Update on Ping An Insurance: What If China gets rich before it gets old

Despite overall weakness, Ping An's core business of L&H remains intact, while it's exposure to real estate is still concerning investors

🔈 Next Deep-Dive:

Teleperformance SE (🇫🇷 Ticker: EPA)

Based on the poll results from last weeks Friday Roundup and Twitter/X, the next deep-dive will be on one of the worst performers of the past months 😳

But, will AI disrupt Teleperformance’s business model ? Or, will it become one of the main beneficiaries?

Subscribe and upgrade now to ensure you don't miss out any upcoming deep-dive report 👇

Summary

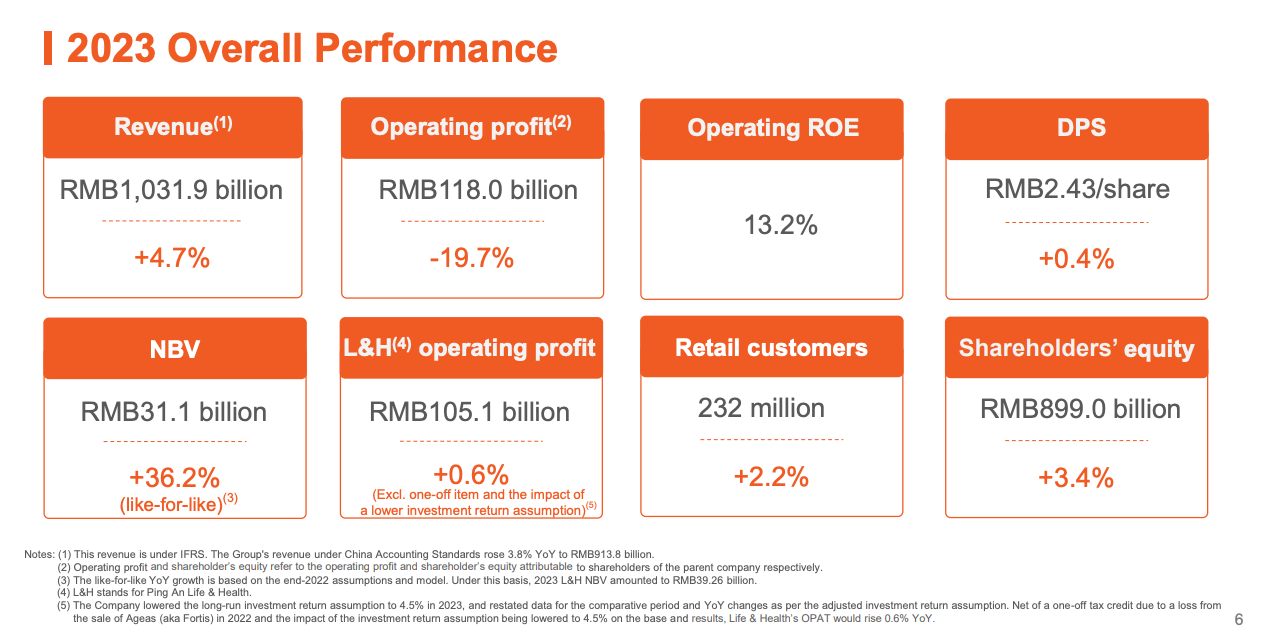

Week Overall FY23 Results: Operating profit dropped by -19.7% to RMB 117.9 billion in FY23, mainly due to a net loss of about RMB 20.7 billion from the asset management business, attributed to unfavorable capital market volatility and performance

Rebound in L&H NBV Growth: As efforts to improve the quality and productivity of its agency channel showed initial results, NBV rose by 36.2% YoY, while NBV per agent increased by 89.5%

Stable Solvency: PingAn sustained an adequate capital buffer in both, L&H and P&C business, with comprehensive solvency ratios at 194.7% and 207.8%, respectively, well above the 100% regulatory minimums

Large Customer Base: Retail customers increased to 231 million, while the number of contracts per customer remained around 2.95

Real Estate Exposure: While it has reduced its real estate exposure in recent years, concerns arise from past losses and rumors of potential takeovers of distressed real estate developers, pushed by Chinese authorities

If you missed the initial report on Ping An Insurance, I highly recommend checking it out first👇

It provides a comprehensive overview of Ping An's operations and the business environment, while the following write-up serves more as an update based on the latest financials and industry dynamics.

Financial Highlights

Relatively weak share price performance of Chinese equities over the past few years were very disappointing and painful. With the exception of PICC, all other major Chinese insurance players, has suffered significantly with shares prices dropping over 30%.

In the case of Ping An, China’s largest insurer by market capitalization, shares dropped by over 50% from their highs in 2020/21 after reporting weak results in FY23, with operating profit after tax (OPAT) declining by -19.7% YoY to RMB 117.9 billion, marking its lowest level in five years.

Besides the negative contribution from its technology business, a significant net loss in Ping An's asset management business of RMB 20.7 billion, reversing RMB 2.3 billion of OPAT in 2022, impacted the group’s operating profitably in FY23.

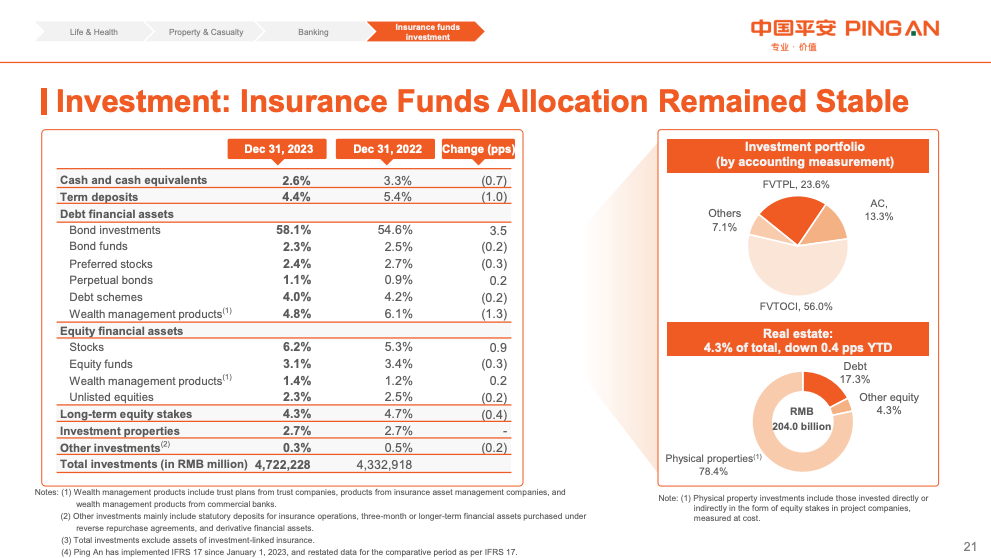

With a traditional 70-30 split between fixed income and other assets, including public and private equity, and real estate it was mainly affected by unfavourable developments of the Hong Kong and mainland Chinese stock markets performance and capital market volatility.

Despite a slowdown in Ping An's core business of L&H, with OPAT dropping by 3.3% YoY, it recorded strong growth in new business value (NBV) by +36.2% YoY to RMB 39.3 billion, based on end-2022 assumptions and models. Moreover, the increase in the 13th-month persistency ratio (policies that renew after a year) to 92.8% implies higher customer retention in terms of renewal premiums, highlighting Ping An’s strong long-term customer relationships.

NBV growth was largely driven by a 40.3% rise in agent channel NBV due to the impressive increase of 89.5% in NBV per agent to RMB 7,524 per month in FY23, which highlights Ping An's successful transformation over the past year three years, moving away from a large, manpower-intensive workforce towards a more productive and qualitative agent channel, powered by it’s technological capabilities. Notably, income per agent also surged by 39.2% YoY to RMB 9,813 RMB per month supported by Ping An's extensive customer base and it’s integrated platform of services, which provides tremendous cross-selling opportunities going further.

While revenues of Ping An’s P&C business grew by 6.5% to RMB 313.4 billion in FY23, OPAT dropped by 11.4% to RMB 8.9 billion, which was largely due to underwriting losses in guarantee insurances, pushing the combined ratio (COR) to 131%, indicating that it spend much more on expenses than it took in premiums. While guarantee insurance historically brought high underwriting profits, recent market changes led Ping An to scale back this business, suspending financing guarantee insurance in Q4 2023. This move may impact premium income over the short-term, but is expected to improve Ping An P&C's overall business quality in the future.

However, Ping An's auto insurance business, which accounts for over two-thirds of the premium income within the P&C segment, demonstrated strong results with a COR of 97.7%, much better than the group average of 100.7%.

In contrast, profits from Ping An’s banking businesses slightly increased by 2.1% YoY to RMB 46.4 billion, while revenues dropped by 8.4% to RMB 164.7 billion in FY23 due to adjusted asset portfolio and market volatilities.

Its banking business demonstrates significant robustness, boasting a non-performing loan (NPL) ratio of 1.06% and a provision coverage ratio of 277.63%. Additionally, its core Tier 1 ratio has improved to 9.22%, surpassing the Chinese regulatory requirement of 7.75% and underlining Ping An Bank’s financial strength.

While the net loss of the asset management business dragged down Ping An’s FY net profit to RMB 85.7 billion (PY: 111 | -22%), the full-year dividend came in at RMB 2.43 per share for full-year 2023, offering a 6% yield at current price levels, and reinforcing the company's commitment to shareholders amidst challenging times.

Industry & Business Environment Highlights

Secular trends within the insurance business remain largely unchanged, with demographic shifts, including low fertility rates, and the aging population. While according to the World Health Organization (WHO) the number of people aged 60 and older is increasing globally, China has been experiencing a more rapid aging process compared to many other countries in recent years. Currently, China's population over 60 years old is about 297 million, accounting for 21% of the total population.

Furthermore, China is also experiencing declining birth rates, with a total fertility rate of 1.09 in 2022, significantly below the 2.1 rate needed to maintain a stable age distribution. Historically, children played critical roles in providing old-age support, but declining family sizes are leading to a rising old-age dependency ratio in China, and elderly people may not have the same degree of family support as in past decades.

While the demographic trend presents challenges for China, it also offers promising opportunities and significant growth potential for the Chinese insurance industry, especially considering China’s low insurance penetration rates compared to developed and emerging countries.

Will Ping An regain its pre-pandemic growth momentum?

The chairman's statement in the FY23 Letter to Shareholders provides a good overview of the current situation of the Chinese economy and the opportunities for Chinese insurers

“Only with secure families can there be a prosperous country. The Chinese economy is transitioning from a stage of high-speed growth to a stage of high-quality development. Consumer demands for wealth preservation and growth health and longevity services, and premium elderlycare are increasing as personal wealth accumulates and population aging accelerates.

When considering Ping An’s brand reputation and its multi-offering capabilities due to its integrated “Finance and Health” platform, along with large existing and increasing customer base, which nearly quadrupled in the past decade to 232 million in FY23, Ping An is well positioned to benefit from the increasing demand for protection and well-being in China.

Additionally, Ping An’s tech-driven eco-systems will benefit Ping An’s core businesses (L&H, P&C and banking) in terms of productivity, operational efficiency and economic of scale, boosting tremendous opportunities in cross-selling to increase the value and profit per customer at very low costs.

In many cases, this is already visible, such as contracts per retail customer reached 2.95 in FY23, holding multiple contracts with different subsidiaries, also resulting in high customer retention rates.

No Investments are without Risk

While the discussed secular trend provides tremendous growth opportunities for Ping An and its peers, ongoing geopolitical tensions between the US and China, along with concerns about technological controls and economic barriers, may further worsen China's economic and capital market conditions, which was already reflected by decreasing foreign direct investment (FDI) in China in 2023, hitting its lowest level since 1993, and indicating reduced confidence among foreign investors.

Furthermore, despite Ping An reducing its real estate exposure in recent years, losses like the RMB 24 billion investment in Fortune Land in 2021 and rumours of a potential takeover of Country Garden, pushed by Chinese authorities, raise concerns. This highlights the risks associated with China's transition from a property-led to an innovation-led growth model if not managed successfully.

Valuation

In terms of valuations (as of April 24, 2024), Ping An’s H-shares are trading at a price-to-book (P/B) ratio of 0.7x, representing an upside potential of more than 100% when compared to the ten-year average P/B ratio of 1.8x.

As China’s largest publicly-traded financial conglomerate, operating in a wide range of markets, it’s not easily comparable with it’s domestic and international competitors. However, when considering the main Chinese insurance players, the median P/B of 0.87x, is pretty much inline with Ping An’s FY23 P/B of 0.82x. Notably, when compared to its international peers, the distressed valuation of the Chinese insurance becomes quite obvious.

As mentioned in my initial report, when considering Ping An’s core business of L&H, its characterized by a higher ROE than its peers. Thus, in an sum-of-parts valuation, this business segment would be rewarded with much higher valuation multiples as on group level.

Final Thoughts

Affected by ongoing economic and geopolitical tensions, as well as weak performance in the domestic capital market, the valuation of Ping An and its peers is currently at all-time lows, making it very attractive for short to midterm investments, especially when the negative sentiment towards investments in China improves.

However, while there are significant opportunities for Chinese insurers driven by long-term factors such as demographics, there is still much work to be done as China is in the early stages of its transitions. Furthermore, Ping An's conglomerate group structure, with its complexity and diverse operations, poses challenges in corporate governance. Additionally, its continued exposure to the Chinese real estate sector leads me to reconsider Ping An as a long-term investment. That being said, overall, I still find the insurance business highly attractive, and I may consider exploring more globally focused players within the life and/or non-life insurance sector.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference

Presentation Annual Results FY23

https://group.pingan.com/resource/pingan/IR-Docs/2024/pingan-ar23-presentation.pdfPopulation Aging, Retirement Income Security, and Asset Markets in China https://www.nber.org/reporter/2019number2/population-aging-retirement-income-security-and-asset-markets-china

China's major insurance problem https://www.insurancebusinessmag.com/asia/news/breaking-news/chinas-major-insurance-problem-481615.aspx

Insurance Penetration, Awareness and Ownership in South and Southeast Asian Markets https://www.peak-re.com/insights/insurance-penetration-awareness-and-ownership-in-south-and-southeast-asian-markets/

Protection for China's ageing society https://www.swissre.com/institute/research/topics-and-risk-dialogues/china/protection-china-ageing-society.html

Further Readings

From protection to prosperity: the dynamics of the insurance market in China https://daxueconsulting.com/insurance-market-in-china/

AIA chief says insurance will outperform banking https://www.ft.com/video/b75788e1-52fc-3b33-8a38-be7c43d761f4

Value of New Business: What “value” does it provide under IFRS 17?https://www.wtwco.com/en-us/insights/2023/04/value-of-new-business-what-value-does-it-provide-under-ifrs-17