Surgical Science: Leading Supplier of Medical Simulators and Software for Robotic Surgery

Robots are revolutionizing operating rooms and Surgical Science's software supports its adaption

Summary

Leading Niche Player: Through the acquisition of key competitors, it created a quasi-monopoly position in medical simulation space; recognized by well-known OEM’s like Intuitive Surgical and Aura Health (owned by J&J)

Strong Growth: Between 2013 and 2023, including acquisitions, sales increased from SEK 33.9 million to SEK 882.9, at a CAGR of around 39%

High-Margin Licensing Business: Industry/OEM segment reported a +23.8% YoY growth in FY23, where licensing revenues constitute around two-thirds of the segment's revenues with gross margins exceeding 90%

Solid Balance Sheet: With no debt, equity/asset ratio of 0.9x and around SEK 630 million in cash; enough dry powder for further, smaller acquisitions

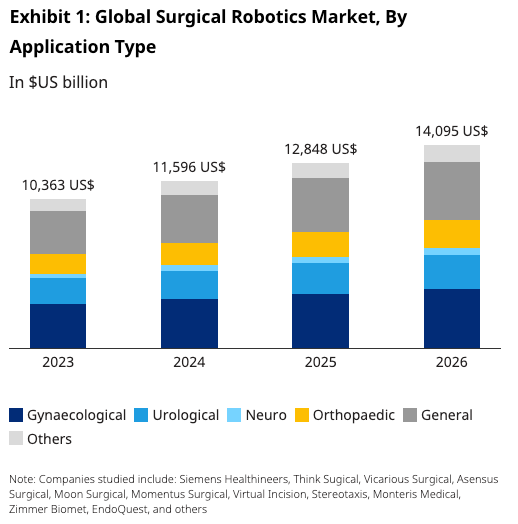

Growing Robotic Surgery Market: Main market of robotic-assisted surgery (RAS) is expected to reach USD 14 billion by 2026 growing at a CAGR of 11%

Introduction of Surgical Science

Founded in 1999, Surgical Science (Ticker: SUS), is a leading provider of medical simulators. It develops hardware and software solutions that allows surgeons and medical specialists to practice and improve their technical skills and improve patient safety.

The company is headquartered in Gothenburg and is listed on Nasdaq First North Growth Market in Stockholm (Sweden).

Product & Service

Surgical Science’s first software LapSim, a laparoscopic surgery simulator, was released in 2001 and formed the basis for its business today. Since going public in 2017, the company has grown its operations and increased its market share through both organic growth and a series of strategic acquisitions. Most notably, with the acquisition of SenseGraphics in 2019, Mimic Technologies in early 2021, and Simbionix in August 2021 it has essentially absorbed almost all significant competitors in the medical simulation sector.

Today, it’s business are grouped into two main reportable business segments, Educational Products and Industry/OEM.

Educational Products

Through its Educational Products segment, the company sells its simulation hardware and software to academic institutions and university hospitals for training of surgeons and other medical personnel. The sales are mostly done through distributors, while only a small part is sold with a direct sales team.

Industry/OEM

With Robotic Assisted Surgery (RAS) emerging as a rapidly growing field, Surgical Science has expanded its business with offering customized simulation solutions for a wide range of medical technology companies.

Since 2017, Surgical Science has strengthened its Industry/OEM segment through acquisitions and partnerships with leading OEMs, such as Intuitive Surgical, and healthcare giants like J&J (through Auris Health). Besides the development revenues during the RAS system's development phase, embedded with Surgical Science's simulation software, upon regulatory approval of the robots, it begins to generate high-margin licensing revenues, which are crucial for Surgical Science's long-term growth prospects and profitably.

Management

The senior management team of Surgical Science, boasting decades of experience in medical technology, is complemented by the retention of key employees from recent acquisitions, many of whom have took over leadership positions in the merged company. This underscores the company's successful M&A strategy, showcasing its skill in integrating diverse corporate cultures, managing talent, and preserving a dedicated leadership team.

While the current CTO and co-founder, Anders Larsson, remains with the company, the current CEO, Gisli Hennermark, who has been a pivotal figure at Surgical Science for nearly a decade and holds a substantial stake in the company—directly owning 0.67% of the shares—has announced his departure planned for March 2025.

Industry & Business Model

Over the past 20 years, surgical capabilities in the operating room experienced rapid and significant changes. With the rise of minimally invasive surgery (MIS), robotically assisted systems (RAS) has transitioned from an innovative, experimental approach to a standard practice in the medical field, revolutionizing complex surgical procedures.

Several factors, such as technological advancements, have dramatically increased the demand for RAS in the past years, leading to an rise of a multi-billion industry. According to predictions by Oliver Wyman’s, the RAS market is projected to expand to USD 14 billion by 2026, growing at a CAGR of 11%.

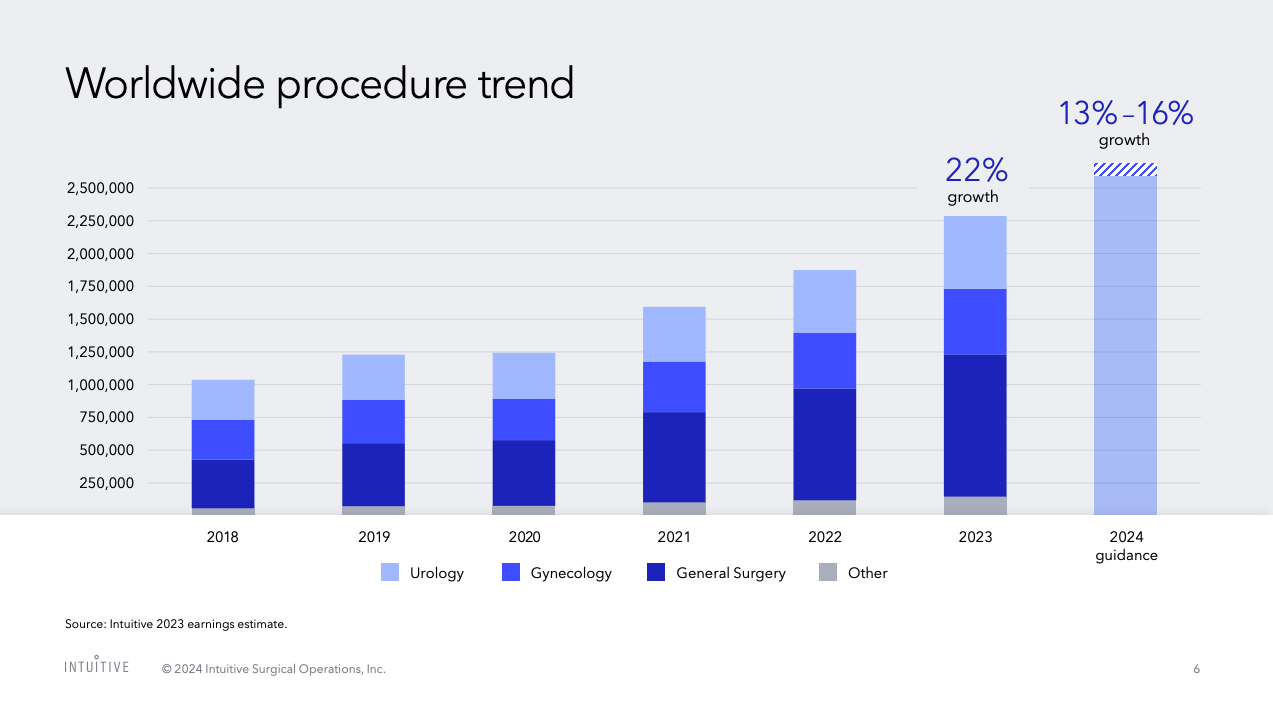

At the forefront of RAS innovation, Intuitive Surgical has dominated the global RAS market by introducing the da Vinci Surgical System in the early 2000s, becoming the first FDA approved surgical robot, which today, according to several market evaluations, holds more than two-thirds of the RAS market with more than 8000 robots deployed worldwide. Moreover, Intuitive Surgical reported a 21% growth in da Vinci robotic procedures in the fourth quarter of 2023 and still expects a 13-16% growth in 2022. These strong figures indicate that an increasing number of surgeons are performing robotic surgery, which also necessitates training beforehand.

The opportunities of the RAS market have also attracted a growing number of players over the past years. Notably, with the expiration of several Intuitive Surgical’s patents since 2016, the competition startedincreasing in the space. Today, various start-ups and established healthcare companies globally are developing competitive robotic platforms, while some still pending regulatory approvals in key markets, widespread availability is expected in the coming years due to the benefits of robot-assisted minimally invasive surgeries, such as shorter recovery times, reduced hospital stays, and lower healthcare costs.

Despite the significant growth of RAS systems over the past two decades, they currently account for less than 1% of the annual 300 million surgeries performed worldwide, according to a study by Roland Berger. The majority of these, 65%, are open surgeries, with the remainder being traditional minimally invasive surgeries. While the largest market for RAS systems is currently the US, growth is anticipated to be strongest Asia-Pacific, especially China and Southeast Asia, driven by economic development, investment in healthcare and the large population.

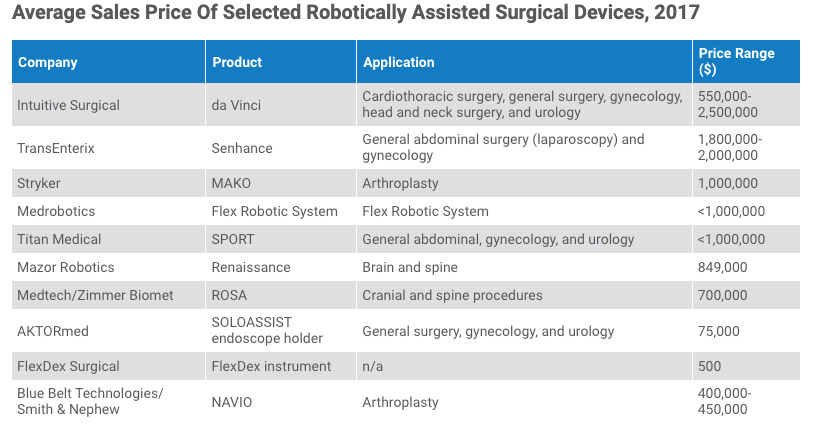

Even with the substantial benefits, including mortality, length of stay, complications, considerable savings and expected growth, the substantial upfront costs of RAS systems, ranging from USD 400,000 to $2.5 million, may act as a barrier to entry, particularly in emerging markets. Therefore, leading RAS players, such as Intuitive, have started offering a variety of flexible financing models, tailored to each hospital or health system's needs, further encouraging the adoption of RAS technology.

Peers & Competitors

Surgical Science has consolidated the medical simulation market by acquiring some of it’s main competitors, and positioned itself as a dominant player in the world of medical simulation.

With the acquisition of Simbionix in particular, which was more than three times the size of Surgical Science at the time of its purchase from 3D Systems in August 2021, Surgical Science significantly broadened its spectrum of simulators, incorporating new specialties such as endovascular procedures and urology, and orthopedics, which gives Surgical Science a significant edge over it’s competitors, like Mentice and CAE Healthcare (a subsidiary of CAE), by offering a wider variety of simulation procedures.

Financials & Key Figures

Combining organic growth and acquisitions, Surgical Science has grown revenues from SEK 33.9 million to SEK 882.9 between 2013 and 2023, at a impressive CAGR of some 39%.

Notably, Surgical Science's revenues leaped from SEK 104 million in FY20 to SEK 365.8 million in FY21, marking a +250% YoY growth. This significant revenue increase was mostly driven by the acquisition of Simbionix in August 2021, which contributed SEK 178.8 million to the group sales (calculated as the difference between its full-year sales of SEK 407.2 million and the pre-acquisition sales of SEK 228.4 million).

While the industry's prospects and Surgical Science's operational performance remain strong, replicating such a growth in the short to mid-term seems highly unlikely. Certainly, this assumption could change if they were to undertake another big acquisition.

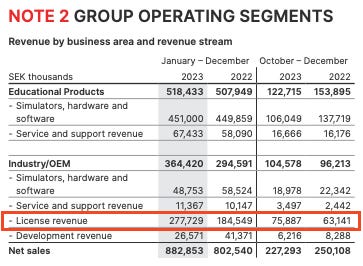

In FY23, the Educational Products segment generated SEK 518.4 million (PY: 507.9 | +2.1%), while the rest of about SEK 364 million (PY: 294.0 | +23.8%) came from it’s Industry/OEM segment.

The company’s gross margin of around 85% changed with the acquisition of Simbionix in 2021, which not only altered the revenue mix but also resulted in lower margins. This shift can be attributed to the fact that about two-thirds of Simbionix's revenues originated from Educational Products sales, which yield lower margins than revenues from the Industry/OEM segment.

Based on the detailed segment revenue reporting, licensing revenues in FY23 have increased by about 50% from the previous year, marking around two-thirds of the sale within the Industry/OEM segment. Moreover, with gross margins above 90%, these highly profitable licensing revenues are expected to significantly boost the company's overall profitability in the future.

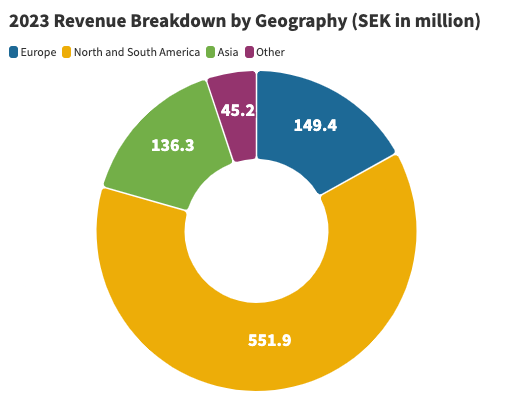

In terms of geographical revenue distribution, more than 95% of the company’s sales are to customers outside of Sweden. The US stands as the company's primary market, followed by Europe (Nordic region included) and Asia.

The significant increase in revenue mix towards the US was primarily driven by Surgical Science’s acquisitions and partnerships with leading RAS companies in US, such as Intuitive Surgical and Medtronic.

Surgical Science's remarkable operational success has resulted in an annual earnings per share (EPS) growth rate of 80% over the past five years, boosting its earnings to SEK 4.59 in FY23. Despite it’s profitability, as noted by the management in the 2022 annual report, it does not intend to distribute dividends for the upcoming 1-3 years. However, the company has indicated plans to potentially pay dividends in the next 3-5 years, aiming for an average payout of 30% of its annual net profit.

It’s important to note that the major acquisitions since 2019 have been largely funded by issuing new shares, mostly to institutional investors, which nearly doubled the share count within five years. Although the management has made considerable and strategic efforts to strengthen its market position and establish a solid foundation for future growth, the dilution of shares remains an important factor to monitor moving forward.

Capital Efficiency and Cashflow

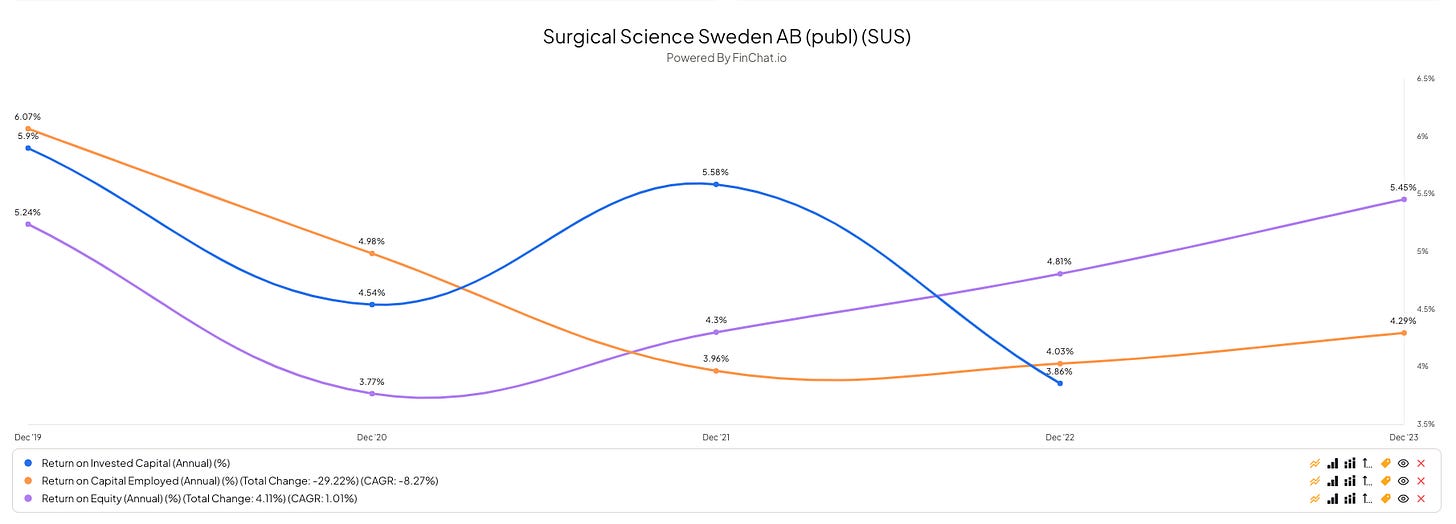

First of all, it's important to note that Surgical Science's business is generally not capital intensive, as indicated by the CAPEX-to-revenue ratio of about only 0.01x.

When looking at the company’s capital efficiency ratios, such as the 5-year average ROIC of about 4%, it might initially appear concerning. However, in the case of Surgical Science, it doesn't necessarily signal a problem. As previously discussed, since 2019, management has actively pursued acquisitions of major competitors, like Simbionix in 2021 for a purchase price of USD 305 million (or about SEK 2.5 billion). Thus, the lower ROIC should be viewed within the context of a strategic growth plan, aimed at entering new markets and increasing market share, with the expectation of reaping the benefits from these investments in the future.

In terms of cash flow, the company has maintained consistently high levels of free cash flow (FCF) due to its profitable and less capital intensive business model. In FY23, the company generated around EUR SEK 227 million in FCF (PY: 120 | +89%), showing a annual growth rate of 40% over the past five years.

It high cash-generative business model is further demonstrated by its strong free cash flow (FCF) margin of around 25% in FY23. This gives the company flexibility in funding future growth and returning value to shareholders through dividends or share buybacks.

Liquidity & Debt Structure

With no debt, a cash reserve of SEK 634 million, and an equity/asset ratio of about 0.9x at the end of FY23, the company has a very strong balance sheet.

Shareholders

In terms of shareholder structure, Surgical Science shows notable insider commitment, highlighted by the Chairman Jan Bengtsson's significant ownership (via Marknadspotential AB) of almost 14%, or former SenseGraphics executives by owning around 5.5% of the shares via Landsnora Software AB.

Together, with the current CEO holding of about 0.67%, the management and board members collectively own more than 35% of the company's shares, with various holding options available that could further increase their ownership in the future.

Outlook

Surgical Science aims for SEK 1,500 million in sales by 2026, targeting growth through M&A and organically across its business segments. Management expects the Educational Products business to grow 10-15% annually, with the Industry/OEM segment projected to grow even faster, especially from licensing revenues as more RAS systems with the company's software are launched and commercialized, also highlighted by the CEO in the latest 4Q23 earnings call

“We have 15 approximately surgical robotics companies that have our software embedded on their platforms. And still, the majority has not even sort of come to market yet. There are only a few of them that have come to market, and there are several that are in various stages of regulatory approval processes. So we are keeping a strict view on our 2026 goals that we will accomplish.”

Bull and Bear Investment Case

Bull Case

Quasi-Monopoly Position: Surgical Science’s strategic acquisition of it’s main competitors have positioned the company as a leading player in the medical simulation market, which not only enhanced its product offering and market reach but also significantly reduced competition

Expanding RAS Industry: Given that only about 1% of surgeries worldwide are RAS-assisted, indicating its early stages, the recent approval gained by several OEM’s is expected to drive organic growth and improve profitability for Surgical Science, particularly through high-margin software license revenues

APAC Region: Such as China and India, currently with a smaller revenue share compared to the US, are anticipated to become key growth catalysts, driven by the size of the population, economic development, and particularly the development of more affordable RAS systems

Bear Case

Customer Concentration: Surgical Science's dependence on a single customer, likely Intuitive Surgical, for over 10% of its total revenue—and even higher when considering the sales of the Industry/OEM segment—poses a significant risk that could substantially affect its growth targets if the relationship breaks

Competition by Big Players: A shift by leading robotic surgery or healthcare technology companies to internally develop simulation software, with the goal of cutting costs or owning additional parts of the value chain, could significantly affect Surgical Science's operations and its market position

High Price of RAS Systems: Despite the efforts of leading RAS players, such as Intuitive Surgical, to address their customers’ concerns about patient care cost, by developing cost-effective, adaptable financing models, failure to further reduce costs could limit the adoption of surgical robotics for wider adaptation, particularly in emerging markets

Valuation

Since its IPO in June 2017, Surgical Science’s stock has appreciated some +1,200% today compared to about +200% for the Nasdaq100.

After reaching a high during the pandemic-driven stock market boom in 2021, where shares soared to over SEK 300 each —P/E ratio exceeded 400x—, its stock price fell in line with the broader market correction.

At around SEK 150 per share today, Surgical Science shares trade at P/E ratio of 32.3x and EV/EBIT ratio of 36.7x, below its historical valuation since its IPO in 2017, reflecting a discount of roughly 40%. It's worth noting here that shortening the timeframe would make more sense in terms of reasonable historical valuation multiples.

Reverse DCF

Let’s perform a quick reverse DCF calculation and understand the FCF growth estimates priced into the stock at its current valuation.

Discount Rate - 12%

Terminal Growth Rate - 1% (over 10 years)

Other data we need to calculate our reverse DCF:

Free Cash Flow (TTM) – SEK 227.8 million

Cash & Cash Equivalents – SEK 634.4 million

Long-Term Debt + Short-term Debt – no debt

Diluted Shares Outstanding – 50.9 million and a 0% dilution (an optimistic view that there will be no further share dilution)

Using reverse DCF model, different implied growth rates (for a growth period of 10 years) are applied, resulting in the following valuations:

21% growth rate – SEK 141.9

22% growth rate – SEK 150.6

24% growth rate – SEK 169.8

26% growth rate - SEK 191.6

28% growth rate - SEK 216.4

30% growth rate - SEK 244.6

The stock market is currently pricing Surgical Science at a level that would be justified only when the company can grow its FCF at an average annual rate of around 22% for the next 10-years, followed by 1% for the subsequent decade.

Surgical Science's FCF growth, averaging 40% annually over five years and 154% in the last three, shows that market's expectations for the business seem justified. While M&A activities have significantly contributed to the rapid growth of the business, the FCF growth demonstrates that the acquisitions, especially the purchase of Simbionix in Q3 2021, have delivered the expected financial outcomes. Furthermore, the growth trajectory of the RAS industry, coupled with Surgical Science’s anticipated increase in the high-margin licensing business, indicates that a projected FCF growth rate of 22% over the next decade is within reach.

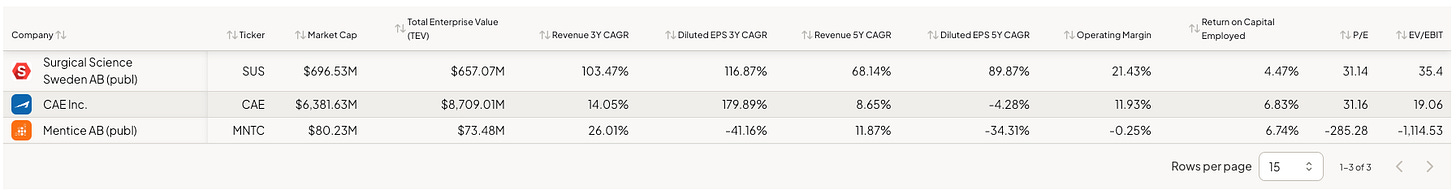

Peer Valuation

With the recent acquisition of nearly all its peers, there is a scarcity of similar companies in the medical simulation or RAS industry. Considering its closest peer, Mentice AB (publ)—a provider of software and hardware simulation solutions for image guided interventional therapies—Surgical Science trades at a significantly higher premium. CAE also competes in the medical simulation space through its subsidiary CAE Healthcare, which represents just a small part of CAE's overall operations.

Given Surgical Science's strong performance record, margins and market position, the premium valuation of Surgical Science seems well-justified.

Final Thought

In my recent analysis of NIBE Industrier, I pointed out that as investors, we sometimes let hope override rationality, drifting into "dream" investing rather than sticking to value investing—seeking high-quality and/or high-growing companies at a reasonable price. Similarly, despite Surgical Science's share price falling by 50% recently, the company's long-term business outlook appears stable, presenting an even greater margin of safety now. Additionally, the double-digit growth in RAS-operated surgeries, as recently reported by Intuitive Surgical, highlights a robust demand for Surgical Science's industry leading simulation software.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference

Investor Relations

https://surgicalscience.com/investor-relations/Capital Markets Day 2023

Further Readings

Robotics in surgery by Roland Berger https://www.rolandberger.com/en/Insights/Publications/Robotics-in-surgery.html

Market Intel: Rivals Catching Up To Intuitive Surgical In Fast-Growing, Fast-Innovating Robotic-Assisted Devices Market https://medtech.citeline.com/MT121751/Market-Intel-Rivals-Catching-Up-To-Intuitive-Surgical-In-FastGrowing-FastInnovating-RoboticAssisted-Devices-Market

Asian Surgical Robotics Market Doubles by 2025 https://asianroboticsreview.com/home316-html

Thanks for the article. Gilsi (CEO) just wants to switch to the Board and dont want to exit. Probably you update this part, as it is a little irretating to readers and missleading?

Moreover all of the Peers of ISRG are also clients of Surgical Science. Also worth mentioning. But competition raise also.