Teleperformance SE (TEP): AI Loser or Beneficiary ?

If AI doesn't pose an imminent risk, the valuation at historical low multiples and a 14% FCF yield suggests that the stock is significantly undervalued rather than being a so-called value trap

🔈 Announcment:

Although I never intended to start journaling, over the past month, I've really enjoyed researching and writing about businesses that could provide good investment opportunities and, more importantly, spark the curiosity for further research and discovery of great companies.

As I prepare to return to the corporate world, I have decided to open up RhinoInsight to all subscribers and discontinue the paid subscription.

What Does This Mean?

Firstly, I will try to continue sharing my investment research as I have in the past. However, especially in the beginning, I might not be able to maintain the pace of posting a new article every four weeks.

But, as I have many great businesses on my watchlist, most of which are rarely covered by mainstream media, and to share more of these insights with you, I've decided to shorten my writings—not the research process!—so that I can provide more frequent updates. This approach also considers the growing challenge of consuming the vast amount of textual and visual data from numerous newsletters and subscription services. By sharing concise write-ups focused on the most important aspects, I hope to deliver valuable insights more quickly. Remember, these write-ups are meant to spark initial ideas, but it's essential for everyone to do their own research to feel comfortable when investing.

Thank you to all my subscribers so far, especially the paid subscribers who have supported me over the last few months. Your support has meant a lot to me and has often been a great source of motivation.

However, if you feel that my work or any of my previous and future write-ups deserve more, you can always buy me a coffee (or two 😉).

Cheers!

Introduction of Teleperformance SE

With a long track record of high cash flow generation, organic revenue and earnings growth, Teleperformance SE (Ticker: $TEP), founded in 1978 and headquartered in Paris, is a global leader in business process outsourcing (BPO) and customer experience management (CX). Employing over 500,000 people in 91 countries, the company offers a wide range of services, from customer relationship operations to business process management to digital platform services, all grouped under Core Services & Digital Integrated Business Services (D.I.B.S). Additionally, its Specialized Services segment delivers high-value offerings such as online interpretation and visa application management across the globe.

Impact of AI

Amidst market concerns about the disruptive impact of generative AI, particularly following Klarna’s announcement of its successful implementation of an AI assistant, Teleperformance shareholders paniced.

According to the CEO, Klarna's AI system managed two-thirds of customer service chats in its first month, equivalent to the work of 700 full-time agents, significantly improving customer satisfaction and efficiency. This led to concerns that AI might replace human jobs in the BPO sector, affecting investor sentiment towards companies like Teleperformance.

What Does This Mean for Teleperformance?

At first glance, investors' concerns about AI taking over seem reasonable, as Teleperformance’s Customer Experience Management and D.I.B.S segment remains the largest revenue driver, contributing EUR 6.98 billion in FY23 and with voice interaction representing the majority of the group's revenue.

However, there is also a strong case for why Teleperformance will, and is already, benefiting from the latest technological advancements.

It is already leveraging AI to enhance efficiency and customer experience. For example, their TP GenAI platform integrates with OpenAI's GPT-4, as well as AWS and Google's generative AI offerings, to support tasks like email and call summarization and response generation. Their TP Recommender uses predictive analytics to personalize recommendations and improve customer interactions.

According to the management, their AI initiatives have already resulted in significant improvements, increasing operational efficiency by 15%-30% and reducing support costs by a similar margin. It's important to note that nearly 70% of Teleperformance's operational costs are personnel expenses.

So, with over 400 experts working on various AI projects and partnerships with tech giants like Microsoft and OpenAI, the company is well-positioned to leverage the latest technological advancements and enhance long-term profitability by further automation of certain processes and tasks, which can free up human resources to concentrate on more complex and high-value services.

As highlighted by Ivan Kotzev in his blog post, a lead CX Service Analyst from NelsonHall, generative AI solutions like ChatGPT cannot fully replace most human-delivered support today, and voice remains the preferred channel for many customers, especially for sensitive topics like money, health, or urgent issues. While automation enhances efficiency and cost savings, the human touch is crucial in BPO services, particularly in sales or customer retention processes where human interaction and empathy are essential and irreplaceable.

Strategic Acquisition of Majorel

The company has a strong track record of integrating acquisitions, such as Language Line Solutions in 2016 and Intelenet in 2018, a key player in high value-added BPO based in India.

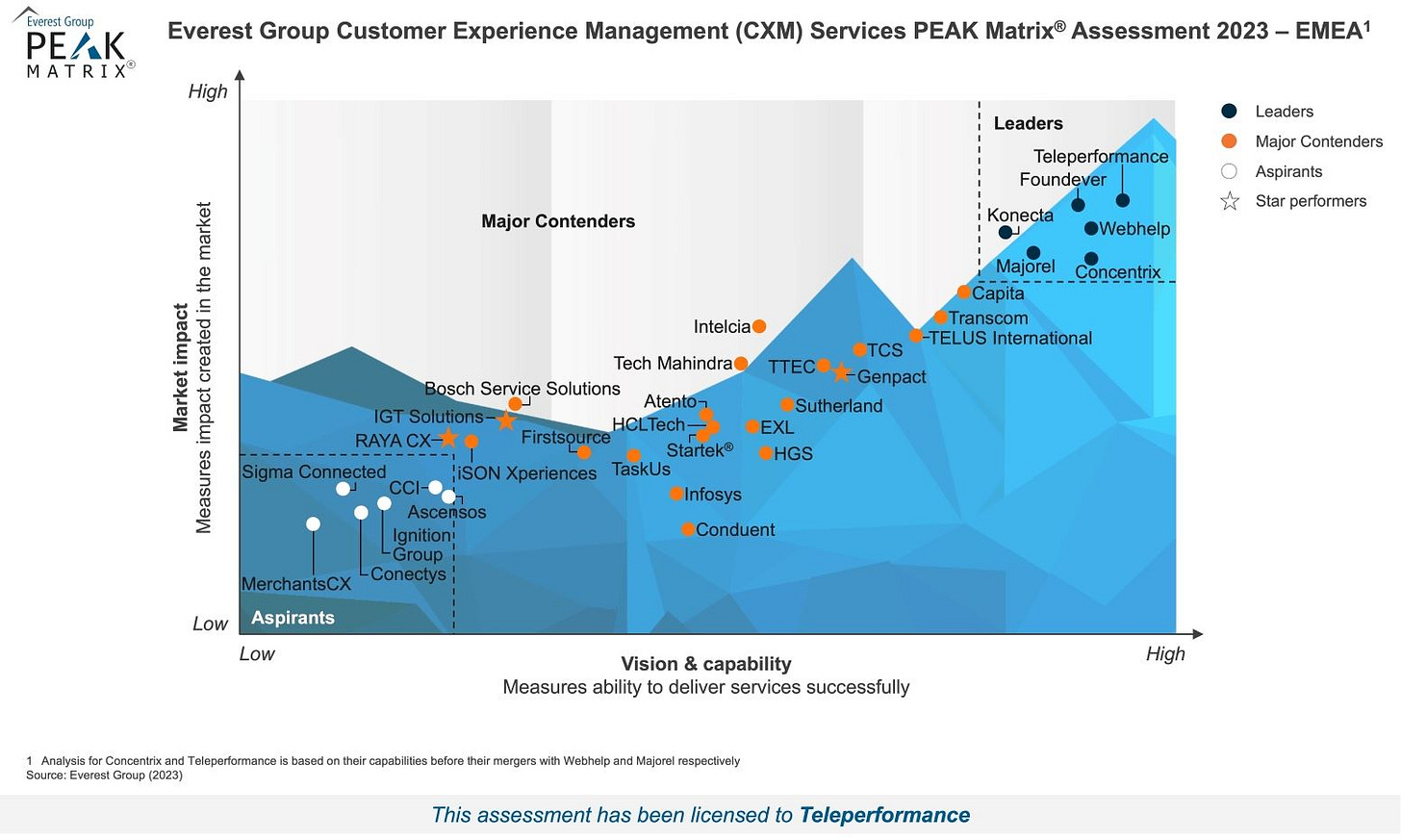

More importantly, the latest acquisition of Majorel in November 2023, the largest in the group's history, bolstered its presence in Africa and Europe as a leading European business services provider.

This acquisition of Majorel not only strengthened Teleperformance’s position as the world’s leading provider of outsourced customer experience management, it also brings with it a vast repository of domain specific data, collected from its operations across various customers from different industries. This data will serve as a goldmine for training and refining AI models, enabling Teleperformance to enhance its AI-driven solutions for clients across various industries and further strengthening its market positioning.

Financials & Key Figures

Teleperformance continued to report solid financial performance in FY23, with revenues growing to EUR 8.3 billion. Adjusted for the non-recurring impacts of the decline in Covid support contracts (-€223 million over the full year) and the high volatility of exchange rates in hyperinflationary countries (-€32 million), the like-for-like growth was +5.1% compared to previous year.

It has also maintained consistent and strong profitability with an operating margin of at least 12% in the last three years.

Teleperformance’s Majorel acquisition is expected to contribute an additional EUR 2 billion in revenue, solidifying its position as one of the largest players in the industry with a global market share of 10%.

Additionally, the integration of Majorel will strengthen Teleperfromance’s position in a number of high-growth potential verticals, such as banking and insurance services in Europe and luxury goods in Asia.

After lease expenses, interest and tax paid, Teleperformance generated a record net free cash flow (FCF) of EUR 812 million in FY23, nearly ten times what it was a decade ago. The advantage of such a cash-generative business is that it provides the company with various capital allocation options, including dividends and share repurchases.

The company paid a dividend of EUR 3.85 per share in FY23, yielding about 4%, and repurchased shares worth EUR 366 million, mainly to offset dilution from the Majorel acquisition.

With a FCF-Yield of around 14% in FY23, Teleperformance has significant flexibility to increase shareholder returns and/or reduce its debt.

Despite a recent decline in return on capital, primarily due to increased goodwill from the acquisition of Majorel in FY23 that diluted margins and return on capital in the short term, it still maintains a relatively healthy level of capital efficiency with a five-year average return on capital employed (ROCE) of around 13%.

Debt increased significantly in FY23, largely due to the EUR 2 billion purchase of Majorel. Nonetheless, Teleperformance's strong cash flow generation and its cash reserves of EUR 882 million provide a solid financial foundation moving forward, supported by a solid BBB credit rating from S&P.

Additionally, the CFO stated during the FY23 earnings call that Teleperformance has undrawn access to EUR 1.5 billion in credit facilities, enhancing its financial flexibility.

So, by looking to the top line numbers, I couldn’t agree more what Daniel Julien, founder and CEO of Teleperformance, said during FY23 earnings call

“I don't think that we should be ashamed of these numbers”

Outlook

Looking back, Teleperformance had an organic growth rate between 7% and 9%. However, the last 1Q24 earnings report showed a slow down in organic growth and the management expects 2 - 4% organic sales growth in 2024 which is still going to be a difficult year as restated by the CEO during an interview with ANC, a Philippine news channel.

It’s all about Risk and Reward

Firstly, it's important to note that future AI developments and unexpected breakthroughs could significantly impact Teleperformance’s operations. Competitors or newcomers might adopt these technologies faster, leading to increased pricing pressure and potentially lower client retention rates or even client losses.

Furthermore, similar to the investigation into Teleperformance’s TikTok moderation practices in Colombia by the Ministry of Labor in 2022, which caused reputational damage and significant drop share price, similar issues in the future could affect the company's operations and market performance.

Lastly, as the CEO indicated in the latest financial reports, the company's intention to continue pursuing targeted acquisitions, particularly in specialized services, could lead to significant debt-financed purchases, which might weaken credit metrics and deter investors.

So, despite the risks, looking at Teleperformance's market position, robust operations over the past decades, its high cash-generating business model and consistent return to shareholders, what kind of risk is left after the company's market value has decreased by over 70% in just few years ?

Valuation

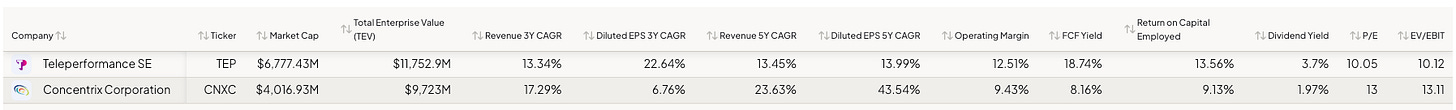

Considering Teleperformance's historical double-digit P/E and EV/EBIT multiples over the past decade, the current P/E (LTM) of 9.8x and EV/EBIT of 10.2x indicate significant undervaluation relative to its historical norms.

Compared to its U.S. peer, Concentrix, which has shown higher growth in revenue and earnings per share over the past five years, Teleperformance stands out with better operating profit margins and capital returns, along with higher FCF and dividend yield, while trading at lower P/E and EV/EBIT mutliples.

Reverse DCF Analysis

So, what growth is currently priced into the stock? Based on a reverse DCF calculation, even if Teleperformance's FCF does not grow at all from this point, the current share price (as of June 12, 2024) is still 16% lower than its intrinsic value.

Considering that over the past five years, Teleperformance has grown its FCF at a CAGR of 15.8%, this potentially indicates a significant misspricing by the market.

Let's assume that the FCF grows at an annual rate of 4% for the next ten years and then at 1% thereafter, a rate significantly lower than the growth rates of previous decades, yet it still offers a potential 100% return in the coming years, not accounting for any dividends or share buybacks.

Final Thought

There is no doubt that AI will impact Teleperformance’s operations, but the long-term effects are still uncertain. This uncertainty isn't just about technical development of AI models but also data governance, a significant concern for any company looking to adopt generative AI.

However, the company's strategic investments in AI, bolstered by the Majorel acquisition, strong financial performance, cash generation ability, and experienced leadership team led by founder and Co-CEO Daniel Julien (who owns about 1.9% of the company), combined with attractive valuation multiples, present a compelling buying opportunity.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Reference

Presentation Annual Results FY23

https://www.teleperformance.com/media/lmkh12cp/teleperformance-2023-annual-results-vdef.pdfTeleperformance on the Offensive with Plan to Acquire Majorel

TikTok’s Subcontractor in Colombia Under Investigation for Traumatic Work

https://time.com/6231625/tiktok-teleperformance-colombia-investigation/

Further Readings

Interview with Daniel Julien (founder and CEO of Teleperformance)

AI-based Assistant for Business Process Outsourcing

AI Chatbots are not Ready for Customer Service

https://analyticsindiamag.com/ai-chatbots-are-not-ready-for-customer-service/

Great write up. One of my top holdings right now.

Great write up, one of my top holdings. Recently published a post of Teleperformance myself

https://open.substack.com/pub/myinvestmentjournal/p/teleperformance-an-artificial-intelligence?r=h29te&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true

Good to see your better coverage of the technology side of things.

Thanks