RATIONAL AG (RAA): A Hidden Campion of Professional Kitchens

A global leader in professional kitchen equipment with exceptional capital management, a robust balance sheet, and significant ownership by the founding family

Strong Brand: One of the best-known names in professional kitchens and by far, the world market leader with over 50% market share

Healthy Balance Sheet: Almost no financial debt with net liquidity position and high equity ratio of 0.76

High Capital Efficiency: Profitable business model with average ROCE(5y) of 33% and low capital intensity with high cash flow generation ability

Global Economy & FX Sensitivity: High sensitivity to global economic activity; Around 50% of group revenues come from foreign currency sales (primarily in USD)

Growth Drivers: Shortage of skilled workers, population growth, rising costs for energy and labor are driving forces for future growth potential

Introduction of Rational AG

Established in 1973 in Landsberg am Lech, Germany, RATIONAL’s story began when Siegfried Meister, founder of the company, combined steam to the hot and dry air in the oven, in a single appliance. Since then, RATIONAL has become a global leader and revolutionized the large and commercial kitchens of the world.

Since its IPO in 2000, it has been listed in the Prime Standard of the Frankfurt Stock Exchange, and is currently included in the MDAX, which lists German companies that rank in size immediately below the companies included in the DAX index.

Product and Service Excellence

Interestingly, the first combi-steamer, for which RATIONAL is known today, was pioneered in the late 1960s by Burger Eisenwerke, acquired by Juno, which is now part of the Electrolux Group, one of the competitors based in Sweden.

However, RATIONAL’s remarkable journey from a small German startup to a global powerhouse for thermal food preparation systems, is attributed to its commitment to innovation and customer orientation, as summarized by Walter Kurtz, Chairman of the Supervisory Board, in the 2022 annual letter.

“We concentrate on what we do best: the preparation of hot food in professional kitchens. It is the heart of any professional kitchen — or, as Siegfried Meister once put it, also its biggest bottleneck. If it is not possible to prepare high-quality meals efficiently and sustainably while maintaining strict hygiene standards, the operation will cease to function or fail to be competitive in the long run. We address this bottleneck and offer our customers solutions that work best in the given context.”

In 2020, the company introduced the newest version of its flagship product, the iCombi Pro, succeeding the SelfCookingCenter, which combines traditional cooking methods with heat and steam, integrating stoves, ovens, and steamers into a single unit.

With the introduction of iVario Pro, who succeeded the VarioCookingCenter in 2020, the company extended its service range from boiling to deep-frying functionalities.

The iVario Pro was founded and manufactured by its subsidiary FRIMA in France, which became part of the RATIONAL group in 1992, which marked a significant expansion of its product range.

According to RATIONAL, when both products are used in combination, they cover 90% of the cooking processes in professional kitchens. This makes the company very appealing as an almost complete solution provider commercial kitchens, eliminating many manual tasks and making workflows as efficient as possible.

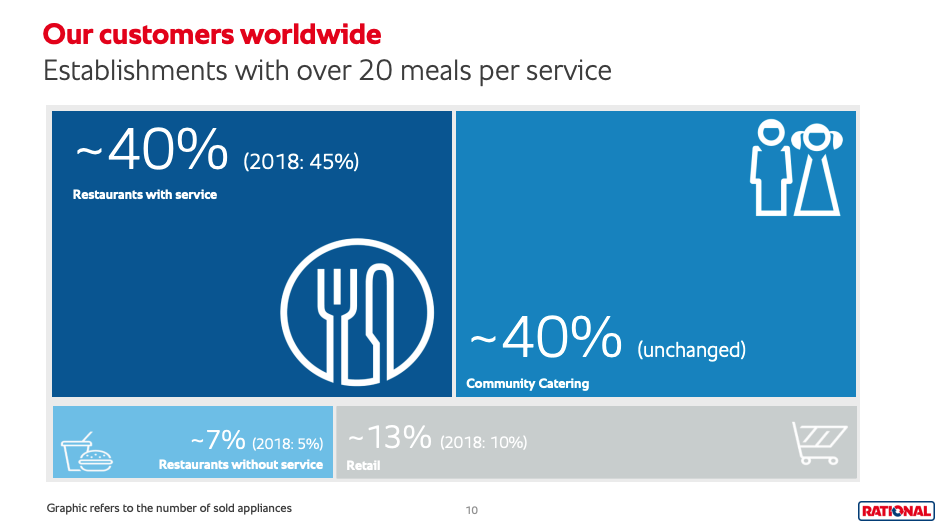

In the world of thermal food preparation, RATIONAL stands as the clear global leader, holding of around 50% of the market share based on its own estimates. With a local presence in over 120, the company serves a wide range of a customer base ranging from restaurants and hotels to large-scale mass catering options, such as hospitals and company canteens, as well as retail, including supermarkets and service stations.

Management

All members of the executive board, with the exception of the CTO, have served for at least a decade for the company, with Dr. Peter Stadelmann as CEO since January 2014.

Low management turnover signifies stability and resilience, and the exceptional performance and capital efficiency of RATIONAL’s business operations over the last decades, to some extend, is also reflected in the persistency of it’s key leadership positions.

In terms of remuneration, in FY22, the Executive Board received a total remuneration of EUR 6,895 thousand (1.22% of 2022 gross profit). Managers in key positions were paid EUR 8,130 thousand (1.44% of 2022 gross profit).

The company provides a very detailed explanation of how the Exetuctive Board and Managers are getting payed and incentivised. Most interestingly, they started using Return on Capital Employed (ROCE) not just to measure financial performance of the business, but since FY22, it has been included as a long-term financial key performance indicator (KPI) in the remuneration system for the Executive Board, which accounts for 20% of total target remuneration. Tying long-term incentives (LTI) to ROCE establishes a framework for fostering sustainable growth by focusing the management to invest capital wisely, resulting in better cash flow, and a competitive advantage, as in the case of RATIONAL.

Industry & Business Model

According to RATIONAL's estimates, the global market potential for combi-steamers comprises around 4.8 million kitchens, 75% of which still utilize traditional cooking technologies, and even 96% when considering the addressable kitchens targeted by the iVario.

Given the high untapped market potential for both product groups, RATIONAL faces significant opportunities to transition professional kitchens from traditional technology to multifunctional intelligent cooking systems. This is also driven by factors such as the shortage of skilled workers—dramatically increased by the pandemic—and the push for further automation due to cost pressures.

Interestingly, RATIONAL has provided examples demonstrating the payoff of its customers' investments, with savings of up to 50-70% in areas such as space and energy costs, which makes its products a logical choice for kitchen chefs worldwide.

For instance, an investment calculation presented during its 1Q18 report illustrated that for a restaurant preparing 200 meals per day, investing approximately EUR 25,000 in 1x SelfCookingCenter and 1x VarioCookingCenter could generate around EUR 5,000 in extra profits per month, achieving a break-even in just about 5 months.

Although the numbers from 2018's may not fully reflect today's reality, given the increased costs of raw materials and energy, they still underscore the attractiveness of buying these products for restaurants and chefs worldwide.

Another accelerating trend in recent years, the rise of so called ghost or cloud kitchens, which are commercial kitchens optimised for third-party food delivery service, creates increasing demand for efficient, and space-saving kitchen equipments provided, which creates additional growth opportunities. For those interested, Middleby, one of RATIONAL’s main competitors, has published several articles about how ghost kitchens are changing the landscape of the foodservice industry and how provider of foodservice equipments leverage technology to benefit from this trend.

Competition

While RATIONAL still maintains its dominance in the global market of combi-steamers, the commercial foodservice and food processing kitchen equipment industry is characterized by intense competition and fragmentation, featuring numerous global and local competitors. One such player is Middleby, a US-based manufacturer comprising some of the most well-known brands in the foodservice and beverage equipment sector.

Unlike RATIONAL, which primarily emphasizes organic growth and has undertaken only one notable acquisition, that of FRIMA in 1992, Middleby has extensively utilized acquisitions to broaden its business scope. Since the start of 2019, Middleby has engaged in over 30 M&A activities, diversifying investments across various sectors within the foodservice industry, ranging from frying technology to multi-purpose cookers. For instance, Middleby introduced the CTX oven, an automated cooking platform capable of cooking, baking, broiling, searing, and steaming, all within a single appliance, directly competing with products offered by RATIONAL.

Financials & Key Figures

All graphs and financial data will reference FY2022 to demonstrate the company's performance over the latest full fiscal year and to identify trends, as quarterly figures exhibit high variability. When necessary for further context, the most recent numbers will incorporated.

The coronavirus crisis had a strong impact on the business activities and those of RATIONAL’s customers, especially in the hospitality, hotel and mass catering segments, and shaped RATIONAL’s overall FY20 performance, with double-digit decline across all regions.

However, due to it’s strong market position, the successful recovery resulted in revenues reaching EUR 1.02 billion (PY: 0.78 | +31%) in FY22, while operating margins continued to improve and reached 23.3%, despite the inflationary environment of input material costs.

Besides the solid operational performance, positive foreign currency effects contributed to RATIONAL's growth. Given that RATIONAL generated 50% of its sales revenues in foreign currencies (PY: 49% ), with the US Dollar being the most important one, sales revenue growth after adjustments for exchange rate movements stand at 27%.

In addition to currency effects, the rise in sales revenues was also driven by the price increases implemented in 2022. The company estimated this effect to be approx. 10% for FY22.

After the significant decrease in sales revenues and EPS, leading to reduced dividend payments in FY20, this deficit was completely offset by special dividend payments of EUR 2.5 per share in the subsequent years. This resulted in a 3-year dividend compound annual growth rate (CAGR) of 24.5%.

Notably, beside the 2020 pandemic-caused cut, the only other dividend cut was made in 2008 during the financial crisis, but shareholders were always compensated in the following years via special dividend payments.

Despite a notable decrease in ROCE to 24.6% in 2020, primarily due to pandemic-induced declines in sales and EBIT, few companies have managed to maintain such a level of ROIC. The five-year average ROCE of 33% highlights the company's disciplined approach to capital management.

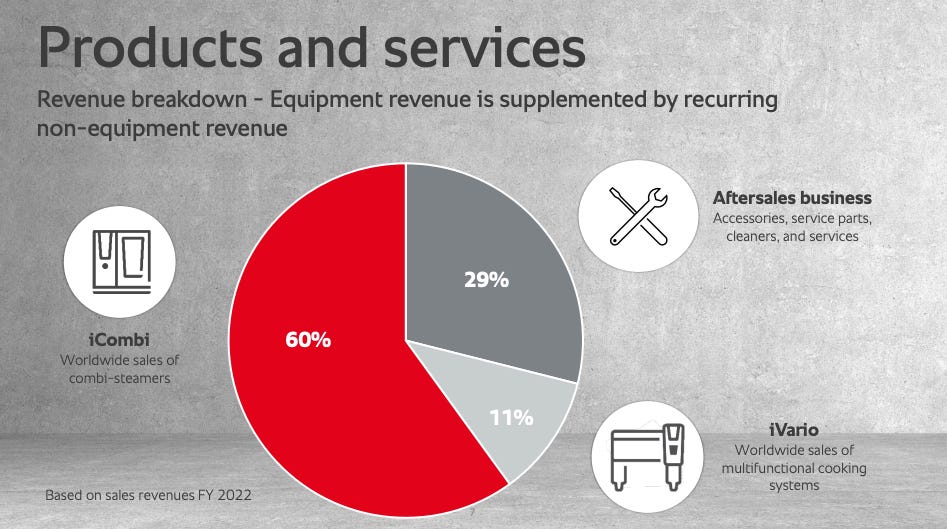

Revenue by Product

The company generates around 71% of its sales revenues from multifunctional cooking systems, with the rest coming from its aftersales business, including accessories, care products, and spare parts, which made an important contribution to growth, particularly with the increasing installed base.

Both the iCombi and iVario, the company's primary product groups, have demonstrated notable growth over the years.

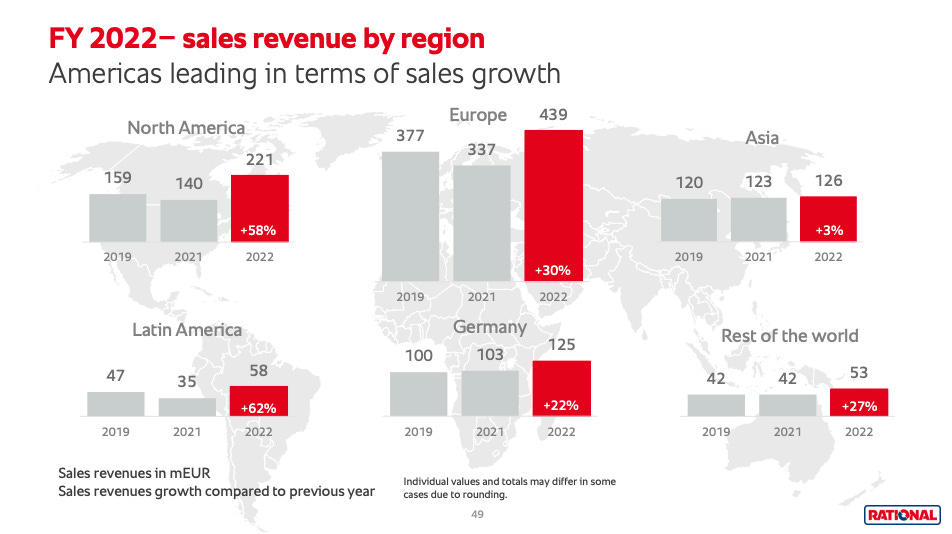

Revenue by Geography

In FY22, the company generated around 50% of it’s sales revenues in Europe (including Germany), and has seen double-digit growth in all regions with the exception of Asia.

The revenues in Asia was only slightly higher then previous year, mostly because of the largest individual market, China, which was 19% down on 2021, due to the strict zero-covid policy and it’s severe domestic economic impact. Positively, in the latest reported preliminary FY23 results, the company noted a 24% increase in sales revenues in Asia, benefiting from the re-opening of China, and according to its own statement, an additional order from a chain customer in Asia, with most deliveries taking place in 4Q23.

The attractiveness and size of the Chinese market were also further emphasized by the CEO in his 2022 annual letter to shareholders. He highlighted the company's investment in a combi-steamer customized for the Chinese market, which aims to particularly targeting less developed regions such as tier-3 and tier-4 cities by providing a more affordable yet high-quality product.

RATIONAL's sales have experienced faster growth in North and Latin America, as well as Asia, over the past few years. This trend highlights a shift in focus towards these markets, which are proving to be important sources of further sales growth.

Free Cashflow and CAPEX

The company has maintained consistently high levels of free cash flow (FCF) due to its profitable, low-capital-intensity business model. In FY22, the company generated EUR 123 million in FCF, down 18% from the previous years. This decrease was largely due to a marked increase in trade accounts receivable at year-end, stemming from strong Q4 sales revenue.

The reported results for the first 9 months of 2023 already indicate a notable increase in cash from operating activities, totalling EUR 197.4 million, which, according to the company, can be attributed not only to higher sales and profits but also to a smaller rise in inventories and trade accounts receivable compared to the previous year.

Liquidity & Debt Structure

The company boasts a robust balance sheet with no longterm debt and substantial cash reserves, cash equivalents and deposits holding of EUR 337.2 million, resulting in a net debt position. Combined with an equity ratio of approximately 0.76, it reflects the management's conservative approach to financing.

Additionally, all liquidity ratios underscore the robust financial health of RATIONAL's business operations, which makes the company largely independent of lenders and enabling it to finance its growth almost exclusively from internal resources.

Shareholder

RATIONAL is another hidden champion from Germany, characterized by strong insider ownership by the founding family and co-founder, Walter Kurtz. Together, they hold around 55% of the outstanding shares.

Interestingly, Fundsmith LLP, a well-known London-based investment firm founded in 2010 by Terry Smith, who is often referred as "the English Warren Buffett," holds about 1.1% of shares in RATIONAL AG. This was initiated when RATIONAL's shares nearly halved in price during the March 2020 stock market crash, and the investment thesis was shortly summarized as follows:

“A position in Rational AG was initiated during the month. The company produces automated professional ovens for restaurants and mass catering venues. Due to the potential impact on the restaurant and catering trade of social distancing measures, the shares of the company have declined 44% since the start of the year. Given its competitive advantage, high returns on capital and strong cash flow, as well as the cash available on its balance sheet, we believe the company will be able to exit the crisis in a good position. We therefore see the recent share price decline as an attractive opportunity to build a position in the company.”

Outlook

According to the financial results for the first 9 months of 2023, there has been a successful reduction in the order backlog, which had reached record levels in 2020 peaking at EUR 245 million due to significant supply chain issues during the pandemic years. At the end of September 2023, the order backlog decreasing to EUR 130 million, nearing pre-pandemic levels.

In his latest letter to shareholders, the CEO effectively summarized the long-term outlook in highlighting RATIONAL's continuous approach to innovation, like the recent announcement of a third product category that simultaneously combines convection, steam, and microwave energy, targeting new market segments.

“These innovations, which create new and additional customer benefit, make us confident about the future, and we are already looking forward to a successful year 2024. Although the year will be impacted by a dampened economic outlook, especially in Europe, we have proved time and again in the past that we are able to cope well with periods of economic weakness. In this regard, our close focus on food, a basic human need, is a huge advantage compared with many other sectors.”

Despite the ongoing energy crisis in Europe, increasing geopolitical tension, and macroeconomic issues posing a risk of further economic distress, the management forecasted a high single-digit range for the full-year FY23.

Bull and Bear Investment Case

Bull Case:

Strong brand, innovation, and sector leadership, combined with the low penetration of combi-ovens in professional kitchens—where more than 75% still use traditional equipment—highlights a significant growth opportunity

Strategic moves to penetrate further into the U.S. market and expand in emerging markets, like China, through the introduction of cost-effective products tailored for lower-tier cities, present substantial growth opportunuties

With average amortization period of less than six months (for restaurants that serves at least 200 meals per day), RATIONAL’s products offers a compelling investment to a wide range of restaurants and catering businesses, driven by labor, energy, and additional equipment savings

Bear Case:

Intense market competition from over 100 suppliers worldwide and fast-paced technological changes could diminish long-term market share and profits

Economic downturns, like the one witnessed in 2020, show RATIONAL's dependency on favourable developments in economic activity, despite covering the basic need for food

Supply chain issues, particularly in chip shortages and increasing raw material prices, affect business operations, compounded by ongoing geopolitical tensions

Valuation

Since its IPO in March 2000, RATIONAL has showcased exceptional operational performance, leading to outstanding financial results and delivering remarkable returns for shareholders, exceeding 3,211%.

Unfortunately, In terms of historical valuation, shares of RATIONAL have never or rarely been available for cheap with the exception of the recent declines in 2020 and at 2022, where these pullbacks opened attractive entry points for such such a high quality business.

However, at today’s (as of Feb. 15, 2024) share price of EUR 755 each, it trades at a P/E multiple of 36.5x, which is still below the company’s own historical median ten-year P/E (LTM) of around 41x.

Same holds true for the EV/EBIT (LTM) multiple of 26.3x, which also trades below the ten-year median EV/EBIT of 28.3x. So, based on historical median multiples, shares of RATIONAL appears to be undervalued by around 7% at today's share price. Additionally, the company’s dividend currently yield at 1.8%.

Peer Valuation

When compared to it’s closest competitors, which includes players from Europe and the US, RATIONAL is trading at significantly higher valuation multiples.

When looking at RATIONAL’s capital efficiency metrics, such as ROCE, it outperforms Middleby and Electrolux by over 20%. Moreover, its operating margins are nearly 7% higher than those of Middleby and more than double those of its Swedish competitor, Electrolux. This highlights RATIONAL’s superior capital efficiency and profitability compared to its competitors. It also underscores that, ceteris paribus (all else being equal), equity valuation is influenced not only by anticipated growth but also by the company's capacity to generate high returns on its capital base.

Reverse FCF

Let’s quickly perform a reverse DCF calculation to determine the FCF growth estimates that the stock market is currently factoring into the stock at its current price levels.

Discount Rate - 10%

Growth Stage - 10 years (variable growth rates see below)

Terminal Stage - 10 years with growth rate of 1%

Other data we need to calculate our reverse DCF:

Free Cash Flow TTM – EUR 209.8 million

Cash & Cash Equivalents TTM – EUR 354.9 million

Long-Term Debt + Short-term Debt TTM – EUR 0

Shares Outstanding – 11.4 million and a 0% dilution (as RATIONAL shareholders have not faced any notable share dilution over the past decade)

To calculate the intrinsic value, different growth rates to the reverse DCF model are applied, resulting in the following valuations:

10% growth rate – EUR 375.13

14% growth rate – EUR 453.75

18% growth rate – EUR 574.98

22% growth rate - EUR 733.57

23% growth rate - EUR 780.23

At the current share price, the market is pricing RATIONAL at a level that would be justified only if the company can grow its FCF at an average annual rate of 22-23% for the next 10 years, followed by 1% for the subsequent decade.

Considering RATIONAL's strong sales and cash flow growth, especially over the past three years, primarily driven by the normalization of its full order books and price increases, it is highly unlikely for the company to sustain or replicate these growth rates, which indicates that its shares are currently trading at a higher premium.

Final Thoughts

RATIONAL boasts an excellent business model with a strong operational track record and a solid balance sheet, showcasing great growth potential driven by various trends in the foodservice and commercial kitchen industry. However, the current share price suggests that these factors may already be priced in.

So, you might be wondering why RhinoInsight is covering a company whose stock price isn’t cheap enough to buy now? Well, RATIONAL first appeared on my radar during the Corona-Crash, with shares trading around EUR 300 each. The second time it caught my attention was during the last drop in October 2022, when it traded around EUR 500 per share. On both occasions, I had limited knowledge about its exceptional business model and financial health. Nevertheless, with all that I know today, I believe that RATIONAL is a high-quality company, making it one of the few businesses on my watchlist that I’m eager to add to my portfolio as soon as the next dip in share price occurs, providing me a higher margin of safety than today.

🔈RhinoWatchlist Launching soon

And if you're curious about how I manage my Watchlist and stay updated with the latest financial and economic data regarding my Watchlist holdings, don't miss out on signing up for RhinoWatchlist, an AI-driven Assistant, which enables You to research any stock on your Watchlist 10x faster 👇

While the launch of the first version is just a few days away, you can also check out the quick demo video in the meantime.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference:

Company Homepage

https://www.rational-online.com/en_us/home/Investor Relations

https://www.rational-online.com/en_us/company/investor-relations/

Further Readings

The iCombi Pro. Intelligent, flexible, productive. The new gold standard.

The Hainan Story Singapore - Solving labour shortage with the RATIONAL iCombi Pro