The Insider Report - 02/2024

Unveiling the top insider buys and sells in the stock market

🔈 RhinoWatchlist is now officially live

From the latest stock insights to personalized watchlist analytics, and global financial events - all at your fingertips, just a chat away.

👉 Just go to rhinowatchlist.com to sign up and enjoy😉

Welcome to the next issue of The Insider Report, your monthly deep-dive into the most significant insider transactions within the corporate landscapes.

And, please note that the monthly report captures the full trading week, potentially extending a few days into the new month due to the cut-off criteria.

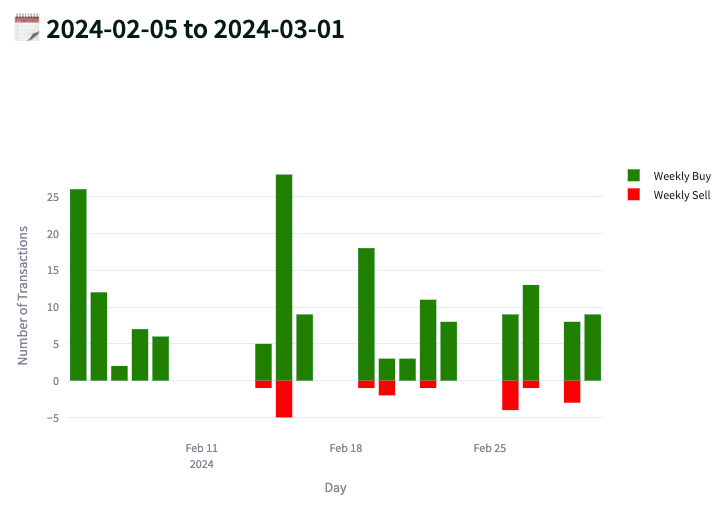

Monthly Summary of Insider Buys & Sells in 🇩🇪 Germany

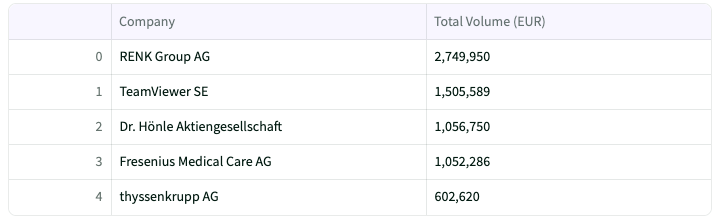

Top Insider Buys 📈

Renk Group (Ticker: R3NK)

Renk Group, is a leading global drivetrain technology manufacturer for both civil and defense industries. The company makes about 70% of its revenue from the defence industry. For instance, it provides gearboxes for Germany's Leopard tanks

According to their latest 2023 first-half report, with a YoY revenue growth of about 7.9% to EUR 410 million and an order backlog just under EUR 1.7 billion at an all-time high, it reveals how its products, like those of many other defence companies, have been on the rise since the growing geopolitical tensions.

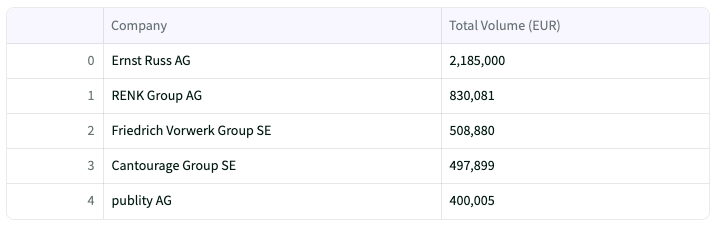

Following the IPO in February of this year, executives, including the CEO and CFO, have actively purchased shares worth EUR 2.7 million, with the CEO subsequently selling shares worth EUR 830 thousand.

Top Insider Sells 📉

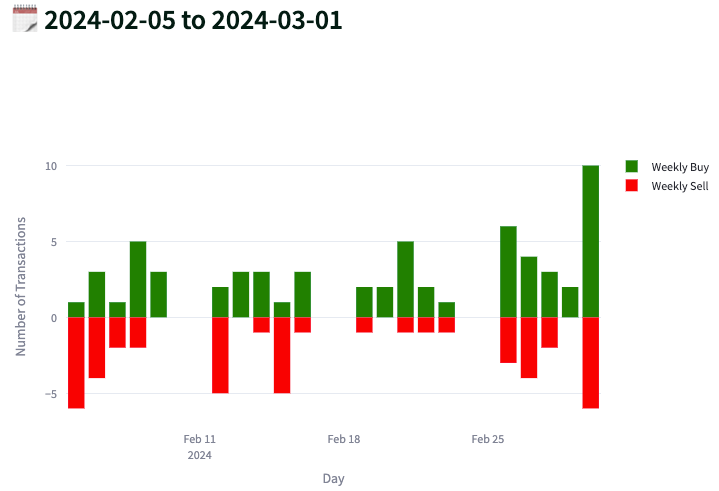

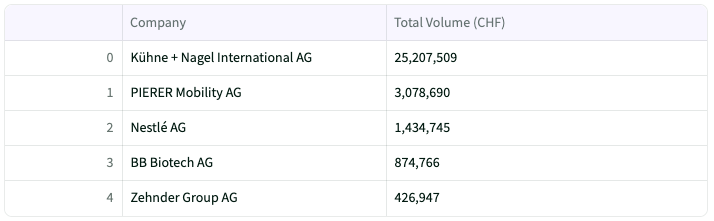

Monthly Summary of Insider Buys & Sells in 🇨🇭Switzerland

Top Insider Buys 📈

PIERER Mobility (Ticker: R3NK)

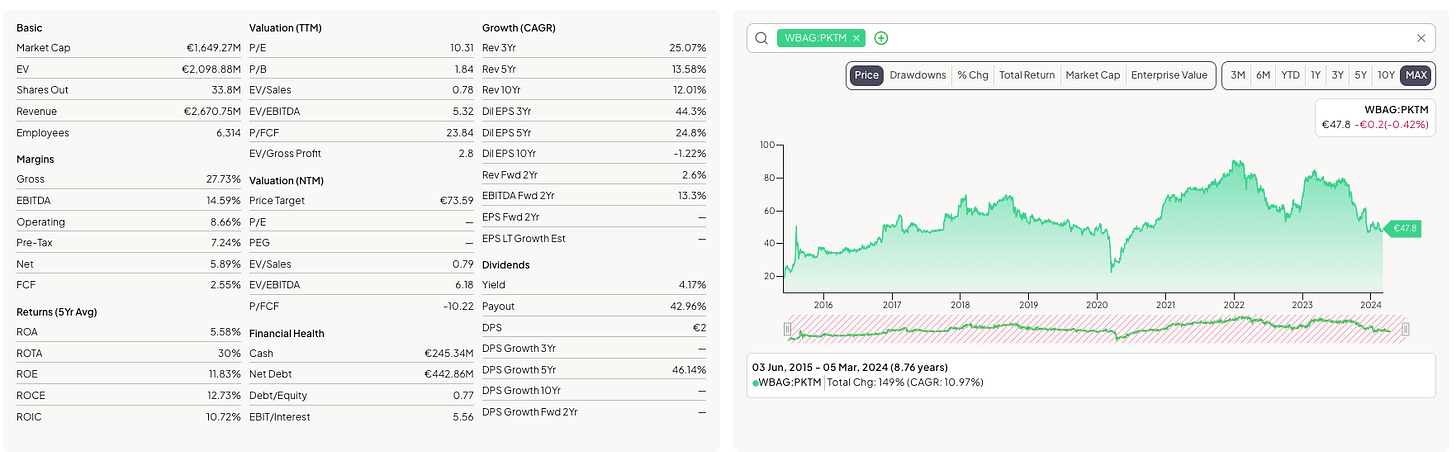

PIERER Mobility AG is an Austria-based manufacturer of motorcycles with focus on motorcycles and e-bikes. It owns a broad selection of premium brands, such as KTM and Husqvarna.

After the short Corona-Crash in 2020, PIERER Mobility, benefited from the boom in motorcycle and e-bike sales for the past three years, increasing sales by 9% to EUR 2.66 billion in FY23. During the same time period, operating profit dropped by 32% to EUR 160 million, according to the management, mainly due to restructuring of the bicycle business and financial support for its distressed motorcycle dealerships with larger discounts.

The company has been listed on the SIX Swiss Exchange (Switerzland's primary stock exchange) since 2016 and is trading about 40% lower today then from its all time highs in 2022. However, despite the on going economical and geopolitical challenges, the management is now looking to boost profitability in 2024 by implementing significant cost reduction measures. This includes a strategic focus on its core business and brands like KTM, and the divestment of R Raymon and FELT brands, even exit from the non-electric bike market. Additionally, the company plans to further outsource some of its production and R&D activities to its strategic partners CFMOTO (China) and Bajaj Auto (India).

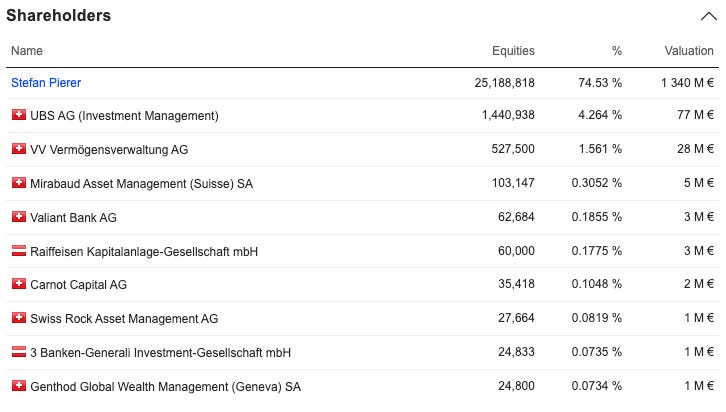

The company’s strong global presence, shift in focus and its collection of premium brands like KTM, coupled with significant ownership by the founder and CEO Stefan Pierer, have definitely piqued my interest. With a P/E (TTM) multiple of 10.3x, I'm adding PIERER Mobility to my watchlist for a further deep-dive.

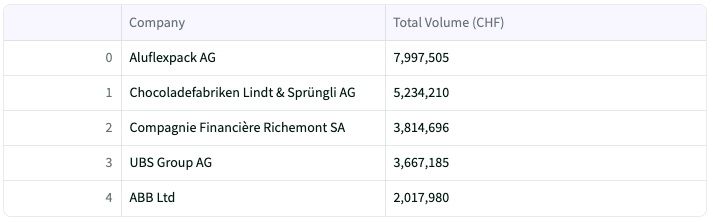

Top Insider Sells 📉

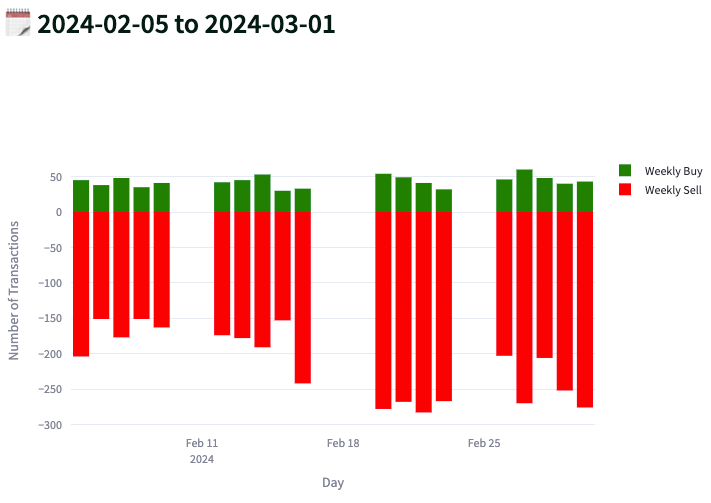

Monthly Summary of Insider Buys & Sells in 🇺🇸 United States

Insider selling in the US market continued in February, gaining attention from mainstream media due to significant sell-offs by prominent figures like Jeff Bezos and Mark Zuckerberg, alongside other CEOs and insiders.

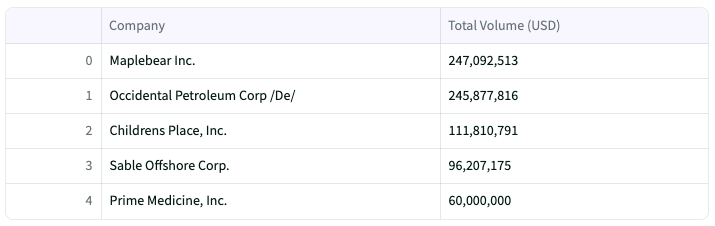

Top Insider Buys 📈

Occidental Petroleum (Ticker: OXY)

As already reported in the Insider Report Week 51 last year, Warren Buffet continues to bet on oil. At the beginning of February this year, in a single transaction, Berkshire Hathaway purchased additional shares worth of around USD 245 million of Occidental Petroleum, one of the largest oil producers in the US. Most interestingly, five years ago, Berkshire owned no Oxy stock, and today Berkshire has invested over $15 billion in Occidental, owning now 28.2% of the entire company.

As I mention in a tweet last week, the energy sector in general piqued my interest most recently, and a high-level research revealed to me that most of the companies whether from the oil, gas or coal sector, earning a ton of money and expected to continue doing so due to various economic and geopolitical reasons.

I’ll probably shift my focus a bit over the next weeks and months, and try to understand whether we still have some good investment opportunities within the universe of energy stocks. Please, let me know in the comments what you think about the energy sector in general or have any particular stock in focus recently.

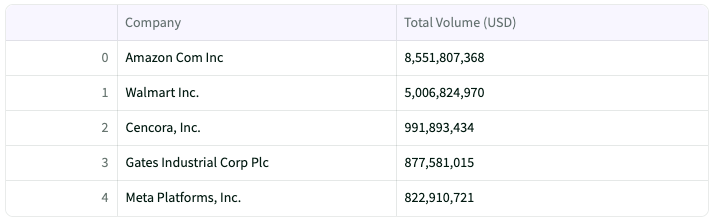

Top Insider Sells 📉

Walmart (Ticker: WMT)

As the world's largest retailer, with nearly USD 650 billion in FY2023 revenue, Walmart has also seen continued insider sales this year. Last month alone, Walmart insiders, mainly the Walton siblings (Jim, Alice, and Rob), sold shares worth USD 5 billion, 1.5 billion each. However, these sales barely affect the Waltons' ownership, which remains at about 45% of the company.

Interestingly, In response to recent inquiries from Business Insider, Walmart directed them to a 2015 Walton Enterprises announcement, in which they outlined a strategy for the Walton family to periodically sell shares to maintain the family's ownership stake below 50% and support their philanthropic efforts.

🙏 Feedback

Just thinking out loud here: Although the data pipeline for The Insider Report is mostly automated, refining these reports requires extra effort. Thus, I'm really curious to know whether you find them useful. Your feedback is invaluable to me!

Regardless of the poll outcome, the Inside Out Tracker app will remain available, and I’ll introduce new features and more advanced analytics over time.

Conclusion

This time, even though PIERER Mobility made it to my watchlist for further research, I was left wondering, particularly based on the insider activities in the US market:

Why are insiders selling shares now? And more importantly, where is the money going?

It's true that the total amount of shares sold, whether by META or AMZN insiders, represents only a small fraction of the total market cap. However, the aggregate volume of all shares sold across the US market is somewhat concerning and provides some food for thought.

Stay tuned for the upcoming issues of The Insider Report and don't miss out on the valuable insights and investment.

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.