PT Cisarua Mountain Dairy (CMRY): Rising Star in Indonesia’s growing Dairy Market

A high-quality business with above average growth, margins and multiple competitive advantages

Introduction of PT Cisarua Mountain Dairy

Founded in 1992, PT Cisarua Mountain Dairy Tbk, also known as Cimory, has become one of the Indonesia’s leading producer of premium dairy products, mainly active in Java, Bali, and other densely populated areas. Its product portfolio is grouped into two segments, Premium Dairy, including fresh and UHT milk, and various yogurt products.

The second category, Premium Consumer Foods, consists of a range of protein based ready-to-cook (RTC) and ready-to-eat (RTE) products, such as sausages and chicken nuggets, which are sold under the Kanzler brand.

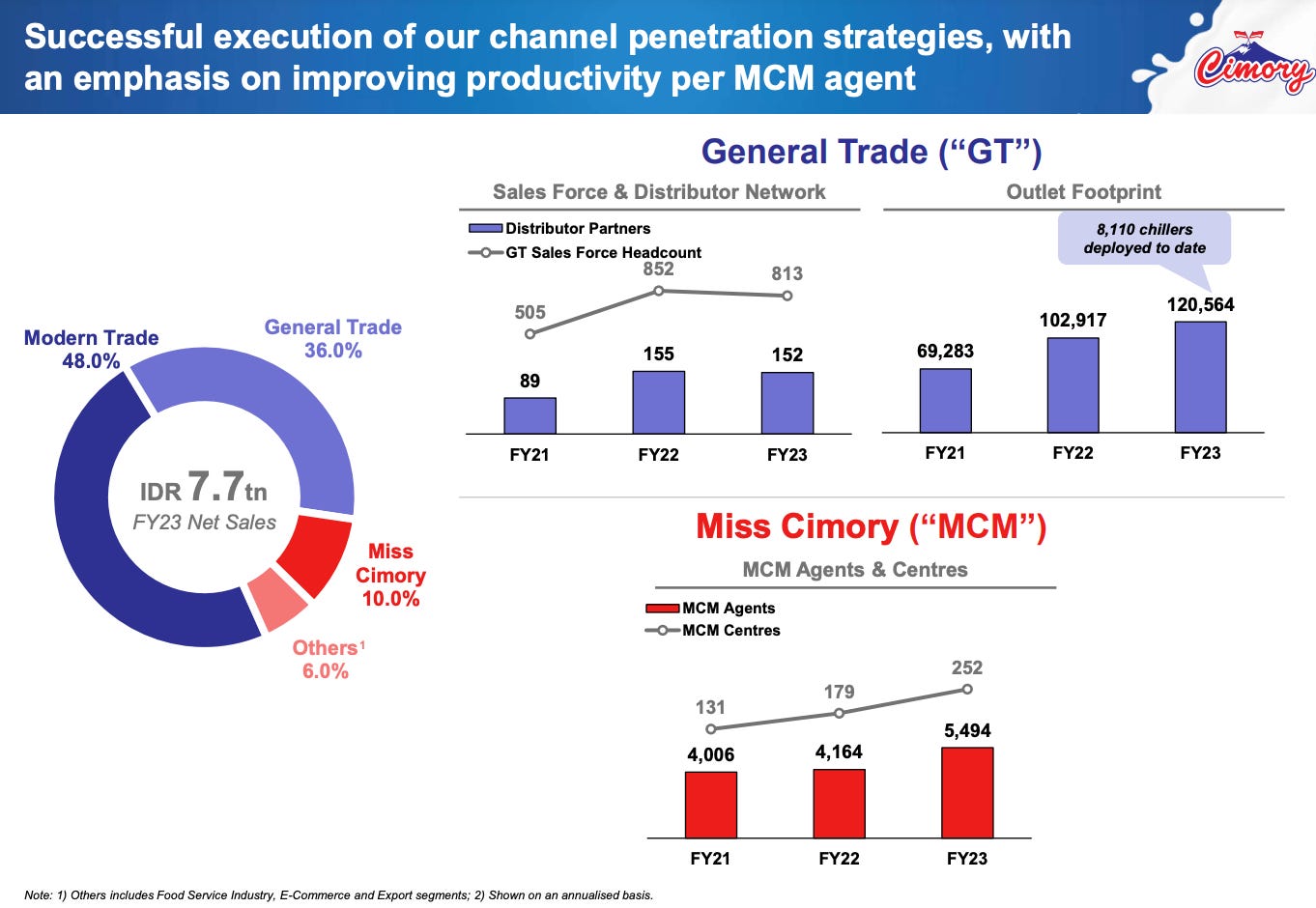

In a pre-IPO interview, Founder Bambang Sutantio emphasized the critical importance of distribution networks in Indonesia due to the country's weak infrastructure. Cimory has capitalized on this by building a distribution network that leverages multiple channels, such as modern trade (supermarkets and hypermarkets) and rapidly growing general trade (wholesalers and small privately owned stores) with over 120,000 outlets across the country.

The company also runs an exclusive direct-to-consumer channel, Miss Cimory (MCM), featuring over 5,000 agents who deliver products weekly to more than 500,000 households across Java and other areas to gather and analyze customer data directly, offering deep insights into preferences and behaviours.

Fast growing local Dairy Market aligned with economic developments of Indonesia

With a strong focus on premium products, Cimory operates in Indonesia's rapidly growing dairy market, experiencing robust growth with projections indicating a CAGR of 5.4% from 2022 to 2027, potentially reaching USD 12.7 billion by 2027.

Despite its growth, the dairy market in Indonesia is still in its early stages, presenting significant opportunities. With a population of around 270 million, an average age of 30, and a rising middle class of 115 million as of 2022, demand for dairy products is increasing. Still, with a milk consumption at 16 kg per capita annually, Indonesia falls well below the Food and Agriculture Organization’s (FAO) low limit of 30 kg and lags behind Southeast Asian countries like Vietnam (28 kg) and Thailand (44 kg).

As incomes rise and purchasing power increases, Indonesians are likely to adopt Western dietary habits, creating significant growth potential in the local dairy market. In 2022, domestic production met only 20% of the 4.4 million-ton demand, leaving the market heavily reliant on imports, especially milk powder. If consumption reaches the lower end of FAO's milk consumption range of 30 kg per capita annually, demand could exceed 8 million tons, further exposing the domestic dairy market to global price fluctuations.

For more stock write-ups, check out RhinoInvestory.com, which now features over 1000 analysis

from 59 stock markets (Japan, Korea, US, India, China, Germany, and more)

across 12 sectors (Information Technology, Industrials, Healthcare, Energy, and more)

Financials

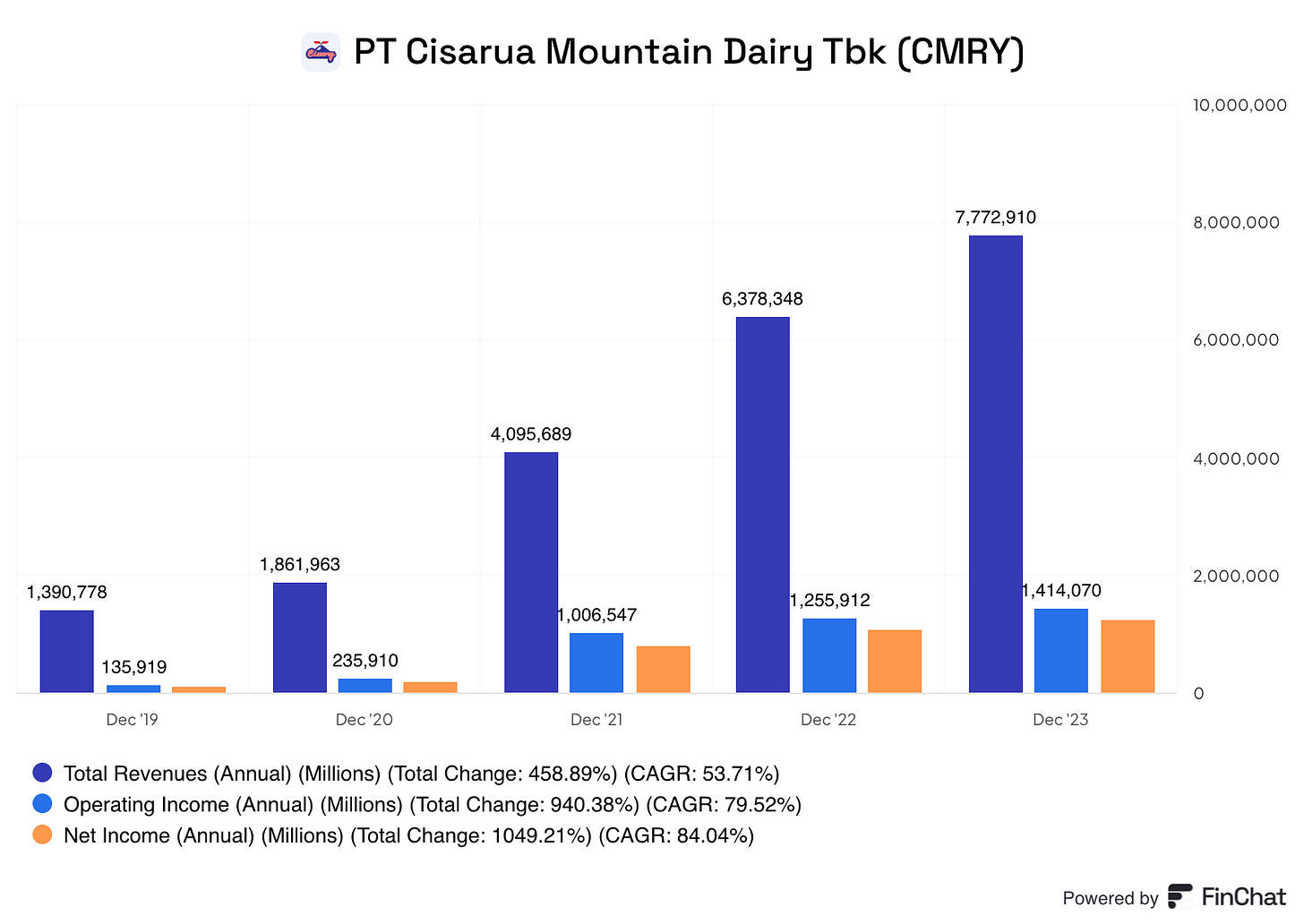

Cimory has a proven track record of growing above the market and demonstrated a stellar revenue growth over the past five years with an average growth rate of 53% per year, while net profit have grown even faster with an CAGR of 84%.

In FY23, Cimory continued to perform with a sales growth of +22% and net profit growth of +17% YoY, driven by expansion of its distribution networks and launch of new products.

The slower sales growth in the dairy segment of 2% YoY was more than offset by the premium consumer foods with strong sales growth of +45% YoY and serving as the key revenue driver in FY23, due to ongoing new product launches such as the Crispy Nuggets and Sticks, meeting the shift in consumer lifestyles towards RTE and RTC products.

Thanks to its premium positioning, Cimory maintained higher gross margins in the dairy industry, which is expected to improve further as raw material prices, especially milk powder, normalize from their peak in 2022.

However, the depreciation of the IDR against the USD continues to pose a risk, as Cimory, like many others in the industry, has significant exposure to imported raw materials due to local demand outpacing supply.

Operating margins declined to 18% in FY23 from 24% in 2019, largely due to increased marketing efforts for new product lines and launches over the past two years.

The Management plans to maintain its aggressive marketing approach, spending 18-20% of revenue on sales and promotional activities in the coming years to support top-line growth.

The company's fundamentals remain strong as it continues to throw off significant free cash flow (FCF) with a annual growth rate of 113% since 2020. It also maintains a strong balance sheet with no long-term debt and a net cash position of IDR 3,690 billion (IDR 270 per share, holding nearly 2x its annual EPS in cash), providing ample flexibility to pursue its growth initiatives.

With over two-thirds of the company's shares held by family and management, more than 50% is owned by the founder alone, Cimory stands as a prime example of leadership with significant "skin in the game," strengthening their commitment and alignment with the company's long-term goals.

Interestingly, in 2023, the New York-based private equity firm General Atlantic bought a 5.64% stake in Cimory.

SWOT Analysis

Having used SWOT analysis for many years in various contexts, including stock research, I find it to be an effective framework for summarizing business, market, and financial highlights, as strengths, weaknesses, opportunities, and threats before moving on to the valuation section. I will also integrate this approach into upcoming write-ups.

Strengths

Strong brand recognition for premium dairy products and consumer foods in Indonesia

Extensive distribution network supporting a multichannel sales strategy

Founder/Family led business with “Skin in the Game”

Weaknesses

Exposure to commodity price fluctuations (mainly milk powder and beef)

High dependency on Indonesia’s underdeveloped physical infrastructure

Limited geographical diversification

Opportunities

Untapped market potential in dairy consumption per capita in Indonesia compared to Asian peers

Growing middle class and rising disposable income are expected to boost dairy consumption

Demand for premium dairy products from overseas, particularly in Southeast Asia

Threats

Highly competitive environment with both local and international players fighting for market share

Economic downturns or fluctuations reducing disposable income, leading consumers to cut back on premium dairy products

Valuation

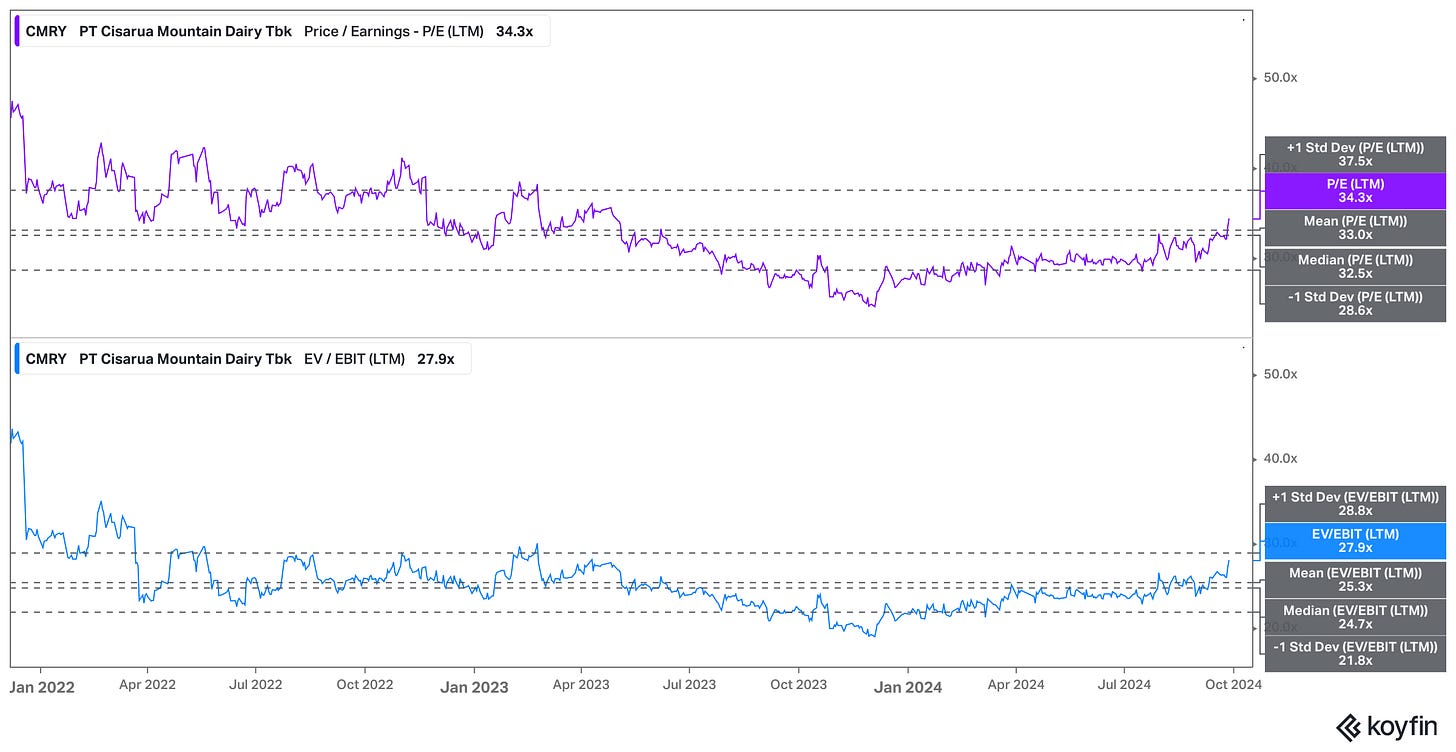

As of October 11, 2024, Cimory shares are priced at IDR 5,350, up 80% since its December 2021 IPO, and are currently trading at 34x FY23 P/E, in line with the 3-year average.

Compared to its local peers, Cimory is trading at a significant premium valuation multiple, which can be justified by its higher growth rates and margins.

Reverse DCF

A simple reverse DCF valuation shows that, to justify the current price, and meet the target return of 10% per year, Cimory needs to grow its FCF by about 18% annually for the next decade and then at 1% per year thereafter.

Final Thoughts

Cimory is well-positioned to take advantage and capitalize on Indonesia’s expanding dairy market, fueled by a growing middle class and an increasing appetite for protein-based products.

However, whether the company can growth FCF at 18% a year is a big question, and opens room for incorrect assumptions around like sales growth, profit margins and future capital expenditure requirements. I believe that current price levels offer a limited margin of safety in case of potential challenges, such as an upcoming global recession, commodity price fluctuations and currency risks.

Therefore, similar to Jungfraubahn Holding, when the right opportunity presents itself, offering a steep discount to the estimated intrinsic value, Cimory checks all boxes for a compelling long-term investment with the potential for above-market returns.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference

Company Website - Investor Relations

https://cimory.com/annual-reports.php

Further Readings

Pre-IPO Interview with Bambang Sutantio (Founder) https://www.gbgindonesia.com/en/manufacturing/directory/cimory_dairy/interview.php

I linked to your post for my Monday EM links collection post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-october-28-2024 A few funds own or have talked about it e.g. On the road: Indonesia from abrdn (I think it was fund managers from Asia Dragon Trust Plc (LON: DGN)): https://www.abrdn.com/en-gb/dgn/news-and-insights/insights/on-the-road-indonesia-dgn-dec-23