The Insider Report - Week 46

Unveiling the top insider buys and sells in the stock market

Welcome to the first issue of The Insider Report, your weekly deep-dive into the most significant insider transactions within the corporate landscapes. In a world where market movements are often precipitated by those "in the know," this report seeks to shine a light on the strategic bets made by the management of leading companies.

For now, the report will cover insider transactions in the German market, with plans to expand the coverage to additional markets, such as Switzerland, UK, US, and Canada, in the near future.

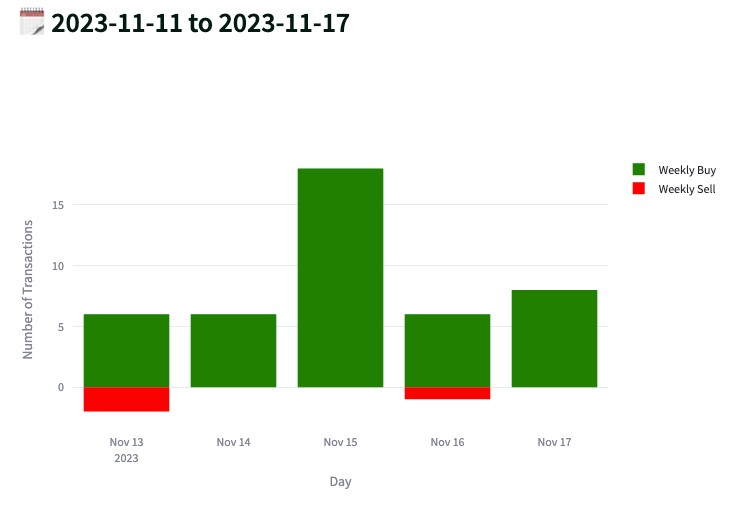

Weekly Summary of Insider Buys & Sells in 🇩🇪 Germany

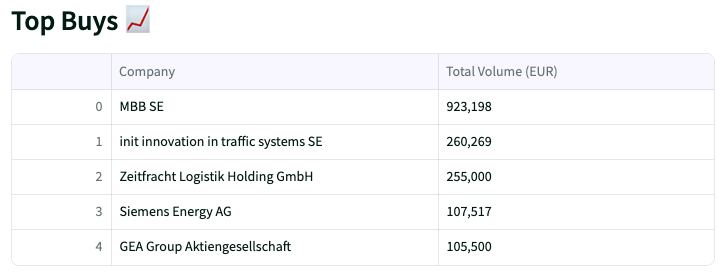

Top Insider Buys 📈

The companies that witnessed the largest total insider purchases last week primarily reflected the theme of micro and small-cap stocks, with the exception of Siemens Energy.

A few of these businesses, along with a select set of transactions that really stand out, are highlighted below.

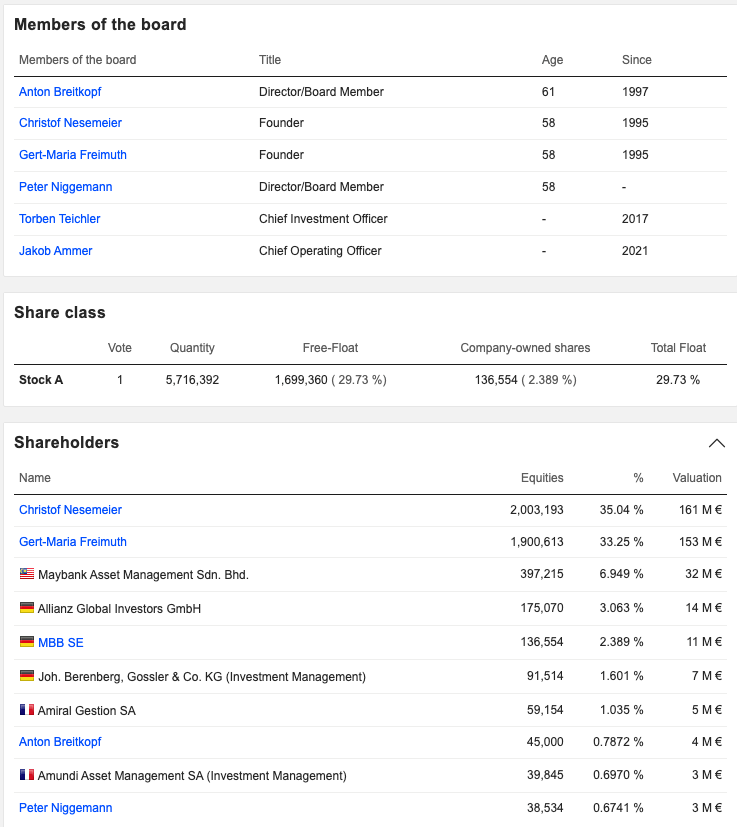

MBB SE (Ticker: MBB)

The MBB SE, founded in 1995, is a family-run industrial holding company, specializing in the acquisition and management of mid-sized industrial enterprises with high technological and engineering expertise. The company's portfolio includes stakes in publicly listed entities such as Aumann AG, where MBB owns a 48% share, a leading manufacturer of specialized machinery and production lines for electric powertrain system components. Another significant holding is Friedrich Vorwerk SE & Co. KG, with a 36% stake held by MBB, known for its specialization in civil engineering and plant construction, particularly for underground gas, oil, and power lines. MBB also holds stakes in privately-owned companies, such as Hanke Tissue (MBB’s stake: 94% ), a company engaged in the production and sale of high-quality tissue products, such as toilet paper, kitchen towels, serving both retail and professional customers.

One of the founders of MBB SE, Christof Nesemeier, seemingly recognized a good opportunity, acting on it by purchasing MBB shares in various tranches. The total value of these recent acquisitions is approx. EUR 923,000, following an earlier investment of around EUR 895,000 in September of this year.

Interestingly, as of November 2023, both founders, Christof Nesemeier and Gert-Maria Freimuth, collectively own around 70% of the total outstanding shares of MBB SE.

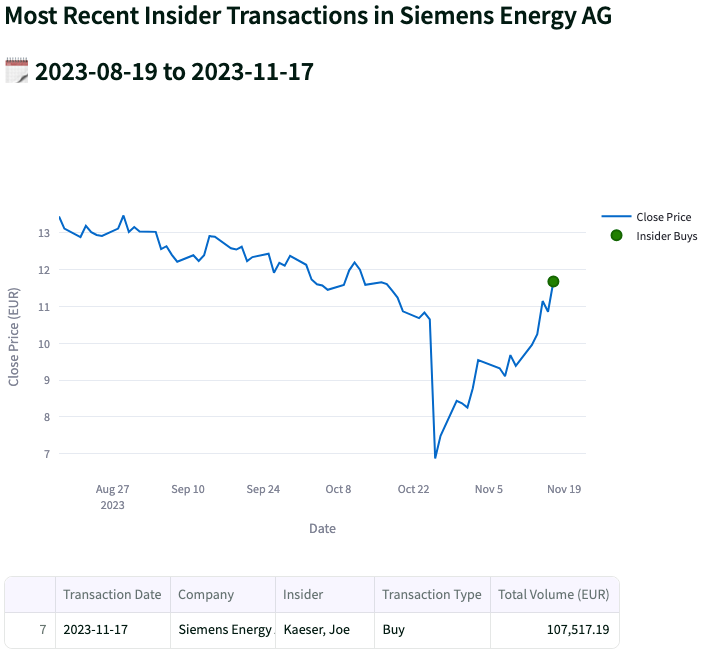

Siemens Energy (Ticker: ENR)

The shares of Siemens Energy have continued their sell-off, intensifying over the past few months. This decline has resulted in a loss of around 65% from its peak in January 2021, with the stock dropping to EUR 11.68 per share as of November 17, 2023. This is its lowest point since the company was spun off from its former parent, Siemens AG, and listed separately in September 2020.

Most recently, the German government provided partial backing for a 12-billion euro credit line from private banks to Siemens Energy, aimed at supporting the company's financial stability and its pivotal role in Germany's transition from fossil fuels to renewable energy.

Despite the turmoil of the last few months, Joe Kaeser, Chairman of Siemens Energy and former Siemens AG CEO, bought shares worth EUR 107,000 last week. However, considering the company’s market cap of EUR 9.4 billion, this insider purchase represents a relatively minor fraction of the company’s total value.

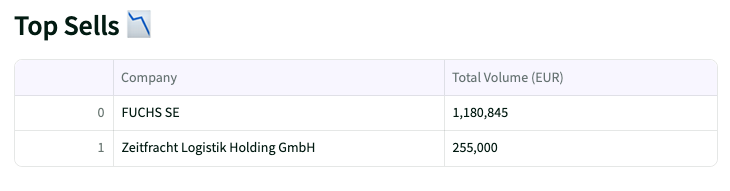

Top Insider Sells 📉

Last week, most of insider sales were concentrated in only two companies. As Zeitfracht Logistik is not a publicly traded company, further details on insider transactions will be skipped.

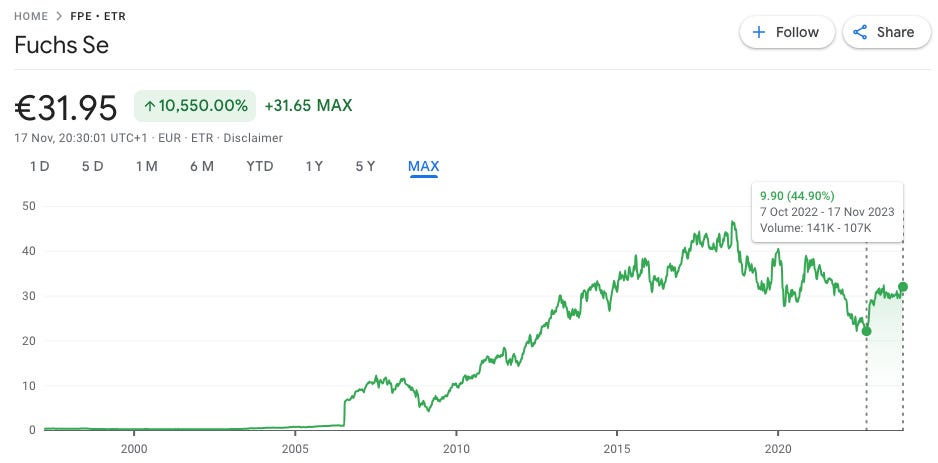

Fuchs SE (Ticker: FPE3)

Fuchs Petrolub SE is a Germany-based multinational manufacturer of lubricants, and related speciality products.

The company is not missing out on the recent change in the automotive industry, as its preparing for the electric revolution and that’s reflected in its recent share price performance, up almost 50% in the past twelve months but still down around 30% from its peak in 2018.

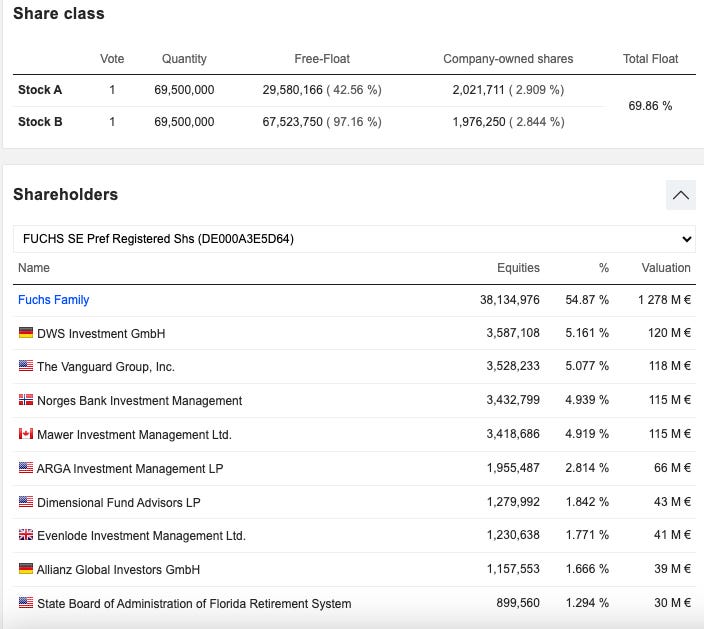

Stefan Fuchs, the Chief Executive Officer since 1998, along with two other members of the executive board, sold shares worth approx. EUR 1.18 million. However, as of November 2023, the Fuchs family still retains around 55% of the preferred shares.

Conclusion

Management of companies have unparalleled insights into the state of their businesses. Therefore, purchases of shares by insiders, in particular, not only provide insights into their outlook on future events but also demonstrate their skin in the game, showcasing their personal commitment to the company's success.

However, we should not overlook insider buying and selling, as this report is aimed to offer food for thought and serve as a source for idea generation. As always, do your own research.

Stay tuned and subscribe now to ensure you never miss the latest insights and analysis! Also, don’t miss the Black Friday Sale👇

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.