Shoei Co. (Ticker: 7839): Uncovered Hidden Gem of Japan

Market leader of premium motorcycle helmets, over 60% global market share and strong balance sheet

Summary

Dominant Market Position: Global leader of premium motorcycle helmets, boasting over 60% market share, targets China/Asia as next growth market

Robust growth: Both revenue and EBITDA, registering 10y-CAGR’s of 10% and 17.7%, respectively

Financial Excellence: Operating profit margins around 20-25%; 5-year average ROIC of around 39% underscores the high cash flow generation capabilities

Currency Concerns & European Economic Sensitivity : Strong JPY could pose potential risks, given that around 80% brand's revenues are generated outside of Japan, and over 40% alone in Europe

Introduction of Shoei Co.

Shoei Co., a Japanese firm, manufactures high-quality motorcycle helmets to riders of all levels - from the everyday rider to the world's top racers. Its roots go back to 1954 with the founding of Kamata Polyester Co., whose first helmets were produced primarily for use in the construction industry. Recognizing the growing demand in the motorcycle racing sector, founder Eitaro Kamata shifted focus in 1960 and started producing motorcycle helmets.

In 1963, Shoei demonstrated their innovative and competitive spirit from the very beginning, producing their first racing helmet, the SR-1.

The remarkable level of craftsmanship in these motorcycle helmets quickly caught the attention of motorcycle enthusiasts. In 1965, Honda Motor Co. partnered with Shoei to produce their official line of motorcycle helmets. This partnership significantly elevated Shoei's reputation and popularity.

In 1968, the Shoei Safety Helmet Corporation was founded in California (USA) following the establishment of the first factory near Tokyo in Ibaraki.

Twenty years later, in 1989, a second factory was established in Iwate, located to the far north of Japan's main island, Honshu. Both factories are structured similarly in terms of production technology, given to Japan’s sensitivity to earthquakes. This strategic setup enables the flexibility of production between the two sites in case of any disruptions, as mentioned by company spokesperson Moichi Tsuzuki. Unfortunately, both factories were impacted by the significant earthquake that struck Japan in 2011 and the cost for major repairs was estimated at about JPY 63 million, recorded on an accrual basis.

Leading quality across the globe - made in Japan

By the end of 2022, the company firmly maintains a significant market position, claiming more than 60% share in the global premium helmet market, which is worth JPY 80 billion, according to the company's own data.

Since the foundation of the company, all Shoei helmets have been designed and manufactured in Japan, and distributed to 60 countries worldwide including Europe, United Sates and China.

Shoei's unwavering dedication to innovation persisted as they continued to push boundaries and redefine industry standards. In 1976, this commitment led to the introduction of the world's first carbon fiber helmet. This groundbreaking approach extended to ventilation, as Shoei introduced the TJ-201V, world's first ventilated helmets.

Today, Shoei produces a wide range of helmet types, encompassing both design and the entire manufacturing process. Regardless of whether it's a full-face helmet or a jet-style one, Shoei's top-tier helmet remains a favorite among riders globally.

Renowned for their exceptional comfort, durability, and safety features, these high-performance helmets have earned significant recognition from motorcycle enthusiasts around the world. Shoei's prominence in motor racing is highlighted by significant achievements, such as Wayne Gardner's victory in the 500cc class title in 1987 and Eddie Lawson's win in the 500cc World Championship in 1988, both wearing Shoei helmets.

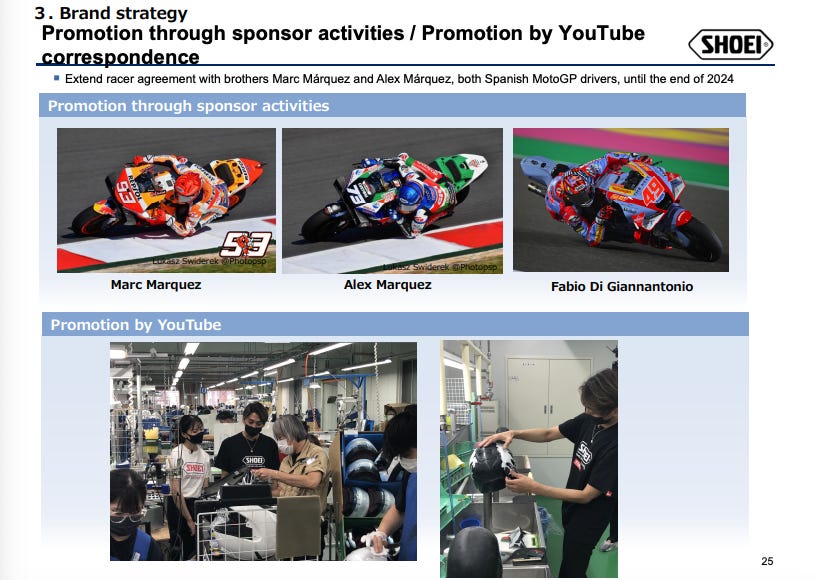

The brand's commitment is further evident through its sponsorship of MotoGP athletes such as the Marquez brothers, Alex and Marc, the latter secured the MotoGP Championship in 2013, 2014, 2016, 2017, 2018 and 2019 while wearing Shoei helmets.

The recognition from these prominent motor racing figures shows that Shoei is a respected brand worldwide, confirming its strong reputation in the industry.

What makes Shoei so unique ?

In a well-written piece by Michael Parrotte, former Vice President of AGV Helmets America (a direct competitor of Shoei), he highlights eight compelling factors that contribute to the excellence and higher cost of Shoei helmets.

Rider-Centric R&D Process

Only Premium Materials

Closely Guarded Manufacturing Process

Aero-Acoustic Performance

Superior Fitment And Comfort

Meeting International Helmet Certification Standards (like DOT, ECE 22.05 & Snell)

Impeccable Quality Control Informing R&D

Shoei’s 5-Year Warranty And Crash Replacement Policy

These factors show Shoei’s commitment to continuous improvement and quality, underscored by a deliberate emphasis on incremental and ongoing changes (aligned with the Japanese philosophy of Kaizen), and has yielded substantial progress over the years.

Good quality comes at a cost

When exploring the the product range of motorcycle helmets, it becomes evident that quality comes with an associated cost. The spectrum of prices for helmets begins at approximately $100, spanning up to $4,000 for the premium helmets.

Within the premium range, Shoei, along with AGV and Arai, stands out in the higher price range section. Despite not having the priciest helmet on the market, their most affordable offering still holds a notable value at $379.99 – almost triple compared to other well-known brands like HJC, and even surpassing Schuberth’s helmets, the renowned German premium manufacturer with a rich 100-year history.

Shoei's handcrafted premium helmets, tailored to specific niches developed over decades, shows their dedication to quality and innovation. This journey has driven remarkable sales growth in the US and Europe, with recent expansion into China presenting vast opportunities for further growth.

Industry & Business Model

When it comes to motorcycle safety, the saying, "Dress for the slide, not the ride," is popular among riders. At the core of this principle lies the helmet, the most critical gear for a motorcyclist.

Despite facing challenges during the COVID-19 pandemic due to manufacturing halts and declining two-wheeler sales, according to Precedence Research’s 2022 report, the premium motorcycle helmet market is projected to expand from around USD 468 million in 2021 to USD 1.5 billion by 2030, marking a CAGR of 14% from 2021-2028. This expansion of the overall market offers significant opportunities for future growth that Shoei is well-positioned to capitalize on.

Asia expected to be the largest market and key driver of growth

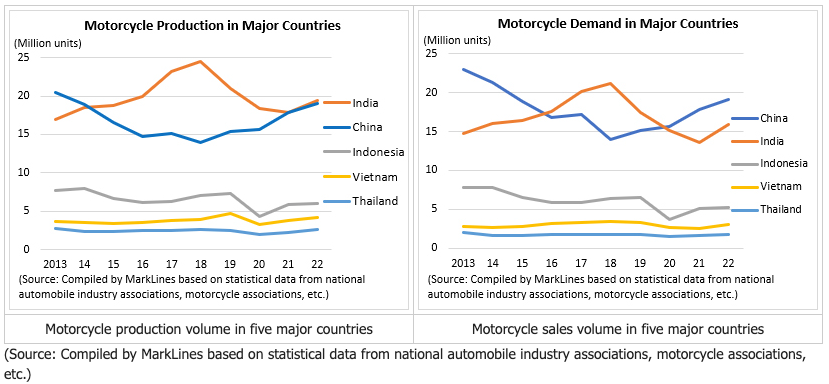

Asia-Pacific dominates the global two-wheeler market, primarily driven by India and China. The Markline’s August 2023 update, reveals that motorcycle production reached 58 million units in 2022, with Asia accounting for 71.5% of this demand. India and China reported motorcycle production of 19.46 million and 19 million units, respectively, in 2022.

The upward trend in this region is further evident by the strong sales of performance motorcycle brands like BMW AG, Harley-Davidson, and Ducati. For example, the well-known Italian motorcycle manufacturer Ducati, concluded 2022 with a record-breaking 59,739 sales (+2.8% YoY) while the ASEAN region led the way with the highest YoY growth of 12.7%. As the demand for high-performance motorcycles is expected to grow, the market for premium motorcycle helmets is also likely to expand.

Furthermore, recent regulatory changes in the Asia-Pacific (APAC) region further support the long-term demand for premium motorcycle helmets. In India, the Bureau of Indian Standards (BIS) updated safety norms for high-speed riding and removed the 1.2 kg weight limit on helmets in 2020, allowing companies like Shoei to import their higher-quality helmet, that usually weigh more than 1.2 kg. Similarly, China introduced laws in 2020 that require electric scooter riders to wear helmets.

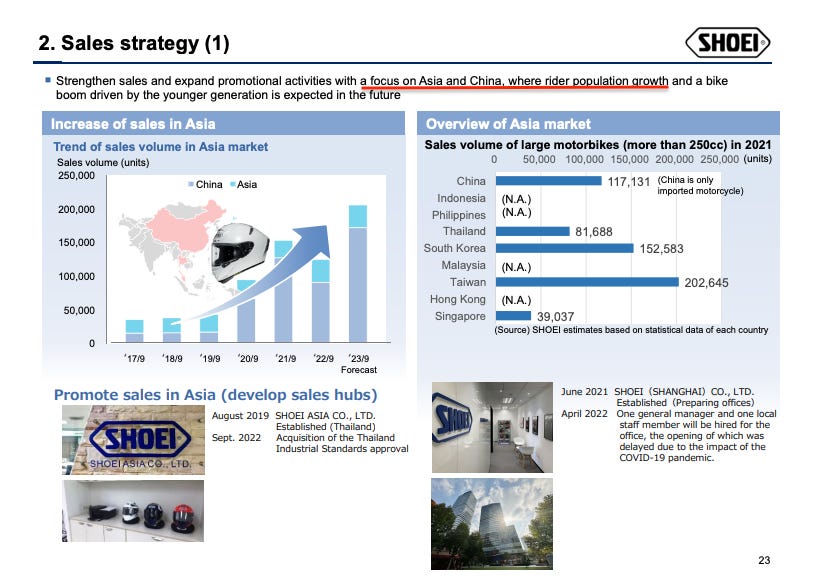

Although the expansion in the two-wheeler industry and recent regulatory changes don't immediately result in increased demand for premium motorcycle helmets, considering the the high-end price range, the outlook for the APAC region remains promising. The expanding middle class, coupled with increased disposable income, is likely to boost demand over time. Interestingly, back in 2018, during the presentation for the FY results, Shoei's management had already identified this potential, signalling the shift of their focus to these growing markets.

Competition & Peers

The premium motorcycle market shows a moderate consolidation, characterized by dominant, renowned local brands specific to their regions.

In Japan, Shoei faces main competition from Arai Helmet. Both are viewed as top-tier, premium brands known for their high-quality products. Their rivalry mirrors the Canon vs. Nikon discussion among photography enthusiasts: each brand has its strengths, with the ultimate choice often boiling down to brand loyalty.

Other players in the premium motorcycle helmet industry include:

🇮🇹 AGV (Subsidiary of Dainese SpA)

🇩🇪 Schuberth GmbH

🇺🇸 Bell Helmets

The essence of the premium motorcycle helmet industry extends beyond merely manufacturing helmets; it's a commitment to safeguarding every journey, be it a short trip to the local market or an adventurous cross-country ride. With evolving safety standards, emerging market demands, and innovative trends, premium motorcycle helmets are set to become increasingly crucial in the overall growing landscape of motorcycles.

Financials & Key Figures

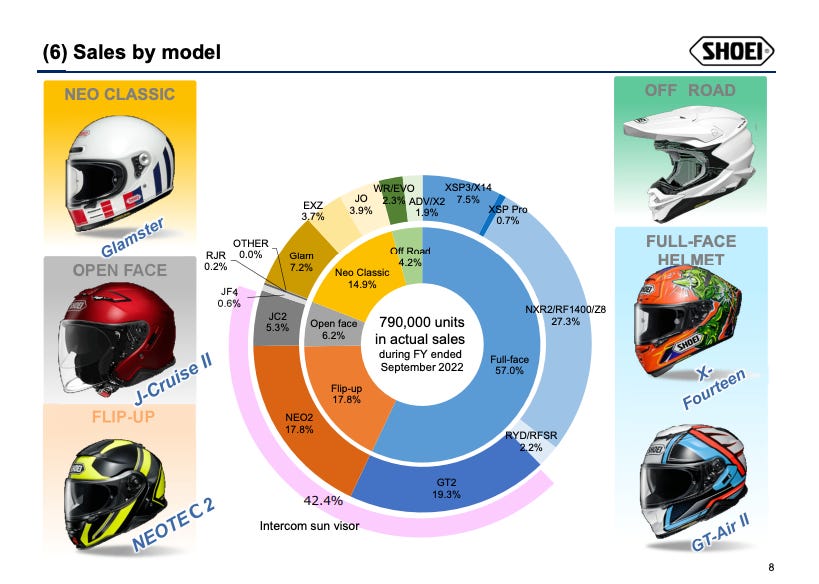

Shoei makes the almost all of its revenue by manufacturing and selling of motorcycle helmets. Despite global economic turmoil and geopolitical risks, the demand for high-end motorcycle helmets remained stable.

Shoei reported solid financial performance for the fiscal year (FY) ended in September 2022 with net sales rising 21.9% YoY to reach JPY 28,953 million. The substantial growth in EBITDA is further emphasized by the increase in operating margin, moving up to 29% from 25% in the previous year

According to management, this growth aligned with the introduction of new models in FY 2021 that had higher pricing as well as lower-than expected selling, general, and administrative (SG&A) expenses. Additionally, the financial landscape was influenced by currency fluctuations, as the JPY depreciated approximately 20% against both the USD and Euro during the same period. But, according to the management, benefits from the weak JPY were limited due to the implementation of foreign exchange rate contracts at an early stage.

The company's robust operational performance enabled it to maintain a consistent dividend payout ratio, accounting for approximately 50% of its net income for nearly a decade. In FY 2022, the company further increased its dividend by JPY 15, resulting in JPY 56 per share. This move is in line with the company's commitment to its shareholders, shown by its five-year CAGR of 24% in dividends.

Revenue by Region

Shoei manufactures its helmets exclusively in Japan but distributes them to over 60 countries globally. The company has asserted its dominance in the premium helmet market across most of these countries, as stated during its FY 2022 reports.

Despite the COVID-19 pandemic and the logistical hurdles it brought, Shoei posted double-digit growth both in unit numbers and revenue across almost all regions. Europe, Shoei's main market, reported a notable YoY revenue growth of 23.2% in 2022, making up about 43% of the company's total revenue. Meanwhile, sales in North America, Shoei's third largest market, increased by 92.7%, with the US contributing to 94% of the total revenue.

While China accounted for approx. 10% of Shoei's overall revenue in 2022, howeverm sales saw a decline of 28.7% YoY. This decline was primarily linked to distributors exercising prudence in handling their inventory, as stated by the company. Despite this sales decline, it's crucial to note that the management's focus to the broader Asian region, with a specific strategic emphasis on China, remains firm. This commitment is further underscored by the initiation of the SHOEI Shanghai Co., LTD, supplementing the existing subsidiaries in Beijing and Xiamen. These actions highlight Shoei's strategic expansion, allowing it to access the increasing demand for motorcycle helmets in China.

The early outcomes of these efforts can be seen in the Q3 2023 results, where SHOEI has reported a remarkable sales volume growth of 129% and net sales growth of 145%.

With 80% of its total revenues originating from international markets, Shoei's financial inflow is heavily influenced by fluctuations in currency exchange rates. Any considerable appreciation of the JPY against key currencies such as the EUR or USD can significantly affect the company's earnings and overall profitability, a scenario observed between 2010-2012.

The aftermath of the Lehman Brothers in 2008-2009 marked a period during which the JPY sustained its strengthened position. By the first half of 2012, it reached a 15-year low, dipping below JPY 85 against the USD and JPY 100 against the EUR. This shift had profound effects on many Japanese businesses, especially those like Shoei that derive a large chunk of their revenues outside of Japan. The appreciating JPY severely impacted Shoei's profit margins when translated back to JPY, resulting in the nearly complete deterioration of profits. This financial strain was not exclusive to Shoei, for instance, automaker Daihatsu found itself pushed out of the European market due to the erosion of profitability caused by these currency shifts.

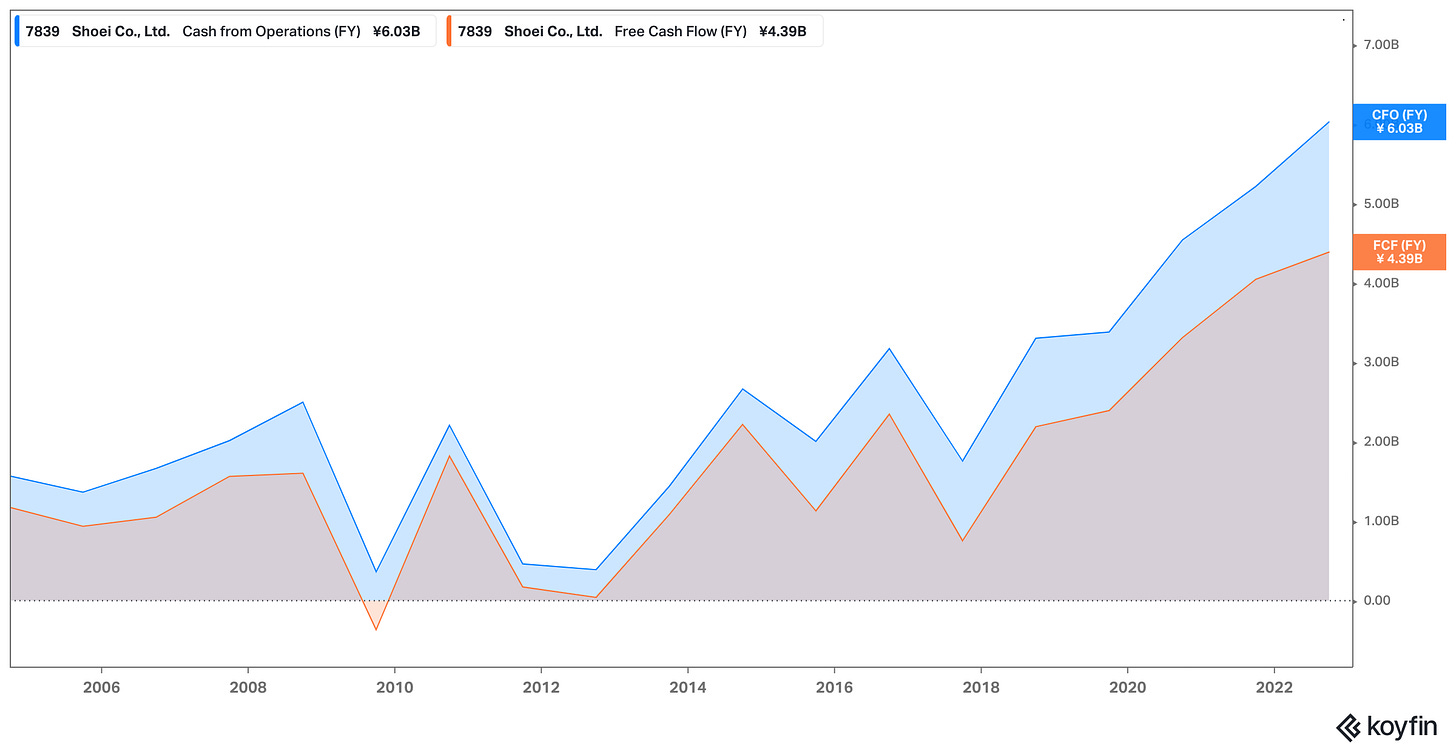

Capital Efficiency and Cash Flow

In terms of capital efficiency, Shoei continued to show superior results. Average return on invested capital (ROIC) over the last five years was 39% and reaching 41% by the end of FY 2022. This trend not only highlights a strong business model but also underscores the management's proficiency in efficiently allocating additional capital to profitable investments.

The impressive ROIC also contributes to increased financial flexibility, and more importantly, enables greater cash flow generation. This financial strength is demonstrated by consistent significant operating cash flow (OCF) generation and restrained capital expenditure, resulting in a robust 5-year CAGR of 19% for free cash flow (FCF).

Furthermore, since going public in 2004, Shoei did not have a single year with a negative OCF, and FCF only saw one negative readings during that time span, which underlines the company’s strong cash generation ability over almost two decades.

Before moving on, it is important to note that in response to the surging demand and to boost production capacity, Shoei has acquired a 7.2-hectare site next to the Ibaraki plant, which itself spans 3.3 hectares. As a result, CAPEX expected to double from 2021's figures, reaching JPY 3,470 million.

However, given Shoei’s solid cash position and stable business operations, this increase shouldn't be a matter of concern.

Liquidity & Debt

With stable source of revenue backed stable cash flow generation, Shoei didn't have any interest-bearing debt on its balance sheet. Their cash on hand was JPY 13,887 million, nearly twice the amount from five years prior, and this cash formed a substantial portion of their total assets of JPY 29,428 million at the end of FY 2022. Their robust balance sheet is further demonstrated by an equity ratio of around 78%.

Additionally, the company's liquidity ratios affirm its strong financial footing, highlighting its readiness to meet short-term financial obligations and sustain its business operations.

Shareholders

By the end of FY 2022, the company had a total of 53.7 million shares outstanding. The free float represented 89.97% of this total.

The top holders, making up 32.87%, include several foreign Investment management firms such as Baillie Gifford & Co., Fidelity Management & Research, with Capital Research & Management being the largest shareholder, holding roughly 7.99% of all shares.

For those interested, here is an article describing Baillie Gifford fund manager Praveen Kumar's visit to Japan, where he explores small but growing Japanese companies, including Shoei.

Outlook

With ongoing production capacity expansion to 830,000 units, Shoei remains optimistic about maintaining its full production pace. Furthermore, in China, after fixing earlier inventory issues, the company saw strong, double-digit sales growth in the third quarter of 2023.

Bull and Bear Investment Case

Bull Case

With China's expanding market for high-displacement bikes, Shoei's strong position in premium motorcycle helmets and its double-digit sales growth in the country set the stage for significant further expansion

Shoei's strong pricing power, based on its brand recognition among top motor racers, market dominance, and high-quality products, enables the company to pass on rising input costs while maintaining profitability

Bear Case

Economic uncertainty in Shoei's largest market, Europe, could severely impact sales and profitability, and compounded by a strengthening JPY, this scenario could further erode company's profit margins (like in 2010-2012)

Potential supply chain disruptions due to events like COVID resurgences or geopolitical tensions could hurt Shoei's profitability by causing stockouts and increased costs, especially since all products are manufactured in Japan

Valuation

At JPY 2,341 per share (August 26, 2023), Shoei trades at an Price-to-Earnings (P/E) of 17.1x, lower than the 10-year average P/E of 21.4. With an Enterprise Value (EV)-to-EBITDA (LTM) of 10.3x, it trades near its 10-year average EV/EBITDA of 10.6x.

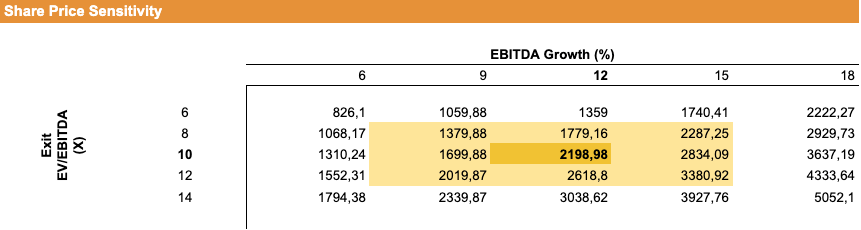

The fair value of Shoei is calculated using a 10-year exit based model that backs out equity from an EV/EBITDA multiple along with following assumption

EBITDA growth rate of 12%, lower than the 17.7% CAGR achieved over the last ten years

Exit EV/EBITDA multiple of 10.0x, close to the ten-year average of 10.6x

APAC region, and China in particular will remain as the next significant growth driver

Taking into account the conservative assumptions, below-average EBITDA growth, excluding dividends, and an exit multiple aligned with the ten-year average EV/EBITDA, the calculated fair value stands at JPY 2198,98 per share, indicating an overvaluation of -6,39% from today's share price.

While a conservative valuation approach might suggest that Shoei is not significantly undervalued at its current price, several factors indicate a substantial margin of safety in this valuation. These include:

Impressive 5-year average ROIC of 39%, and robust cash generation capabilities

Solid balance sheet with zero interest-bearing debt along with substantial cash reserves

Consistent dividend payout ratio around 50%, along with a ten-year CAGR of 14% and a five-year CAGR of 24%

Considering the expected discounted rate of 10% across all scenarios, the price sensitivity analysis, based on EBITDA growth and EV/EBITDA multiple, will provide a range of potential values, rather than a single point estimate.

Final Thoughts

In conclusion, Shoei stands out as a remarkably prosperous player in the niche market of premium motorcycle helmets. It’s high-quality products, global market leadership, and solid financials make it a small-cap success story worth tracking closely. Despite conceivable near-term economic hurdles, especially within it’s major market, Europe, the company's robust cash generation and operational effectiveness underscore it’s resilience. In fact, a stronger JPY or economic downturn could even widen the window of opportunity for this remarkable business, just as it did during 2010-2012.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference:

Company Homepage

https://www.shoei.com/worldwide/Investor Relations

https://www.shoei.com/en/ir/Why Are Shoei Helmets So Expensive? 8 Reasons For The Hefty Price Tag

https://agvsport.com/blog/helmets/why-are-shoei-helmets-so-expensive.htmlShoei Helmet Production