NIBE Industrier (NIBE): Swedish Compounder Ready for a Rebound after 50% Crash?

High quality compounder and global leader of premium heat pumps with some short-term pain but promising long-term outlook

Summary

Strong Growth: Revenue increased over 60x since IPO in 1997, and still both, revenue and EPS showed 5y-CAGRs of 15.7% and 18.2%, respectively

High Capital Efficiency: Growing operating profit margins with 14.9% in FY23, and 5y avg. ROCE of 12.8% and ROIC of 9.8% underline the high cash flow generation capability

Significant Management Ownership: Former board members and the management team, inclduing the CEO, collectively own around 45% of the company

Demand Fluctuations for Heat Pumps: Elevated inventory levels in the value chain as reported in 4Q23 indicate that wholesalers and installers are likely to reduce their stocks, resulting in decreased demand and lower profits in the short term

Green Transition and Government Support: As consumer choices are frequently influenced by immediate subsidies rather than the long-term environmental impact of products, the consistency of policy changes, such as the REPower EU plan and the Inflation Reduction Act, will largely impact future growth

Introduction of NIBE Industrier

From its humble beginnings as a family business, over the last 70 years, NIBE has risen to become a global player in the production and sale of climate control systems. Established in 1952 and headquartered in Markaryd (Sweden), NIBE has expanded its reach to include more than 40 subsidiaries across 15 countries.

NIBE’s Class B shares listed on the NASDAQ OMX Large Cap list in Stockholm, and since 2011, with a secondary listing on the SIX Swiss Exchange in Zurich.

Product and Service

NIBE’s offerings include a diverse range of components and solutions for smart heating and control across industry and infrastructure. It operates through three following distinct businesses.

Climate Solutions

NIBE Climate Solutions business segment offers a wide range of products for energy-efficient indoor climate comfort, including heating, air conditioning, ventilation and water heating for both single-family homes and installations in commercial properties and industrial applications.

Climate Element

NIBE Climate Element specializes in making parts for smart heating and control, serving a broad range of customers, which includes industries that are quickly growing, like the semiconductor and electric vehicle sector.

Climate Stove

As for Climate Stove products, recent fluctuations in energy prices have made stoves an appealing backup heating option for single homeowners. NIBE provides a diverse selection of high-quality products, including wood-burning stoves, which are essential for non-urban households in extreme weather regions like Canada and the northern US, where wood serves as a heat source some or all of the time.

NIBE has a strong presence in Europe and North America across its three main business areas, aiming for further expansion by leveraging the global market's vast potential. According to the company’s own evaluation, the overall addressable market size for NIBE is significant, estimated at approx. SEK 1,200 billion (USD 117 billion), predominantly driven by demand for sustainable heating, cooling, and air quality products. NIBE Climate Solutions holds the most substantial potential, estimated at about SEK 1,000 billion, followed by NIBE Element and NIBE Stoves at SEK 160 billion and SEK 50 billion, respectively.

Strategic Acquisitions: A Key Pillar in NIBE's Expansion Strategy

Right from the start, NIBE has paired its organic development with a strategic emphasis on acquisitions to position itself across different markets and product segments, primarily targeting small to medium-sized enterprises.

Some of NIBE's notable acquisitions in 2023 included:

The complete acquisition of Climate for Life (CFL) for a purchase price of SEK 7,154 million. The Dutch-based company is specialised in HVAC systems and reported 2022 sales of EUR 221 million and operating margin of around 18%

A 65% stake in Miles Industries Ltd, a Canadian stove company with sales of approx. CAD 75 million and operating margin exceeding 10%

A 77.5% stake in Ceramicx, an Irish company specialising in elements with sales of EUR 10 million and an operating margin above 10%

In the past five years, NIBE's sales have more than doubled, with growth partly fueled by the strategic acquisition of 36 businesses during this period. These acquisitions have not only opened new markets and revenue streams but also reinforced NIBE's dominant stance in its three key business sectors. Considering NIBE's remarkable revenue increase of more than 60x since its 1997 IPO, without jeopardising any considerable profitability, this approach has clearly been very successful.

Management

The NIBE management team is led by CEO Gerteric Lindquist, who has been with the company since 1988, spanning over three decades. His significant personal investment in NIBE, owning 11.6% of the A-shares and 3.6% of the B-shares, underscores his commitment and confidence in the company.

Also the rest of the team mirrors this dedication with considerable tenures and ownership stakes that underscore their long-term investment in NIBE's future.

Industry & Business Model

According to Eurostat data, about 50% of all energy consumed in the EU is used for heating and cooling, and more than 70% still comes from fossil fuels (mostly natural gas). In the residential sector, around 80% of the final energy consumption is used for space and water heating, which is the main business of NIBE and obviously, still offers tremendous growth opportunities.

Consumer decisions are often influenced by short-term subsidies rather than the long-term environmental impact of products. Consequently, government incentives in recent years have spurred strong demand for eco-friendly climate solutions. For example, the EU Green Deal's REPowerEU plan by the EU Commission is designed to phase out Russian gas, oil, and coal imports by 2027, encouraging investments in renewable energies and energy efficiency. This plan includes an ambitious goal to install an additional 60 million heat pumps between 2023 and 2030.

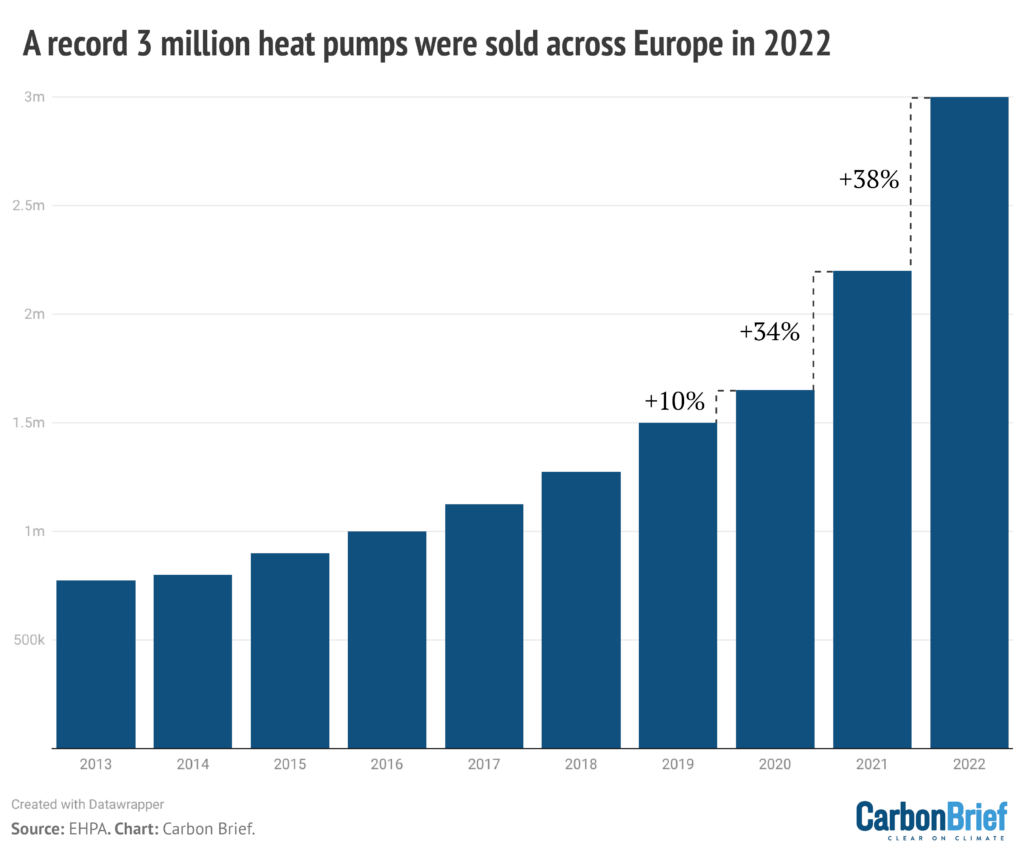

Driven by such policies, the global heat pump sector, NIBE’s most important business segment, achieved considerable growth recently. In 2022, heat pump sales in Europe jumped to 3 million units, a 38% increase from the previous year and double the number sold in 2019.

The market boom in 2022 was observed across all European regions, experiencing double-digit growth in both established and emerging markets. Notably, Norway, which boasts the highest heat pump usage globally with two-thirds of homes using this technology, still experienced a 25% increase in heat pump sales.

It’s important to understand that Norway’s early adoption was triggered after the 1970s oil crisis. The country embraced heat pumps, fuelled by government subsidies, high fossil fuel taxes, low electricity prices and restrictions on oil boilers, which have been banned since 2020.

Beyond Europe, the United States has emerged as a major player in the global heat pump market, with heat pump sales surpassing gas furnace sales for the first time in 2020. This shift is reinforced by the Inflation Reduction Act (IRA), offering rebates and tax incentives for the installation of heat pumps in both residential and commercial properties. Moreover, regulations like New York's ban on gas heating and cooking in new buildings, and Quebec's (Canada) prohibition of oil-powered heating, further encourage the long-term adoption of heat pumps.

Additionally, the conflict between Ukraine and Russia, which began in 2022, significantly impacted the market. Skyrocketing gas and oil prices due to EU sanctions on Russian imports and the reduction of Russian gas supplied to the EU have led to a higher demand for heat pumps as an alternative by home and property owners.

However, the trend of the last decade, where combined sales in Europe increased annually, reversed in 2023, and heat pump sales in 14 European countries felt by around 5% compared to 2022. The slowdown, which was further elevated by drop in oil and gas prices mid-2023, already led to increase in substantial inventory levels. This trend, particularly in Europe, prompts a critical question, also raised by NIBE's CEO in the recent 4Q23 earnings call:

“…are we really heading in the right direction or are we returning more to a gas driven society again when prices are down…”

I highly recommend listening to this call, especially to hear CEO Gerteric Lindquist address analysts concerns about whether the current fourth-quarter trends are temporary or indicate a deeper issue. His responses seemed to be marked by some level of uncertainty. And, if this trend is not temporary, it may severely affect NIBE and its peers, potentially hindering their anticipated growth in the short to medium term.

Although the theoretical demand for heat pumps and other sustainable climate solutions is significant, bolstered by strong government support and public awareness in recent years, the successful execution of the ambitious green energy transformation depends on having sufficient structural incentives, regulatory frameworks, and favorable macroeconomic conditions in place. Ultimately, the decision for home and property owners to transition will hinge on the economic benefits and the consideration of opportunity costs.

Competition

The global heat pump market is highly competitive, with a large number of players operating at regional and global stage. Some of the main publicly listed competitors include

🇺🇸 Carrier Global Corporation

🇺🇸 Trane Technologies

🇯🇵 Daikin Industries Ltd.

🇯🇵 Mitsubishi Electric Corporation

🇨🇳 Midea Grou

Meanwhile, in Europe, NIBE's most important and largest market, policies like the European Green Deal and a series of subsidy programs for heat pumps, along with tax refunds, have attracted other global climate solution players to invest outside their home markets. Thus, over the past few years, competition has intensified, particularly from a significant number of non-European companies originating from the air-conditioning industry, like Daikin Industries, who invested EUR 300 million in Europe in 2022 to establish a new heat pump factory in Poland.

Financials & Key Figures

All of the graphs and financials will refer to last Fiscal Year (FY) because that way I can see how the company has progressed throughout recent years, which may show more of a trend than looking at every quarter that may fluctuate quite a bit. I will include some of the most recent numbers if they are necessary for extra color.

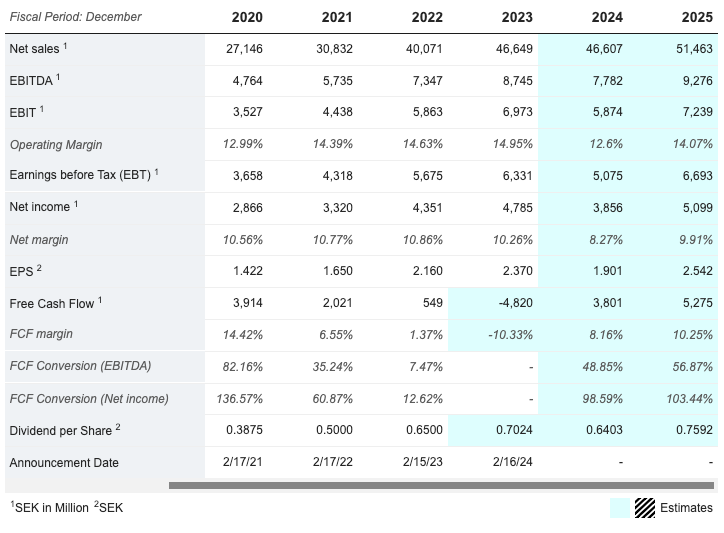

Over the years, NIBE has showcased impressive operational success, with revenues increasing at a CAGR of around 17% from SEK 736 million (IPO in 1997) to SEK 46.6 billion in FY23.

Out of the current FY23’s revenue, SEK 2.5 billion was generated through acquisitions, highlighting that although total revenue increased by 16.4%, organic sales experienced a growth of 10.2%, a decline from the previous year's 26.5%. During the same time period, operating profit swelled to SEK 6.9 billion (PY: 5.2 | +33,1%), resulting in an operating margin of 14.9% (PY: 13.1%).

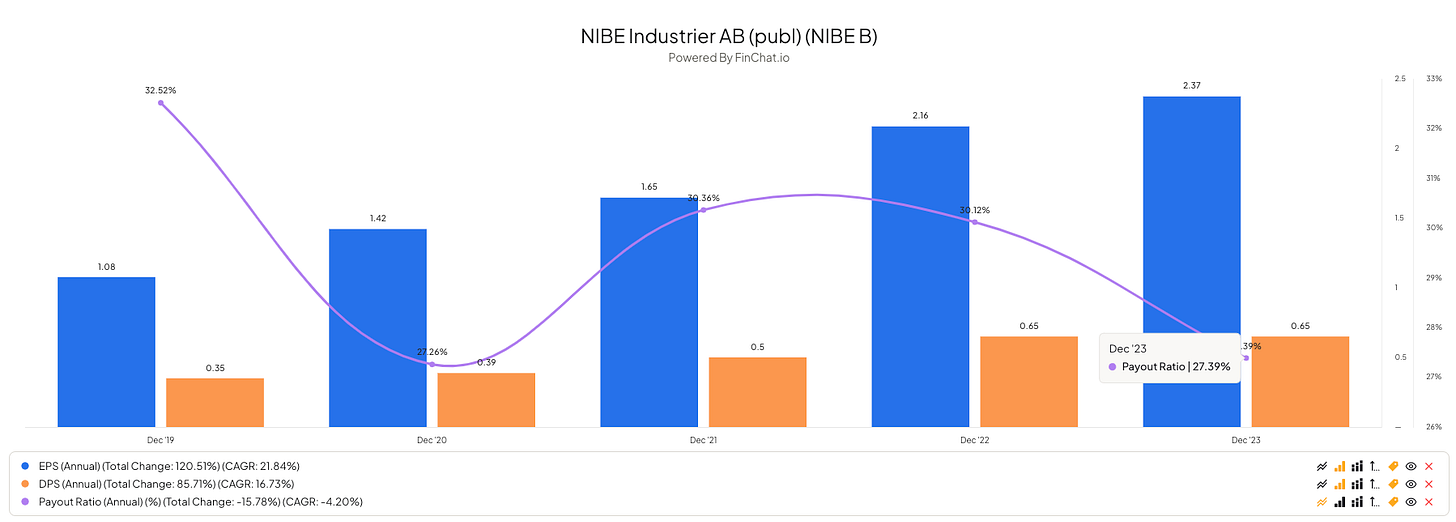

NIBE’s double-digit revenue growth and steady margins have resulted in a continually increasing earnings-per-share (EPS) with a 5y CAGR of 17% reaching SEK 2.37 in FY23.

Zooming into the business areas, NIBE’s Climate Solution segment has seen significant growth in the last two years, reaching EUR 31.3 billion in FY23 (PY: 26.1 / +20.3%), after already showing growth +29.06% in FY22 due to the favourable business environment based on supportive government policies, especially in Europe, and rising cost of fossil fuels which made heat pumps more attractive for the end consumer.

With two-third of total revenues, NIBE’s Climate Solutions business segment, still remained as the most important business segment in FY23, where the majority of sale is made by selling heat pumps.

It has not only continued to be the largest source of revenues, it has also remained the primary contributor to the group's profitability accounting for almost 80% of total profit, which didn’t change much over the years.

However, It’s important to note here, that despite FY23's record-high turnover and operating profit, the company reported large fluctuations across all business segments over the year, particularly in Q4, which showed a slow down in demand compared to the same quarter of the previous year.

Notably, while NIBE’ Climate Solution sales experienced a slight contraction, its operating profit declined from SEK 1.5 billion SEK 1.2 billion in 4Q23, which due to its significant size, was the largest negative driver for the decline of 15% total profit in the fourth quarter. According to the management, this negative trend is the result of higher interest rates and inventory adjustments by distributors, which occurred from a demand-supply mismatch amplified by the up and down of energy costs since 2022.

The headwinds in last quarter of the FY23 also impacted NIBE’s two other segments, Element and Stove, which reported weak performance compared to previous quarter of the year with declining profits and margins.

Looking at the geographical split of sales in FY23, Europe remains as the primary market for NIBE with SEK 21.9 billion (PY: 18.4 | +24.5%), followed by North America and Nordics with SEK 12.6 billion (PY: 10.6 | +18.9%), and SEK 9.7 billion (PY: 8.9 | +8.9%), respectively.

Though Europe, including Nordics, has been the main market for NIBE since founding company, through several strategic acquisitions since 2011, such as the leading US geothermal heat pump brand WaterFurnace in 2014, as well as several other acquisition in the following years, North America continued to be a significant market for NIBE.

Capital Efficiency and Cash Flow

In terms of capital efficiency, NIBE's competitive advantages—whether in technology, operational efficiency, or market position—are reflected by the average Return on Capital Employed (ROCE) and Return on Invested Capital (ROIC) over the past five years. This also demonstrates NIBE's commitment to sustainable growth and its success in creating significant value for its shareholders.

While NIBE has consistently demonstrated a strong ability to generate cash flow over the past several decades, there was a noticeable decline in operating cash flow during 2021 and 2022 compared, driven by increased inventories. Management attributed this to the strategic stockpiling of components and materials intended to mitigate supply chain interruptions, coupled with a slowdown in demand. Positively, the most recent financial report shows an improvement in operating cash flow, reaching SEK 3.8 billion in FY23, as efforts to reduce inventory levels begin to take effect.

Additionally, investments in expanding production capacity across all business areas, combined with ongoing acquisitions effected free cash flows. The Group’s total investments amounted to SEK 13,037 million (PY: 3,745 million). Business acquisitions accounted for a total of SEK 9,185 million (PY: 1,680) of the investments. A return of FCF to pre 2020 levels can be anticipated, as mentioned by the management in the latest year-end report

In view of the expected opportunities for future growth, we already established a proactive investment program of SEK 10 billion in 2020. The majority of the investments, around SEK 8 billion, have already been implemented and the remainder will largely be completed in 2024/2025.

Liquidity & Debt

At the end of FY23, the company saw significant increase in financial liabilities, which doubled from SEK 11.4 billion at the beginning of the period to SEK 21.5 million, mainly due to investments in the group’s production facilities and business acquisitions. Considering NIBE’s cash and cash equivalents position of SEK 5.98 billion, NIBE’s net debt almost tripled to SEK 17.2 billion (PY: 6.2 | +177%).

While equity/assets ratio at the end of the period came to 44.4% (PY: 51.8%), the rise in debt costs has led to a significant drop in interest coverage ratio to 6.3x compared to the much more robust levels of 14-20x in the past.

The main reason for increasing financing costs is, according to the management, that NIBE’s loans mostly have variable interest rates, which means when interest rates go up, so do their loan payments. While NIBE isn’t in immediate trouble of paying back its debts, it's something to watch closely, especially when the demand fluctuates and the economic environment is getting tougher.

Shareholders

NIBE has a dual share class structure, where B-class shares are available for individual investors while the A-class shares are mainly held company by board members and senior executives, including the CEO Torsten Lindquist. As of the end of FY23, 1,782,936,128 B-class shares were in circulation, with a free float of 78.27%.

Interestingly, former board members and the management team collectively own 70.5% of the A-Shares and 13.7% of the B-Shares, highlighting their long-term investment in NIBE's future. The largest single shareholder is the investment company of Melker Schörling, a Swedish billionaire businessman, holding a voting right of 18.68%.

Outlook

Listening to NIBE’s latest 4Q23 earnings call, NIBE is preparing for a tougher market in 2024. The company predicts that things might be a bit slow, especially during the first half of the year, but remains cautiously optimistic about potential growth in the latter half of the year.

”This cautious view of the immediate future notwithstanding, we are relentlessly positive about future growth opportunities in the heat pump market, not least against the background that there are few other realistic, sustainable alternatives for climate control of both existing properties and new housing output.”

Since expectations of a recovery have been pushed into second half of 2024, it will be important to see in the upcoming reports how the overall demand and inventory situation will develop in the upcoming months.

Bull and Bear Investment Case

Bull Case

Global Market Size and Penetration: Given that heat pumps are still make only a small part of the heating market, where the use of oil and gas boilers dominates, it still offers huge market potential; According to the company’s own evaluation, the total market value for NIBE’s Climate Solutions, mainly heat pump, represents around SEK 1,000 billion (approx. USD 100 billion)

Government Support and Geopolitical Tension: The growing recognition of the urgent need to decrease the reliance on fossil fuels, with the uncertainty surrounding the price of electricity, gas and oil, supported by government policies, especially in the EU to become independent from Russian fossil fuels, could lead a continues robust demand for heat pumps in the long-term

Bear Case

Impact of Energy Prices: The recent growth in the heat pump market has been partly driven by rising energy prices. Should these prices stabilize or decline, the urgency for consumers and businesses to switch to more efficient, alternative solutions like heat pumps could lessen, potentially slowing down market growth

Vulnerability to Policy Changes: The global heat pump market's growth, supported by environmental policies and subsidies, could face headwinds if government actions slow down or reversed, which would slow the company's growth trajectory

Valuation

Based on NIBE’s operational performance since its IPO in March 1997, the share has yielded a total return of +31,692%, averaging 25% annually, even when considering the recent decline of over 50%.

Currently, with a share price of EUR 55.7 and a P/E (LTM) ratio of 23.5x, NIBE is trading below its ten-year median P/E of 27.8x, while the EV/EBIT (LTM) ratio at 18.8x is significantly below the ten-year median EV/EBIT of 24.2x.

Based on the historical multiples, today's share price appears to be undervalued by around 15-20%.

The extreme valuation in 21/22 highlights the contrast between Dream Investing and Value Investing. After a more than 50% decline in share price from its peak in 2021/22, NIBE still remains a strong company with a excellent management team. Considering the current challenges, at todays price levels, it offers a much higher margin of safety than just a few months ago, and is a great example of the importance of valuation in achieving long-term investment returns.

Valuing the total 10-year return of a stock based on analyst estimates for EPS, and incorporating dividend yields, which includes:

1% dividend yield

6-7% annual earnings growth (as per MarketScreener estimates for 2025)

would result in a 7-8% annual total return, or an expected total return of around 96 - 115% over the next 10 years.

Given the modest dividend yield and the expectation that the earnings multiple will not grow in the medium term, the forecasted total return over the coming decade might not sufficiently offset the investment risk. It's important to note that, neither in the most recent year-end report nor during the earnings call, were there any changes to the three major financial targets, which include an average annual revenue growth of 20% over a business cycle (half organic and half acquired). Taking these growth rates into account, the expected returns in the coming years would clearly be much higher.

Peer Valuation

NIBE is currently priced at a premium to compared to most of its peers, which given to it’s high profitability and robust earnings growth, is somehow justified.

Final Thoughts

The very ambitious timeline for the zero carbon transformation pushed by the governments worldwide, particularly in Europe, calls for caution. I believe the recovery in the second half of 2024 or 2025 might not be as sharp as NIBE's management highlighted in the fourth quarterly earnings call, considering the current market environment. Additionally, the high inventory levels in the value chain, which typically takes some to normalise, bear the risk of price wars that could impact operating margins and earnings.

Yet, with a consistent track record of value creation over its extensive history of more than 70 years, NIBE has demonstrated success across various market scenarios, which makes it a solid long-term business and potentially a promising investment, despite the current challenges.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference:

Investor Relations

https://www.nibe.com/investors/The Future of Heatpumps by IEA https://iea.blob.core.windows.net/assets/2cf6c5c5-54d5-4a17-bfbe-8924123eebcd/TheFutureofHeatPumps.pdf

NIBE’s Q4 Earning Call

https://quartr.com/companies/nibe-industrier_5793NIBE Air/water heat pumps

https://www.atmopomiar.pl/wp-content/uploads/2015/02/NIBE-AIR-HEAT-PUMPS.pdf

Further Readings:

NIBE: Creating Millionaires and a Greener Future

https://quartr.com/insights/company-research/nibe-creating-millionaires-and-a-greener-futureEurope’s Heat-Pump Bubble Is Sadly Deflating

https://www.bloomberg.com/opinion/articles/2024-02-22/climate-crisis-europe-s-heat-pump-bubble-is-sadly-deflating