The Insider Report - Week 51

Unveiling the top insider buys and sells in the stock market

Welcome to the next issue of The Insider Report, your weekly deep-dive into the most significant insider transactions within the corporate landscapes.

Finally, just before the year ends, last week's Insider Report will include US insider transactions, along with the usual insider activities in the German and Swiss markets.

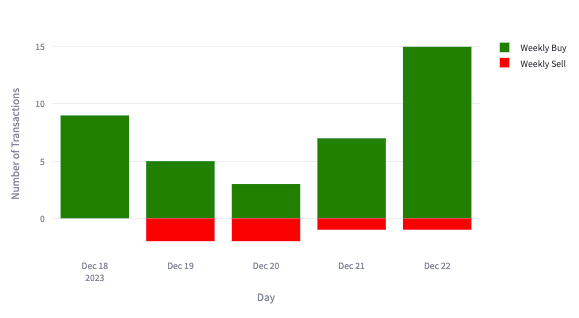

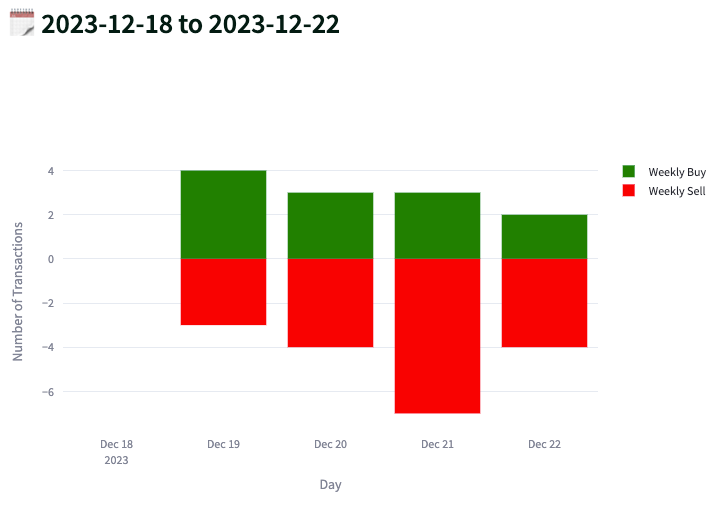

Weekly Summary of Insider Buys & Sells in 🇩🇪 Germany

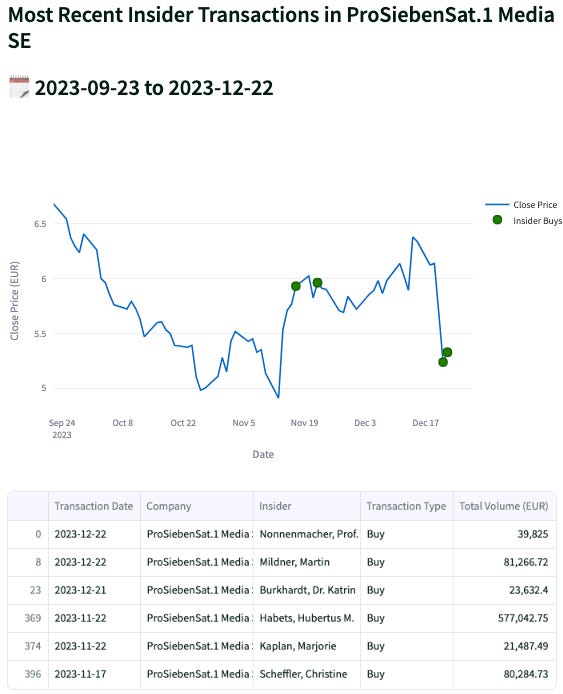

Top Insider Buys 📈

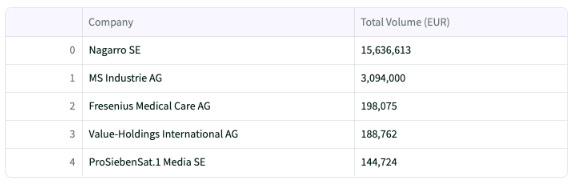

Nagarro SE (Ticker: NA9)

Nagarro is a leading global engineering and technology consulting company headquartered in Germany. With over 19,000 employees, it offers a set of services, such as digital product engineering and enterprise resource planning (ERP) and operates across the globe in 25 countries.

The company maintains several strategic partnerships and serves a wide customer base across various industries and sizes, from small enterprises to large blue-chip companies, helping its clients to innovate and adopt a digital-first approach.

It went public in 2021 as a spin-off from Allgeier SE, a Germany-based holding company that also operates in the information technology (IT) services sector. Excluding the 2021 market frenzy, where Nagarro was traded at around EUR 200 per share at its peak, it now trades around its initial public offering (IPO) levels.

The insider trade doesn't seem to be anything extraordinary, as the shares were traded within the same company, StartView. Specifically, the shares were moved from an income fund to a growth fund, both managed by StartView, the family asset management company of Vikram Sehgal, Co-founder of Nagarro.

However, based on high-level research of the company, it appears that Nagarro operates in the same sector as Reply SpA, which was covered on RhinoInsight a few months ago. Due to the strong secular trend in the IT service sector and the positive outlook regarding digitalization efforts in businesses for the foreseeable future, I've added Nagarro to my watchlist for further research.

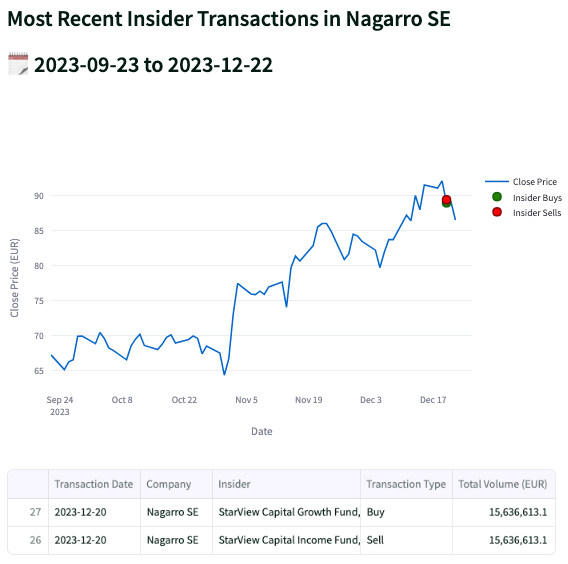

ProSiebenSat.1 Media SE (Ticker: PSM)

Cluster Buys, where multiple insiders of the same company make purchases, are often seen as a positive signal in the market. At ProSiebenSat.1, which was covered in the Insider Report Week 47, three insiders have once again made purchases last week, acquiring shares with a total value of EUR 144 thousand led by Martin Mildner (CFO).

Another interesting find is that MFE-MediaforEurope, an Italian media company largely owned by the Berlusconi family's Fininvest Group, holds about 26% of ProSiebenSat.1's shares. In the past, there have been rumours about MFE, the major investor, potentially planning to buy the company.

Top Insider Sells 📉

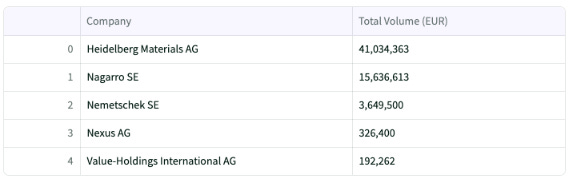

Heidelberg Materials AG (Ticker: HEI)

Last week, the world's second-largest cement manufacturer experienced another sell-off. Following the CFO's share sale, as reported in the Insider Report Week 48, Ludwig Merckle, the company's largest shareholder, offloaded shares valued at EUR 41 million through his investment firm, Spohn Cement Beteiligungen GmbH. Nevertheless, he still retains ownership of around one quarter of the company.

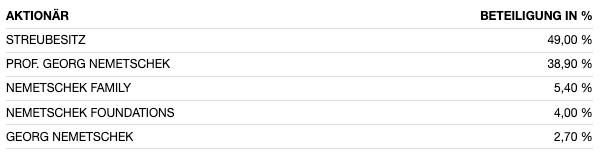

Nemetschek SE (Ticker: NEM)

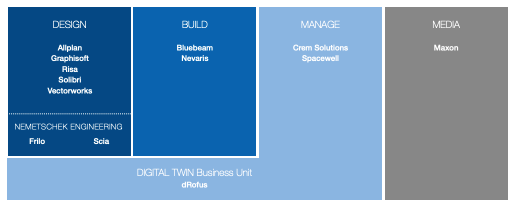

Nemetschek is a leading global software provider for digital transformation in the construction and media industry. It is one of those German quality stocks, with strong profitable growth and shareholder returns over the last decade.

The founder and Honorary Chairman of the Supervisory Board, Prof. Georg Nemetschek, sold shares valued at EUR 3.6 million last week. This sale constitutes only a small portion of his overall ownership stake in the company.

According to Nemetschek’s latest 3Q23 results, it is transitioning to a subscription and SaaS business model which brings the opportunity to generate higher revenues through up-selling and cross-selling to streamline and harmonize its brands to enhance operational efficiencies.

Furthermore, as elaborated in my recent analysis of Mensch und Maschine Software, companies like Nemetschek stand to gain from significant secular growth trends, such as the creation of digital twins, which are virtual replicas of physical assets or systems. Thus, Nemetschek is one of the top-ranking stocks on my watchlist, and I hope to own it at some point in the future.

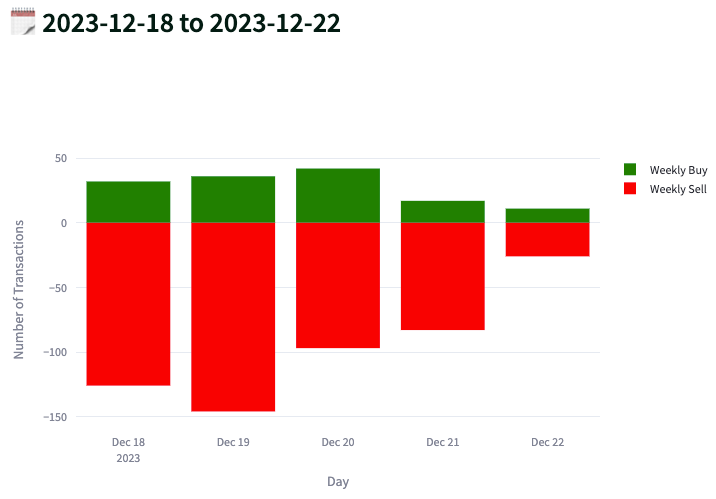

Weekly Summary of Insider Buys & Sells in 🇨🇭Switzerland

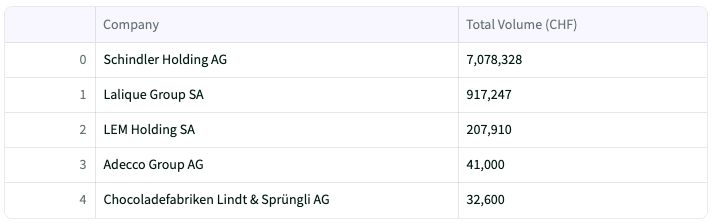

Top Insider Buys 📈

Last week, as reported in The Insider Report for Weeks 49 and 50, insider buying continued in Schindler Holding and Lalique.

Since there have been no recent or significant insider trades in the Swiss market, no businesses will be highlighted in this instance.

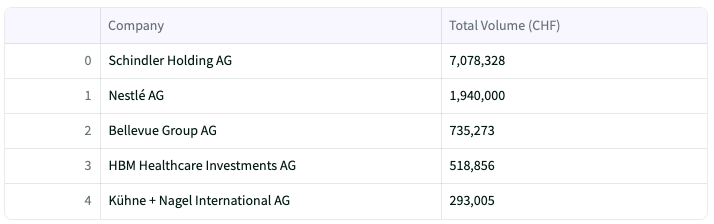

Top Insider Sells 📉

In terms of sell-side activity, Schindler stands out as the top insider sell based on volume. However, considering the exact number of shares sold and bought (as mentioned earlier), this appears to be more of a transfer of ownership rather than a straightforward sale.

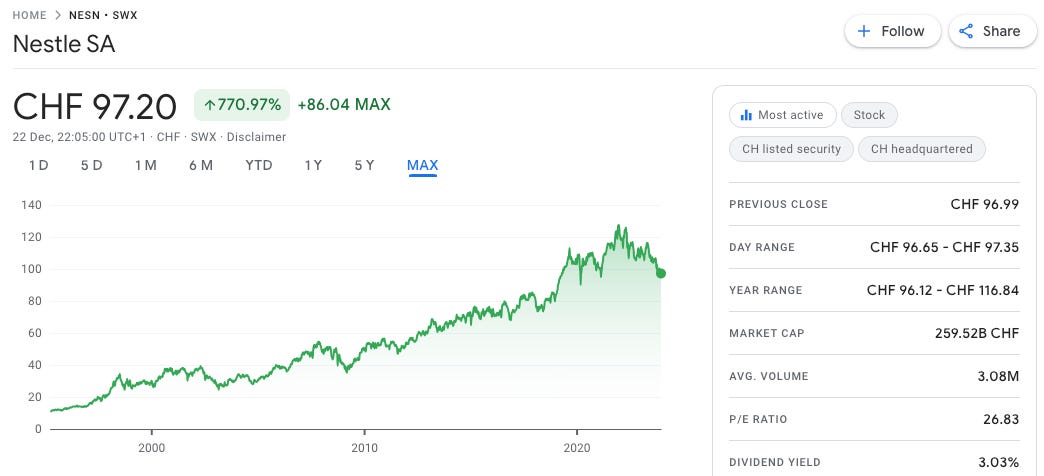

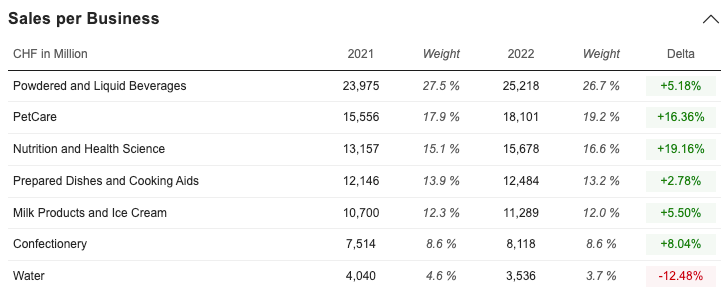

Nestlé AG (Ticker: NESN)

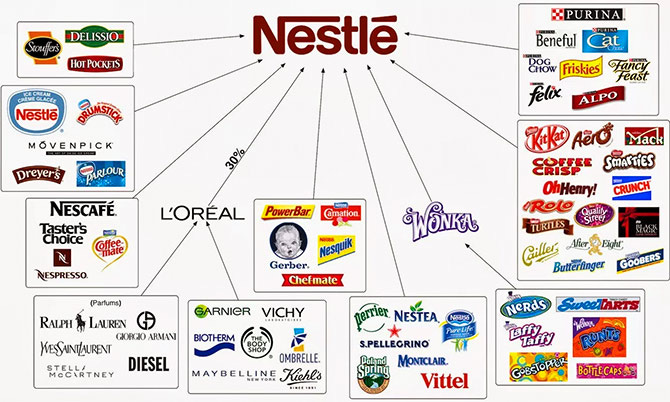

Nestlé is the world's largest, most diversified food and beverages company headquartered in Switzerland. It offers with range of products from coffee over candies to milk and water.

The supply chain issues during the pandemic, along with increased input costs, affected Nestlé's business, resulting in diminished gross profits. Furthermore, the announcement and introduction of weight-loss drugs Wegovy and Ozempic for treating type 2 diabetes by Novo Nordisk have added further pressure. This development alarmed investors and analysts due to its potential impact on food sales.

While it's important not to solely focus on the most recent news and headlines, according to CEO Schneider, Nestlé has not observed any impact from such medications on its revenue. Nestlé certainly benefits from the fact that its key product categories - coffee, pet food, and nutrition - are unaffected. The potentially affected categories are ready meals (13% of revenue) and confectioneries (8% of revenue, with very limited exposure in the USA).

Nestlé claims that only 15% of its global portfolio could be impacted, suggesting that the effect would likely be less than 1% of the total volume.

Given the market capitalization of CHF 259 billion, the recent insider sell involving shares worth a few million, represent only a minor fraction.

Weekly Summary of Insider Buys & Sells in 🇺🇸 United States

For the first time, based on the poll results here, the US market will be included in last week's Insider Report. The most significant and interesting insider trades within the US market will now be highlighted moving forward.

Top Insider Buys 📈

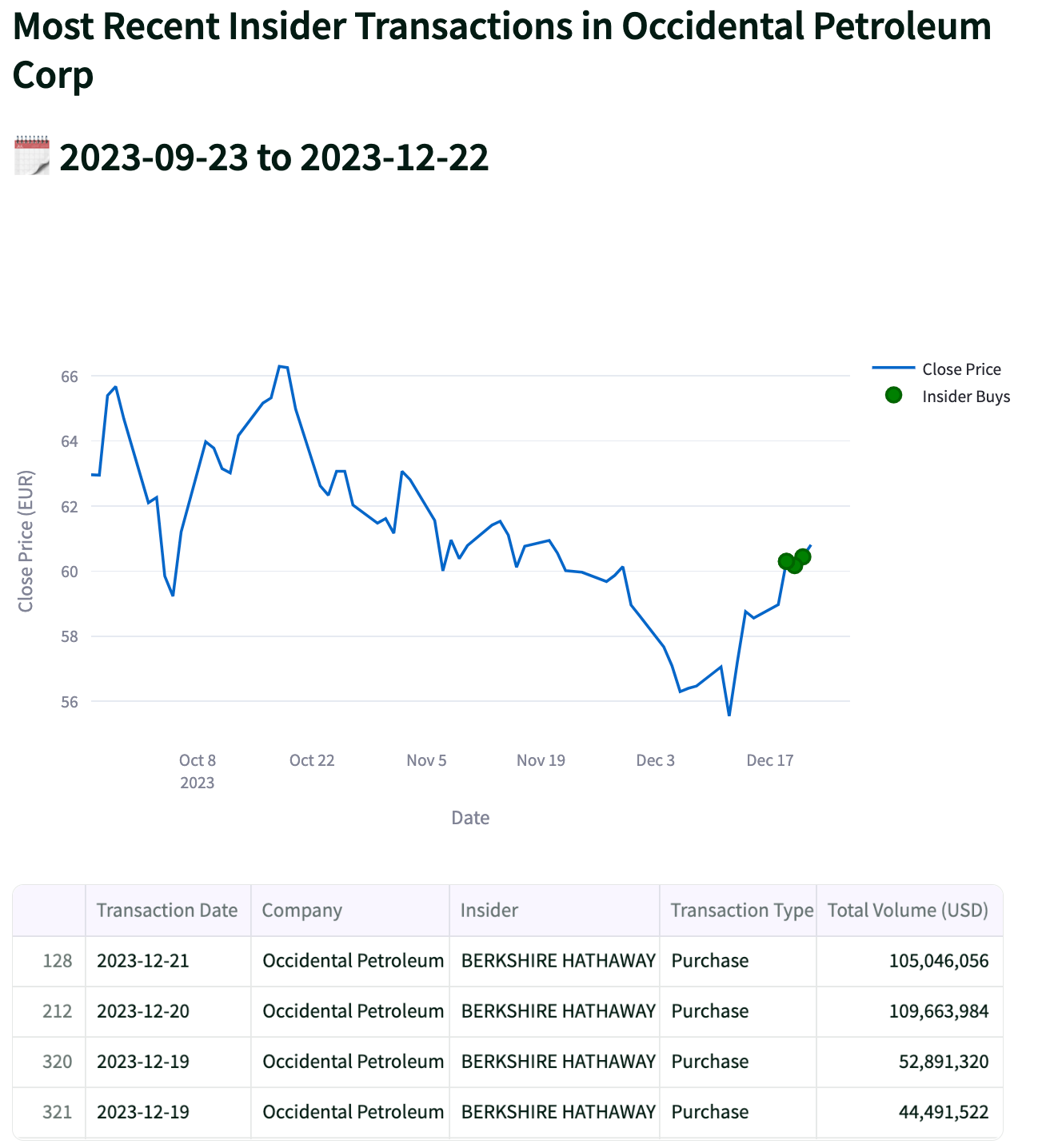

Occidental Petroleum Corp (Ticker: OXY)

Occidental is an international energy company and one of the largest oil producers in the US with operations in the U.S., Middle East, Africa, and Latin America. It has has made it onto many investors' radar thanks to Warren Buffett and Berkshire Hathaway's buying activity.

Since 2022, Berkshire has purchased 228 million shares (26% of the company), on the open market for around USD 10.5 billion. This includes shares worth more than USD 300 million, bought just in the last week.

In 2020, there were two distinct opportunities for investors: first, during the March COVID-19 pandemic flash sale, and later in November. Since then, the share prices have soared, yielding a return of over 600%. However, the company remains susceptible to fluctuations in oil prices. Its primary revenue source is drilling activities, making it highly sensitive to shifts in crude oil prices.

This year, as oil prices have returned to levels seen before the Ukraine-Russia conflict, there has been some impact on the company's earnings.

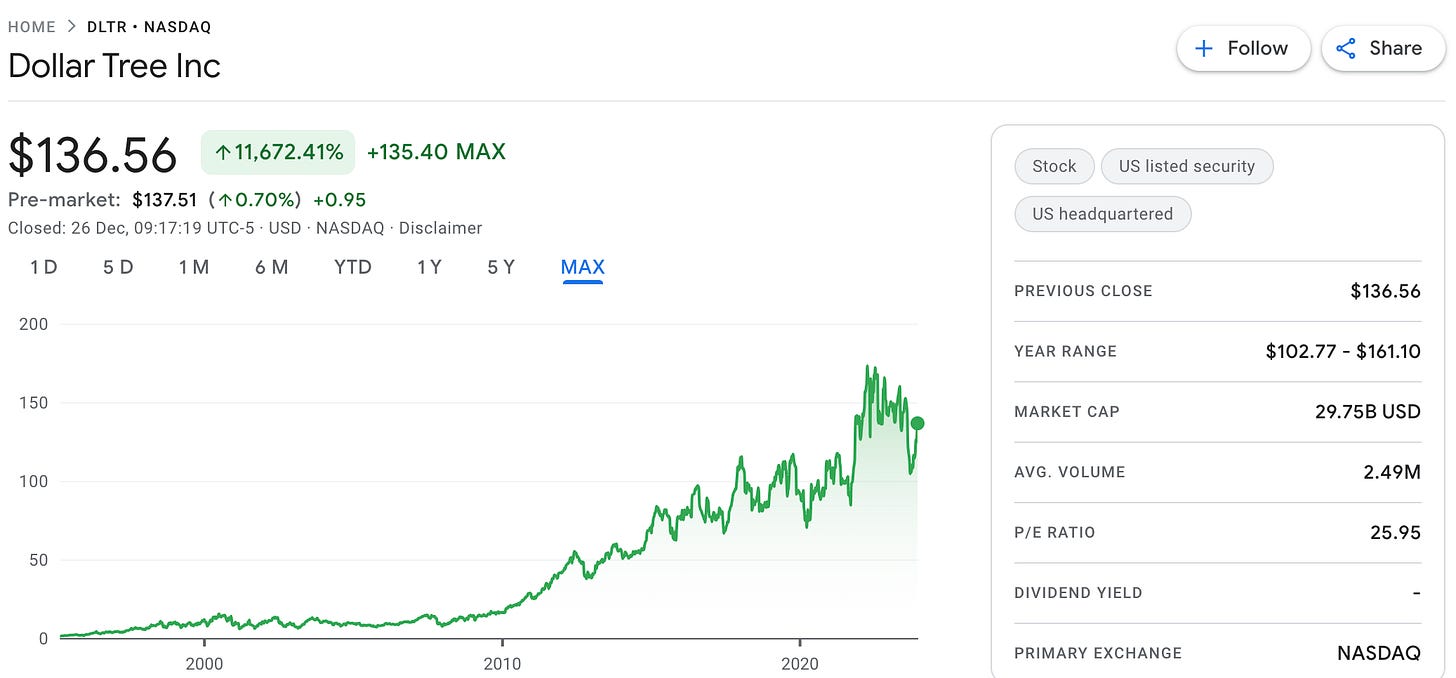

Dollar Tree (Ticker: DLTR)

Dollar Tree, along with Dollar General, are one of the leading operators of discount variety retail stores in North America. It operates over 16,000 stores in two segments, Dollar Tree and Family Dollar. The Dollar Tree segment offers merchandise at a fixed price of USD 1.25 in both the US and Canada, while its Family Dollar segment, like Dollar General, offers a broader variety of general merchandise across a wider range of price points.

In terms of share price performance, Dollar Tree is definitely one of the best-performing stocks, having outpaced some software giants like Alphabet (Google) since inception, with a return of more than 11,000%.

Activist investor Mantle Ridge, which acquired a USD 1.8 billion stake in the discount retailer in 2021, made additional investments or around USD 74.9 million last week. As a result, it now owns more than 5% of all outstanding shares, making it one of the top two shareholders in Dollar Tree stock.

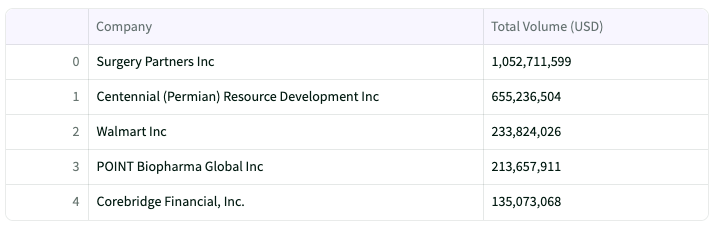

Top Insider Sells 📉

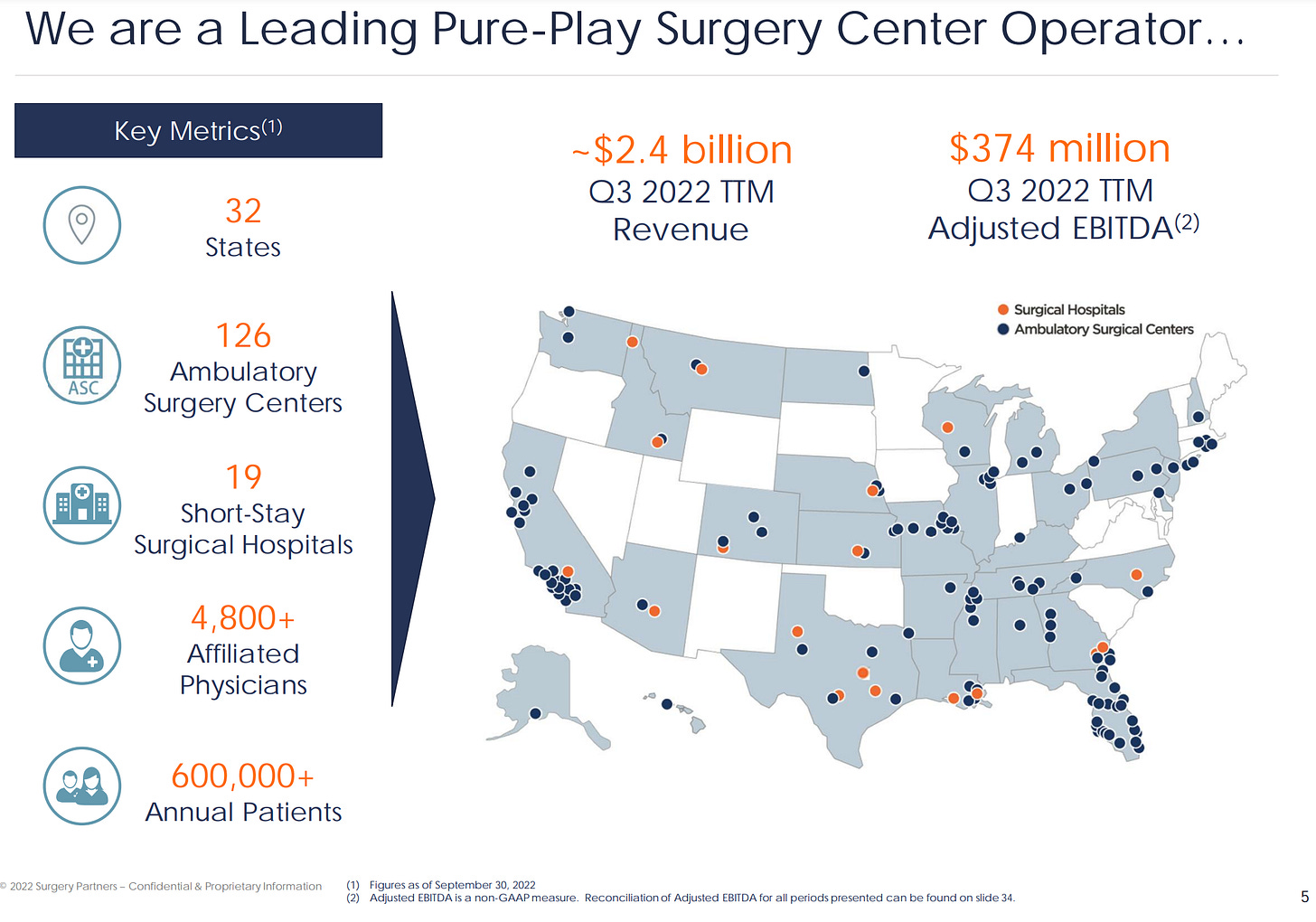

Surgery Partners (Ticker: SGRY)

Surgery Partners is a healthcare services holding company that engages in providing solutions for surgical and related ancillary care in support of its patients and physicians. It operates surgical hospitals and ambulatory surgery centers in partnership with physicians, handling the non-specialist side of the business.

.According to the company's own statement, significant demand is anticipated for the Outpatient Surgical Market, which is expected to reach a market size of over USD 90 billion due to demographic changes.

Despite the optimistic outlook, several board members, along with Brain Capital — the largest shareholder owning approximately 46% of the outstanding shares — sold shares amounting to around USD 1 billion last week.

Conclusion

Exploring US insider trades provides new chances to identify and consider notable businesses for potential investment. Since oil and gas companies fall outside RhinoInsight's scope due to their cyclicality and sensitivity to underlying commodity price fluctuations, Dollar Tree has made it onto my watchlist. It could be an interesting defensive play in the event of a recession in 2024.

Stay tuned and subscribe now to ensure you never miss out on the latest insights and analysis👇

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.

Interested in the UK being covered in upcoming issues