AI meets Finance and Investing | Intro

Exploring how latest developments in LLMs and NLP are revolutionizing the world of finance and investing

The world of finance is rapidly evolving, and so is the data that drives it. Every minute, new information becomes available about companies and industries, offering valuable insights for investors. While this abundance of data presents significant opportunities, it also poses a challenge: the sheer volume can be overwhelming, making it difficult for investors to efficiently process and analyze everything manually, particularly when dealing with alternative data, which often requires additional handling to derive meaningful insights from it.

What exactly is Alternative Data?

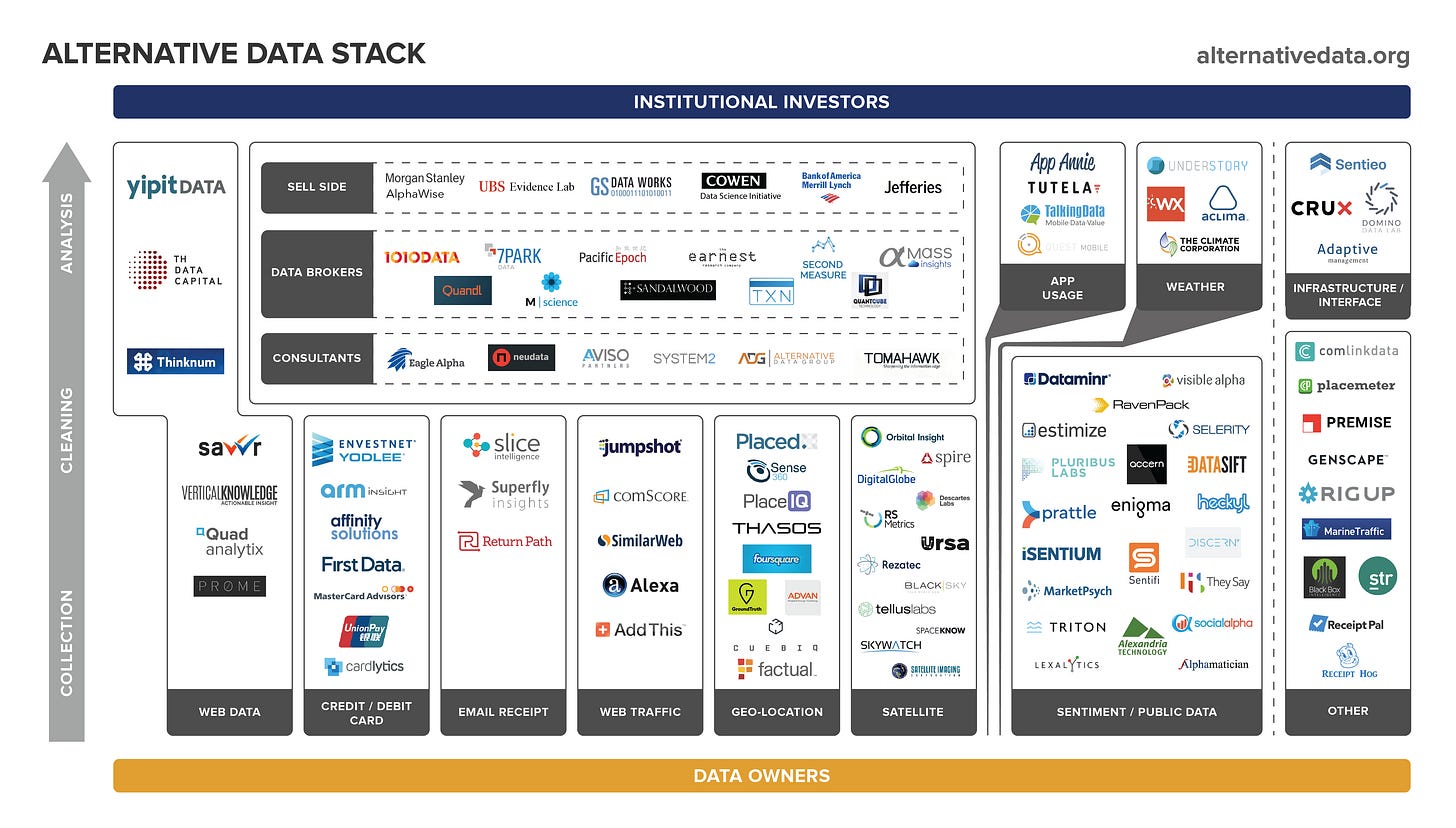

Unlike structured (numerical) data, which is highly organized and easily searchable, alternative data is mostly unstructured and refers to non-traditional data sources, which means it comes in raw formats that aren't readily processable. Interestingly, 80-90% of all new data falls into this category, encompassing text, images, and voice formats. Sources of this data include web data, search engines, social media posts, credit card transactions, satellite images, and more.

In the financial world, far beyond traditional metrics and ratios, alternative data comes from various sources like

Annual and quarterly reports, and other statements and disclosures

Earnings call transcripts, press releases, and other company presentations

Analyst reports, fund manager investment management letters

News, including Wall Street Journal, YahooFinance, Financial Times, Barron’s

Social media, including Reddit, Twitter and blog posts

Using alternative data offers deeper insights into market dynamics and consumer behavior, enabling investors to predict trends and forecast revenue growth and earnings. However, it requires advanced tool chains to process the vast amount of mostly unstructured textual data for effective insights extraction and analysis. This is where AI and software come into play.

How can AI help?

Recent advances in AI are empowering investors worldwide to process vast and ever-increasing amounts of new data sources and types. By extracting meaningful insights and incorporating them into investment decisions, investors can gain a significant informational advantage.

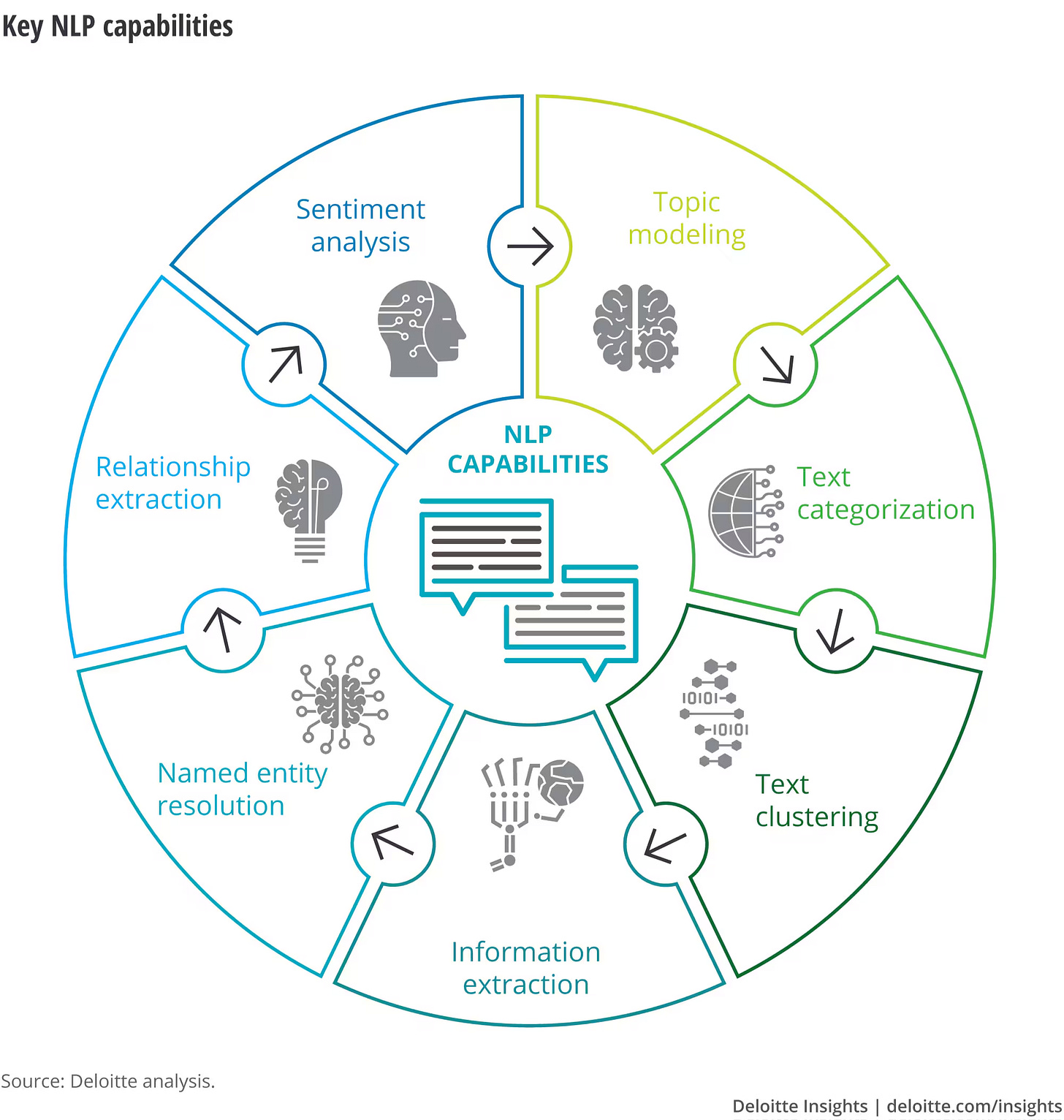

For example, natural language processing (NLP) enables machines to interpret and analyze human language, helping investors summarize and extract key insights from large volumes of textual data, such as earnings call transcripts and securities filings. Another application of NLP, known as sentiment analysis, extracts information from news headlines or social media posts and determines the polarity (positive, negative, neutral) towards a specific stock to predict price movements.

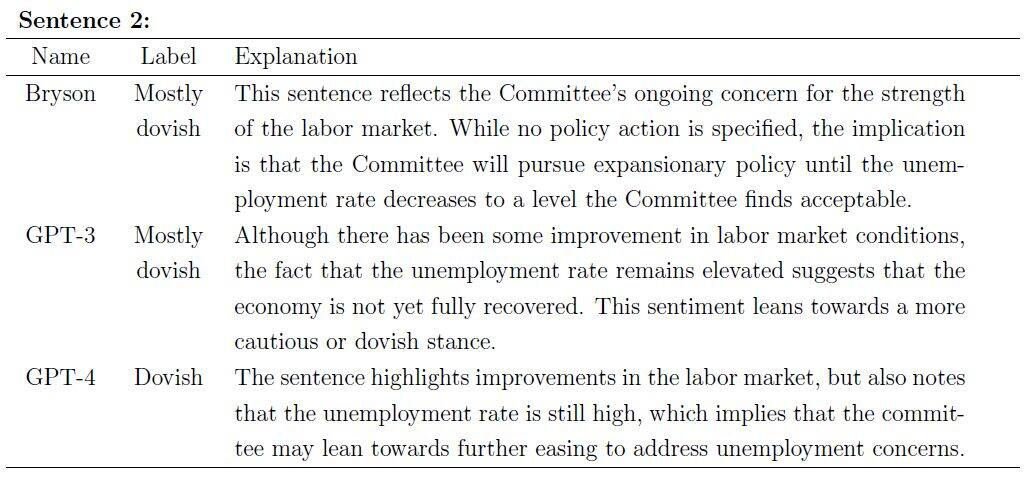

With the recent introduction of large language models (LLM) such as ChatGPT, sentiment analysis performed on textual data has become even more sophisticated, in terms of parsing nuance and context. As demonstrated by two researchers from the Federal Reserve in their academic paper titled "Can ChatGPT Decipher Fedspeak?", ChatGPT could not only classify policy statements as dovish, but also explain the reasoning behind its classifications.

Harnessing the latest advancements in AI alongside the expanding sources of alternative data could offer supplementary insights that complement the information investors obtain from traditional sources, like identifying trends and patterns, and enabling a more comprehensive understanding of the company and market environment.

What to expect

Starting from next week, over the upcoming months, I’m planning to explore the intersection of finance, economics, and AI to enhance investment strategies and share actionable insights that enable investors to gain a competitive edge by going beyond traditional financial data sources.

You can expect to

Discover alternative data sources beyond traditional financial data

Explore how technologies such as NLP and LLM are being applied in finance and investing by learning about real-world use cases

Get the code snippets to replicate alternative data analysis workflows and enhance your own investment research and process

As mentioned in the latest Friday Roundup, the agenda is not set in stone, allowing for topics and use cases based on feedback from my subscribers and community. So, please feel free to share your ideas to be featured in one of the upcoming posts.

In the next part of this series, inspired by the Man Group's article on "Alternative Data as a Leading Indicator for Banking Crises", I'll start with building a similar alternative data analysis pipeline, including

Mainstream Media

Social Media

Insider Transactions

Online Searches

Network Analysis

This series of posts is free and designed for both professional and retail investors seeking real-world AI use cases to enhance their research and investment process through alternative financial data sources. It's also important to note that these posts are not a step-by-step coding guide or an in-depth academic exploration of AI models like LLMs.

So, if you want to understand how the AI revolution in finance and investing is being developed, subscribe now 👇

I'm excited to start this journey and share my experiences with you about the latest technologies and tools that are already changing the investment world.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Future Reading

ChatGPT can decode Fed speak, predict stock moves from headlines https://www.moneycontrol.com/news/world/chatgpt-can-decode-fed-speak-predict-stock-moves-from-headlines-10430131.html

Using AI to unleash the power of unstructured government data https://www2.deloitte.com/us/en/insights/focus/cognitive-technologies/natural-language-processing-examples-in-government-data.html

Making the investment decision process more naturally intelligent https://www2.deloitte.com/us/en/insights/industry/financial-services/natural-language-processing-investment-management.html

Future in the balance? How countries are pursuing an AI advantage https://www2.deloitte.com/uk/en/insights/focus/cognitive-technologies/ai-investment-by-country.html