Reply (REY) - The Compounding Story Likely To Continue

Founder/Family-led IT service company, multibagger returns since IPO in 2000, high growth and capital efficiency coupled with strong balance sheet

Summary

Solid Growth: Revenue increased by 57x since IPO in 2000, and still both, revenue and EPS, registering 10y-CAGRs of 14% and 20%, respectively

High Capital Efficiency: Growing operating profit margins with 14% in 2022, and 5-year average ROIC of 15% underscores managements cash allocation abilities

Strong Balance Sheet: Low leverage, net cash position provides flexibility for further M&A’s, investment, and dividends

Founder/Family-Led Business: The founding Rizzante Family still owns 39.75% of total outstanding shares with majority of voting rights (due to double voting shares)

Continues Demand for IT Solutions: Multi-Trillion Dollar industry expected to growth with a CAGR of 14%, reaching USD 4.7 trillion in 2027

Introduction of Reply

Reply is a leading IT and technology consultancy, founded in 1996 by a group of IT managers led by Mario Rizzante. It provides a wide range of IT solutions and outsourcing services to various businesses across the globe. The company is headquartered in Turin (Italy) and listed on Borsa Italiana Stock Exchange (Ticker: REY) since December 6, 2000.

With over 13,000 employees, the company is well diversified within verticals and provides its services to a variety of sectors, including

Manufacturing and Retail

Financial Services (including banking and insurance)

Telecommunication, Media & High-Tech

Energy and Utilities,

Healthcare and Government

Products and Services

Reply with a network-based organisational model which combines expertise in different industrial sectors with supports its customers with the development and implementation of the latest digital solutions for improving their entire digital value-chain.

The companies services include strategic consulting, system integration and digital services. Based on the organizational model, these services are grouped into three, reportable business segments

Processes

Integrating technology as an enabling factor, and leveraging in-depth market knowledge and industry-specific contextsApplications

Designing and building software solutions tailored to meet core business needs across various industrial sectorsTechnologies

Optimising the use of innovative technologies, and developing solutions that ensure maximum efficiency and operational flexibility for customers

Reply operates through a vast network of over 100 complementary businesses, each established as its own enterprise, specializing in particular areas such as cloud computing, artificial intelligence (AI), and the Internet of Things (IoT). This approach fosters specialized expertise in various sectors, ensuring tailored and innovative solutions to meet diverse client needs. Below, we highlight a few notable subsidiaries within Reply’s network:

Storm Reply

Storm Reply specializes in designing innovative Cloud-based solutions and has been an AWS Premier Consulting Partner since 2014

It recently achieved AWS Automotive Competency status, underscoring its expertise in cloud solutions for the automotive sector

Data Reply

Focused on big data, business analytics, and AI, Data Reply aids companies in optimizing processes through advanced solutions and models, leveraging expertise in quantum algorithms and machine learning

Logistics Reply

Logistics Reply offers advanced software solutions for digital supply chains, integrating AI, robotics, and IoT

Reply’s M&A Strategy, Global Network of Partnerships and Brand Recognition

One of the factors driving Reply’s success is its acquisition strategy. Acquisitions not only contribute to the development of a broad portfolio of digital services and revenue but also, when executed successfully, provide:

Prompt access to an additional customer base

Expansion into new markets and geographies

Immediate access to new talents and capabilities

Reply's balanced approach of technological investment and strategic acquisitions has fueled its double-digit growth over the last two decades and expanded its digital capabilities and talent base. It was incorporated from the very beginning, as outlined in the 2001 annual report:

“Reply wants to settle its expansion, both in the national and in the international markets, by replicating the current business model, structured on a network of companies skilled and flexible, and on a list of clients of middle and large dimensions. The geographic spreading out, both domestic and foreign, will also take place as a result of the acquisition of innovative niche companies, accomplished with qualified human resources and working alongside the Group Offer lines.”

This sentiment was reaffirmed by founder Mario Rizzante in 2018 in a interview with Reuters

“We will press on with M&A but we want to avoid transformational deals, acquiring competences focused on our core business”

Reply continues to actively invest in innovation through acquisitions to strengthen its position cloud computing, data, AI, and other emerging areas, including IoT and cybersecurity. Below are some of Reply's acquisition highlights that have broadened its capabilities and expanded its sectoral and geographical reach

2005

In late 2005, Reply acquired a controlling stake in syskoplan AG, a German company specializing in SAP technologies and CRM consultancy, which had a 2005 turnover of 41.8 million euros and became part of Reply's expansion strategy in Germany

2008

Communication Valley, a company specialised in IT security services management, acquired from the Unitcredit group in 2008 for 16 million, expanded Reply’s services in Business Security and Data protection

In 2008, Reply acquired 100% of the share capital of glue:, a UK-based leader in enterprise architecture and solution design consulting serving clients like BBC and Unilever

2010

In August 2010, Reply acquired 75% of Riverland Solutions GmbH, a German firm specializing in Oracle Applications, serving leading German companies in various industries

2018

In 2018, with acquisition of 70% of the shares in Valorem, Reply extended its Microsoft Cloud Offerings and fueld its further international growth strategy, particularly in the North American market with major international groups such as Boeing, Intel, and Red Bull

2020

In 2020, Reply has strengthened its presence in the US market with its USD 31 million investment in Sagepath, a leading US-based company specializing in digital transformation, e-commerce, and digital experience for blue-chip companies such as The Coca-Cola Company and Oppenheimer

2021

Reply acquired Enowa LLC in January 2021 for USD 35 million, a US-based company specializing in SAP technology consulting and solutions

2022

In August 2022, Reply announced the acquisition of The Spur Group for USD 33 million, a US-based consulting and technology firm supporting tech giants and global brands like Cisco, Microsoft and Rockwell Automation

With the acquisition of Fincon in May 2022 for EUR 119 million, a German consulting company, Reply expanded its presence in Germany, in the banking and insurance sector in particular

In October 2022, Reply acquired Wemanity Group for 55 million Euros, a leader in agile and digital transformations in France and Benelux

Reply successful M&A approach has not only fueled sustainable growth in revenue and profitability but also demonstrated management’s adeptness in funding and seamlessly integrating businesses.

Reply’s Global Partnerships and Brand Recognition

Over the years of operation and Reply has expanded its network by collaborating with major leaders in the IT industry. These partnerships have not only enhanced Reply's expertise but also fortified its partner ecosystem, which includes prominent global giants like Amazon, Google, Microsoft, Oracle, and SAP. Reply enjoys a leading partner status with all these major global technology vendors and has achieved top certification levels such as

Microsoft Gold Partner status in all countries where Reply operates including Germany, Italy, the UK, US

Oracle Platinum Cloud Select Partner and received 4 Oracle EMEA Cluster Partner Awards in the categories of Innovation, Business Impact and Customer Success

Salesforce Platinum Consulting Partner status and secured over 200 certifications in Salesforce.com competence

SAP Quality Award Gold for five consecutive years as of 2018, and holds SAP Gold Partner status

In September 2023, three of Reply's subsidiaries (Concept Reply, Data Reply, and Storm Reply) achieved AWS Automotive Competency status, highlighting technical expertise and a successful track record in AWS-based cloud solutions for the automotive sector

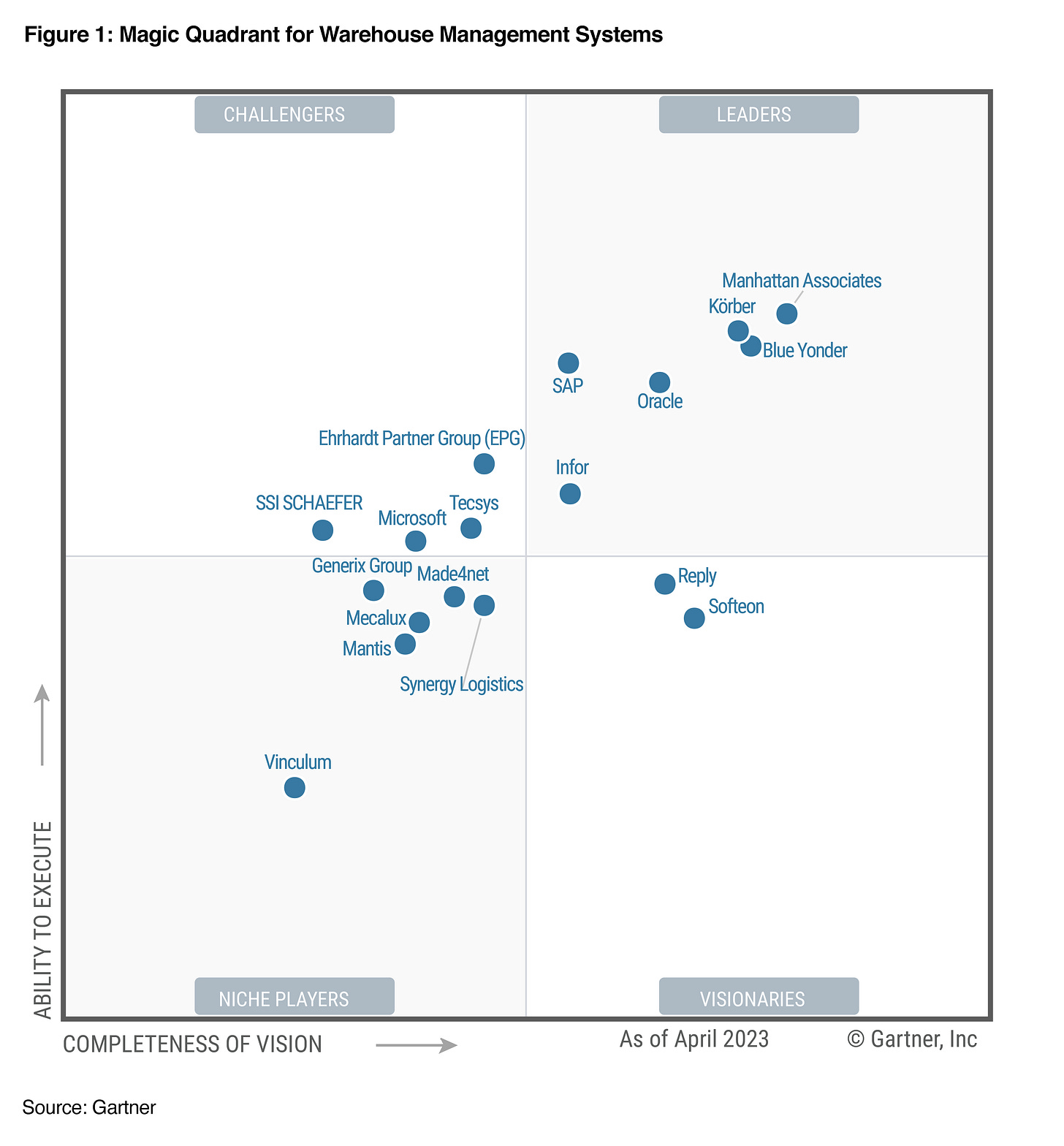

Reply’s expertise in the logistics area has been recognised by several analysts, including Gartner, which named Reply a Visionary in the 2023 Gartner Magic Quadrant for Warehouse Management Systems (WMS) for the fourth consecutive year

Reply's extensive network of partnerships and certifications reflects its commitment to innovation and excellence in the technology sector, demonstrating the depth and diversity of its collaborations and expertise.

Management

The company was founded in 1996 by a group of IT managers led by Mario Rizzante. He has been Chairman since then and serves as the co-CEO along with his daughter, Tatiane Rizzante, which took over the leadership of the company in 2006. Mario Rizzante’s son Filippo Rizzante is also part of the management team as chief technology officer (CIO).

In the highly competitive IT services industry, where the talent pool plays a pivotal role, culture stands out as one of the most significant advantages. According to Glassdoor, as of today, Reply boasts an impressive employee satisfaction level, with over 90% of its employees recommending the company to their friends and a 96% approval rating for CEO Tatiana Rizzante. In contrast, its peers, such as Accenture with 86% recommendation and 4.1 rating, Cognizant with 73% recommendation and 3.8 rating, Capgemini with 82% recommendation and 4.0 rating, and Infosys with 78% recommendation and 3.9 rating, all fall behind in employee satisfaction.

Moreover, based on 784 reviews on the Indeed platform, the company also maintains a strong rating of 4.3 out of 5 and an 84% CEO approval rating, further solidifying its positive reputation in the industry.

Industry & Business Model

In recent years, the digital industry has seen an accelerated evolution, in no small part due to the COVID-19 pandemic, which instigated unprecedented shifts in both consumer behaviours and business operations globally.

According to Gartner’s July 2023 forecasts, worldwide IT spending is expected to projected to total USD 4.7 trillion in 2023, an increase of 4.3% from 2022. While the overall outlook for IT enterprise spending is positive, IT services are even expected to grow 8.8% this year and 11.6% in 2024 reaching USD 1,585 million making almost 30% of the total IT spending.

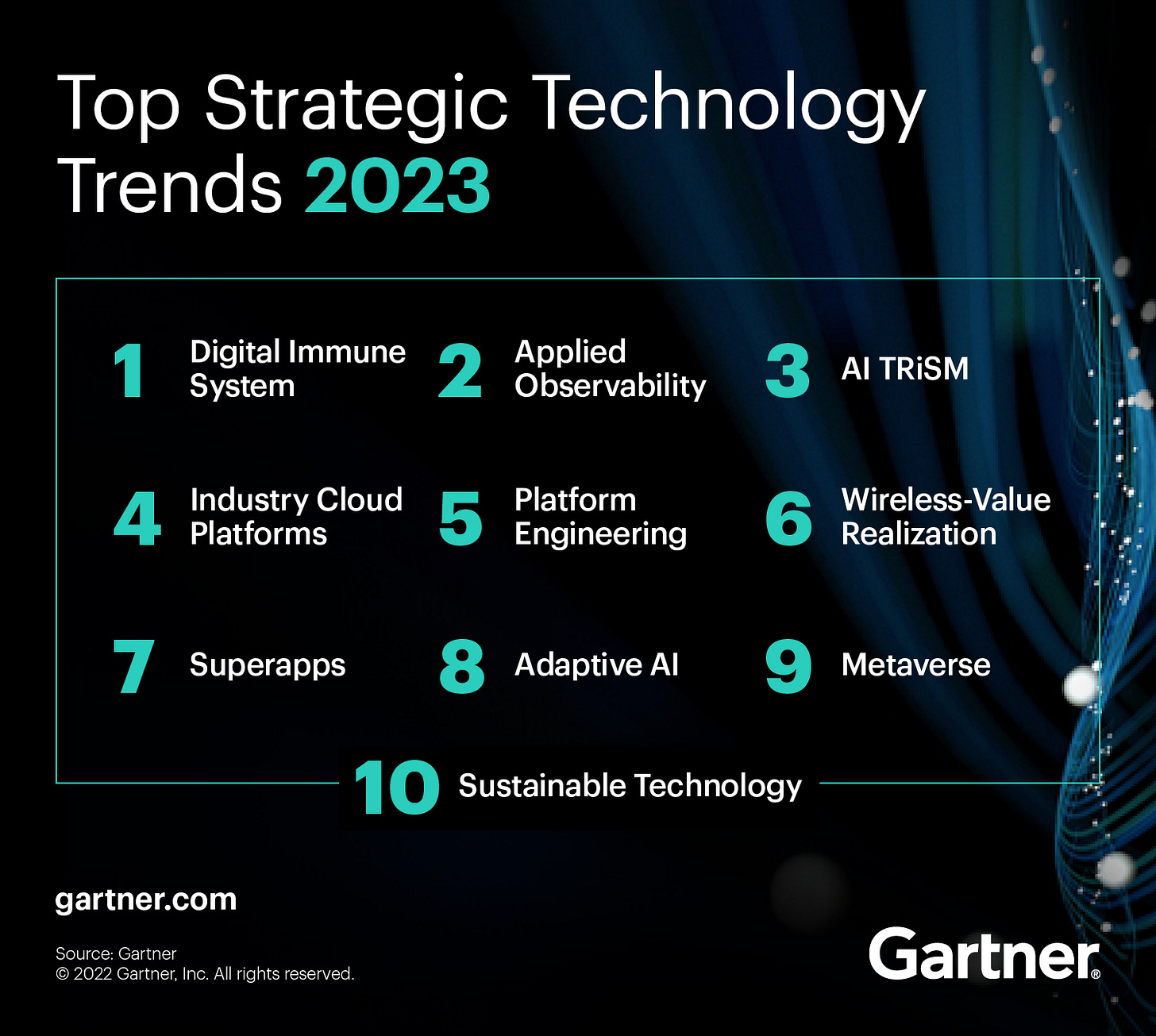

Whether companies need to cut costs to improve margins through automation, accelerate cloud adoption for scalability and security, or explore various other scenarios, these represent opportunities for IT service providers. According to Gartner, the top 10 technology trends in 2023 include cloud computing, adaptive AI, and the Metaverse, all areas in which Reply has developed in-depth expertise over the years. This positions the company in a prime position to benefit on multiple fronts from the growing demand for digital transformation efforts across all industries.

Talent Shortage: The Double-Edged Sword of the IT Service Industry

According to Garnter’s annual CIO survey in 2022, 59% of executives believed digital initiatives take too long to complete and according to John-David Lovelock (vice president analyst at Gartner), one way to speed up projects, resource-constrained CIOs must bring on more consultants, making it as one of the main growth drivers for the outsourcing IT activities according to Lovelock.

“CIOs are losing the competition for talent, IT services spending is growing more quickly than internal services in every industry. Skilled IT workers are migrating away from the enterprise CIO towards technology and service providers (TSPs) who can keep up with increased wage requirements, development opportunities and career prospects.”

However, the pandemic initially led to a decrease in attrition rates, a metric used to measure the loss of employees over time, in 2020, but they soon returned to pre-pandemic levels. The IT industry and engineering sectors, particularly among leading enterprises and third-party service providers, faced unparalleled attrition, with rates reaching the highest seen before the pandemic as described in Spiking Attrition Impact On IT And Engineering Services, written by Peter Bendor-Samuel on Forbes in 2022.

The article stated that the average post-COVID attrition rate among service providers is 23%, posing a significant challenge for companies with engineering operations and highlighted that outsourcing is no longer a viable solution due to acute talent shortages globally, with India facing a 39% shortage, behind the US (45%) and Western Europe (43%). The ongoing Russia-Ukraine war has further disrupted the services of 70,000-100,000 workers, including those with IT and engineering skills.

The most valuable assets for services firms are employees and their skillsets, especially as employees are so integral to service organizations, losing a highly skilled consultant has significant impact on these businesses. Thus, hiring and retaining consulting talent is always top of mind. According to the On average, it takes 117 work days to find, recruit, hire and ramp a new consultant, and the average estimated cost of replacement is $150,000 and losing employees also has a major revenue impact.

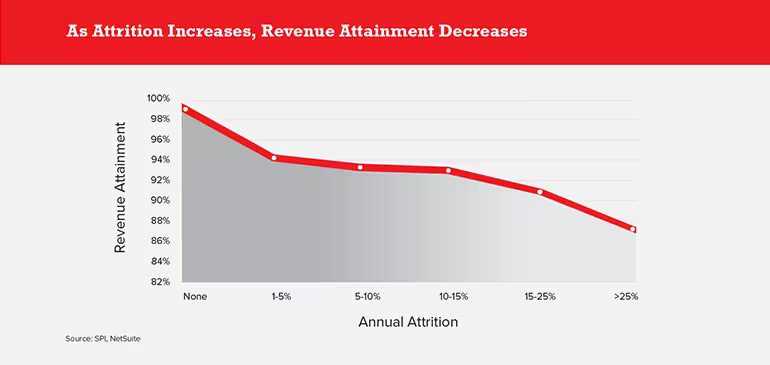

Employees, with their unique skillsets, are the most valuable assets for service firms, and losing a skilled consultant significantly impacts these businesses. Therefore, hiring and retaining talent is a priority. According to an article by Oracle Netsuite, it takes on average 117 work days to onboard a new consultant, with an estimated replacement cost of $150,000, highlighting the substantial revenue impact of employee loss.

Consequently, as the attrition rate increases, there is a corresponding decrease in the percentage of annual revenue achievement. For instance, service organizations hit 98.9% of revenue targets with no attrition, but this figure drops to 87.7% when attrition exceeds 25%.

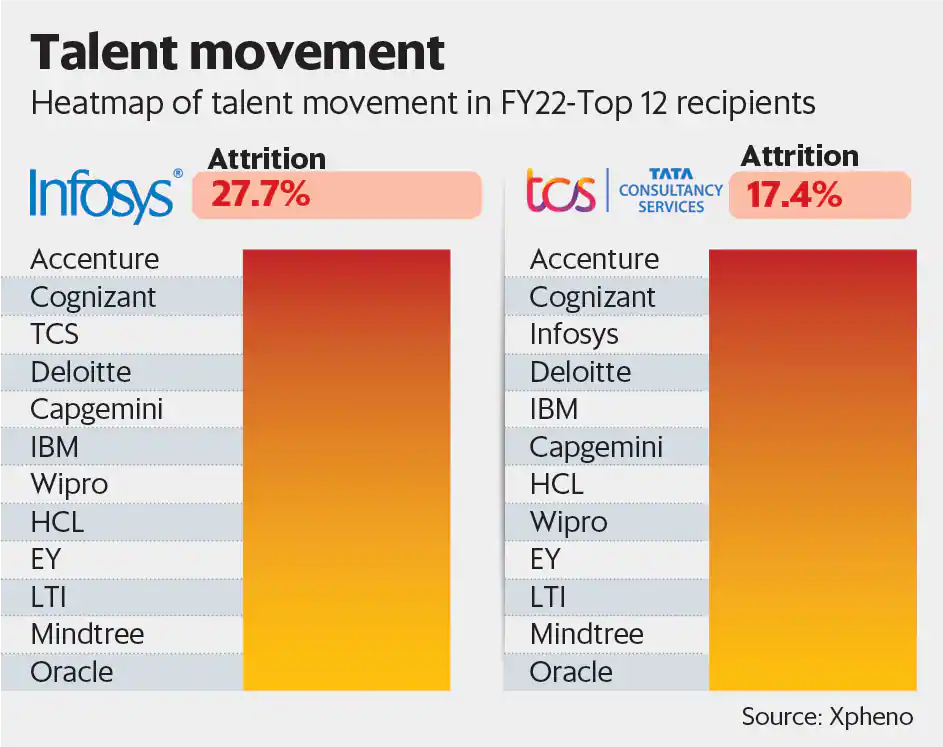

In light of this, data in 2022 from Xpheno, a specialist staffing company, shared exclusively with the Indian business publication Mint, provides further insight into the industry dynamics.

Talents departing from leading providers often find opportunities with other sector leaders, continuing to contribute and thrive within the same industry. A quote from the article illustrates this trend:

“Talent that transitioned out from Infosys and TCS last financial year, was absorbed by a nearly identical set of enterprises. In either of the cases, the Top 12 absorbers have taken over one-third of talent on the move”

This transition reflects the dynamic nature of the workforce and the diverse opportunities available within the sector, allowing professionals to explore varied roles while still remaining within the industry's ecosystem. On a positive note, according to the article in Mint, industry experts are optimistic, predicting an improvement in the situation, possibly over the next six months.

Attrition is an industry-wide issue that requires careful monitoring in how IT service companies address it, as the loss of talent in such a talent-intensive industry is closely tied to a decline in competitiveness and financial performance. To combat attrition, companies are advised to offer competitive wages, which can increase operating costs and impact profitability.

Competition & Peers

The IT service industry is marked by intense competition and a rapidly evolving marketplace. This landscape features large, global technology service providers as well as emerging competitors in niche technology areas, with a focus on agility, flexibility, and innovation. Some notable names in this sector include Accenture, Cognizant, and Tata Consulting which are primarily focused on providing IT services.

On the other hand, other leading software and technology companies such as SAP and IBM are also making inroads into the IT service industry. While they do offer IT services, they have significant operations in developing and selling hardware and software solutions as well.

Financials & Key Figures

Key Financial Results 2022

Revenue: €1,89 million (up 26% YoY)

Operating Profit / Margin: €287.7 million (up 29% YoY) / 14.7%

ROIC: 15% (5y-avg.)

Free Cash Flow / Margin: €142.8€ (down 176% YoY) / 7.5%

Revenue & FCF per Employee: €140k / €12k

Dividend / Payout-Ratio: €1 p. Share (up 25% YoY) / 20%

Following Reply’s IPO in 2000, Reply demonstrated a strong commitment to expanding its business by increasing its revenues by a factor of 57x, from EUR 33 million to EUR 1,891 million in 2022, making a CAGR of about 20% over more than two decades.

Despite economic challenges and geopolitical tensions of the recent years, Reply has been able to sustain its high rates of revenue growth at a CAGR of 16% and 18%, over the past 5 and 3 years, respectively, mainly due to overall positive trend in IT spending and outsourcing.

For the FY 2022, Reply reported a revenue increase of 27.5% compared to previous year reaching EUR 1,919 million. Operating profit stood at EUR 281.7 million marking an increase of 29.5% YoY.

Technologies segment continued to represents the largest source of revenues, amounting to 63.8% in 2022 (63.5% in 2021), followed by applications and processes.

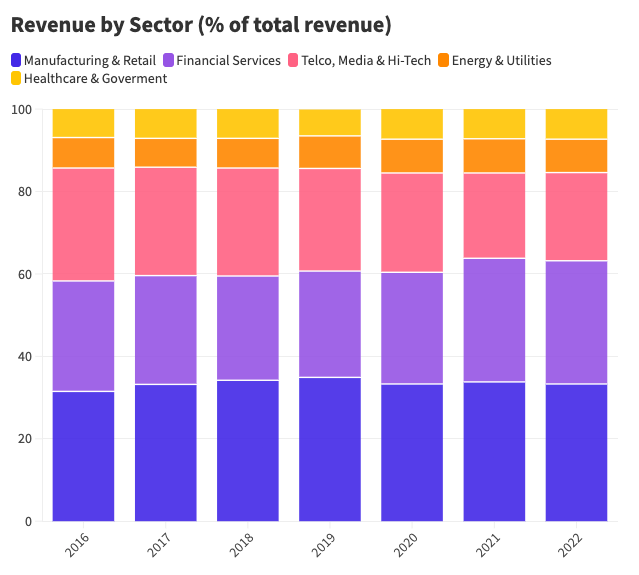

Revenue by Sector

Reply provides expertise across several industry-based verticals, which are aggregated into five reportable business segments. In FY 2022, the distribution of the groups sales in its various vertical sectors was as follows

Over the years of operation, Reply's exposure to sectors such as Financial Services and Manufacturing (including Automotive & Logistics) & Retail has remained stable, collectively contributing to over 60% of the revenue.

While its true that this sector provides tremendous opportunities and that there is significant work required to enable a corporation to harness the benefits of cloud computing, AI, and other technologies, this dual reality not only renders Reply's business cyclical but also makes it sensitive to economic downturns and recessions. This sensitivity is evident in the recent events that have influenced Reply's share price performance.

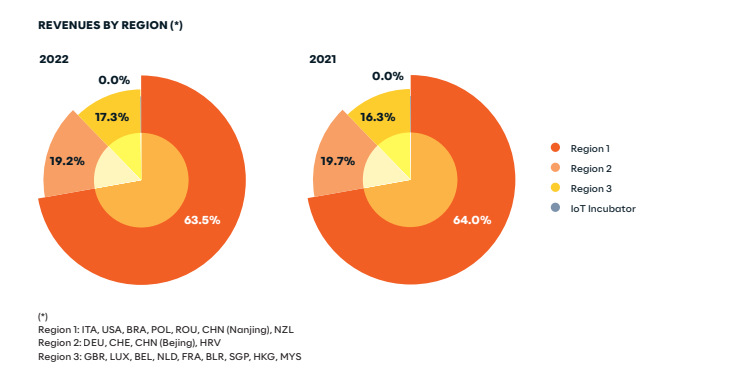

Revenue by Geography

In 2022, Reply's largest market continued to be Region 1, which accounted for 63.5% of total revenues. This was primarily driven by Italy as the main market, with contributions from the US. Region 2 accounted for approximately 19.2% of revenues, primarily generated in Germany. Region 3 contributed 17.3% to the total, with the UK and France being the main drivers.

Reply’s annual report from 2015 reveals that a significant portion of their business was concentrated in Italy, Germany, and the UK.

In 2016, there was an unusual change in how revenues were reported by geography. Since then, Region 1, with Italy, has continued to be their largest market, while the company has also been growing and gaining market share in the US, primarly driven by various acquisitions.

The change in revenue reporting by geographic markets may be attributed to how Reply's revenues are distributed among regions based on contract types, typically categorized as fixed price projects and time and material (T&M) in software development outsourcing.

In Region 1, more than 80% of the business is based on fixed-price contracts where the IT vendors gives a project quote that sets out the full scope of work and the cost and timelines for delivery upfront. On the other hand, Regions 2 and 3 show a more balanced mix between fixed price and T&M project, with the latter charging for the actual time spent on development.

Profitability and Earnings

In terms of profitability, Reply has steadily increased its operating margin over the past five years reaching 14,7% in 2022, and maintained a net profit margin between 9-10% during the same time period.

Reply's double-digit revenue growth and steady margins have resulted in a continually increasing earnings-per-share (EPS) with a 5-year CAGR of 17%.

Furthermore, Reply has shown its commitment to returning capital to shareholders, increasing its dividend per share at a CAGR of 22% over the past five years. In FY 2022, the company raised its dividend by 25% YoY to EUR 1 per share, supported by a conservative payout ratio of 20%.

Despite the low payout ratio, future dividends depend on the continuation of Reply’s cash generation ability, overall liquidity position, and potential alternative uses of cash such as acquisitions and technology investments, as emphasised in the latest FY 2022 reporting

Like employees, Reply’s shareholders should participate in the Group’s sustainable operational performance in the form of dividends. Every year this principle is balanced with the need for internal financing to finance Reply’s investments (in new startup companies, new technologies and potential acquisitions to further elaborate Reply’s offering portfolio in Germany, UK, US, France as Reply’s strategic regions).

Capital Efficiency and Cash Flow

Despite Reply's strong cash flow generation over the last years, since the start of the pandemic in 2020, the company has witnessed a continuous decline in operating cash flow (OCF), even as it experienced double-digit revenue growth and an expansion in operating profit margins. The free cash flow (FCF) stood at EUR 142.8 million, representing an FCF margin of 7.5%, which is a decrease of approximately 2.5% compared to 2021 and 6% compared to 2020.

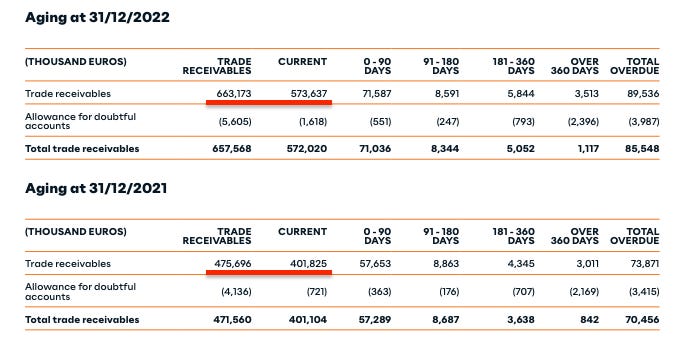

Looking into the balance sheet reveals, that during the same time period, account receivables has increased significantly, which led to an increase in net working capital (NWC) and decline in OCF.

According to the FY 2022 report, the majority of accounts receivable are categorized as 'Current,' typically referring to receivables not yet due or only recently due (usually up to 30 days past the invoice date). These are considered the most liquid and have the highest likelihood of being collected.

The increase in accounts receivable, and consequently, the rise in net working capital, has reduced the conversion of revenues into cash, thereby negatively affecting cash flows and putting pressure on the FCF margin. However, due to Reply's successful business operations and strong balance sheet, it is not expected that the growing disparity between booked revenues and actual cash collections will result in a cash crunch or potential liquidity issues. However, its essential to keep a vigilant eye on this matter.

Reply's return-on-invested-capital (ROIC) levels, which have averaged 15% over the last five years, underscore management's ability in capital allocation and long-term value creation. If Reply can sustain this performance, they will be better positioned to finance their growth internally, without the need for external capital.

Liquidity and Debt

The company ended FY 2022 with EUR 75 million in long-term debt and cash on hand of EUR 280 million, which has grown at a CAGR of 22% over the last 5 years.

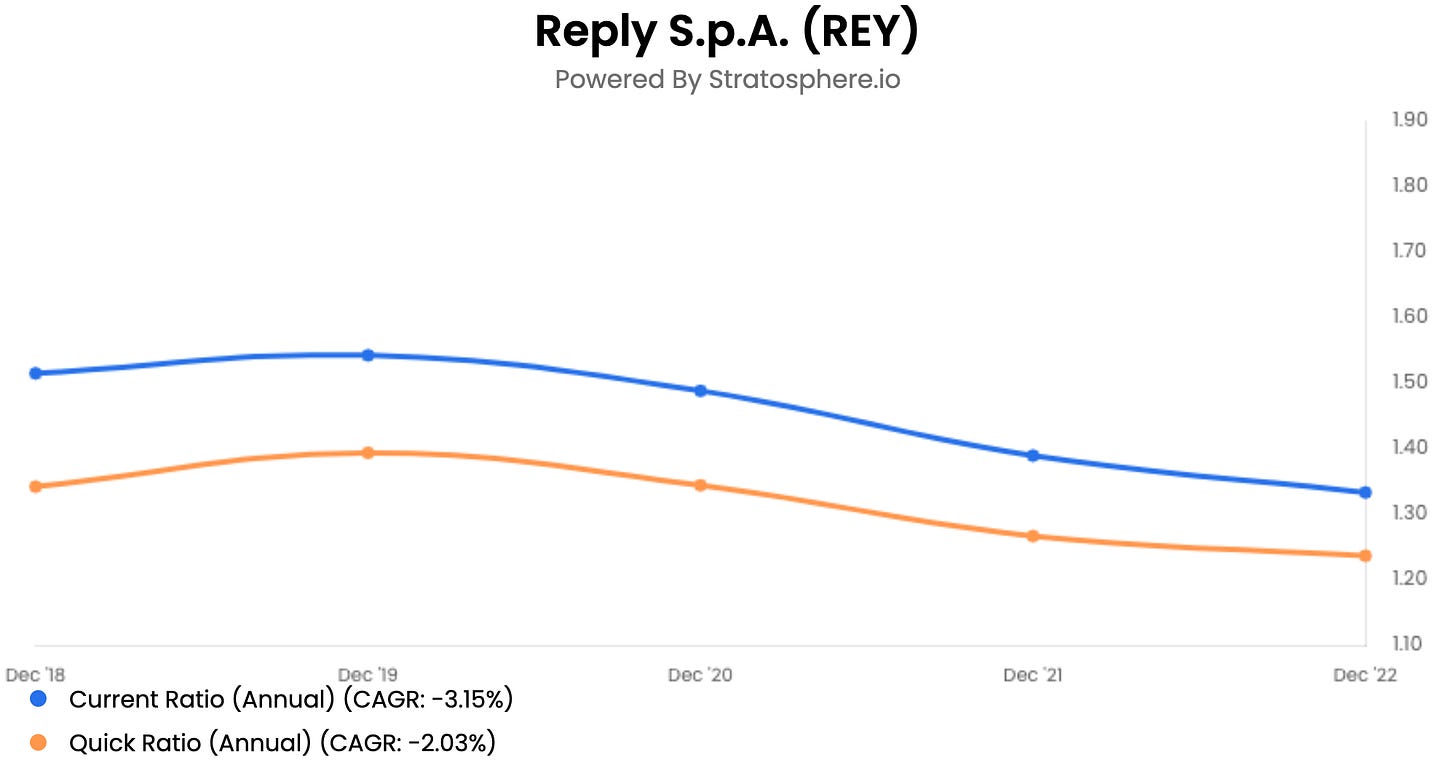

Moreover, both the current ratio and the quick ratio reflect the liquidity and financial well-being of the company, allowing it to meet short-term liabilities.

Even after the latest acquisitions in 2022, totaling over EUR 150 million, Reply's balance sheet remains in good shape. Thanks to its strong operational performance, cash generated from operations has historically been the primary source of liquidity for funding operations and investments, avoiding share dilution and any liquidity risks.

Reply’s Quality of Growth

It is worth highlighting that the success and profitability of IT service businesses hinge on their workforce and training of highly qualified professionals. This holds true for Reply as well, where personnel costs represent the single largest expense item in their operations, accounting for approximately 50% of their total revenues in 2022, as well as in previous years.

When looking at revenue per employee, a ratio that measures the total revenue divided by its current number of employees, Reply stands out with robust revenue per employee (LTM) of USD 150,000 (USD is chosen here for comparison to its international peers).

This shows the efficiency of Reply's relatively small workforce of around 13,000 employees in comparison to industry giants like Accenture with over 700,000 employees and even to small peers such EPAM Systems with 59.000 employees.

Moreover, considering the FCF per employee, Reply secured the second position with an FCF per employee of EUR 12.7k, ranking next to Accenture, a competitor approximately 65 times larger in market capitalization.

This highlights not only Reply's operational efficiency but also, and more significantly, the sustained quality of growth throughout their years of operation, with its M&A strategy being particularly noteworthy.

Shareholders

As of FY 2022, the company had a total of 37,411,428 shares outstanding, with Reply S.p.A., the parent company, owning treasury shares amounting to 0.35% of the total shares, and a free float of 59.89% of the outstanding shares.

Along with the founder Mario Rizzante's 12.35% stake, Tatiana and Filippo Rizzante each possess a 25.32% share in Alika S.R.L., the family holding company that controls 39.75% of Reply S.p.A. with double voting rights, resulting in a substantial 56.89% of the total voting rights. 'Skin in the game' is definitely the case with Reply, as the Rizzante family's significant ownership and active involvement underscore their vested interest in the company's success.

Outlook

Despite the prevailing global uncertainty and concerns about a potential recession, the management's outlook remain optimistic in their 2022 year-end report

The future still remains, in part, conditioned by the evolution of the Russian-Ukrainian war that increases tension on the main markets. In any case, the transformation process towards the new digital economy, which began in 2020, is now unstoppable and opens up opportunities for growth and development for companies like ours. In particular, we expect an increasingly pervasive diffusion of artificial intelligence on board products, processes and services and it is here that we intend to position ourselves as niche players, with very high technological content.

Bull and Bear Investment Case

Bull Case

Reply is well positioned in several verticals to benefit from the ongoing, long-term digitization of businesses. This trend is expected to boost enterprise IT spending in a growing multi-billion-dollar market, which includes continuous upgrades of cloud infrastructure services, enhancing cybersecurity, task automation, AI-driven decision-making, and many other use cases.

Acquisitions have played a pivotal role in Reply's growth strategy, allowing the company to enter new markets, diversify its product offerings, and maintain its position in the industry. These acquisitions, driven by management's expertise in integration, are expected to remain a significant contributor to Reply's revenue stream.

Bear Case

In the event of a severe global economic downturn, especially with a distressed economic outlook in Europe, Reply is exposed to concentration risk due to the majority of its revenues (over 60%) coming from the Financial and Manufacturing segments. This could result in reduced client spending on consulting services in its largest market, impacting Reply's revenues.

The IT services industry is highly competitive, and IT service companies heavily rely on a talented workforce to meet global client demands. The intense competition for digital talent and high employee attrition can result in revenue loss and a decline in market share.

Valuation

Taking December 6, 2000, the date of the Reply IPO, as a reference, the share performance has returned over 2000%, even after losing almost 50% of its market cap in the last few months since the all-time highs at the end of 2021. It has clearly been a multi-bagger, as it has consistently compounded its capital at very profitable rates of return over the past two decades.

It has experienced a decline of around 50% since reaching the 52-week highs during the pandemic rally in late 2021. This decline is likely attributable to Reply's significant exposure to cyclical sectors, including manufacturing (including automotive) and the financial sector, as well as the heightened tensions resulting from the outbreak of war on Europe's eastern borders.

Historically, Reply has traded in the Price-to-Earnings (P/E LTM) range of 15.8x to 31.1x (+/- 1 STD) with a ten-year average of 23.5x. Currently (September 28, 2023) the ratio is at 16.6x, which is near the lower end of the historical range.

The same holds true for its Enterprise Value (EV)-to-EBITDA (LTM) ratio of 9.1x, which is also lower than the ten-year average of 13.4x and is near the lower end of the historical range.

Based on historical multiples, as of today (September 28, 2023), Reply’s share price of EUR 84.85 per share appears to be undervalued by approximately 30%.

Peer Valuation

On a peer valuation basis, when comparing Reply's current P/E ratio of 16.6x with industry giants like Accenture and Tata Consulting, it becomes evident that Reply is currently trading at a substantial discount of 40-50%, despite the fact that Reply has achieved higher, double-digit revenue and EPS growth over the last 5 and 10 years.

In comparison to one of its closer peers in terms of market cap, such as EPAM Systems (which is still more than 3x larger than Reply) with P/E ratio of 29.3x, EPAM is trading at a premium, given its significant growth, with over 20% revenue and EPS growth over the last 5 and 10 years. Or, put differently, Reply is trading at a significant discount compared to its closest peer and may offer a more favorable balance between growth potential and valuation.

Author’s Note

Some of my readers may wonder why there is no discussion of DCF (Discounted Cash Flow) or exit-based EV/EBITDA intrinsic valuation calculations in this post. I want to clarify that while these methods are valuable tools for assessing the fair value of a company, I've decided not to explore these methods in this post, and I won't be including them in any future write-ups or analyses. I do plan to share my thoughts and experiences on intrinsic valuation in general in a separate post soon.

Final Thoughts

With its network of specialized subsidiaries and strategic partnerships spanning various sectors, strong operational performance and balance sheet, Reply is well-positioned to leverage the increasing demand for IT services driven by automatisation and digitalization needs. Today's fluctuations in Reply's share price could provide investors with a better opportunity to acquire shares in a thriving and expanding business, possibly at an appealing discount.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference:

Company Homepage

https://www.reply.com/enCompany Website Investor Relations

https://www.reply.com/en/investorsReport on Corporate Governance and Ownership Structure 2022

https://www.reply.com/contents/REPLY_Relazione_Governo_Societario_ENG_2022.pdfLünendonk Survey 2022 (featuring an interview with Reply)

https://www.luenendonk.de/en/products/surveys-publications/luenendonk-survey-2022-the-market-for-digital-experience-services-in-germany/

Further Readings:

Barilla selects Logistics Reply for its warehouse management

https://www.reply.com/click-reply/en/content/barilla-selects-click-reply-for-its-warehouse-managementInterview with CEO Tatiana Rizzante during Euronext Tech Leaders Campus 2022

CEO Tatiana Rizzante interviewed during 2021 ESCP Turin Campus Opening Ceremony