The Insider Report - Week 49

Unveiling the top insider buys and sells in the stock market

Welcome to the next issue of The Insider Report, your weekly deep-dive into the most significant insider transactions within the corporate landscapes.

Following the poll results from the last Insider Report, the next report will include insider buying and selling activities in the US.

Meanwhile, let's take another look at insider activities in the German and Swiss markets.

Weekly Summary of Insider Buys & Sells in 🇩🇪 Germany

While this week was like the formers again dominated by insider buys in terms of quantity, one large sell-off again in SAP SE stood out.

Top Insider Buys 📈

Publity AG (Ticker: PBY)

Established more than 20 years ago, Publity AG is a Germany-based real estate investment company with focus on commercial and office properties in top German metropolitan areas, such as Frankfurt am Main, Hamburg, and Munich.

The company has a robust foundation for various market phases through its real estate asset management and the utilization of non-performing real estate loans (NPLs). Since 2018, Publity has also been building its own portfolio of selected office properties, fully benefiting from the properties' value appreciation.

The recent insider purchase in publity was notable, continuing a trend where it's been a top stock for insider buying in recent months. NEON Equity AG, a key player in Central European capital markets, has notably increased its stake in Publity to nearly 55% while Thomas Olek, Founder and CEO of NEON Equity AG, expects a significant upturn in publity's business within the next 12-18 months, driven by rising US investor interest in German commercial real estate, particularly in a market anticipating declining prices.

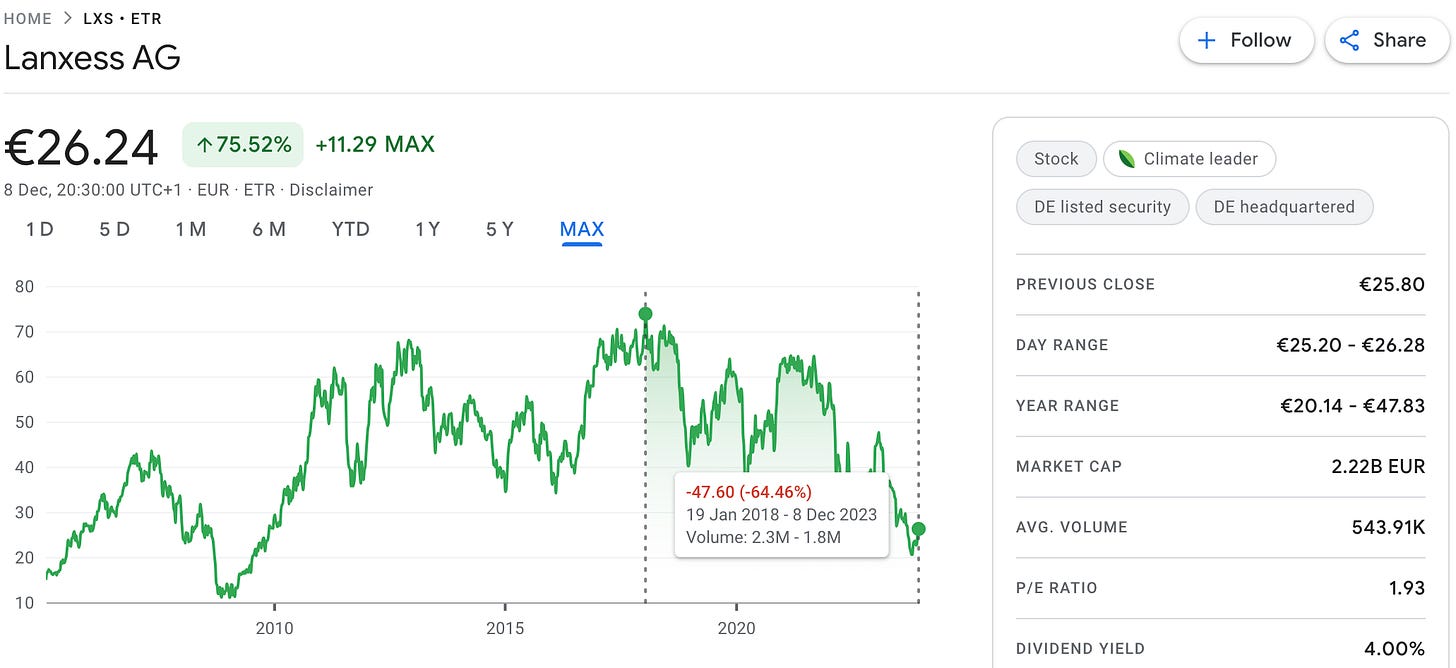

LANXESS AG (Ticker: LXS)

Norma Group SE, is a leading chemical company who has faced significant losses in market capitalisation as high energy prices and cratering global demand continued to drag on the chemical industry due to the ongoing global tension between Russia and Ukraine.

Despite the cyclically of the chemical sector reflected in LANXESS’s share price performance, today it notes at EUR 26 per share and record low levels not seen since 2010.

Despite the looming challenges in Germany's chemical industry, two insiders from the company (a Cluster Buy) persisted in purchasing shares, led by the CEO, Matthias Zachert, who acquired shares valued at approximately EUR 400 thousand this week.

Top Insider Sells 📉

SAP SE (Ticker: SAP)

The selling of shares in SAP by insiders continued this week, marked by a significant divestment from Hasso Platner through his foundation.

According to Reuters, this move is a component of an agreement that Platner has with an undisclosed bank to offload his personal 13.6% stake in SAP, along with an additional 3.44% held by his foundation. As part of this plan, there is an intention to sell between 40 to 60 million shares in SAP by December 2013 as announced earlier in June of this year.

Vulcan Energy Resources (Ticker: VUL)

Vulcan Energy is an Australia-based company engaged in geothermal energy and lithium exploration and production.

The company made headlines in 2020 for its innovative approach to extracting lithium from geothermal brines in Germany's Upper Rhine region. This breakthrough, coupled with multiple agreements to supply renewable energy to various European car manufacturers, including Volkswagen and Stellantis, resulted in Vulcan Energy's share price soaring, witnessing an extraordinary increase of over 9,000% since January 2020 and peaking at around AUD 15.9 on September 10, 2021.

However, Vulcan Energy became a target for short sellers in late 2021, and one of the leading lithium experts, Joe Lowry, described the euphoria surrounding Vulcan Energy's utopian plan as “a modern-day ‘tulip bulb’ investment. Great marketing, low on substance”, as reported in an Australian Financial Review (AFR) article.

The company, which is dual-listed in Germany, is obligated to disclose transactions such as the sale of shares worth approximately AUD 400 thousand by Robert Ierace, the Chief Financial Officer (CFO).

Please note that, this transaction was initially incorrectly reported in EUR in the Top Buys section, as the Insider Tool is currently undergoing a review to be updated to accurately handle such unique cases.

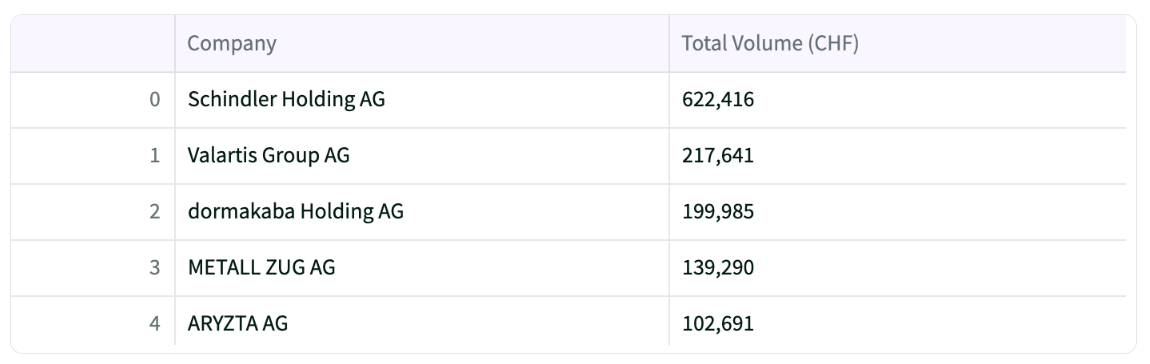

Weekly Summary of Insider Buys & Sells in 🇨🇭Switzerland

This week, the insider activity in the Swiss market is dominated particularly in the industrial and healthcare sectors. Below are some highlights of these interesting transactions and business developments.

Top Insider Buys 📈

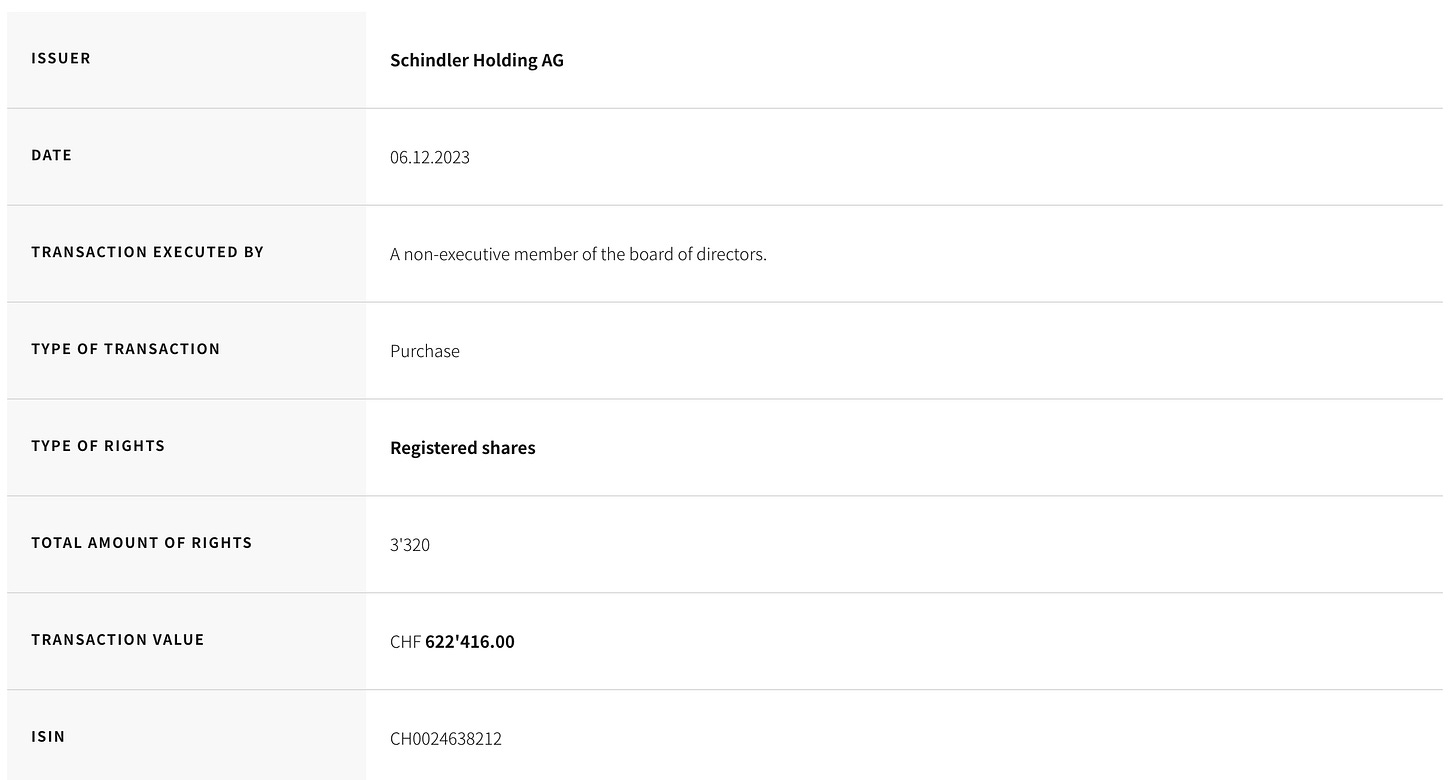

Schindler Holding AG (Ticker: SCHN)

Founded in Switzerland in 1874, Schindler is a leading manufacturer and provider of related services for elevators, escalators, and moving walkways.

Schindler is facing challenges due to a decline in demand for new equipment in China, stemming from the ongoing real estate crisis. China was Schindler's third-largest market following EMEA and the US, accounting for 18% of its total revenues in 2021. However, this figure has now dropped to 15%, reflecting the impact of these market conditions on the company's performance.

Moreover, the situation is worsened by rising interest rates in the United States and Europe, leading to a further slowdown in the construction market. This economic pressure is also mirrored in the company's stock performance, with the share price experiencing a decline of over 30% since its peak on August 6, 2021.

The SIX Exchange Regulation, the stock market supervisory authority, reported on Wednesday that a non-executive member of the board purchased Schindler shares valued at approximately CHF 600 thousand.

For those interested in the elevator industry, there's a great write-up on this sector by Junto Investments that's definitely worth checking out. It provides valuable insights and covers major players in the global elevator market, including Schindler, Otis from the US, and Finland's Kone.

Top Insider Sells 📉

Straumann Holding AG (Ticker: STMN)

Straumann Holding AG is a Switzerland-based company and a global leader in tooth replacement and orthodontic solutions.

The company's shares have lost more than 40% since their peak in late 2021, followed by another significant drop in October this year. This decline was triggered by reports from the US dental company Align, which alarmed investors with its third-quarter results and commentary on the current market environment. Consequently, there was a substantial sell-off of Straumann shares from portfolios. Bernstein, an asset management firm, noted that Align's figures are often regarded as an indicator of customer investment readiness.

While the company reported positive results for the third quarter of 2023, with strong organic growth, insiders continued to sell off their shares, 4,150 in total worth around CHF 488 thousand.

Conclusion

Despite the ongoing sell-off by insiders, Straumann Holding remains the sole company to have earned a spot on my watchlist. As a high-quality Swiss company operating in a promising market, it stands out for its potential.

Stay tuned and subscribe now to ensure you never miss out on the latest insights and analysis👇

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.