% (PY: 13.7%).

Consequently net earnings fell to EUR 487.7 million, or EUR 3.9 per share (PY: 3.0 | -21.5%). In accordance with the company's dividend policy of distributing 40% to 50% of earnings, the dividend per share (DPS) was set at EUR 1.5 (PY: 1.9 | -12.2%).

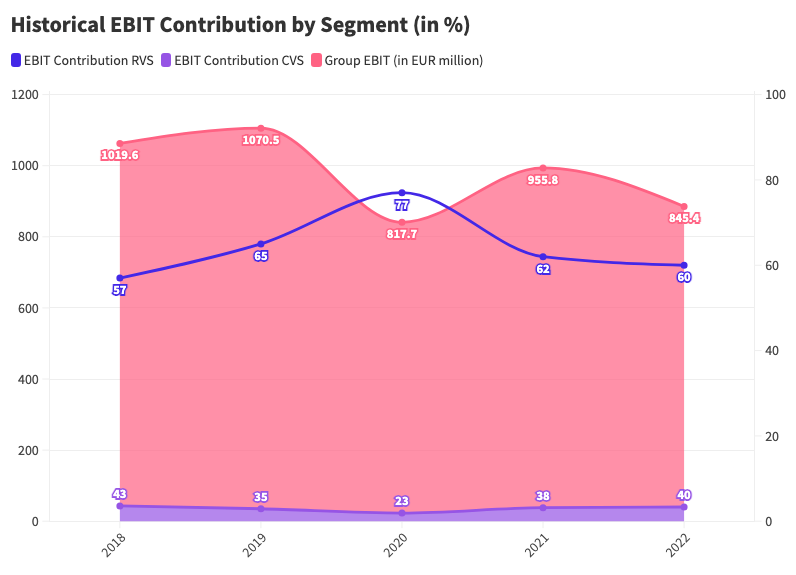

In terms of business segment performance, the CVS market was the main driver of revenue growth in the last two years following the pandemic, with a 20% increase in 2021 and an additional 10% in 2022, reaching EUR 3.75 billion. This growth was further supported by sales from the RVS division, which amounted to EUR 3.4 billion (PY: 3.3 | +2.6%).

While the revenue distribution between the two segments has remained relatively stable over time, the performance of the CVS segment closely reflects global economic trends, as seen in the significant revenue drop in 2020 when the Covid pandemic heavily affected economies and caused a decrease in truck production due to near-halts in global supply chains. Conversely, the RVS business, particularly in the passenger segment, tends to be less affected by economic cycles, making it more resilient to such trends. This underscores the advantage of Knorr-Bremse's strategy in combining rail and commercial vehicle businesses.

In terms of profitability, the operating margin of the CVS division temporarly recovered in FY21, achieving an EBIT margin of 10.7%, primarily due to truck production and demand in Europe and North America. However, the division's profitability dropped again in FY22 to an EBIT margin of 8.5% mainly due to high input costs and soaring energy prices in Europe.

It's noteworthy that in the 3Q23 results, Knorr-Bremse reported a considerable rise in group EBIT and an improvement in the EBIT margin to 11.5%.

Despite the EBIT margin of the RVS business declining to 13.3% in 2022, impacted by sanctions on Russia and the situation in China, it remains Knorr-Bremse's more profitable segment. In FY22, the RVS division contributed approx. 60% of the group's EBIT, largely due to its significant share of high-margin aftermarket revenues, as detail below.

Aftermarket: The Resilient Backbone and High-Margin Recurring Revenue Stream

The resilience and profitability of Knorr-Bremse's business, particularly during economic downturns, is bolstered by its aftermarket segment, which are typically done at higher margins and are less cycle than OE sales, because a certain level of aftermarket maintenance and service work must be performed, even during an economic slowdown. At the group level, sales of aftermarket parts and services rose to 38% (PY: 36%) of total sales in FY22, adding further stability to its business model.

Both the RVS and CVS segments benefit from substantial aftermarket opportunities, arising from a large installed base of vehicles equipped with Knorr-Bremse's systems. Additionally, increasing regulatory requirements, particularly for railways, for regular inspections and fleet upgrades are further boosting the aftermarket volume.

The RVS division, under RailService brand, offers aftermarket services including spare parts, maintenance, and repair for rail vehicles, which represented 48% of its total revenues in FY22.

Similarly, the aftermarket in the CVS segment presents significant opportunities, particularly as components like brake pads and disc brakes in commercial vehicles require multiple replacements throughout their average lifecycle of about 20 years, as noted by Knorr-Bremse. In FY22, the global aftermarket platform TruckServices, contributed 28% to the CVS revenues.

As outlined in the CEO's letter in the FY22 annual report, this area will remain a key strategic focus going forward.

In future we intend to focus even more on the aftermarket and on data-driven solutions. This is a core element of our strategy. With three successful takeovers and strategic partnerships in precisely these areas we delivered on our promises last year. The investments in Cojali, Nexxiot and DSB will sustainably strengthen our digital and aftermarket business. Here too, Knorr-Bremse intends to continue its profitable growth.

Geographically, demand for rail vehicle systems and commercial-vehicle systems remained robust in all markets, with the exception of China. As Knorr-Bremse’s largest market in the Asia-Pacific region and a crucial segment for rail vehicles, China faced considerable challenges due to its zero-Covid policy and related transportation restrictions until the end of FY22. According to Knorr-Bremse, these issues resulted in a 53% YoY decline in commercial vehicle production in China for 2022, dropping to about 690 thousand units. Consequently, revenues in the Asia-Pacific region dropped to EUR 1.8 billion (PY: 2.0 | -11.3%), accounting for 25.1% of the group’s total revenues (PY: 30.2%).

In the Europe/Africa region, revenues increased to EUR 3.4 billion (PY: 3.2 | +6.1%), representing the group's largest market with a 47.4% share. North America also recorded substantial growth, with revenues up to EUR 1.8 billion (PY: 1.4 | +29.7%), accounting for 25.4% of total revenues.

Operating Efficiency & Profitability

While Knorr-Bremse has consistently generated returns above its cost of capital in the past, its ROCE, calculated as EBIT/Capital employed, has declined from 27% in 2018 to 15% in 2022,. This decrease can be attributed not only to reduced EBIT due to the Covid pandemic but also to a higher level of capital employed, partly resulting from the company’s M&A activities in recent years.

Although these acquisitions targeted key growth areas, they have not yet fully benefited the business or created shareholder value, as reflected in the disproportionate increase in goodwill and other intangible assets, as well as property, plant, and equipment (PPE), which almost doubled since 2018 to EUR 1.5 billion in FY22. During the same timeframe, operating income decreased by more than 25%.

The improvement in EBIT margins and ROCE to reach the levels seen in 2018 and before will take some time, as highlighted by CFO Frank Weber in the recent 3Q23 earnings call in November.

“As already mentioned several times: in the case of longer-term OE legacy contracts that we won before the sharp rise in inflation, it is not possible to fully pass on the increased costs to our customers but it is important to note that the new OE contracts we have won already since the end of last year have the same good profitability as contracts we realized before the sharp increase in inflation.”

It's important to note another aspect that emphasizes Knorr-Bremse's position as an innovative leader and its potential for further margin improvements. To maintain its technological edge and market leadership, the company continuously invests in R&D to keep up with developments in key areas, such as automated driving, e-mobility, and connectivity.

In FY22, the R&D investments reached EUR 466.1 million (PY: 431.4 million | +8.1%), accounting for 6.5% of the total sales. Compared to its peers, Knorr-Bremse invested substantially more in R&D, a commitment that is also evident in the significant number of patents it has secured.

Regarding margin improvement, Knorr-Bremse can benefit from synergies between its two segments, optimizing R&D investments and reducing costs, which is also highlighted by the company in recent annual reportings

“In our research and development activities, we leverage the potential synergies between our two divisions. Across parts of our product portfolio, the underlying technologies can be applied in both divisions….Synergies between the divisions translate into a faster time to market and reduced development costs. For instance, the technologies for both disk brakes and screw compressors were transferred from our RVS division to our CVS division.”

Free Cash Flow and CAPEX

In FY22, the free cash flow fell short of the initial forecast of €500 million to €600 million made in February, ultimately reaching €314 million (PY: €713 million | -55%). The primary reasons for this downturn were significantly lower cash flow from operating activities, mainly due to reduced net income for the period and a substantial increase in inventories, which was caused by supply constraints and market challenges.

Knorr-Bremse's capital expenditure (CAPEX) on property, plant, and equipment (maintenance CAPEX) totalled to only EUR 227.4 million in FY22. Considering the company’s operation in over 20 countries worldwide and nearly 70 production sites., this might lead one to assume that the business is highly capital-intensive. Yet, it has allocated just about 3-4% of its sales towards CAPEX over the past five years, demonstrating efficient capital management despite its extensive global operations.

More positively, the group's incoming orders climbed to a new peak at EUR 8.1 billion (PY: 7.3 | +11.4%). This growth was driven by robust demand in the global rail vehicle market. The book-to-bill ratio, representing the ratio of incoming orders to revenues, stood at 1.13 for the FY22 (PY: 1.09), which laid a solid foundation for 2023. Remarkably, throughout the past five years, Knorr-Bremse's book-to-bill ratio has continuously exceeded 1, demonstrating resilience even amidst the challenging conditions of the Covid-19 pandemic and subsequent temporary shutdowns of its customers' manufacturing sites, which signals sustained high demand for its products and prospects for revenue expansion.

Furthermore, Knorr-Bremse's order book saw a significant increase to EUR 6.9 billion at the end of FY22 (PY: 5.5 | +25%) increase. This growth, propelled by a positive order environment, led to an unprecedented forward order book of 11.7 months According to the company, it is the largest forward order book in the company's history, indicating that Knorr-Bremse has secured sufficient orders to sustain its operations for nearly a year, signifying strong demand and operational stability.

Liquidity & Debt Structure

Regarding debt financing as of FY22, the balance sheet included:

Knorr-Bremse AG corporate bond: EUR 750m (maturity June 2025, coupon 1.125% p.a., rated A2 by Moody's).

Knorr-Bremse AG corporate bond (Sustainability-linked): EUR 700m (maturity to be confirmed, coupon 3.25% p.a., rated A by S&P).

In January 2022, the group secured an ESG-linked syndicated credit of EUR 750 million with a five-year term. This resulted in an increase in long-term debt to EUR 1.5 billion (PY: 0.78 | +86.9%). This credit formed part of the group's approved credit lines, which total EUR 2.4 billion, with approx. 70.6% still available at the end of the fiscal year.

Despite the acquisitions in 2022 and economic challenges of recent years, the company maintained solid liquidity with a substantial portion of EUR 1.34 billion in cash and equivalents (PY: 1.37 | -2.7%).

Throughout the last five years, Knorr-Bremse has consistently demonstrated solid financial position by maintaining a rurrent ratio of at least 1.5. This strong financial positioning affirms the company's capability to efficiently meet its short-term liabilities without facing any pressing liquidity concerns, underscoring its fiscal resilience and stability.

Shareholders

Europe, and particularly Germany, is known for its family-led businesses, and Knorr-Bremse is another example. 59% of Knorr-Bremse's shares are held by KB Holding GmbH, the investment vehicle of the company's former long-term CEO, Heinz Hermann Thiele.

Outlook

Despite the challenging economic environment and ongoing geopolitical tensions that bring uncertainty, the management confirmed its positive outlook during the 3Q23 earning results for the full year of 2023, with expectations of:

Revenues between EUR 7.5 to 7.8 billion

An operating EBIT margin between 10.5% and 12.0%

A Free Cash Flow between EUR 350 and 550 million

Also, CEO Llistosella, in his own statement, emphasized the company's focus during this call:

“The focus is clear: our top priorities are margin development and cash flow.”

This is followed by actions to divest from unprofitable holdings, starting with optimizing the portfolio through the sale of the subsidary Kiepe Electric. The company projects that this move will increase the RVS division's EBIT margin by 60-90 basis points by 2025. Additionally, the CVS division in the US has completed the sale of a foundry, originally a part of Sheppard, a leading manufacturer of steering systems for commercial vehicles in the US, which was acquired in 2020 from WABCO Holdings.

These actions also highlight the execution of steps that are aligned with the strategy update "BOOST 2026", which was introduced in July of the previous year.

Bull and Bear Investment Case

Bull Case

With over a century of experience, Knorr-Bremse holds a dominant position in the rail and commercial vehicle industries, commanding significant market shares. This strong standing positions it to benefit from key global trends like urbanization in emerging markets, infrastructure development, and digital megatrends like automated driving and data-driven solutions

The RVS and CVS divisions feature a robust, high-margin aftermarket business, contributing 38% of total sales in FY22 and providing recurring revenues. The extensive installed base, especially in RVS, along with the 40-year lifecycle of rail vehicles, combined with it’s higher aftermarket profitability—three times that of the OE business—presents significant potential for further margin improvements.

Bear Case

Global economic slowdown and geopolitical tensions, particularly the ongoing Russia-Ukraine conflict, which poses risks to global economies due to potential intensiving trade-wars, enegry crises and inflation. Furthermore, a potential conflict between China and Taiwan could significantly impact Knorr-Bremse's business, considering China is its second-largest market with substantial growth expectations.

he company is facing increasing challenges as customers, particularly in the rail industry, begin to develop key components in-house to decrease dependence on suppliers like Knorr Bremse. This trend is especially evident among major Chinese manufacturers and could significantly impact Knorr-Bremse's operations and market shares.

Valuation

Shares of Knorr-Bremse are currently priced at EUR 58.7 each (as of December 29, 2023) resulting in an P/E (LTM) of 19.6x, below the five-year average P/E ratio of 22.3x. Looking at the EV-to-EBIT (LTM) multiple of 13.3x, it also trades below the five-year average of 15.2x.

Based on historical average multiples, Knorr Bremse appears to be undervalued by around 12-15% at today's share price. Furthermore, the company’s dividend currently yield at 2.5%.

Another way to value the the company, with simplicity and speed in mind, is to use analyst estimates for EPS while incorporating dividend yields and the potential for annual valuation multiple upside, in order to calculate the total return over 10 years. Considering,

2.5% dividend yield

10% annual earnings growth (although MarketScreener's EPS estimates suggest a higher rate of 12.40% from 2023-2025)

1.2% annual valuation multiple upside

an investment in Knorr-Bremse would result in a 13.7% annual total return, or an expected total return of 261% over the next 10 years.

Even if we exclude the bet on a multiple expansion, it would still result in a 12.5% annual return, or total 10-year return of 224%.

Peer Valuation

Given that Knorr-Bremse significantly differs in terms of business segments and size, and considering that its closest competitor, such as Wabco in the CVS segment, was acquired by ZF and consolidated the business segments, the peer group analysis should be considered as supplementary to other valuation methods.

*Due to WABCO's merger with ZF Friedrichshafen AG, the latest stock price and multiples from May, 2020 will be used as the reference point for the peer valuation.

Despite underperformance in revenue, Knorr-Bremse stands out with its operating profitability and ROCE compared to its peers during the challenging market environments of the previous years.

Final Thoughts

On one hand, Knorr-Bremse's historical success and innovation, spanning over a century as one of the world's leading suppliers of braking systems, its competitive edge with high barriers to entry in the market, and strong aftermarket segment, indicate a clear potential for a rebound, which will require patience.

On the other hand, the company faces economic hurdles, including inflation and ongoing geopolitical tensions, particularly in crucial markets like Europe, China, and the USA. Additionally, the high rate of management turnover, evidenced by four CEOs in only three years, raises significant concerns that need to be closely watched over the next few months.

For now, the instability places Knorr-Bremse in RhinoInsight's category of 'Playing The Game' investments, especially considering its distressed historical and relative valuations as a leading supplier of critical components for the global transportation industry. Should there be another downturn, with shares falling to levels seen in October 2022, around EUR 44.0 each, it would offer a larger margin of safety than at today's price.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference:

Company Homepage

https://www.knorr-bremse.com/en/Company Website Investor Relations

https://ir.knorr-bremse.com/websites/Knorrbremse_ir/English/0/investor-relations.html

Further Readings:

History of Knorr-Bremse

https://www.knorr-bremse.com/en/company/history/?accordion=2021 Death of Heinz Hermann ThieleGlobal Commercial Vehicle Market https://www.bglco.com/research/global-commercial-vehicle-market-july-2023/

Report - Fostering the railway sector through the European Green Deal https://www.era.europa.eu/content/report-fostering-railway-sector-through-european-green-deal_en

China’s heavy-duty truck industry: The road ahead https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/chinas-heavy-duty-truck-industry-the-road-ahead