Mensch und Maschine Software SE (Ticker: MUM): Another Hidden Champion from Germany

A consistent and fast growing business with a highly profitable software segment, a robust balance sheet, and a founder with significant 'Skin in the Game'

Summary

Consistent Growth: Steady growth in revenue and EPS with 10y-CAGR’s of 10% and 27%, respectively; DPS growth with a 5y-CAGR of 17.55%

High Capital Efficiency: Growing operating profit margins with 14% in FY2022, and average 5y-ROIC of around 19% underscores managements ability in capital allocation

Strong Balance Sheet and FCF: Low debt and high interest coverage ratio of 98x in FY22; High cash flow generation with FCF growth of 5y-CAGR of 30%

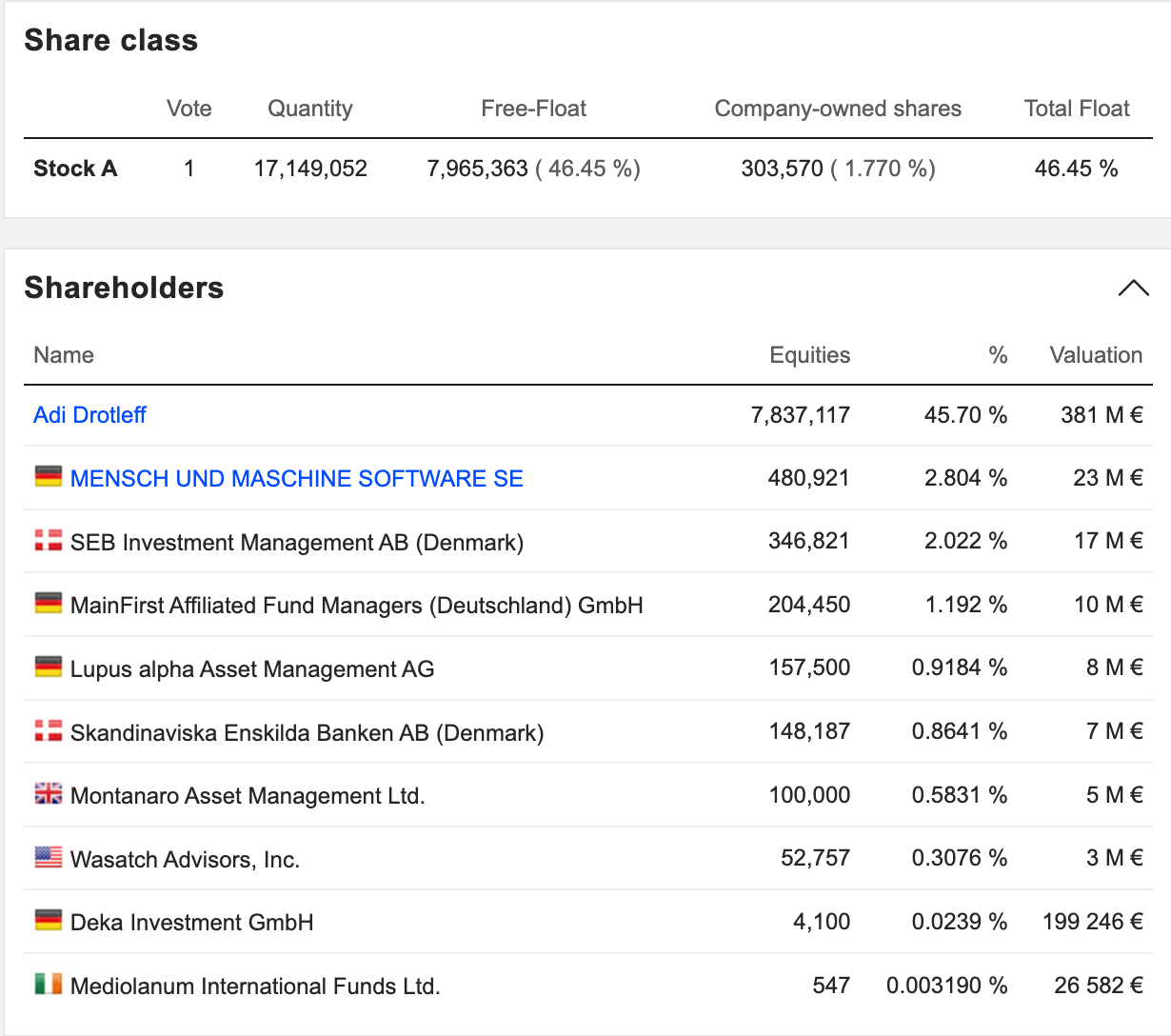

Stable Shareholder Structure: More than 50% of shares in management hands while founder Adi Drotleff still owns 45.7% of the outstanding shares

Valuation: Historical & relative valuation indicates that the stock is undervalued at today’s price levels

Geopolitical Tensions and Fear of Recession: Geopolitical tensions and macroeconomic situation in M+M’s main market Europe, Germany in particular, present short-term headwinds

Introduction of Mensch und Maschine Software SE

Mensch und Maschine Software SE (M+M or the company), founded in 1984 and headquartered in Wessling, Germany, is a publicly traded company listed on both the Frankfurt and Munich stock exchanges. The company has established itself as a leading global provider of engineering software solutions, inducing

Computer-Aided Design (CAD): Essential for creating detailed 2D and 3D models, CAD provides the groundwork for precise technical drawings and product modeling

Computer-Aided Engineering (CAE): CAE is integral for simulating and analyzing engineering tasks, enabling the digital validation and enhancement of designs, including techniques like finite element analysis (FEA) and computational fluid dynamics (CFD)

Computer-Aided Manufacturing (CAM): CAM software translates digital designs into exact manufacturing instructions, crucial for production process automation

Product Data Management (PDM): PDM tools centralize control over design data and engineering processes

Product Lifecycle Management (PLM): PLM systems manage the full product lifespan, harmonizing data, processes, and systems to enhance development efficiency

Building Information Modelling (BIM): BIM facilitates real-time collaborative work on unified models, incorporating complex data to improve efficiency and coordination in construction projects.

The ongoing digitization in the industrial and construction sectors is fueling the growing demand for M+M's comprehensive suite of software solutions, positioning M+M as one of the many beneficiaries in the industry.

Products and Services

Up until 2009, M+M functioned primarily as a distributor of engineering software, which transitioned its business model from low-margin software distribution of the American CAD pioneer Autodesk, to become a value added reseller (VAR) and maker of proprietary software products.

With this positioning, the company addresses attractive markets in which it is one of the leading providers today, with an impressive installed base of over 100,000 CAD/CAM/PDM/BIM seats. They serve over 30,000 end customer sites which spans from small architectural firms to large international enterprises as a dedicated B2B service provider.

Since 2012, M+M's business model has been based on and grouped into two reportable segments: proprietary software and the VAR business.

M+M Software

Within its Software segment, M+M stands out primarily due to the technological superiority of its products, which allows the company to secure a position in the market's high-price tier and maintain the operations of a traditional software business with high margins. The cornerstone of its robust proprietary software business was established around the turn of the millennium when M+M made several strategic acquisitions of prominent engineering software firms. Some of the key acquisitions, still integral to M+M's portfolio, are highlighted below:

Open Mind (CAD/CAM-Software):

was acquired in 2002 and since then has assumed a leading position in the CAM market with presence in main Asian, European and American markets

With over 10,000 clients, Open Mind’s software solutions are used predominantly for milling, drilling, and turning processes across sectors like mechanical engineering, aerospace, and automotive

While the majority of the CAD/CAE/PDM/BIM revenues are generated in the mid-price range, M+M's proprietary CAM software, hyperMILL, are positioned in the upper price segment with an average revenue of approx. €30k per seat

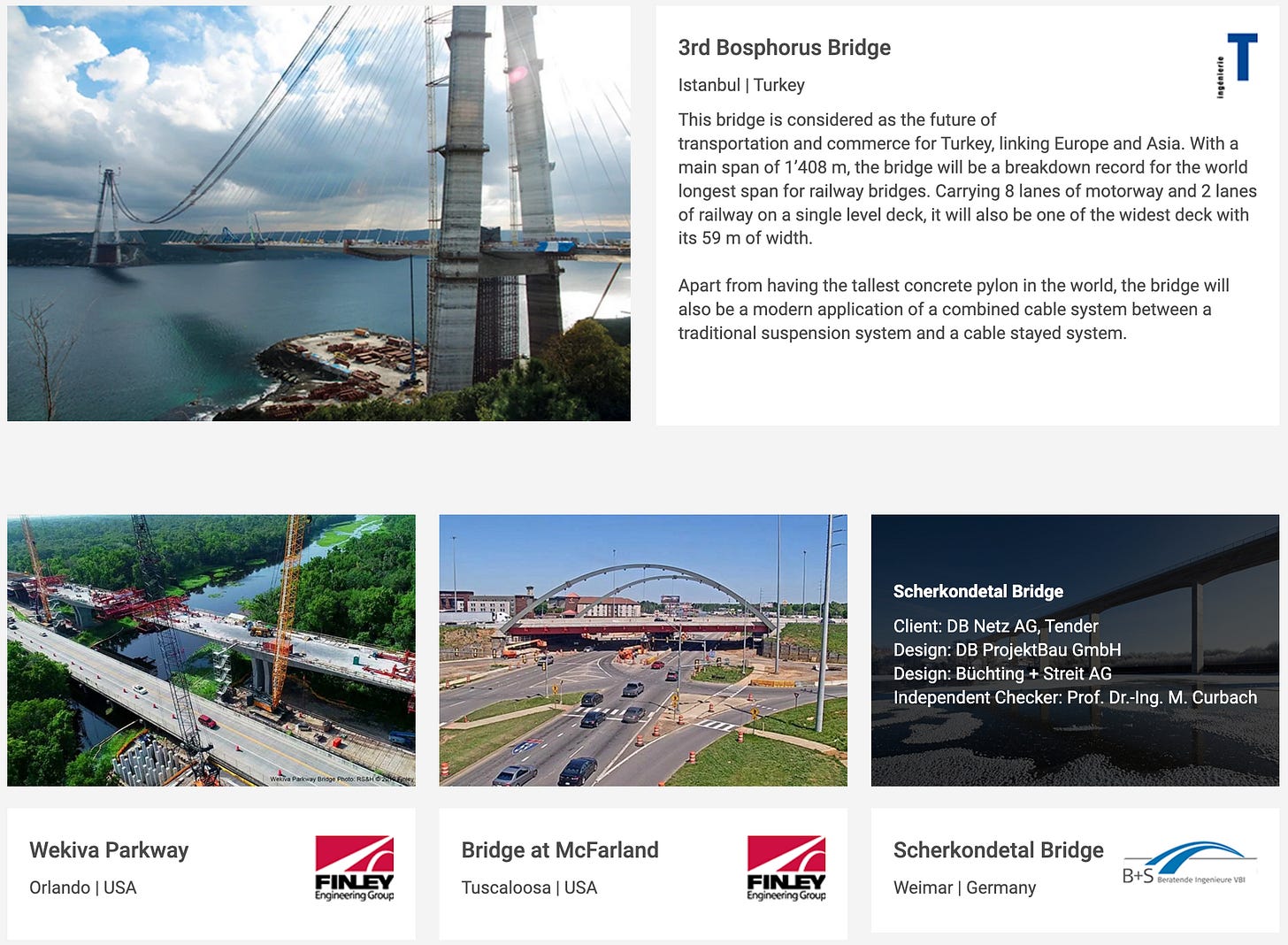

SOFiSTiK (CAD/CAE/BIM-Software)

Initially acquired a 13.1% stake in 2000, later increased its stake to 51% at the beginning of 2019, SOFiSTiK claims to be Europe's leading software producer for the calculation, design and construction of building projects, with a particular focus on bridge and tunnel construction serving over 2,000 customers worldwide

Notable, International bridge projects include the Bosporus Bridge in Istanbul (Turkey), Sixth Street Viaduct, also known as the Sixth Street Bridge, in Los Angeles(US) and many others.

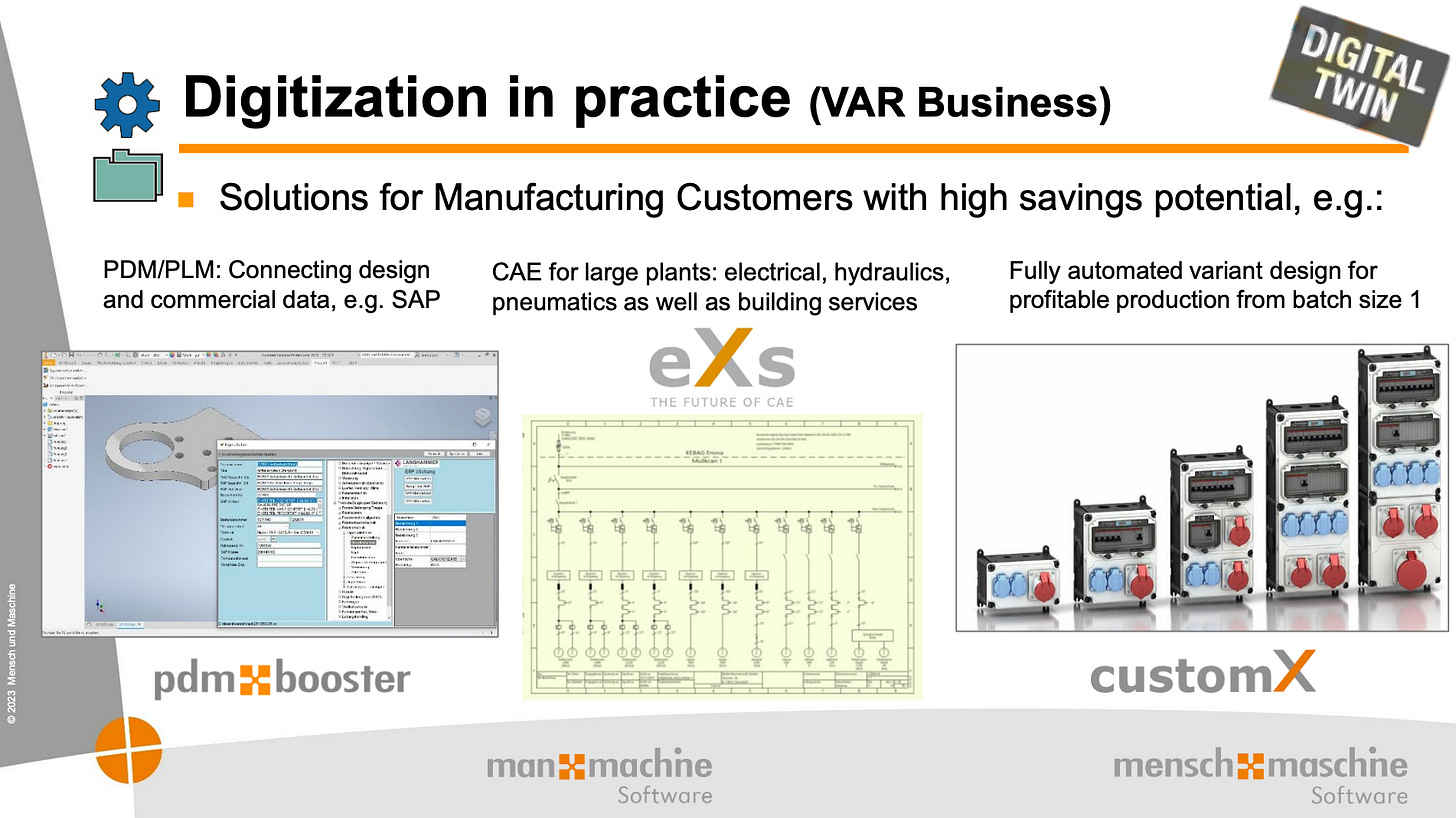

VAR Business

With a partnership spanning almost 40 years, M+M has become Autodesk's largest VAR in Europe and boasts a consolidated market position, serving approximately 20,000 customers of various sizes across diverse sectors, including Industry, AEC, and Infrastructure. The company has a broad geographical presence. Today, it stands as the primary revenue contributor, accounting for about three-quarters of the total group revenues.

Furthermore, contribution to the Systemhaus segment isn't solely based on the trade margins from standard software. It also includes proprietary services such as installation, configuration, maintenance and training courses, as well as M+M's own products, developed based on the standard CAD software, such as customX and bim booster.

With bim ready, another in-house developed software solution, M+M offers BIM training for all stakeholders involved in construction projects. Since 2012, they have already trained more than 12,000 professionals.

Management

According to the announcement at the end of 2022, founder and former CEO Adi Drotleff, who has largely withdrawn from daily business over the years, switched to active Chairman of the Supervisory Board.

"However, I will remain in the entrepreneurial role with my M+M as anchor shareholder with more than 45% shareholding and continue to contribute to the continuation of our success story as Chairman of the Administrative Board as well as - with halved remuneration - Managing Director for Strategy and Group Communications."

He handed over the operational management of the group completely to CFO Markus Pech and the experienced and well-established top management team.

The management team boasts extensive experience, with several members having been with the company for many years. They demonstrate deep expertise in the engineering software field, and some have been with M+M since its early days. Rainer Sailer, another member of the management board, has been in the industry for a long time and is well-known in Germany as an early expert in BIM.

The total remuneration for the Managing Directors in FY22 was EUR 1,085 thousand, composed of 39.2% fixed salary, 55.3% performance-based variable pay, and 5.5% in non-salary cash components. This remuneration structure, which constituted only 0.6% of the company's gross profit, falls within a reasonable range, reflecting a balanced compensation approach that aligns with the company's financial health and performance incentives.

Industry & Business Environment

With its focus on IT services and software, Mensch und Maschine operates in markets with above-average growth dynamics. As mentioned in my latest analysis of Reply (Ticker: REY), according to Gartner’s July 2023 forecasts, worldwide IT spending is projected to reach a total of USD 4.7 trillion in 2023, representing an increase of 4.3% from 2022, and is expected to rise further by 8.8% in 2024, reaching USD 5.1 trillion.

Source: Gartner

While the overall outlook for IT enterprise spending is positive, IT Software and Services are expected to grow even more rapidly than the overall IT market in 2023 and the subsequent year, reaching approximately USD 1 trillion and USD 1.5 trillion, respectively, collectively accounting for around half of the total IT spending.

While it's challenging to gather specific market data on individual segments of the engineering software space due to many companies operating in the CAD/CAM market as part of a broader PLM offering, a recent report on the global simulation software market by Precedence Research reveals that the global simulation software market was valued at USD 14.8 billion in 2021 and is projected to exceed USD 40.5 billion by 2030.

As digitization continues to propel the CAD/CAM market forward, BIM serves as additional promising market and growth driver. Meanwhile, Cambashi's latest report on the BIM Software Market forecasts the market to reach USD 30.7 billion by 2027. The primary growth factors include government policies endorsing BIM, rapid urbanization, and the ongoing digitalization trend within the construction industry. With its expertise in BIM, M+M’s SOFiSTiK subsidiary is well-positioned to address these promising market.

Competition & Peers

The competitive landscape of the industry is extensive, with well-known industry players Autodesk and Dassault Systèmes leading the way, followed by Siemens and its subsidiary Siemens Digital Industries Software. Furthermore, Nemetschek, a German company specializing in engineering software for architecture and construction, presents significant competition to M+M, while being nearly ten times larger in terms of market cap

Although advanced computing power has become more accessible and affordable, lowering the barriers for new companies, the market is still mostly made up of firms, both large and small, that started decades ago, mostly around 1980s when significant rise in the accessibility and capability of personal computers. The release of IBM’s first personal computer in 1981, followed by other affordable models from various manufacturers, brought computing power to a broader audience, including small and medium-sized businesses. There have been hardly any significant new competitors in recent years, which shows the strong market position of the established players.

Financials & Key Figures

All graphs and financial data will reference FY2022 to demonstrate the company's performance over recent years and to identify trends, as quarterly figures exhibit high variability. When necessary for further context, the most recent numbers will incorporated.

M+M’s economic moat is also visible by looking at key financial metrics. The company showed robust revenue CAGR of 14% over the past five years and reached EUR 320,5 million in FY22 (PY: 266.2 / +20.4%), while operating profit grew at a CAGR of 21% and increased to EUR 42.6 million. Over the same period, operating margins climbed from 10.6% in 2015 to 13.3%.

After deduction of finance costs and taxes, net earnings came in at EUR 26 million (PY: 21.3 / +22.1%) or EUR 1.6 per share. With an CAGR of 21% over the past five years, the earnings per share (EPS) have more than doubled which allowed the company to increase it’s dividend per share (DPS) to €1.4 per share (PY: 1.2 / +23%) in FY22 with an average payout ratio around 90% over the past 5 years.

In terms of business segments, the VAR business reported EUR 233.2 million (PY: 182 / +23%), continued to represent the main source of sales accounting for two-third of total revenues.

M+M's software business has seen significant growth over recent years, reaching EUR 97.3 million (PY: 84.2 / +16%), accounting for a third of the total revenues.

M+M has successfully combined this growth with a disproportionately low increase in operating costs over the past years, which, in turn, has led to high profit. More importantly, while the M+M segment accounts for a third of the total revenues, the operating profit, amounting to EUR 25.1 million (PY: 21.4 / 18%), represented approx. 58.9% of the group's operating profit in FY22.

After the final sale of the Autodesk distribution business, which was closed in 2011, and the successful transition to the VAR business, both segments have seen an improvement in profitability over the last decade. The most notable gains were in the Software segment, where operating margins have expanded significantly, rising from 15.6% in 2008 to 25.8% in 2022 and become the primary contributor to the group's profitability. This is more than triple the VAR segment's operating profit margin, which was reported at 7.9% in FY22.

Geographically, Europe is the primary market for M+M, contributing over 90% to the group's revenues, with Germany leading at 41%, followed by Austria and Switzerland. Though the company has a presence in Asia and North America, revenues from global customers constituted only 8.3% of sales in FY22, presenting a significant opportunity for further expansion.

The company has not only show strong revenue and earnings growth over the past 5 years. During this time period, it also became more operationally efficient, with an average impressive return on invested capital (ROIC) of 24.9% and a 41.2% return on capital employed (ROCE).

M+M's impressive ROIC and ROCE highlights the management's ability to allocate the company's resources efficiently and maintain a disciplined approach to capital management. This has led to significant value creation for shareholders over the last 5 years, as evidenced by the company's robust share price performance and growth in dividend per share (DPS), with a CAGR of 13% and 17.55%, respectively

Free Cash Flow and CAPEX

On the cash flow side, the company managed it’s upward trend and generated EUR 53.2 million in operating cash flow (OCF) in FY22 which grew at an impressive 5y-CAGR of 30%.

M+M operates a capital-light business model, which requires minimal ongoing investment to maintain, replace, or upgrade productive assets. This is reflected in the low and stable CAPEX, amounting to approx. 2% of sales. After deducting outflows for investing and financing activities, the free cash flow has continued to grow, reaching EUR 33 million in FY22 — almost triple the amount from 2018. This demonstrates the company's commitment to financial stability and the long-term sustainability of the business model.

It's important to highlight that the company's total dividend payout of EUR 20.1 million in, corresponds to 59% of its free cash flow, indicating potential for further increases or sufficient liquidity for additional acquisitions.

Liquidity & Debt Structure

As of FY22, the company held EUR 24.4 million in cash and equivalents, while having a total debt of EUR 37.9 million. This resulted in a net debt position of EUR 13.5 million, an increase from EUR 3.5 million the previous year.

In the past 5 years, the interest coverage ratio of M+M, calculated by dividing earnings before interest and taxes (EBIT) by the total amount of interest expense on all of the company's outstanding debts, improved significantly from 32x in 2018 to 98x in 2022 and highlights the financial health and well-being of the business.

Looking at M+M's liquidity ratios, the Current Ratio has remained above 1.0x over the past 5 years. This suggests that the company isn't facing any immediate liquidity issues. However, it's not as secure as preferred; a ratio of at least 1.5x or ideally 2.0x would assure that the company can comfortably meet its short-term obligations while retaining a surplus of assets.

Shareholders

Having “Skin in the Game” by the founder/management makes an investment more appealing, especially in micro and small caps. In the case of M+M, CEO and founder Adi Drotleff still owns 45.7% of the shares. Other company management own a further 6% and the company holds 2.8% as treasury shares, leaving a free float of 46.45%.

Over the past five years, the number of outstanding shares has remained relatively flat, while M+M has spent around EUR 15.7 million to repurchase its own shares.

Despite being the largest shareholder in the company, Adi Drotleff, the founder, has recently increased his stake in M+M, showcasing his continued confidence in the company.

Additionally, several members of the Supervisory Board have also acquired shares of M+M which demonstrates a clear commitment and "Skin in the Game" from the company's leadership.

M+M’s 3Q203 Update: Strong Performance and Positive Outlook

During the the most recent quarter, Q3 2023, the company reported strongest 9M result in company’s history. The record-breaking Q1 was driven by high reselling business, with the proprietary M+M business taking the lead in Q2 and Q3.

Key Highlights:

Revenue in the last nine-month was EUR 242.21 million (PY: 228.25 / +6.1%)

Operating profit EBIT was increased to EUR 34.41 million (PY: 30.34 / +13%)

EBIT margin rose to 14.2% (PY: 13.3%)

Operating cash flows was up +41% to EUR 48.61 million (PY: 34.44) or 290 Cents/share (PY: 205)

The company's outlook for 2024 remains positive, with projected EPS growth of 14% to 20% and an anticipated dividend increase of 15 to 25 cents. Furthermore, the goal of doubling earnings by 2026/27 to more than EUR 3.00 per share has been reaffirmed.

Overall, the company demonstrates strong operational performance, marked by a consistent track record of revenue and earnings growth. This performance is underpinned by a robust balance sheet, high capital efficiency, and substantial cash flow generation.

Bull and Bear Investment Case

Bull Case:

High Switching Costs and Strong Moat: Existing customers trained on M+M’s solutions will be reluctant to switch to alternatives due to familiarity with the product as well as the financial cost of deploying and training on a new software. This is especially true for those using multiple solutions such as CAD/CAM or PLM and BIM, making it challenging to switch without significant productivity losses.

Growth Potential and Market Position: The current focus on infrastructure investment and manufacturing reshoring presents a substantial opportunity. With government bills boosting infrastructure spending, specifically in the United States, companies in the engineering software sector are poised to benefit. For example, the construction industry, just beginning to embrace digitization, offers significant growth prospects, especially with the rising demand for BIM software driven by remote work trends and government digital mandates.

Cost structure and asset light business: The company's lean cost framework and asset-light approach position it for margin expansion alongside revenue growth, particularly evident within its M+M Software segment. This division, while representing one-third of total group revenues, contributes more than half of the group's profit. With impressive gross margins at 98% and profit margins at 25%, the segment showcases efficient scalability and indicates potential for reinvestment and further innovation, driving a strong bull case for the company's future performance.

Bear Case

Dependence on Autodesk: The VAR business is tied to Autodesk's success. If Autodesk fails to innovate or remain competitive, it could have a cascading effect on the VAR business. Moreover, Autodesk's policies regarding software pricing and delivery can directly influence the performance and profitability of the VAR segment.

Economic Reliance on Europe and Germany: The company has a substantial exposure to the European market, Germany in particular, which makes around 41% of total revenues. This heavy dependence means that any economic downturn or instability in Germany could have a signifcant impact on the company's revenue and profitability

Valuation

When looking at the stock performance, the stock returned 1,247% to shareholders with a CAGR of 29.66% over the past ten years and clearly outperformed the DAX as well as the NASDAQ100.

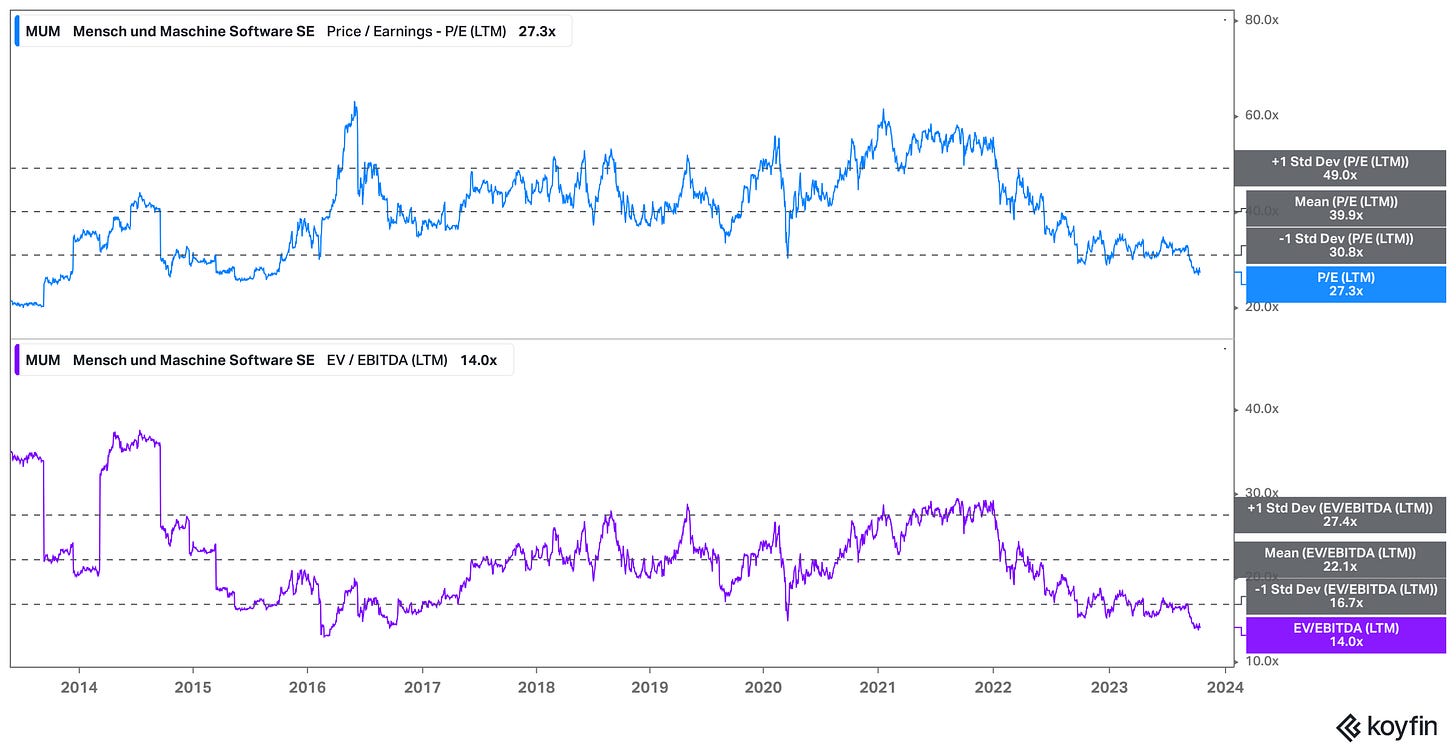

In terms of valuation, M+M has historically traded within a Price-to-Earnings (P/E LTM) range of 27.3x to 49x (+/- 1 STD), with an average of 39.9x over the past decade. The current P/E (as of November 8, 2023) stands at 27.3x, which is lower than the historical average of 40.7x. The same holds true for its Enterprise Value (EV)-to-EBITDA (LTM) ratio of 14.0x, which also falls below the ten-year average of 22.1x.

Based on historical average multiples, today's share price appears to be undervalued by around 30-35%.

Peer valuation

Compared to a group of peer companies, which includes both European and larger international software firms active in the engineering software space, M+M is trading at the lower end of the valuation spectrum.

With an EBIT margin lower than the peer average of 20.0x, M+M stands at the low-range relative to its peers in terms of P/E and EV/EBIT ratios despite the strong revenue and earnings growth over the last years. Also, M+M's dividend yield is significantly higher than that of the peer group.

Reverse DCF

Let’s perform a quick reverse DCF calculation and understand what’s the FCF growth estimates the stock market is pricing in the stock at the current price levels.

Discount Rate - 12%

Terminal Stage - 10 years with Growth Rate of 1%

Other data we need to calculate our reverse DCF:

Free Cash Flow TTM – EUR 46.6 million

Cash & Cash Equivalents TTM – EUR 33.8 million

Long-Term Debt + Short-term Debt TTM – EUR 12.9 million

Shares Outstanding – 16.7 million and a 0% dilution (as M+M shareholders have not faced any notable share dilution over the recent years)

To calculate the value of M+M's shares, we applied different growth rates to the reverse DCF model, resulting in the following valuations:

12% growth rate – EUR 44.41

13% growth rate – EUR 47.35

14% growth rate – EUR 50.49

15% growth rate - EUR 53.86

At the current share price, the market is pricing M+M at a level that would be justified only if the company can grow its free cash flow (FCF) at an average annual rate of 15% for the next 10 years, followed by 1% for the subsequent decade.

Given M+M's past FCF performance, which boasts a 5-year CAGR of 30%, and considering the expected growth rate of the engineering software market in the coming years, an anticipated FCF growth rate of 15% for M+M appears highly probable over the next decade.

Over the past few trading days, M+M's share price has seen a significant increase of about 20%. However, since the start of the analysis just over four weeks ago, M+M's share price was at EUR 46.6 (as of October 6, 2023), which might have presented a greater margin of safety.

Final Thoughts

Few companies have consistently delivered such solid performance over the years as M+M has. The robust and profitable growth rates and high returns on capital coupled coupled with a healthy balance sheet, makes M+M a high-quality hidden German champion with a considerable growth trajectory ahead. The market demand for engineering software and digitization services is strong and expected to persist, driven by factors ranging from cost savings to environmental impact, particularly in machinery and labor-intensive industries. M+M is well-positioned to capitalize on these trends.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference:

Company Homepage

https://www.mum.deCompany Website Investor Relations

https://www.mum.de/investor-relations/investor-relations-english

Further Readings:

Interview with founder Adi Drotleff and CFO Markus Pech