The Insider Report - Week 48

Unveiling the top insider buys and sells in the stock market

Welcome to the next issue of The Insider Report, your weekly deep-dive into the most significant insider transactions within the corporate landscapes.

As promised in the last issue, this weeks report covers insider transactions in Switzerland in addition to the German market, with plans to expand the coverage to additional markets, such as UK, US, Canada, and Australia in the near future.

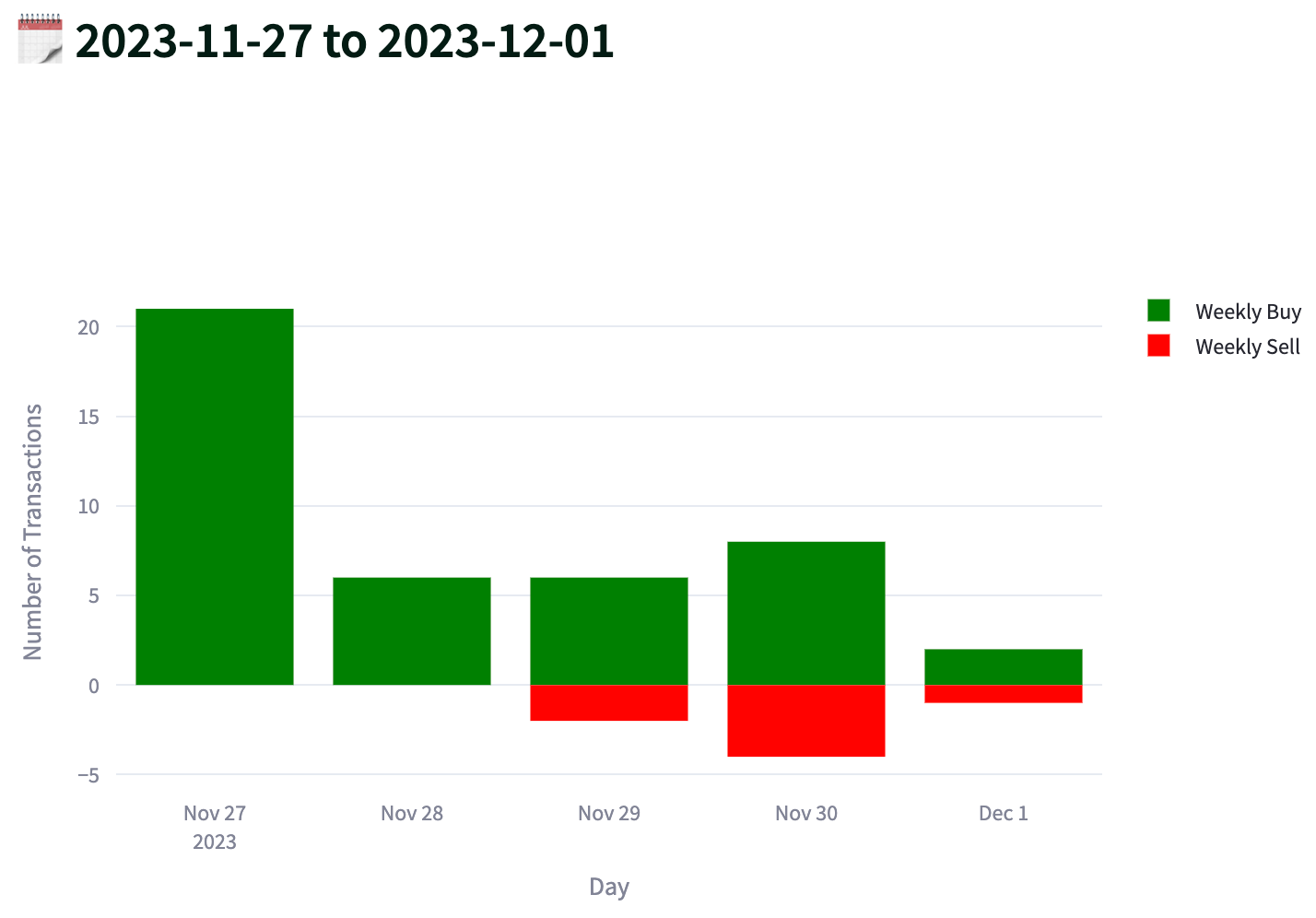

Weekly Summary of Insider Buys & Sells in 🇩🇪 Germany

This week started with a large number of insider transactions compared to the rest of the week, including buys in Germany's largest real estate group, Vonovia SE.

A few of these businesses, with the focus on small and large caps, along with a select set of transactions that really stand out, are highlighted below.

Top Insider Buys 📈

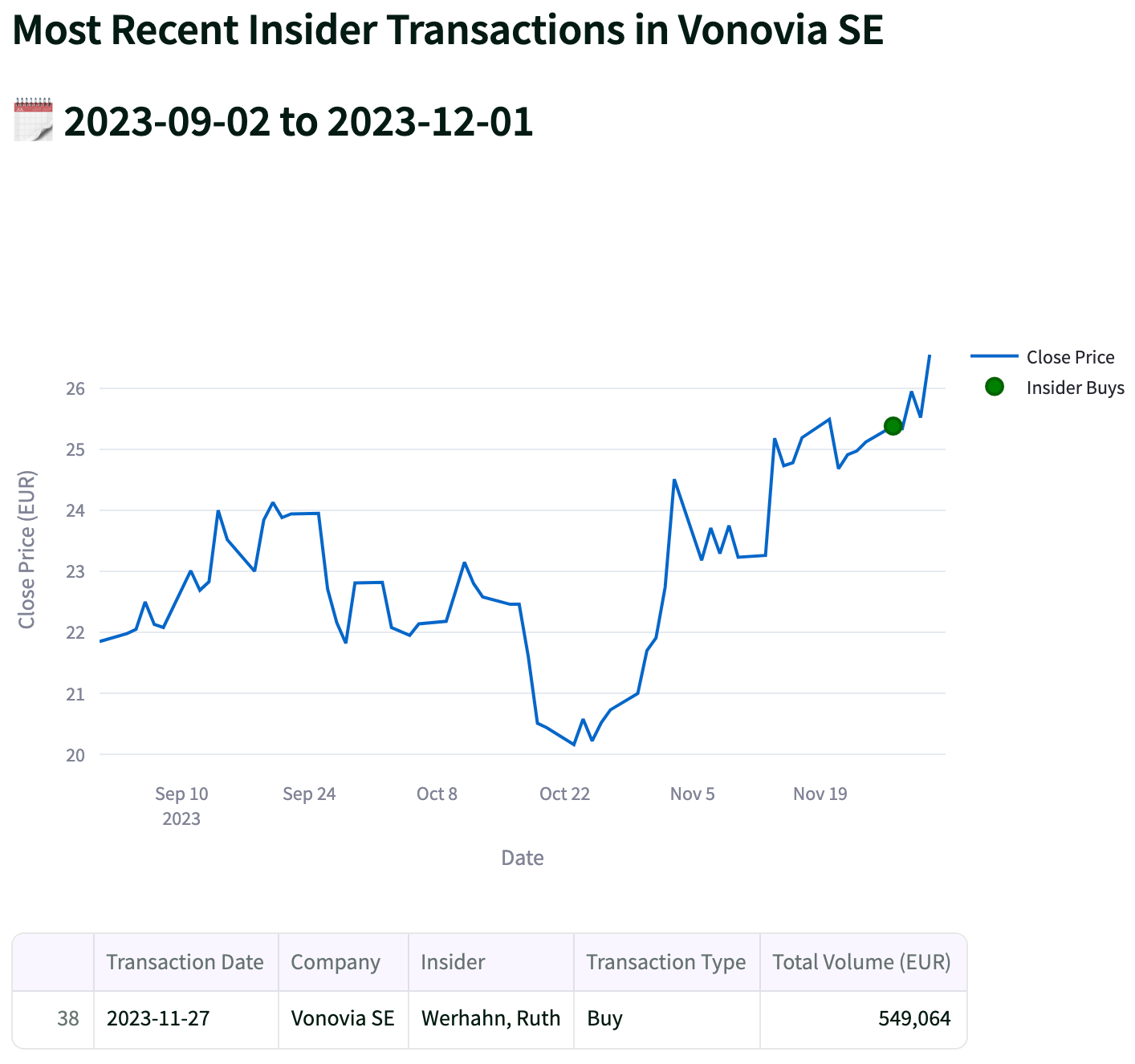

Vonovia SE (Ticker: VNA)

Vonovia is a German real estate company, and one of the largest real estate players in all of Europe, owning and managing residential real estate assets. At the end of 2022, the residential units portfolio of over 500,000 units.

Like with most European real estate companies, Germany’s in particular, experienced a spectacular crash in terms of valuation in the past couple of months, mainly due to rising interest rates and cost inflation which led to the announcement of postpone all new constructions staring in 2023 at the beginning this year.

The most recent insider purchase, amounting to about EUR 549 thousand, was made by the newly appointed member of the Management Board, Ruth Werhahn, who will assume responsibility for the newly created Human Resources division.

However, even though Vonovia has seen a 51% gain from its low in March this year, the market environment remains highly uncertain due to the uncertainty about the interest rate policy of the European Central Bank and the overall economic condition in Europe.

NORMA Group SE (Ticker: NOEJ)

Norma Group SE, with over 120 years of history, is a Germany-based global market and technology leader, proving hose clamps and pipe connections to over 10,000 customers in a range of industries, from cars to washing machines.

Norma’s operating business was heavily impacted by the pandemic years, where net income fall about 90%, and led do deterioration of profit margins.

This was also reflected in the share price performance, which continued to decrease from its peak in June 2018.

Interestingly, at the beginning of the year, Norma’s shares experienced a price increase of about 20%, spurred by speculation of a takeover offer from several equity firms. However, this increase was short-lived. The company had rejected several offers in the recent months

Anyway, three insiders (Cluster Buys) have shown confidence and have purchased shares this week, led by CFO Annette Stieve.

Top Insider Sells 📉

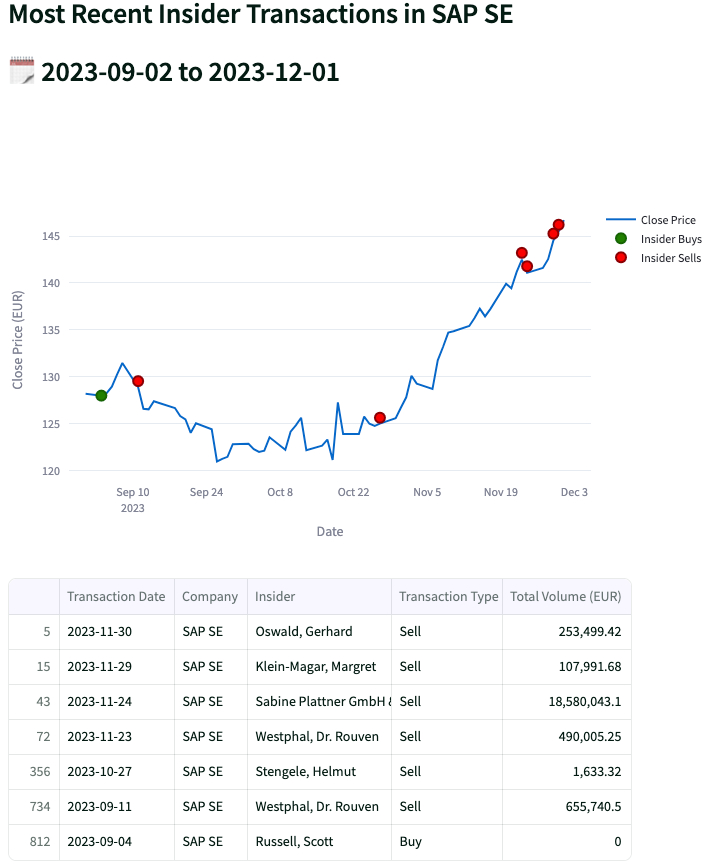

SAP SE (Ticker: SAP)

As covered in last week's Insider Report, the sell-off by insiders at SAP continued after its shares reached a new all-time high (ATH).

However, given SAP’s market capitalization of EUR 180 billion, this represents just a minor fraction of the company's total market value.

Heidelberg Materials AG (Ticker: HEI)

Founded in 1873, Heidelberg Materials is the world's second-largest cement maker with activities in more than 50 countries. While the company operates through three main segments, cement sales make up more than 50% of its revenues.

Cement production is among the highest emitting industries, accounting for nearly 7% of total global CO2 emissions. Policies such as ESG (Environmental, Social, and Governance) and decarbonizing efforts with net-zero targets introduced by regulatory bodies worldwide put further pressure and challenges on cement producers.

This is also reflected in Heidelberg Materials' share price, which has been volatile in the past five years, as the cement business is cyclical in nature. Notably, the company’s Chief Financial Officer (CFO) René Aldach sold around EUR 383 thousand worth of shares last week, which, while substantial, still represents just a small portion in comparison to the company's overall market capitalization.

Weekly Summary of Insider Buys & Sells in 🇨🇭Switzerland

This week saw a notable number of insider activity in the Swiss market, featuring some interesting transactions and businesses, as highlighted below.

Top Insider Buys 📈

Ningbo Shanshan Co. (Ticker: SSNE.SW or 600884:SHH)

Ningbo Shanshan, is a company based in China. It is among the few Chinese businesses that have utilized the 'Stock Connect' program, which became effective on July 25, 2022, to list on the SIX Swiss Exchange via Global Depositary Receipts (GDRs).

The company's primary focus is on the research, development, production, and sales of polarizers and lithium battery materials. The production of battery cells, such as cathodes and anodes, are highly concentrated both geographically and within a small number of companies. Accordig to a recent IISD report, only four companies produce over 50% of global anode capacity, and Ningbo Shanshan is one them making him of the largest producers of battery cell components.

As the names of insiders buying or selling company shares are not required to be publicly disclosed by SIX exchange regulations, it is only known that the buyer of 760,000 shares, worth around CHF 1.27 million, is an executive member of the board of directors or a member of the senior management.

Ningbo Shanshan’s shares have continued to decline over the last few months, losing about 67% from their peak in October 2021. With the rapid growth in demand for new energy vehicles, there's also a corresponding increase in the need for battery anode materials. In response to this trend, the company has announced plans for further expansion. This includes an investment of up to EUR 1.28 billion (USD 1.34 billion) to establish a lithium battery anode material project in Finland.

Top Insider Sells 📉

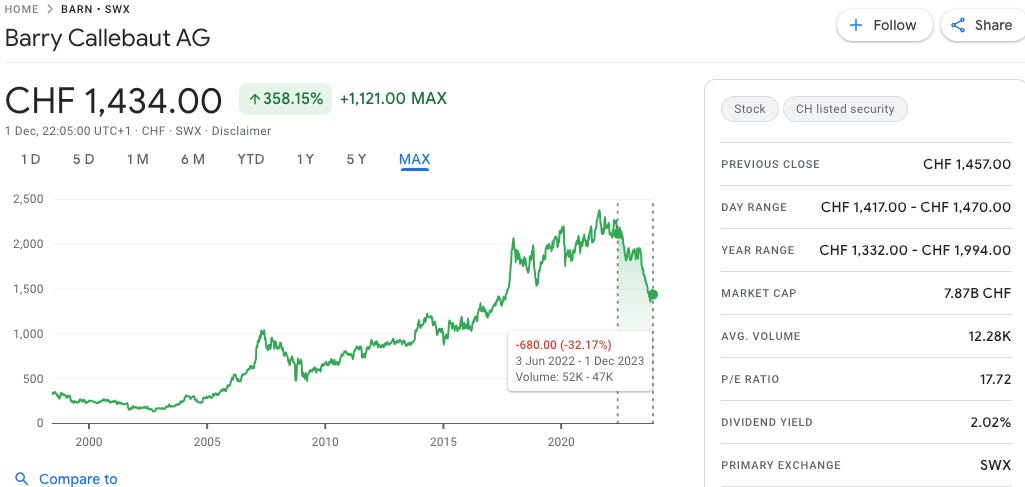

Barry Callebaut AG (Ticker: BARN)

Even if it ranks among the last in this weeks top insider sales based on total volume of CHF 294 thousand, it's worth highlighting one of the world's leading manufacturer of high-quality chocolate and cocoa products.

Barry Callebaut was established in 1996 through the merger of the French company Cacao Barry and the Belgian chocolate producer Callebaut. Morningstar reports that the company is responsible for producing about 40% of the world's industrial chocolate in the open market, and its products are a component in roughly 20% of all chocolate and cocoa goods globally.

Despite the strong growth and solid shares price performance over the last decades, Barry Callebaut has recently faced significant challenges, including the temporary shutdown of its main factory in Wieze due to salmonella contamination and the resignation of CEO Peter Boone after less than eighteen months in the role. Additionally, soaring cocoa prices, driven by crop diseases and adverse weather in West Africa, have further strained the company's operations and impacted its share price. hese cumulative issues have led to a notable impact on its share price, resulting in a 30% decline from its peak in August 2021, with the stock now trading at levels not seen since 2017, except for the flash sale in March 2020.

Conclusion

Since Barry Callebaut and Norma Group have made it onto my watchlist this week, the Insider Report has once again continued to fullfil its purpose. It offers a glimpse into insider trades and serves as a source of idea generation for interesting businesses that merit further research.

Stay tuned and subscribe now to ensure you never miss out on the latest insights and analysis👇

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Great coverage and super helpful information for someone who's looking to understand the Swiss equity market.