Villeroy & Boch (VIB3): 275 Years of History in Luxury Tableware and Beautiful Bathrooms

One of world's best-known sanitary ceramic producers, also known for modern home design for over three centuries, strong balance sheet and 275 years of history

Summary

Strong-Brand: Founded in 1748, one of the leading supplier of ceramic sanitary ware, eye-catching, high-quality tableware producer

Stable Growth: Steady revenue growth over the last ten years with a CAGR of 3.5%, EBITDA margins around 10-15% and ROIC at 15% in the last five years

Solid Balance Sheet: Low debt profile, and high liquidity of €260 million (cash + short-term investments) considering the market cap of around €500 million

Attractive dividend yield: Dividend track record spanning over 30 years, dividend CAGR (10y) of 11% with average payout ratio of 40%

Geopolitical Tensions and Fear of Recession: Key Challenges include rising interest rates and geopolitical tensions leading to a cooling of economic activities in the construction sector, increase in energy costs, particularly in European and German markets, and increased inflation negatively impacting consumer behaviour

Introduction of Villeroy & Boch

From small ceramic Producer to leading global Lifestyle Provider

Back in 1748, the luxuries of a modern home seemed like a distant dream when François Boch and his three sons embarked on their journey to craft ceramic tableware. Villeroy & Boch, founded in 1748 by François Boch, started as a small pottery workshop in Audun-le-Tiche (France), eventually evolving into a renowned manufacturer of affordable ceramics. In the 19th century, Jean-François Boch and Nicolas Villeroy merged their businesses to compete with English stoneware manufacturers.

Throughout its 275-year history, Villeroy & Boch has navigated several political changes, world wars and market dynamics. Today, the company is one of the leading ceramic manufacturer, operating internationally across the globe and is diversified into sanitary ceramic wares and high-end luxury dinnerware.

Products & Customer Groups

Headquartered in Germany and products sold in around 125 countries, Villeroy & Boch’s business activities are broadly classified into two segments, Bathroom & Wellness and Dining & Lifestyle.

Bathroom & Wellness

The Bathroom & Wellness segment accounts for two-thirds of the revenues and focuses on ceramic sanitary was as the core business and wellness products including WCs, shower toilets, bathtubs and shower trays, washbasins, bathroom furnitures, and whirlpools (in- and outdoor). To effectively address the needs of these different customer groups, the company adopts a two- or three-tier sales approach. This involves collaborating with retail and trade partners as well as planners, architects, and interior designers who play a crucial role in connecting the company's products with the end customers.

Some of the Villeroy & Boch’s innovation include products, such as the rimless DirectFlush WC or the ViClean 100 shower toilets, providing intimate cleansing and offering ultimate hygiene.

Dinning & Lifestyle

This segment makes one-third of the total revenue and includes high-quality and luxury dinnerware such as cutlery collections and home accessories.

To make these premium offerings easily accessible to customers, the company employs a well-structured distribution network. In an B2C sales approach, customers can discover these products via large department stores, various e-commerce platforms and retail partners such as Amazon and Macy’s. In addition to these sales channels, the company successfully operates its own online shop which has proven to be a valuable platform especially during the recent years of the COVID-19 pandemic.

Management

The company boasts an experienced management team with almost all Members of the Management Board having served for more than a decade, with low management turnover in key functions.

Frank Göring, the current Chairman of the Management Board (CEO), has been with Villeroy & Boch since 1997, initially joining as a Marketing Director for the Bath & Kitchen segment. Over the years, he progressed to become a member of the board of management, responsible for the bath and wellness segment. Since 2007, he has served as CEO, marking more than a decade in this role.

Georg Lörz has a long history with Villeroy & Boch, joining in 2003 and serving in various Sales & Marketing roles until 2009. After almost a decade, he returned as CEO of the Bath and Wellness Division.

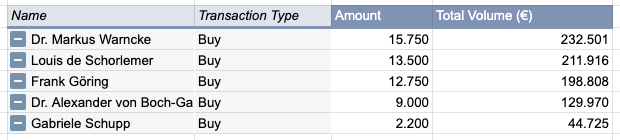

Dr. Markus Warncke, the CFO of the company since 2015, has been with Villeroy & Boch for over two decades, joining in 2001. Notably, he, along with the Frank Göring, has been actively purchasing Villeroy & Boch shares on the open market since 2016, with the most recent purchases occurring in March 2022.

SWOT Analysis

Strengths

Competency in Ceramics with 275 years of history, manufacturing know-how, product technology, customer relationships, access to distribution channels, capital intensity

Brand name, Villeroy & Boch, is associated with product quality and technical leadership in ceramic sanitary ware

Continuous Innovation with products such as DirectFlush-WC, ViClean-I 100 and TwistFlush and material innovations such as TitanCeram

Sound balance sheet with low debt profile and high level of cash + short-term investments of over €260 million considering the company's current market cap at around €500 million

Weakness

Cyclical Business with high dependency on the overall economic activity, private and public nonresidential and residential construction spending, consumer sentiment, commodity prices and purchasing power of households

Exposed to changes in input costs, including raw materials and energy (natural gas) components, and labor costs

Supplier concentration due to single sourcing for some of the raw materials due to no other available alternatives

Opportunities

Further Growth potential in APAC regions due demographic trends such population growth, urbanization, rising middle class

Increasing share of project business in the post-Covid era with hospitality industry showing signs of recovery, leveraging partnering opportunities with leading hotel chains and other companies

Expanding in other big construction markets such as United States due to geopolitical tension with Russia and China

Threats

European construction slowdown on the back of macroeconomic slowdown and sharp increase in interest rate, worsening in consumer sentiment,

Further escalation of geopolitical tensions threatening the outlook for global economy

High dependency of Bathroom & Wellness segment on the European, especially German construction activity and financing conditions

Shortage of skilled workers in sanitary industry, especially in Germany which could impact and limit further growth

Production Risk due to “grean deal” in EU, to become net-zero greenhouse gas emissions until 2050 resulting in increased cost for domestic production

Industry & Business Environment

Global Sanitary Market

The demand for sanitary ware products is continuously growing, driven by their essential role in residential, commercial, and public spaces. Ceramic sanitary ware, in particular, is highly favoured by end-users because of its durability, low maintenance needs, cracking resistance, and aesthetic appeal. This heightened preference for ceramic sanitary ware has led to an upsurge in demand across various sectors, including residential properties, hotels, industries, hospitals, and public establishments.

According to the latest industry research, the global Ceramic Sanitary Ware market size was valued at $46 billion in 2022 and is expected to expand at a CAGR of 8.53%, reaching $76 billion by 2028. Factors such as the rising population, urbanisation, and increasing disposable income of middle-class population and growth in awareness regarding sanitization and hygiene are supporting market growth.

The ceramic sanitary market can be segmented on the basis of product such as Toilet Sinks & Water Closets, Urinals, Wash Basins and application, residential (Single & Multifamily) and Commercial (Industrial, Hospitality, Retail & Offices)

Geographically, the Asia-Pacific-China (APAC) witnessed the fastest growth and is the largest market of ceramic sanitary ware, followed by Europe and North America. The massive industrial growth, in China in particular, the expansion of middle class income groups, infrastructural development and new product launches by key players in the region has as been fuelling the growth of the ceramic sanitary ware market over the past few years, and let to speed up the investments as well as local representation across major players like Geberit, Duravit, Villeroy & Boch and others.

Inflation, Slowdown in Construction, Geopolitical Tension

Villeroy & Boch operates in a highly cyclical business environment, where its Bathroom & Wellness segment is closely tied to the construction industry and economic growth prospects. Therefore, it is worthwhile to take a quick look into current development of the construction sector and its impact on the company's business.

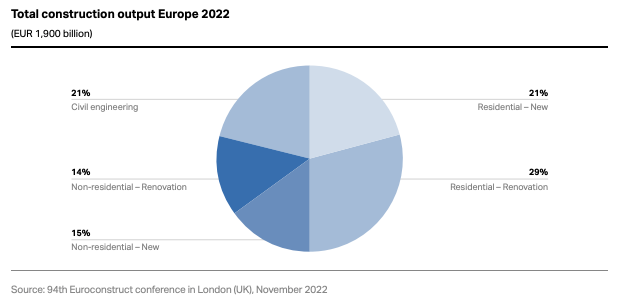

The construction industry remains a significant global sector, contributing a substantial share to the Gross Domestic Product (GDP) in most countries. The worldwide construction market was estimated at $7.28 trillion in 2021 and is expected to reach $14.41 trillion by 2030, with a compound annual growth rate (CAGR) of 7.3% between 2022 and 2030. In Europe, the main market for Villeroy & Boch, approximately 80% of the total construction volume of €1.9 trillion was attributed to building construction. Residential construction and non-residential construction maintained their distribution at approximately 60% and 40%, respectively. Additionally, renovation projects continued to dominate new construction activities throughout the year.

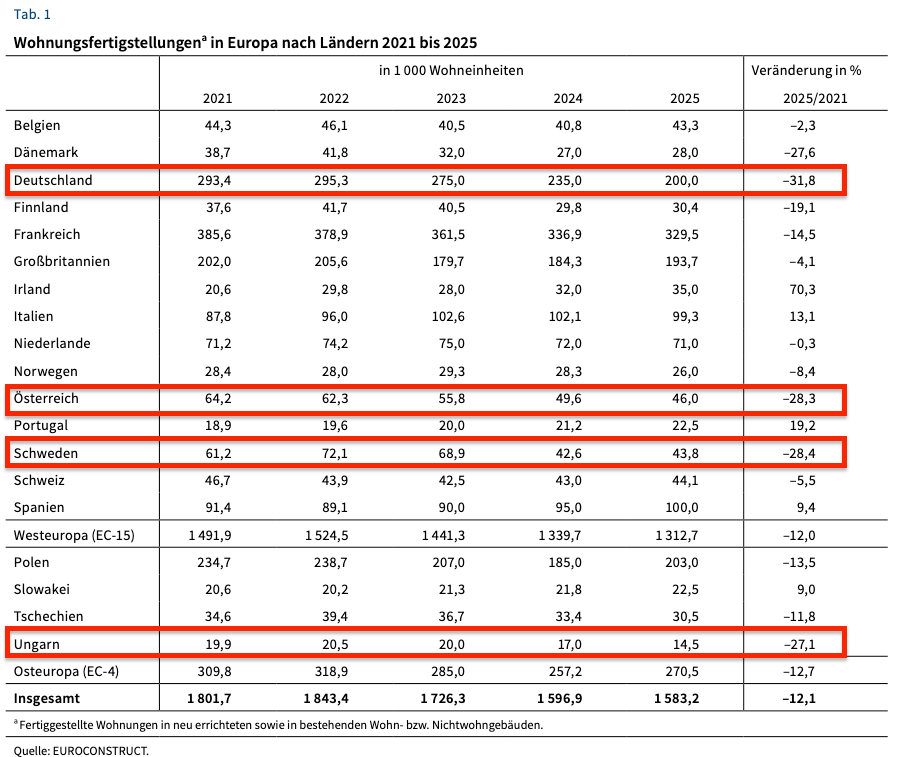

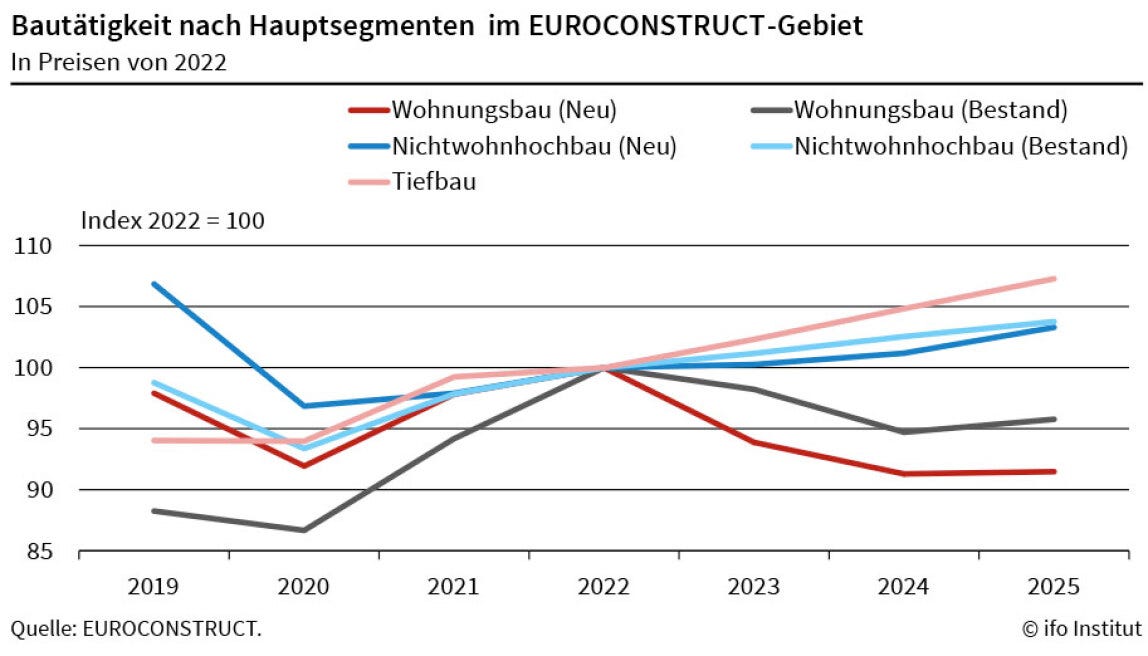

The construction sector experienced a slowdown in growth compared to the previous year, primarily due to the lingering impacts of COVID-19 recovery. The impacts by the interest rate turnaround in EU, which almost tripled from 1,2% to 4,6% between Jan 2022 to April 2023, and the increase in construction costs due to energy and raw material cost, puts the severe pressure on the overall construction industry, especially for residential construction, contributing to constraining growth in various markets. In the latest Euroconstruct summer conference in 2023, projections indicate a further slowdown in construction activity across Europe from 2023 to 2025. The residential construction sector in Germany and other European countries is expected to face notable challenges during this period, with an anticipated decrease of 31.8% in the German residential construction sector.

The construction of new non-residential buildings is experiencing only marginal progress, while renovation activities are showing robust growth until 2025. However, both segments are impacted by rising interest rates and stricter credit requirements, which also affect companies' willingness to undertake construction projects.

Due to its significant dependence on private consumer spending, the Dinning & Lifestyle business is particularly susceptible to various economic factors, including inflation and the purchasing power of households. These challenges have been evident in the last few months worldwide, with Europe and Germany being especially impacted.

Key Industry Players & Peers

The global ceramic sanitary ware market is characterized by its high fragmentation, with the presence of both global players and local manufacturers. Some notable global players in the market include Duravit (Germany), Geberit (Switzerland) - Europe's market leader in sanitary products, Toto (Japan) - a high-tech toilet manufacturer, and Grohe (Germany), which was acquired by Lixil Group (Japan).

It is worth mentioning that Geberit's acquisition of Sanitec in 2015, Finnish maker of toilets and bathroom ceramics, allowed them to expand their product portfolio to include bathroom ceramics and solidified their position as the European market leader for sanitary products. Additionally, the acquisitions of Grohe by Lixil in 2014 and Masco Corporation with a major stake of 68% in Hansgrohe underscore the trend favouring the creation of complete product portfolios in the bathroom & wellness segment. This strategy aims to provide customers with a comprehensive range of offerings from a single source. As a result, larger players are emerging in the market, intensifying competition and putting pressure on Villeroy & Boch to maintain its market share.

In summary, Villeroy & Boch operates in a highly competitive and fragmented industry, facing challenges such as high raw material costs and a slow construction economy in Europe, especially in Germany, it’s key market.

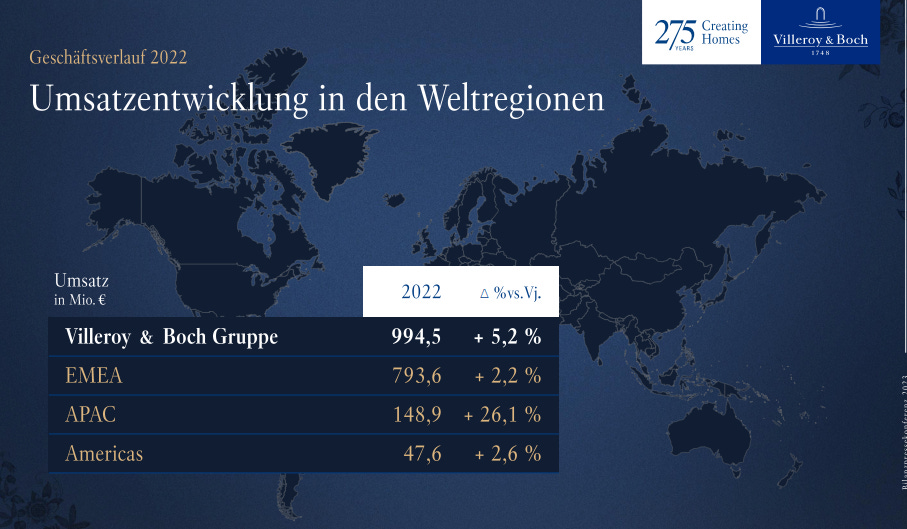

Financials & Key Figures

As of Dec 2022, despite the challenging environment in the construction industry with rising interest rates and cooling of the construction activity in EU in particular, as well as the high inflation which put pressure on consumer spending, Villeroy & Boch managed to increase the consolidated group revenue by €49,5 million. (5,2% YoY) to €994,5 million. The operating EBIT saw an increase of 5.8% to €98.2 million, and net income increased by 18.2% to €71.5 million (€60.5 million in 2021). The higher growth compared to the EBIT was due to an improved net finance cost and a lower tax rate in 2022.

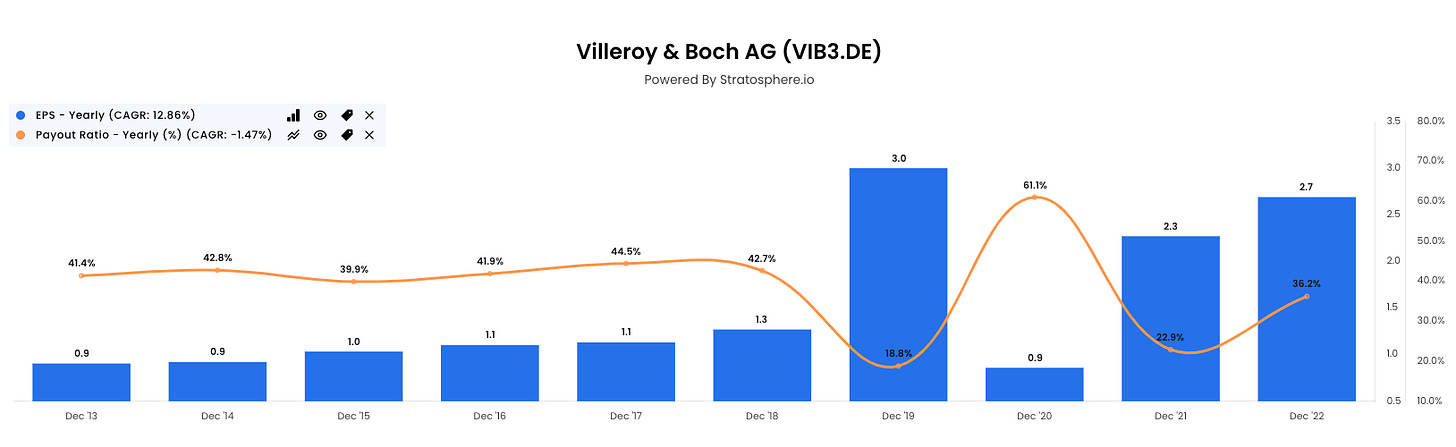

One thing to note here is that in 2019, the income doubled from 2018 to €80 million due to a one time, non-recurring property sale in Luxembourg as stated in the annual report in 2019.

Overall, we even achieved a record result, primarily thanks to the sale of our property in Luxembourg, which generated non-recurring income of €87.7 million.

Despite the unpredictable events in 2020, largely defined by the COVID-19 pandemic that led to the temporary closure of several shops and plants, Villeroy & Boch managed to perform well towards the end of the year 2020. After facing significant challenges in the first half of the year, the company closed 2020 with only a 3.9% decline in revenue compared to the pre-pandemic year of 2019.

In terms of margins, the company maintained their gross margin above 40% over the last 10 years with 42.8% in 2022, a slight decrease of 1.6% compared to 2021. This was mainly due to multi-tier distribution in the sanitary industry where adjustments to selling prices can only be implemented with a time lag. As a result, the higher raw material and energy prices in 2022 have not been fully compensated.

The earnings per share showed a positive trend over the last 10-years with a CAGR of 11% yielding in € 2.69 € for ordinary shares, up from €2.27 in 2021. Similarly, non-voting preference shares saw an increase in earnings to €2.72 per share in comparison to €2.30 in the previous year.

The positive trend in earnings per share, allowed the company to maintain its attractive dividend distribution, with an average payout ratio around 40% over the past 10 years. In 2022, the company increased the dividend by 25 cents to €1.20 for preference shares, resulting in a total dividend payout of €33.0 million. With the company holding an unchanged 12% of preference shares at the payment date, the total cash outflow for dividends was around €31.1 million.

Revenue by Segment

Villeroy & Boch’s business are categorised in two segments, Bathroom & Wellness which accounts for two-third of the business, and Dinning & Lifestyle.

Both segments have equally provided to the overall revenue growth in 2022 of around 5%. Among the business areas within the Bathroom & Wellness segment, the wellness business experienced a decline in revenue by 6.4% (€5.2 million). This decline was primarily driven by the suspension of business activities in Russia and the impact of the energy crisis in Europe, which resulted in a downturn in the market for outdoor hot tubs.

In the Dinning & Lifestyle business, revenue growth was evident in almost all areas except for e-commerce, where there was a decline of €12.7 million compared to 2021. However, during the Covid pandemic years, the company successfully accelerated its e-commerce business for the dinning & lifestyle segment and managed to double the revenue from 2019 to 2021, surpassing €100 million in revenue.

Despite the e-commerce hype cooling off in 2022, the business still maintains a significantly higher level than the pre-pandemic period, accounting for around for 30% of total revenue in the Tableware Division and remains a key focus area for further growth, as emphasized in the last annual report of 2022.

Although this means our sales channels are now slightly more balanced again, e-commerce revenue remains well above the pre-pandemic level of 2019 and will remain a key driver of our business in future. After all, digital transformation is a central aspect of our efforts to reach consumers and inspire them wherever they are. We now create around 450 posts of social media content every month so that users can experience our diverse product range across different platforms.

Geographical Distribution

The company primarily operates in two key regions, EMEA and APAC, and has witnessed positive growth across key regions in 2022.

The revenue in the biggest region EMEA increased by 2.2%, where Germany remains as the the biggest market by accounting for almost one third of the total revenue with €287.5 million. Strong revenue growth has ben recorded in Southern Europe by 18% and Easter Europe by 8,6%. The biggest decline in growth was recorded in Russia 47% due to the ongoing war and in Northern Europe by 8,6% mainly impacted by economic development and exchange rate developments.

Overseas showed double-digit revenue growth of 19.4%, where APAC countries makes 15% of the total revenue. In particular, China showed a strong growth of 31.8% accounting alone for €96.4 million of the total revenue.

Operating Efficiency & Profitability

Reviewing Villeroy & Boch’s cost efficiency, one thing that stand out is that Sales & Marketing expenses over the last 10 years, increased from €297.3 million in 2013 to €323.5 million in 2022, at a GAGR (10y) of only 0.68% despite facing of inflation-driven cost increases in the last few years.

To ensure their competition position and earnings which last for 275 years, Villeroy & Boch continuously invests in research and development (R&D) of ceramic materials, new products and upgrade of machineries. In 2022, the R&D investments including design developments accounted for 2% of the consolidated revenue.

In terms of profitability, the return on invested capital (ROIC) rose to 14.9% at the end of 2022 (compared to 13.39% in the previous year). Given the competitive environment of the sanitary ware business, the consist growth of ROIC at a ten-year CAGR of 7.4%, indicates the ability of the management to generate profitable returns on the capital invested in the business.

Liquidity & Debt Structure

In terms financial leverage, the company operates at comfortable levels, with a low debt profile and following non-current liabilities at the end of 2022

Long-term financial liabilities amounting to €75.0 million (previous year: €85.0 million)

Two loans of €25.0 million each, maturing in 2024

One loan of €25.0 million, maturing in 2025

Short-term financial liabilities total €10.4 million (previous year: €25.3 million) and include a bank loan of €10.0 million, due in January 2023.

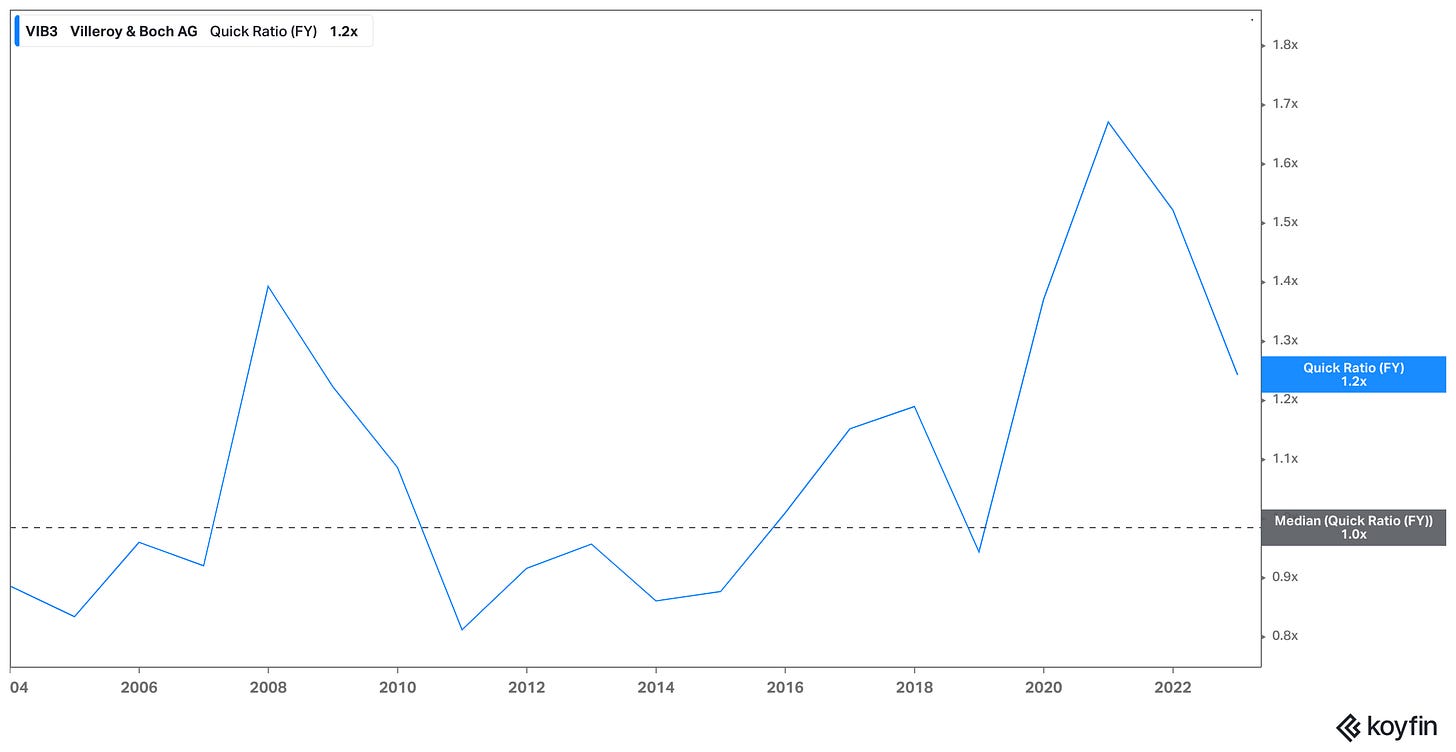

Considering the reported substantial amount of cash and short term investments totalling €262.5 million as of December 2022, which makes 25% of todays market capitalisation, results in a solid net liquidity of over €130 million, maintained well over the the last 5 years indicating improved debt management and reduced financial risk. Additionally, unutilized credit facilities of €237.8 million were available for the company's operational activities which makes the company well equipped for the future.

With a Quick Ratio of 1.2, which solely considers highly liquid assets like cash and short-term investments in comparison to short-term liabilities, Villeroy & Boch maintains a comfortable liquidity position, indicating a sufficient degree of liquidity.

Moreover, the interest coverage ratio, EBIT-to-Interest Expense, provides further support for the company's effective debt management. At the end of 2022, the ratio of 15.7x signifies that the company faces no immediate liquidity issues and also reflects a stable financial standing, making the company an attractive prospect for lenders, as the risk of default is notably low.

The equity ratio showed a significant improvement as well, reaching 38.0% compared to 31.9% in 2021, underlying a strong presence of equity within the capital structure. It's essential to consider that besides the noteworthy net income of €71.5 million contributing to this increase, there were certain accounting effects influencing the valuation of specific items on the financial statements. In particular, the impact of higher interest rates resulted in a €28.7 million increase in the valuation of the company's pension obligations. Despite accounting for these effects and removing their influence, the equity to debt ratio remains around 35%. This figure underscores the company's firm financial standing, as it reflects a healthy balance between equity and debt financing.

Free Cash Flow and CAPEX

Free Cashflow for the company experienced a significant decline of 60% to €17.4 million compared to the previous year. This decrease was primarily attributed to lower operating cash flow, which was impacted by negative effects from changes in net working capital, similar to the trends observed in 2021.

The increase in net working capital was a major factor influencing the Free Cashflow, driven by a substantial rise in inventories amounting to €49 million across both the Dinning & Lifestyle and Bathroom & Wellness segments. The company explained in its latest annual reports that this inventory buildup was necessary to address potential supply shortages and cope with higher input prices, reflecting market and supply chain challenges. Unforeseen events, such as further intensification of geopolitical tensions, could disrupt the smooth flow of goods and raw materials and needs to be closely monitored in the coming months.

In the 2022 financial year, the company's capital expenditure amounted to €36.7 million, which is slightly higher than the previous year's €32.8 million. Approximately two-thirds of the investments were allocated to the Bathroom & Wellness segment, primarily for modernization and automation of production. The remaining one-third was invested in the Dinning & Lifestyle segment, with a focus on optimizing and expanding the retail network, including renovating existing stores and opening new ones. Despite the increase in capital expenditure, it remained relatively low compared to revenue and was maintained at a similar level as the previous year.

Upon further examination of the growth Capex, which includes net capital expenditure (the difference between capital expenditures and depreciation), acquisitions, and R&D, it makes a modest 3% of revenues, indicating that the company is not prioritising aggressive growth strategies and focusing on maintaining stable operations and generating cash flow which can be used for further debt repayment or dividends.

Shareholders

As of December 2022, the total shares outstanding for Villeroy & Boch were 26.5 million, and the company offers only preferred shares to individual investors. The ordinary shares, on the other hand, are exclusively held by the founding families. Villeroy & Boch itself owns 11.59% of the total preferred shares, and the free float accounts for 44.21% of the total shares.

Outlook

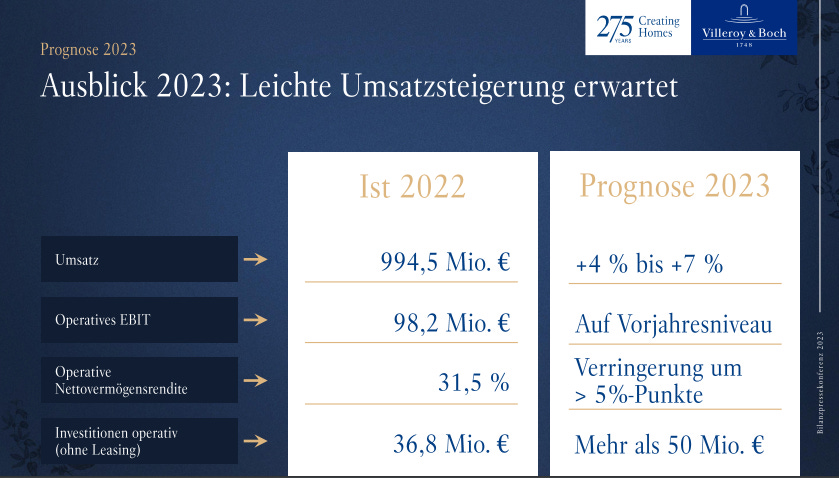

The outlook for the construction industry in 2023 is uncertain, given the overall economic situation and factors like supply shortages, raw material scarcity, and rising energy costs. Geopolitical tensions further contribute to the industry's uncertainties and impact the overall economy. However, there is some positive outlook as economic research institutes predict a minimal decline in real GDP for the new year, with improving in energy prices. Concerning the current economical developments and the ongoing geopolitical uncertainty, the management expects consolidated revenue to grow between +4 and +7% and EBIT to be at the same level as of end of 2022.

Valuation

Villeroy & Boch is trading on Price-to-Earnings (P/E) of 8x and Enterprise Value (EV)-to-EBITDA of 3x, at historical low valuations compared to the 10-year average P/E of 13.3x and EV/EBITDA of 5.6x

The fair value of Villeroy & Boch is calculated using a 10-year exit based model that backs out equity from an EV/EBITDA multiple along with following assumption

CAPEX and R&D spending are maintained at their current levels, 3-4% and 2% of sales, respectively.

EBITDA growth rate of 10%, lower than the ten-years CAGR of 11.8%

Zero Dividend growth which is quite bearish considering Villeroy & Boch’s dividend CAGR of 11% over the last ten years, and a dividend track record spanning more than 30 years

exit EV/EBITDA multiple of 3x, significantly lower than the average of 5.6x over the last ten years

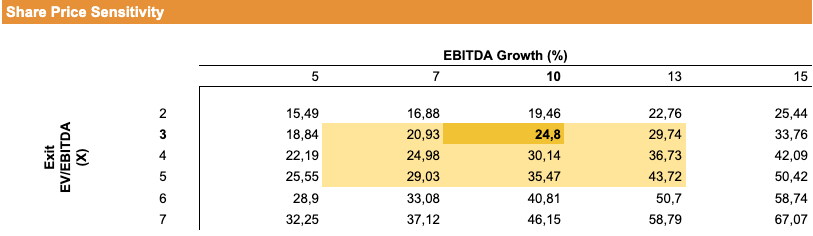

Taking into account the very conservative assumptions of EBITDA growth, zero dividend growth, and a lower EV/EBITDA ratio compared to historical averages, the calculated fair value of €24,80 per share represents an upside of 34%.

The following price sensitivity analysis shows the valuation sensitivity to the EBITDA growth and EV/EBITDA multiple assumptions.

Final Thoughts

Amid the turbulence of recent years and the cooling down of the economy, particularly in Europe, I firmly believe that the demand for sanitary ware and luxury tableware products remains timeless. As the economic winds subside, geopolitical tensions clears off, Villeroy & Boch, with its impressive 275-year track record and commitment to continuous innovation, will continue to play a crucial role in the market with its innovative and high-end product portfolio. Additionally, the rising middle class, especially in regions like India and Southeast Asia, presents further growth potential for luxury, high-quality products, opening up new opportunities for the company.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference:

Company Website for Investor Relations

https://www.villeroyboch-group.com/en/investor-relations/shares.htmlAnnual Report 2022

News on Villeroy & Boch’s Property Sale

https://www.luxtimes.lu/luxembourg/villeroy-boch-sells-site-to-make-room-for-urban-development/1321492.htmlMarket Research on Ceramic Sanitary Ware https://www.fortunebusinessinsights.com/ceramic-sanitary-ware-market-106587

Summary of Euroconstruct summer conference 2023

https://www.baulinks.de/webplugin/2023/0772.php4

I feel its quite unclear why they can sustain past 10 year EBITDA growth, what are the biggest growth prospects, the TAM and by which channel?