Turkcell Iletisim Hizmetleri A.S (TCELL): Promising Telecom Business

Growing operating results, solid Unit Economics, and strong balance sheet despite macroeconomic challenges

Summary

Market Leader: Dominant market share of 41.5% in an attractive, three-player market with a subscriber base of about 41.7 million (37.5 million on the mobile front) in Turkey

Revenue Growth Continues: Strong Q1/23, 61.5% YoY revenue growth, surpassing TL 17 million with and EBITDA margins maintained around 39%

Strong Unit Economics: ARPU growth of 67.9% in 1Q/23 (YoY) outpacing inflation, impressive churn numbers of less than 2%, both for mobile and fix segment

Low Leverage: Despite the Turkish Lira's depreciation against major currencies, the company managed to reduce its leverage level (net debt/EBITDA) to 0.9x

Challenging Business Environment: Despite Turkcell's strong performance, current price reflects the problems with Turkish Lira and Turkey’s economy leading to a general dislike in investing of Turkish stocks

Introduction of Turkcell

Turkcell İletişim Hizmetleri A.Ş, established in 1993 and started operations the following year, has emerged as the premier telecommunication operator in Turkey. Known for its mobile and fixed network services encompassing voice, data, and TV, Turkcell successfully pivoted into digital services, offering digital services such as streaming media, gaming, messaging, and payments. With an extensive customer base totalling 41.7 million, Turkcell has firmly established itself as the leading communications and technology company in Turkey, commanding an impressive market share exceeding 40%. The company also operates through subsidiary entities in Northern Cyprus, Ukraine, and Belarus. Turkcell has been listed on the New York Stock Exchange (Ticker: TKC) as American Depositary Shares (ADS) and on the Borsa İstanbul Stock Market (Ticker: TCELL) since July 2000.

Products & Services

Turkcell Groups divides its main products and services into three key segments

Telecom Services

Turkcell offers a wide range of services including voice, data, TV, and other value-added services on both mobile and fixed networks. This is the core of Turkcell's business today, accounting for more than 80% of the total group revenue

Digital Services and Solutions

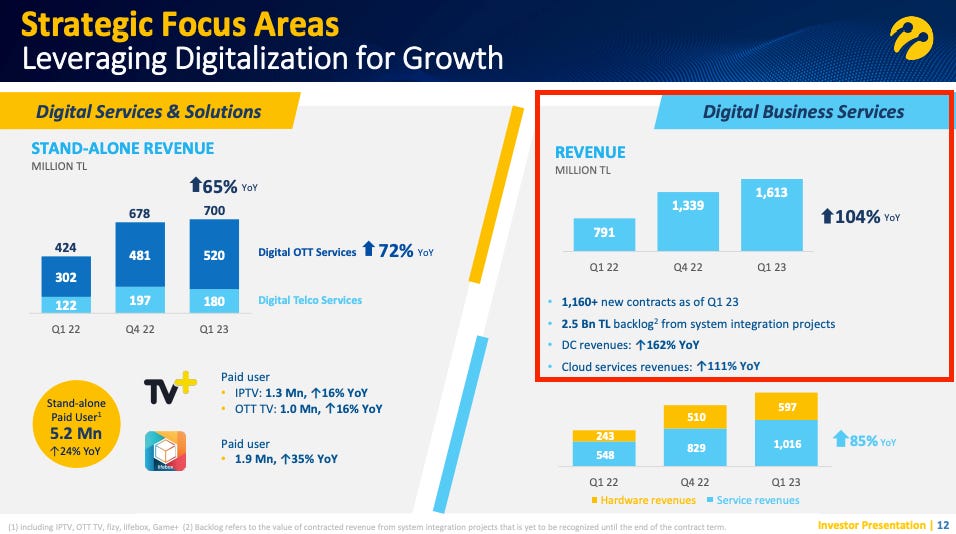

Turkcell is successfully transforming from an a mobile service provider into a digital innovative digital operator provides and serve the consumers with a unique portfolio of digital services delivered via their own mobile and fixed-line networks.

It provides digital business solutions such as data center management, cloud solutions, cyber security, and managed services, aiming to support its corporate customers digital transformation processes

Turkcell engages in strategic collaborations with leading IT companies like HP and VMware, aiming to deliver top-notch digital business services to its customers. This partnership has been instrumental in driving remarkable revenue growth, reaching triple-digit growth figures, across the entire spectrum of the digital business service segment.

Techfin Services:

Turkcell's strategic emphasis on digital finance transformation has resulted in the successful development of techfin products, like Paycell the leading payment platform in Turkey and Financell which offers financing services to individual and corporate customers

Paycell, the leading financial “Super-App” in Turkey, with 3-months active users of with 7.7 million to 40 million customers, it provides substantial opportunities for upselling and cross-selling the diverse range of digital services

Another unique aspect of Turkcell's business is the tower business reported under Telecom Service. Global Tower, established in 2006, is the sole tower company in Turkey and operates in Turkey, Ukraine, Belarus, and Cyprus. It offers independent infrastructure services such as tower leasing and tower build & sell to a diverse range of customers including mobile operators, radio and TV broadcasters, internet service providers, energy companies, and public institutions.

Based on the Annual Report 2022, the management outlined a potential IPO of it 100%-owned towers subsidiary. Turkcell has chosen not to reveal the specific number of shares available for purchase. However, they have stated that the initial public offering (IPO) will take place at an appropriate time, considering market conditions and legislation. Interestingly, in a presentation titled "Unlock Turkcell's Potential" by LetterOne (the second largest shareholder of Turkcel via IMTIS) in Feb 2022, it was stated that the IPO of the towers subsidiary could contribute significant value to the business and potentially increase Turkcell's market capitalization.

Shareholders

As of June 2023. Türkiye Wealth Fund (TVF), is the largest shareholder of Turkcell.

As stated on their official website, the purpose of Türkiye Wealth Fund (TVF) is described as follows

Türkiye Wealth Fund realizes investments that have strategic priority for Turkish economy and adds value to our well-established institutions.

The second largest shareholder is IMTIS Holdings, part of the Luxembourg-based global investment vehicle LetterOne Group. They have maintained a significant economic interest in Turkcell for over 16 years. In October 2021, LetterOne expressed concerns to Turkcell’s Board of Members regarding various aspects of the company's operations, including margin compressions, execution of value-realization strategy, and governance. While some of the points mentioned may no longer be relevant, the document is recommended for interested readers seeking insights into the telecommunications industry and peer valuations. Turkcell's management has responded to these concerns, making it an interesting read as well.

Industry & Business Environment

Mobile Communications in Turkey

Turkey's mobile communication market has significantly evolved since its inception in 1994, experiencing a multitude of changes over time. Here are some key highlights

Originally, Turkcell and Telsim were the only two providers operating between 1994 and 2001

The sector witnessed an increase in competition from 2001 to 2004, with two more players, Aria and Aycell, taking the total operator count to four. Post-2004, the market consolidated to three operators: Turkcell, Telsim, and Avea.

In 2005, Telsim was was acquired by Vodafone, and since then, the company has been providing its services under the brand “Vodafone”.

Since 2016, Avea has been operating under the "TT Mobil" brand

Today, Turkey's mobile subscriber base exceeded 90.8 million which represents a unique phenomenon in the market: an over-saturation, as indicated by a penetration rate of ~107.2% (100% penetration is possible and implies multiple subscriptions by some users).

In line with this remarkable growth, the Turkish mobile communication sector has established itself as one of the densest markets in Europe. It is dominated by three major players - Turkcell, Vodafone and Turk Telekom - each holding significant market share, based on number of subscribers, of 41.3%, 30.8% and 27.9% , respectively.

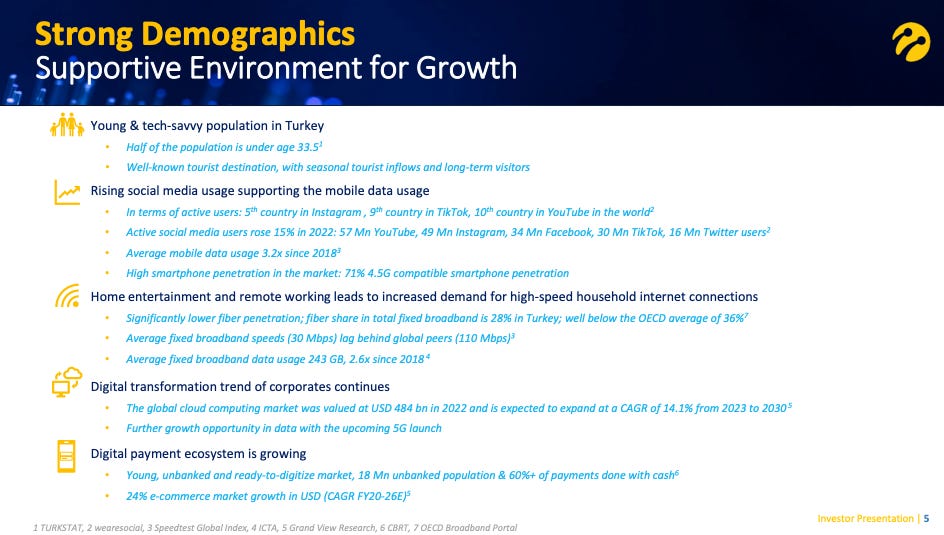

Despite the economic challenges, Turkey's demographics — a young, tech-savvy population, and growing digital adoption — make it a potentially ideal environment for telecommunication investments, and the low share prices today are probably disconnected from the long-term trend and opportunities, due to a generic dislike in the market for investing in the Turkish economy.

Turkey, the Turkish Economy and the Turkish Lira

Turkey the 19th largest economy in the world, has a nominal GDP of almost a trillion dollar and GDP per capita of USD 10,680. It shows favourable demographics, where young people, defines as under age 14, making up 26.5% of the total population of 85 million. According to OECD figures, Turkey has been the fastest growing economy in the world in 2021 with 11%, averaging 5.8% yearly GDP growth between 2002 and 2021, and slowed down to 5,6% in 2022. Political turmoil and, Erdogan’s “unorthodox” understanding of monetary policy have led to some financial and currency market instability and uncertainty about Turkey’s economic future in recent years.

Despite its operational success, Turkcell like any other businesses operating in Turkey, faces challenges due to inflationary pressures that led to the significant Lira depreciation against the USD over the last decade. As Turkcell receives subscription fees in Turkish lira from its subscribers, the value of that currency has decreased by over 90% when measured in US dollars.

The recent substantial policy rate hike of 650 basis points to 15% by the central bank marks a significant shift after a two-year period without any increases. However, despite this monetary policy reversal, analysts remain cautious and concerned about the uncertain macroeconomic conditions that persist, leaving the situation in uncharted territory.

Competition & Peers

In the domestic market, Turkcell faces competition from Vodafone Turkey and Turk Telecom. In terms of mobile subscribers, Turkcell holds the leading position with 37.5 million subscribers, while Türk Telekom, the second-largest, has 25.6 million mobile subscribers (as of 1Q23).

Turk Telekom demonstrates a more advanced position in its fiber business, boasting 8.1 million fiber customers, which surpasses Turkcell's 2.1 million. This indicates an opportunity for Turkcell to achieve strong growth in the fiber infrastructure segment. However, pursuing this growth potential would require significant capital investments to catch up with its rival.

Bull and Bear Investment Case

Bull Case

Long-term opportunity in fiber: due to growing need for broadband connection and a low fiber penetration of 21.9% in Turkey compared to other peer countries

Strong UE: with double-digit ARPU growth and and low churn in both, fixed and mobile markets, and 68.1% share of postpaid subscriber underlines the stickiness of Turkcell’s business

Unique portfolio of assets and digital services: Turkcell is well placed to tap into the future of high-growth and high-margin markets driven by continued growth in data usage with digitalization

Bear Case

Sustained lira depreciation: risk of further deprecation of the Turkish Lira puts pressure on Turkcell's financials and debt structure

Investment for infrastructure and new technologies: With the cost of upgrading telecommunications equipment, infrastructure and investments in new technologies, Turkcell’s EBITDA margin and free cash flow will be hard to maintain in the short term

Financials & Key Figures

Despite the challenges posed by the Turkish economy and the Turkish Lira economic, Turkcell has demonstrated a robust performance in 1Q23 by achieving

high revenue growth of 61.5% YoY, reaching a total revenue of TL 17.3 billion

EBITDA reached TL 6.8 billion with a increase of 57.1% YoY and EBITDA margin maintained around 39%

solid net profit of TL 2.8 million based on strong operational performance, lower foreign exchange (FX) losses

higher ARPU growth of 67.9% YoY due to inflationary pricing, exceeding headline inflation

The revenue break-down shows that, Turkcell Turkey which includes telecom services (voice, data, TV on mobile and fixed networks), represent a significant portion of the group's revenues.

Alongside the successful core business, the contribution of the strategic focus areas, digital services and solutions, digital business service and techfin also contributed to the strong revenue growth. The company's ability to perform exceptionally well in these strategic focus areas is evident from the continues YoY growths, both in terms of revenue and user.

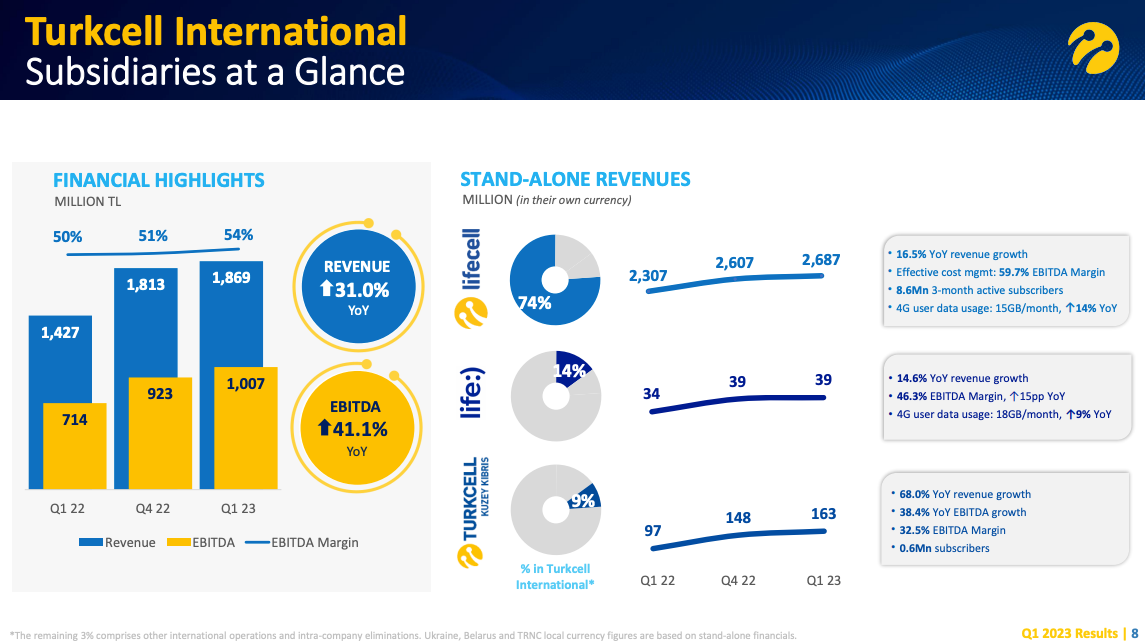

Turkcell’s international subsidiaries contributed to a organic revenue growth of 20% YoY (31% including FX effects) and reached TL 1.87 billion in revenue, managed to maintain EBITDA margins around 50%.

Lifecell, Turkcell’s subsidiary operating in Ukraine, accounts for 74% of Turkcell’s international revenue with a reported EBITDA margin of 59% during 1Q23. Despite the current situation in Ukraine, it showed a strong 3-month active subscribers of 8.6 subscribers and reached a 22.0% ARPU growth in 1Q/23.

Liquidity, Debt Structure and Funding

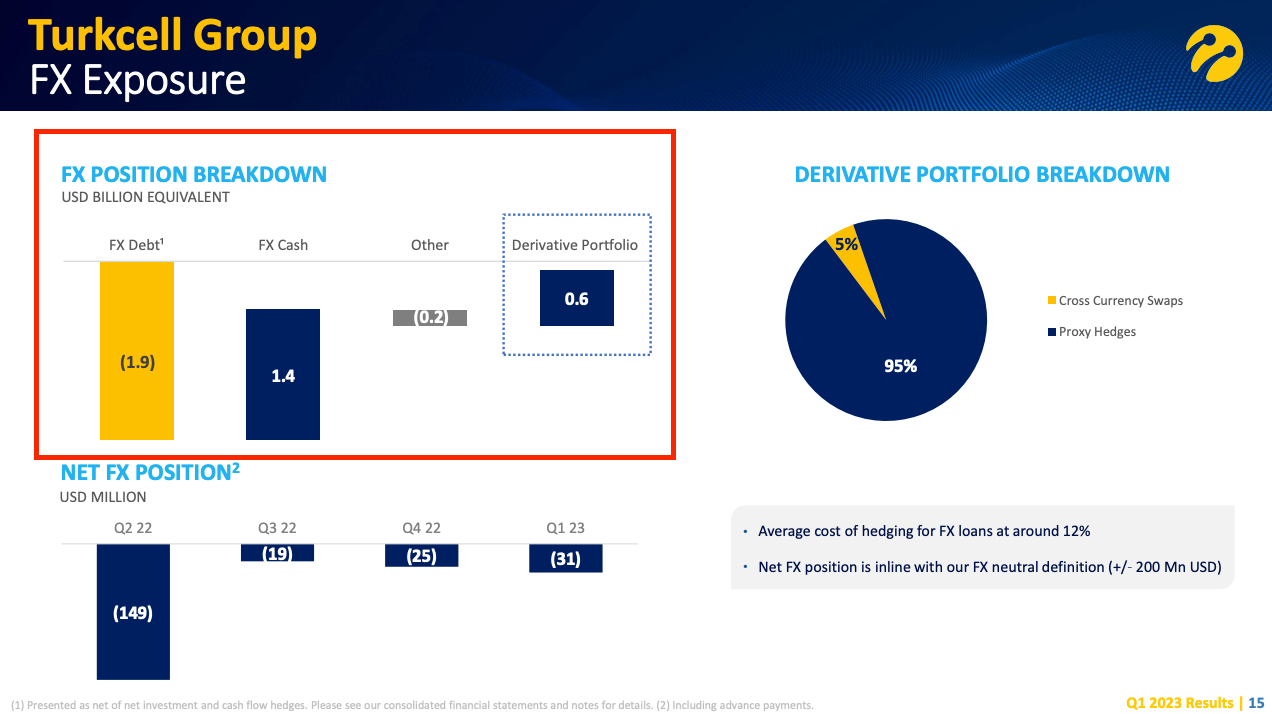

In addition to the inflationary pricing, which means that the company increases subscription fees in Turkish lira in line with inflation, Turkcell adopts risk management techniques such as hedging and maintaining a significant portion of its cash reserves in US dollars. According to the CFO in the Q1 2023

The majority of our cash is held in hard currencies, with 57% in US dollars and 15% in euros, excluding FX swaps. This cash reserve is more than enough to cover our debt service until 2025. With a manageable FX debt service of approximately US$280 million this year, we have a strong cash position and committed long-term credit lines to comfortably meet our financial obligations.

Turkcell maintains a strong focus on minimizing leverage, as evidenced by its net debt leverage of only 0.9x which is significantly lower than the industry average of 2.0x for telecommunications companies. The company's commitment to prudent financial management ensures that it remains well below its long-term threshold of 1.5 times net debt to EBITDA, as highlighted in their Q1 2023 earnings call.

Turkcell's solid revenue and income performance have positively impacted its liquidity condition. The company has consistently maintained a quick ratio of 1.6 over the past few years. The quick ratio, which measures a company's most liquid assets in relation to its total current liabilities, demonstrates that Turkcell has readily available liquidity to meet its short-term financial obligations.

The management helped avert leverage peaks under worsened macro conditions and showcased the ability to minimize the potential negative effects of further currency devaluation.

Turkcell issued several USD and EUR dominated bonds, with a maturity of the earliest in 2025 and later. Therefore, it does not have any significant debt redemptions scheduled in the near future and it will take some time before Turkcell needs to replace all their debts with newer, more costly debts. Additionally, Turkcell FX cash reserves, amounting to USD 1.4 billion, serves as a mitigating factor for the risks associated with refinancing.

The management has done a excellent job, helped avert leverage peaks under worsened macro conditions and showcased the ability to minimize the potential negative effects of further currency devaluation.

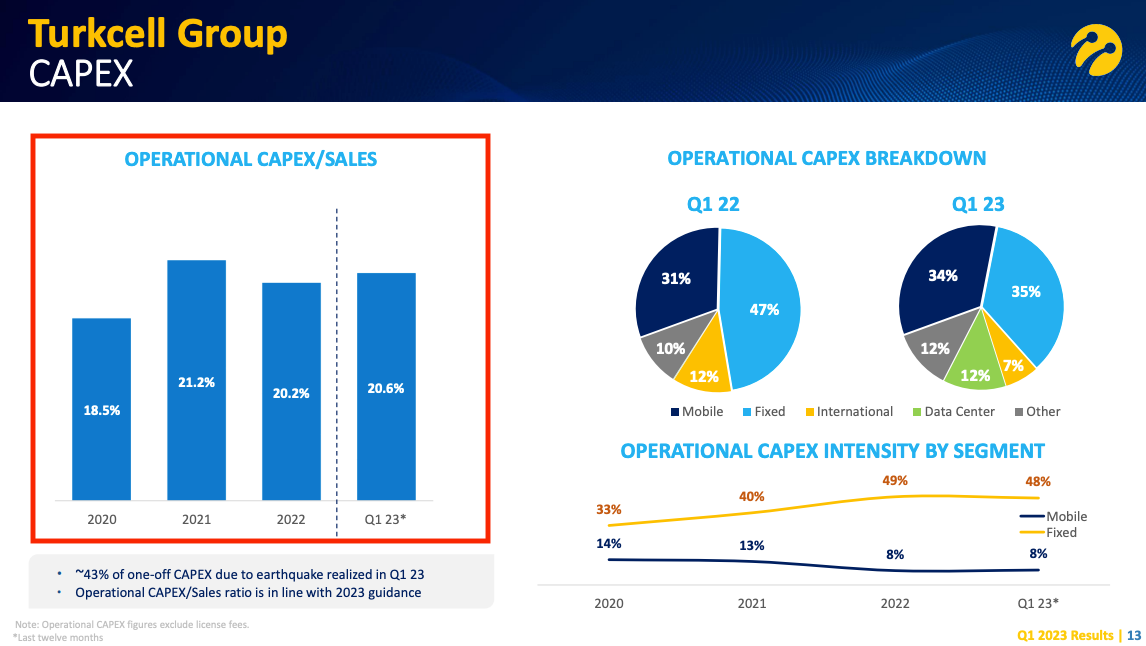

CAPEX and Cash Flow

Telecom companies, operating in a capital-intensive industry, require extensive network infrastructure to provide fixed line and wireless services, and the CAPEX/sales ratio helps investors measure how much revenue is put back into capital expenses as these companies continuously maintain, replace and upgrade productive assets.

Over the past few years, Turkcell has demonstrated a relatively stable CAPEX/sales ratio of approximately 20%. The company's management maintains a disciplined approach to their capital expenditures, this was also underscored by the CFO during the 1Q23 call

On the fixed side, having realized 1.5 million fiber homepasses in past two years. We have decided to slow down the given compelling cost environment. Therefore, this year we will focus on monetizing these recent homepasses.

On the cash flow side, following a period of limited and even negative free cash flow between 2014 and 2018, primarily due to substantial investments in 4.5G technology, the company managed to get back on a upward trend in the following years. Turkcell's free cash flow amounted to TRY 1.1 billion in 2021, which further increased to TRY 1.7 billion in 2022. This consistent improvement underscores the company's commitment to financial stability and sustainability.

After experiencing low and even negative free cash flow levels between 2014 to 2018, mostly due to the investments in 4.5G technology, the company saw a positive free cash flow trend in subsequent years. In 2021, Turkcell generated TRY 1.1 billion in free cash flow, which increased to TRY 1.7 billion in 2022.

Outlook

In summary, Turkcell demonstrates a robust balance sheet, consistent growth in average revenue per user (ARPU), minimal customer churn, strong cash flow, and a positive outlook for the remaining period of 2023.

Valuation

Currently, TKC is trading at an EV/EBITDA (LTM) ratio of ~5.3x, near its 10-year average valuation of 5.8x.

The fair value of Turkcell is calculated using a 10-year exit based model, which involves extracting equity from an EV/EBITDA multiple (Credit is given to Invariant Substack by Devin LaSarre for originating the concept of the exit-based model). The calculation is based on the following assumptions.

CapEx remains stable at current levels, around 20% of sales

Zero forecasted dividends from now on (which is quite unrealistic as the company has a dividend track record of over 10 years)

EBITDA growth of 15% per year (lower then the 10-year CAGR of 16.4%)

exit EV/EBITDA multiple of 5, slightly lower than the current multiple and the 10-year avg. of 5.4

Taking into account the very conservative assumptions of below-average EBITDA growth, zero dividends, and a slightly lower EV/EBITDA ratio compared to historical averages, the calculated fair value of TL 49,24 per TCELL share represents an upside of 23.34%.

Before drawing any final conclusions, let's adopt a more optimistic view on the company and the overall Turkish economy and consider the following scenarios

If Turkey's economic situation improves, resulting in a deceleration of the depreciation of the Turkish Lira and a return to normal or historic levels, similar to those observed in 2019

If Turkcell continues to demonstrate strong execution of its business strategies and achieves consistent growth

If Turkcell successfully capitalizes on emerging digital trends and leverages its unique digital asset portfolio to expand into new growth areas, further diversifying its revenue streams and enhancing its competitive position

Any surprises would benefit the investor positively, potentially leading to higher return on investments and the following data table (based on 12% expected rate of return) shows the impact of changes in EBITDA growth and EV/EBITDA multiple on a Turkcell’s share price.

Please note that when dealing with TCK (ADR) shares, which represent Turkcell shares traded on the NYSE, it is important to consider potential ADR fees and foeign taxes as additional cost factors.

Final Thoughts

Turkcell's robust strategy in addressing currency risk, managing liquidity and debt, successfully mitigated financial risks and maintained stability amidst extremely demanding and unpredictable market conditions. Moreover, it shows the characteristics of a well-managed company, including being a reputable market leader, possessing a strong balance sheet, solid unit economics, and benefiting from a unique digital asset portfolio that presents multiple opportunities for future growth.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference:

Turkcell’s Website for Investor Relations

Investor Presentation from May 2023

Annual Report 2022

https://ffo3gv1cf3ir.merlincdn.net/hakkimizda/en/yatirimciiliskileri/InvestorReportLibrary/Turkcell E.F.R 2022 ENG.pdfRegulation and Competition in the Turkish Telecommunications Industry: https://research.sabanciuniv.edu/id/eprint/14658/1/atiyas_reg_com_telecom_update.pdf

Fitch Affirms Turkcell at 'BB-'; Outlook Stable https://www.fitchratings.com/research/corporate-finance/fitch-affirms-turkcell-at-bb-outlook-stable-17-11-2021

I included a link to this post in my latest post:

Emerging Market Links + The Week Ahead (July 10, 2023)

https://emergingmarketskeptic.substack.com/p/emerging-markets-week-july-10-2023