The Insider Report - Week 50

Unveiling the top insider buys and sells in the stock market

Welcome to the next issue of The Insider Report, your weekly deep-dive into the most significant insider transactions within the corporate landscapes.

Due to the delay in data collection and the necessary adjustments to the current Inside Out Tracker for representing insider transactions in the US market, this week's coverage will still focus on insider transactions within the German and Swiss markets.

Hopefully, as already promised last week, insider buys and sells in the US market will be included in the report starting from next week.

Weekly Summary of Insider Buys & Sells in 🇩🇪 Germany

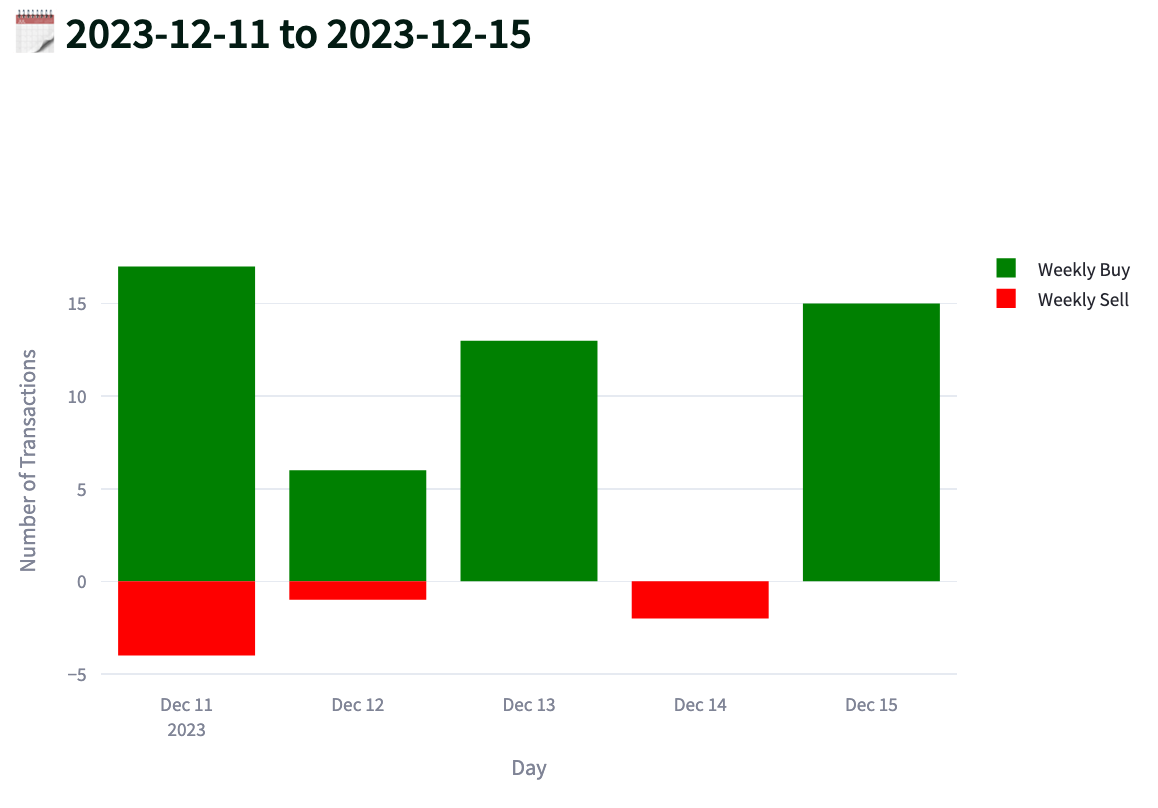

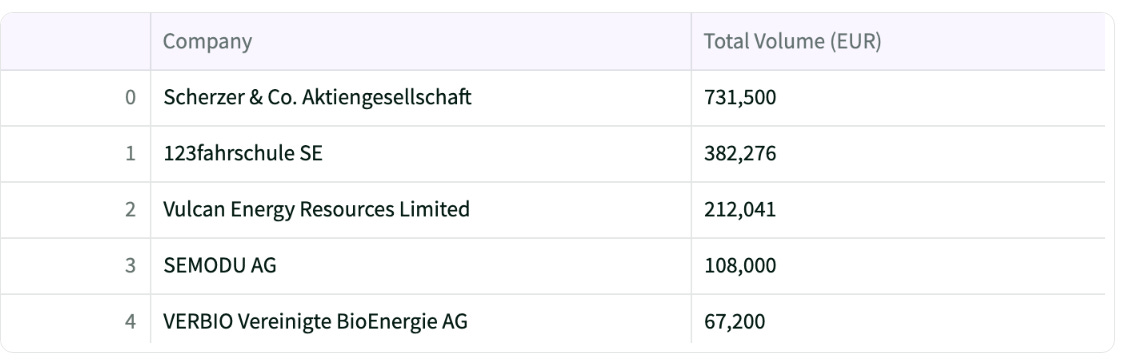

This week was once again dominated by insider buys in terms of both quantity and volume, while one of the largest single transactions by an insider also took place.

Top Insider Buys 📈

Schaeffler AG (Ticker: SHA)

Schaeffler AG, based in Germany, specializes in producing automotive parts and stands as one of the world's largest family-owned businesses. With over 1,800 patent applications in 2021, it is ranking as Germany’s third most innovative company according to the DPMA (German Patent and Trademark Office).

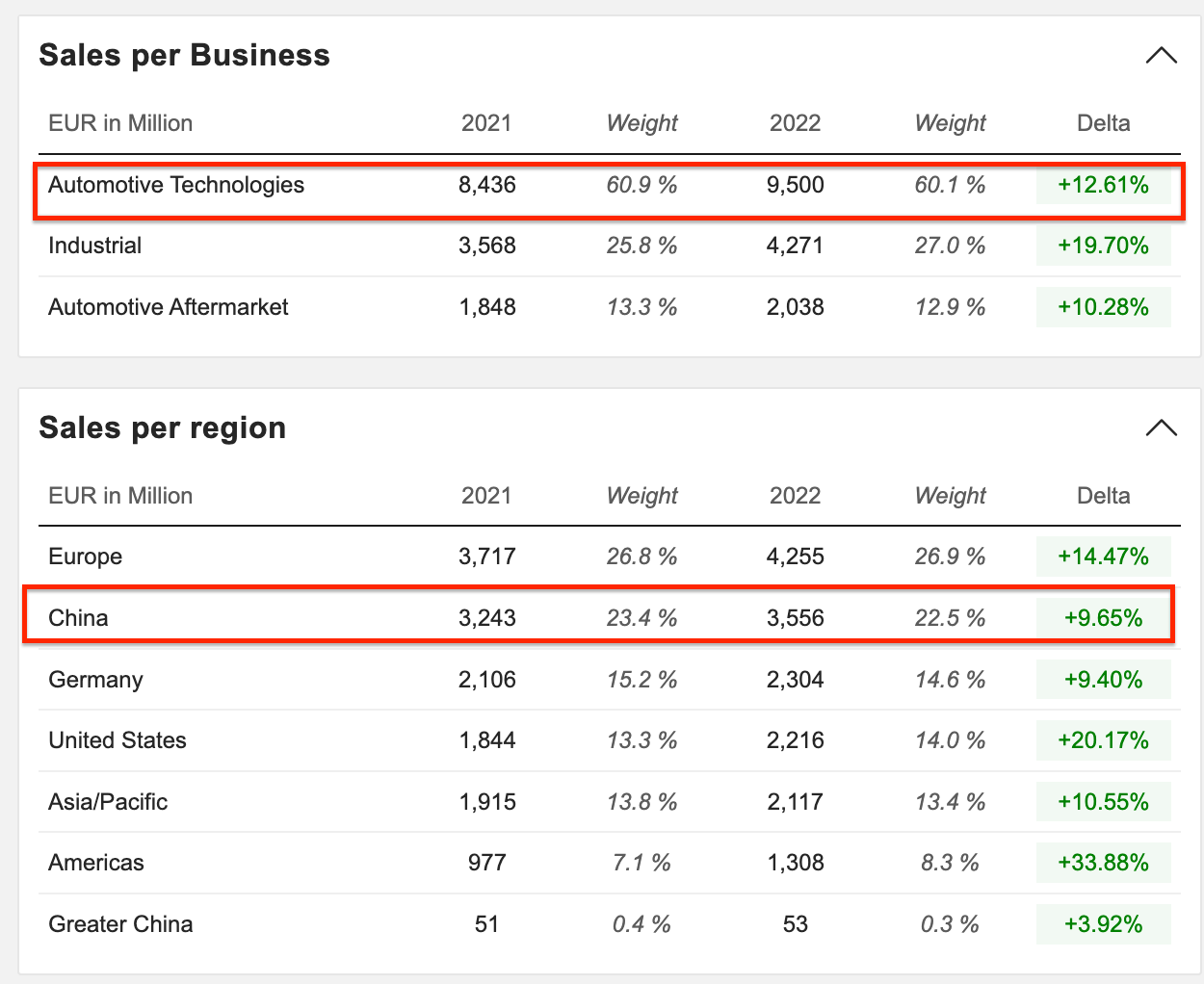

Despite robust FY22 results marked by significant revenue growth, amounting to EUR 15.8 billion (PY: 13.9 | + 14.1%), net income fell to EUR 557 million (PY: 756 million | -26%), This decline was primarily due to increased material and energy costs and disrupted global supply chains. Consequently, the non-voting preferred shares continued their downward trend, reaching record low levels.

The company's high exposure to the Automotive segment and to China, its second-largest market after Germany, has heightened investor concerns, coupled with fear of a deepening recession next year and ongoing geopolitical tensions are contributing to these worries.

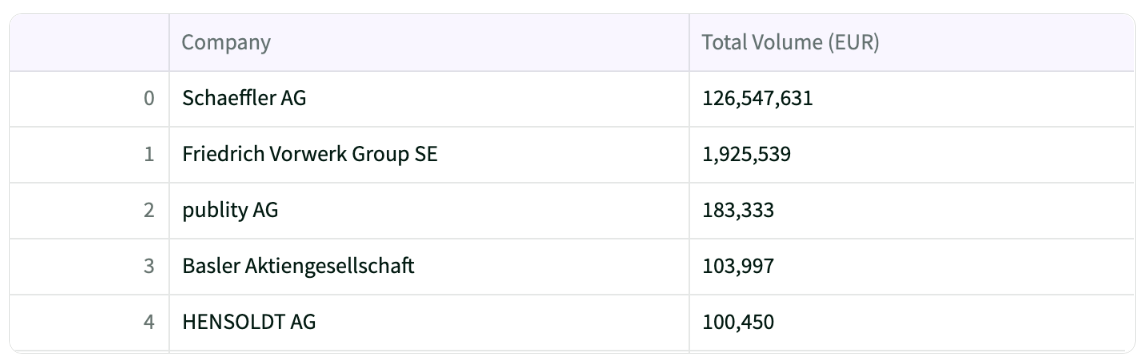

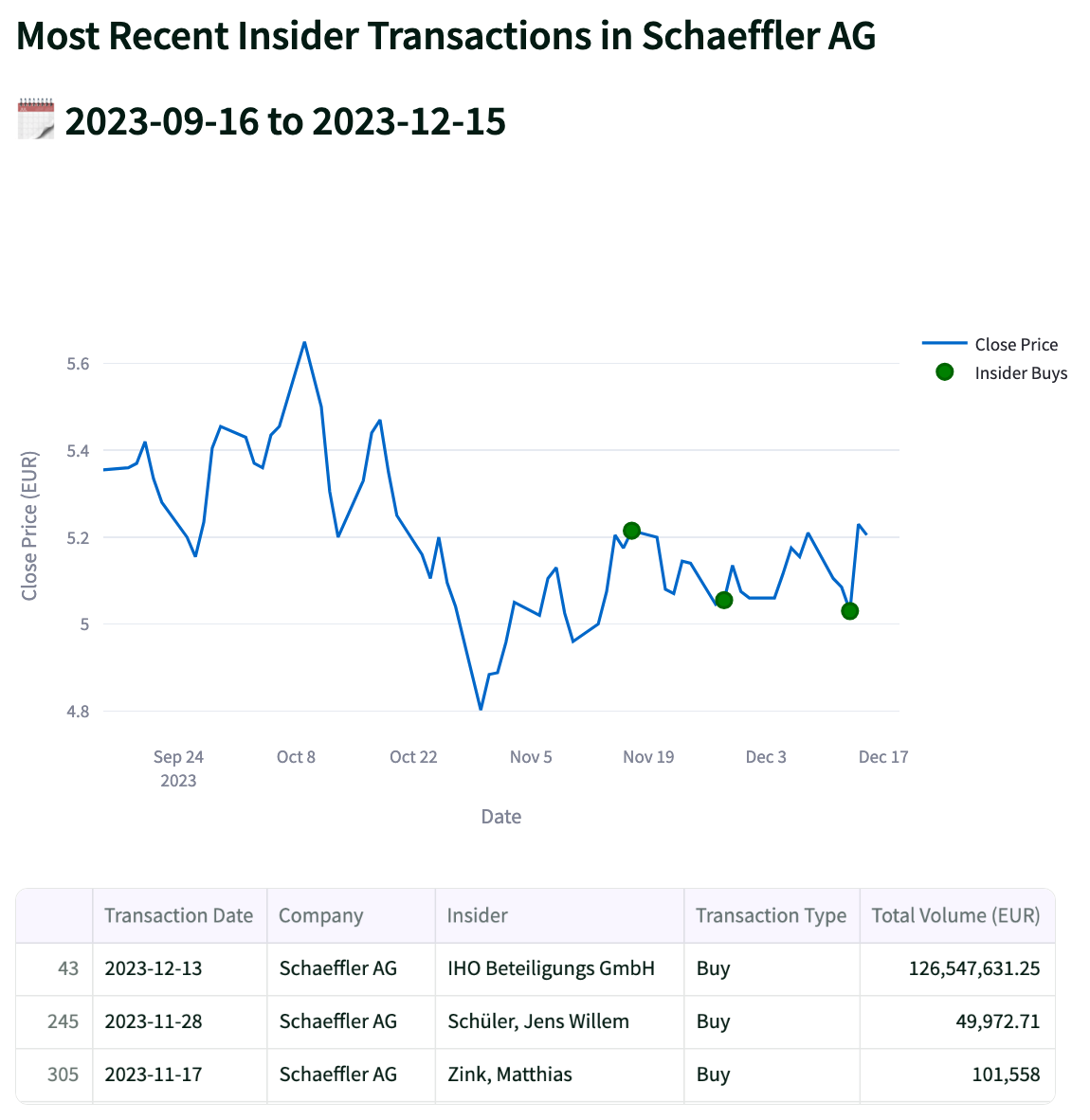

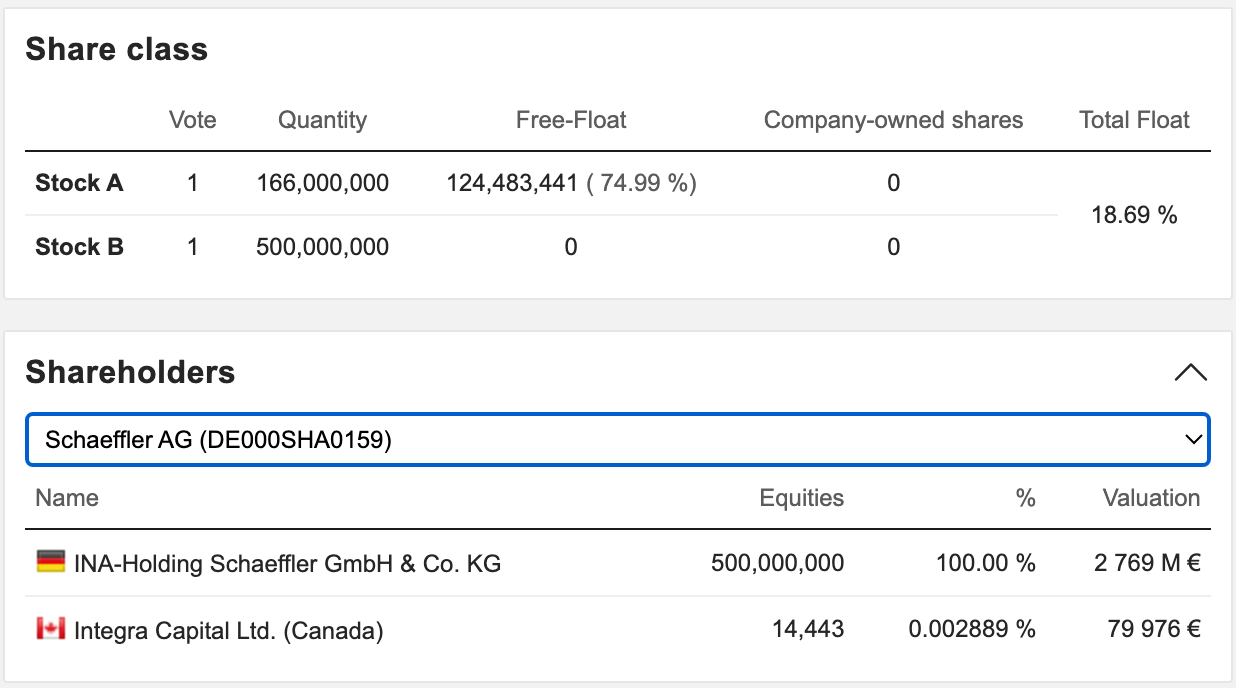

Company insiders have shown their confidence in the firm, demonstrated by continued insider buying, including a notable transaction where shares worth around EUR 126 million were purchased in one go. This significant acquisition was made by IHO Beteiligungs GmbH, a subsidiary of IHO Holding, a strategic investment holding entity owned by the Schaeffler family.

Notably, IHO Holding holds 100% of the voting rights in Schaeffler AG and also possesses a 46% stake in Continental AG, along with a 49.9% of Vitesco Technologies Group AG's shares.

Friedrich Vorwerk Group SE (Ticker: VH2)

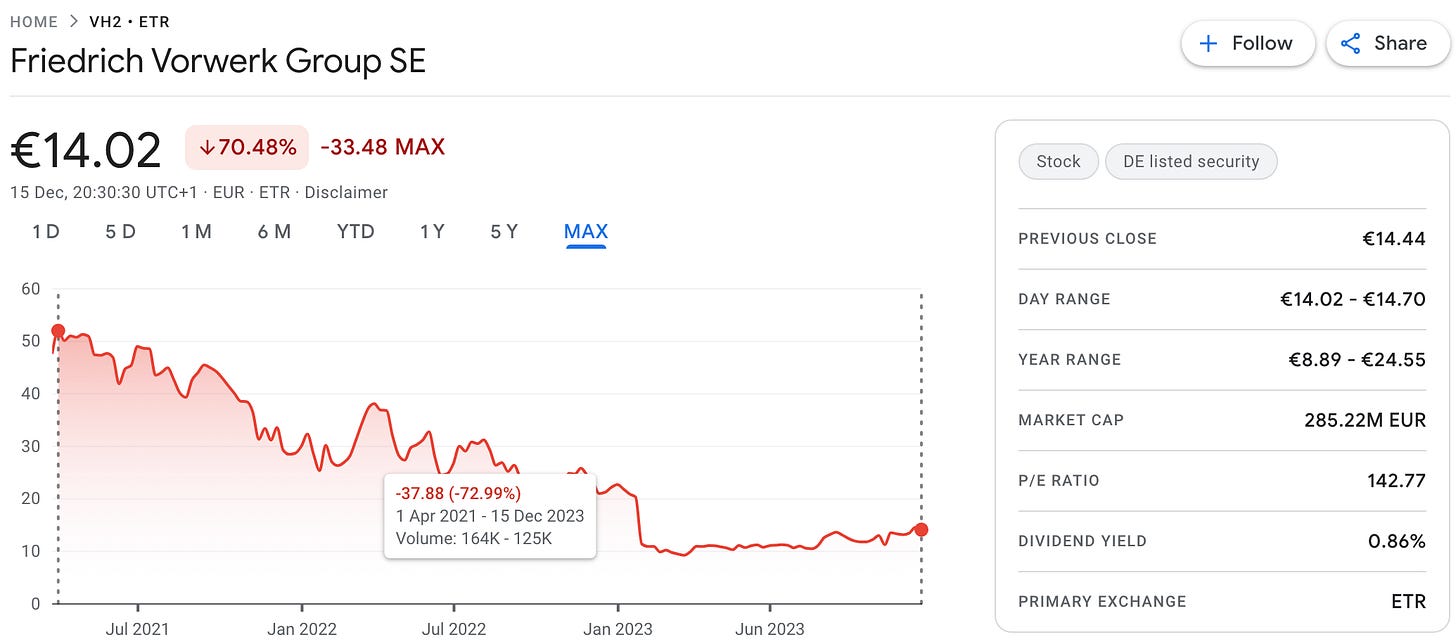

Friedrich Vorwerk Group SE, a Germany-based company specializing in energy transportation and transformation infrastructure for the gas, electricity, and hydrogen markets, successfully raised up to 414 million euros in its initial public offering (IPO) in March 2021. A total of 9.2 million shares were offered at €45 each, capitalizing on the heightened investor interest in businesses poised to benefit from Europe's clean-energy transition amid the green energy hype of 2021.

Nevertheless, shareholders might feel somewhat relieved to see the stock price increase by 26% in the last six months from its record low of EUR 9 per share. However, this recent rise doesn't completely offset the challenging times experienced over the past year, during which the stock price plummeted by over 70%.

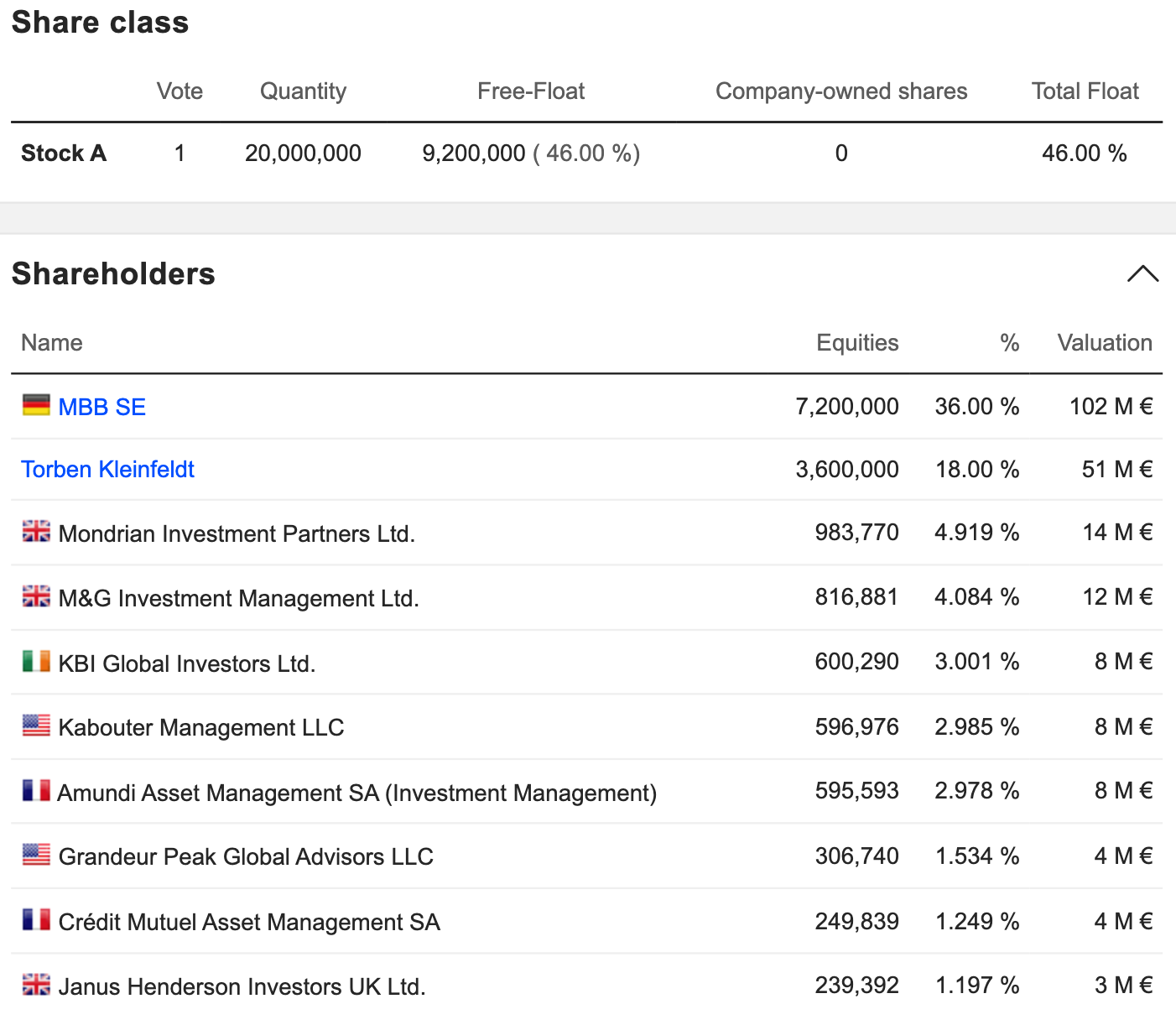

According to the 3Q23 report, the company saw its order intake surpass EUR 1 billion in the first nine months of the financial year, more than tripling the previous year's already substantial figure of €318 million. With a record-high order backlog laying a solid foundation for ongoing profitable growth, the Management Board of Friedrich Vorwerk Group SE is optimistic about the future. This positive outlook likely influenced the recent insider buying by two company insiders, including CEO Torben Kleinfeldt, through ALX Beteiligungs GmbH, who purchased shares worth EUR 1.9 million.

Notably, Torben Kleinfeldt is the second-largest owner of the company, holding 18% of the shares, following MBB SE, which has ben covered by the Insider Report Week 46.

Top Insider Sells 📉

This week, the majority of insider selling activity was seen in nano and micro-cap stocks. Thus, 123fahrschule, the first company that was featured in a deep dive on RhinoInsight, will be briefly highlighted below.

123fahrschule SE (Ticker: 123F)

123fahrschule SE, a Germany-based driving school chain, specializes in digital e-learning solutions. The company capitalizes on current market dynamics, such as the shortage and aging of driving instructors and the shift from smaller to mid-sized schools in a fragmented market.

Nevertheless, as highlighted in RhinoInsight's initial deep-dive report in June, the company's size and liquidity constraints continue to necessitate reliance on external financing for growth and investment activities. This situation led to another round of share issuance in the middle of this year, underscoring the ongoing trend.

However, despite strong 3Q23 results featuring a significant increase in sales to EUR 15.59 million for Q1-Q3 2023 (PY: 11.88 | +31%), and an improved EBITDA of EUR 0.20 million in this period – a notable 110.29% rise from the same timeframe last year (EUR -1.97 million), the share price has been quite volatile over the last few months due to the factors mentioned above.

An update to the initial write-up on 123fahrschule will soon be featured on RhinoInsight, likely next year, alongside the full year results for 2023.

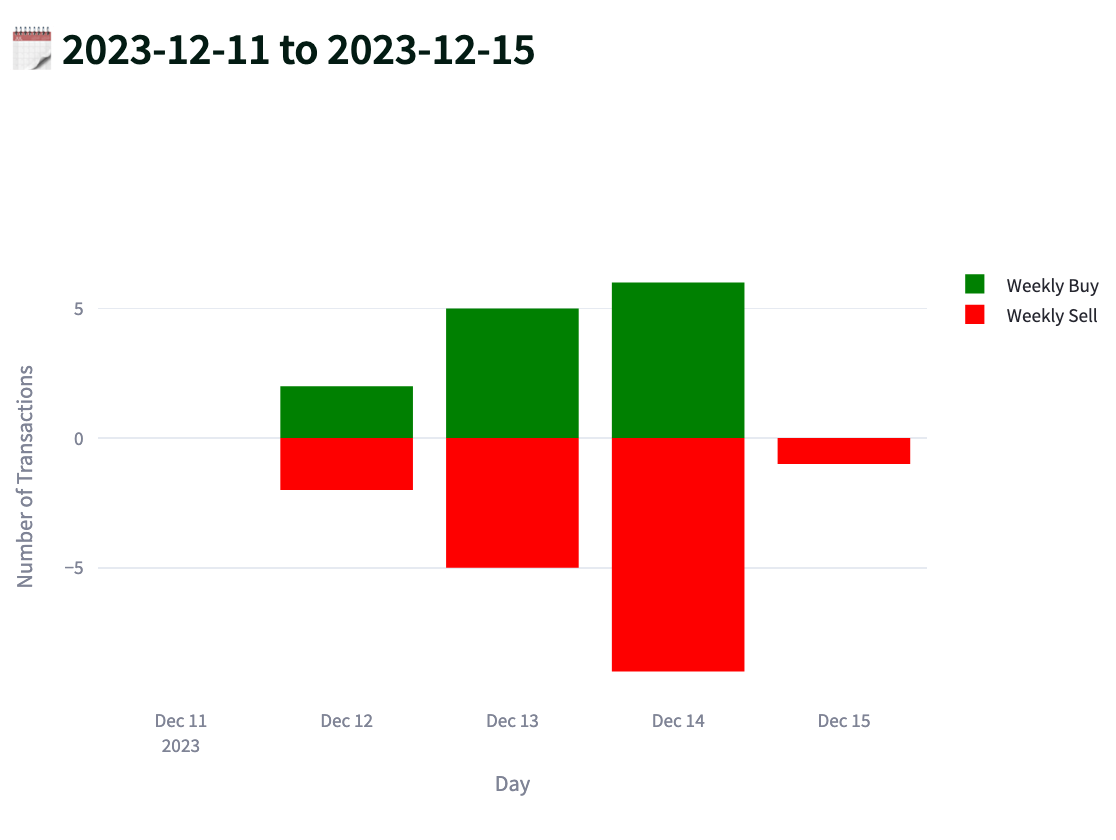

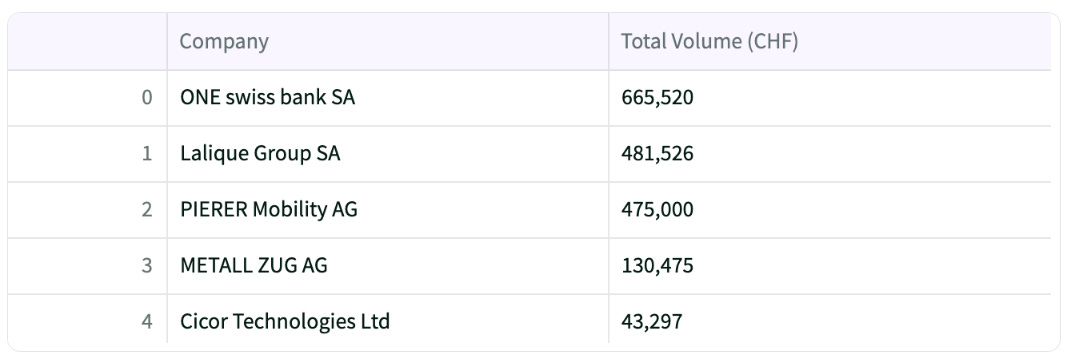

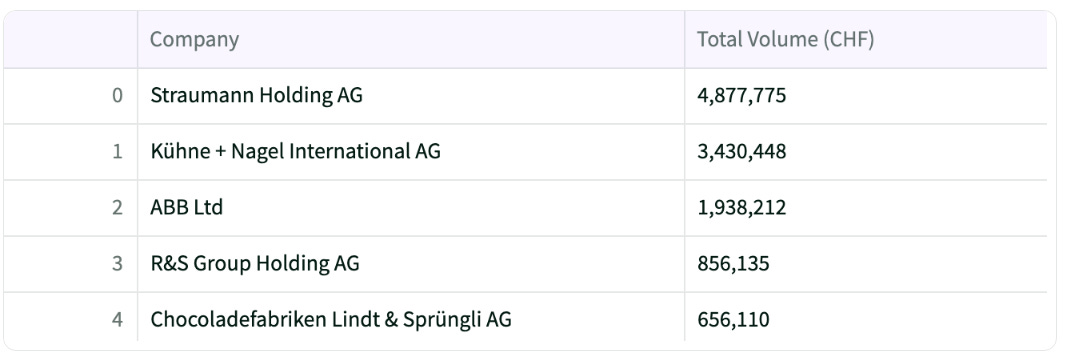

Weekly Summary of Insider Buys & Sells in 🇨🇭Switzerland

As the year end approaches, this week was clearly dominated by insider selling, marked by some significant sell-offs as highlighted below.

Top Insider Buys 📈

Lalique Group SA (Ticker: LLQ)

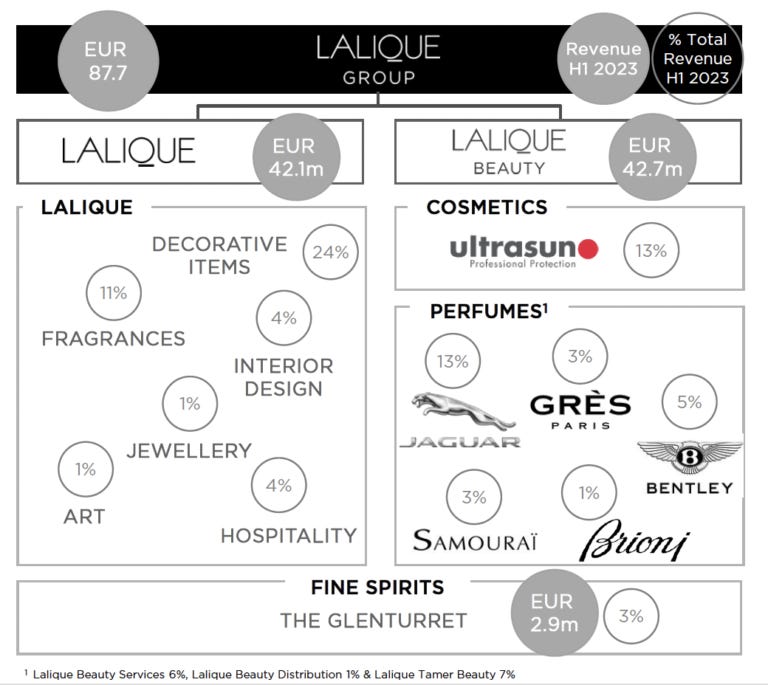

Founded in 1888 by Rene Lalique, a French jeweler, the history of Lalique spans over a century. After transitioning through generations, it was acquired in 2008 by Swiss businessman Silvio Denz's company, Art & Fragrance, now known as the Lalique Group. Today, the company has evolved into an owner of various luxury brands in the perfume, cosmetics, crystal, gastronomy, jewelry, and fine spirits industries. This includes a 50% stake in The Glenturret, a Scotch whisky distillery renowned as one of the oldest still in operation and ownership of few other well-renowned vineyards in France.

Recently, the company announced a partnership and licensing agreement with Mikimoto, a Japanese jeweler renowned for its 130-year history in jewelry and pearls, which will facilitate the creation, marketing, and distribution of perfumes and crystal products, thereby expanding the Swiss luxury group's international offerings.

Although it didn't report spectacular growth in its latest half-year 2023 results, the company's ownership and growing portfolio of luxuries such as perfume brands, hotels, restaurants, vineyards, and more, are somewhat appealing for a deep dive into the company.

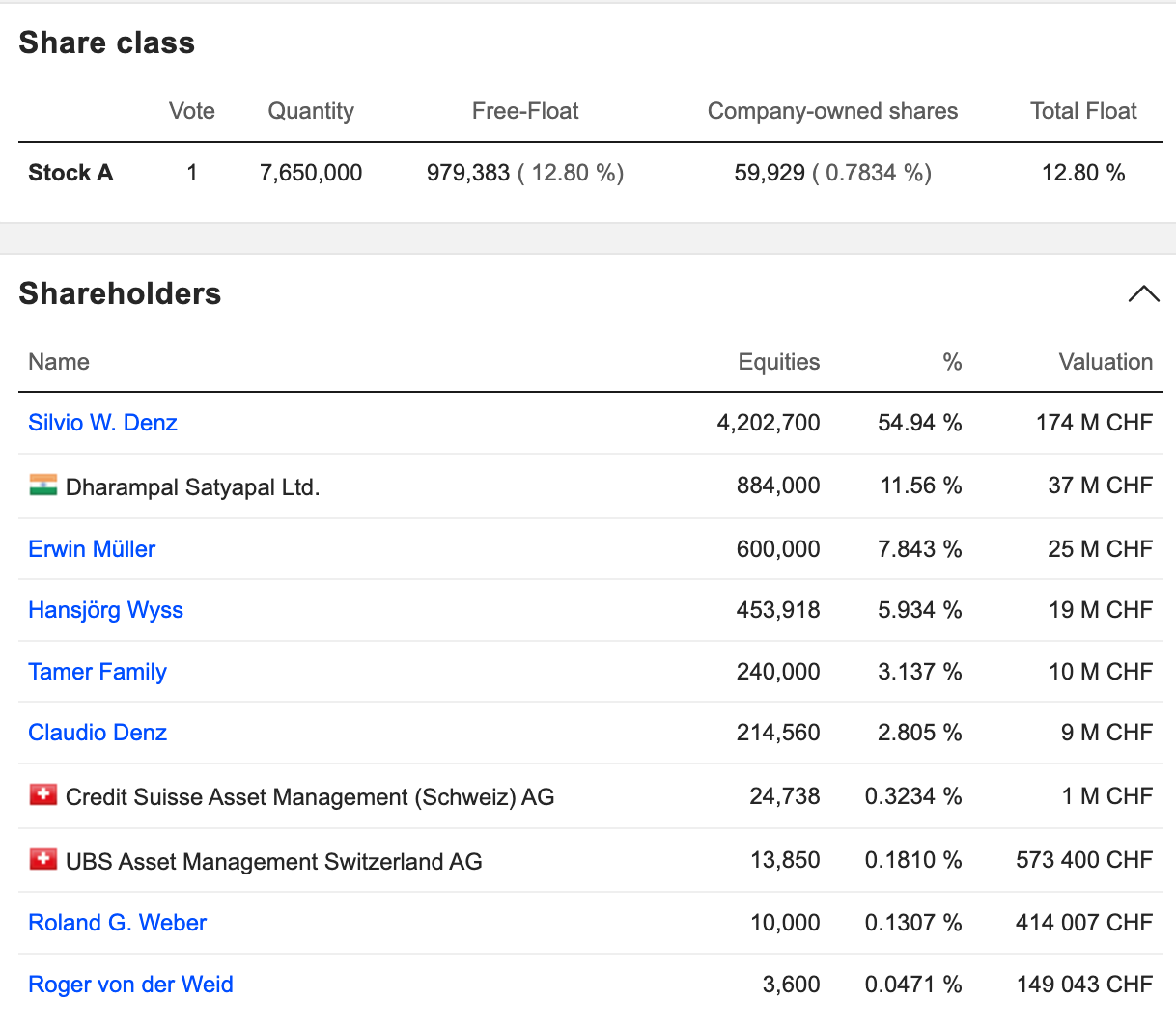

Additionally, the substantial insider ownership, led by the founder Silvio Denzer who owns over 50% of the business, further strengthens the ambition to find the next LVMH.

Top Insider Sells 📉

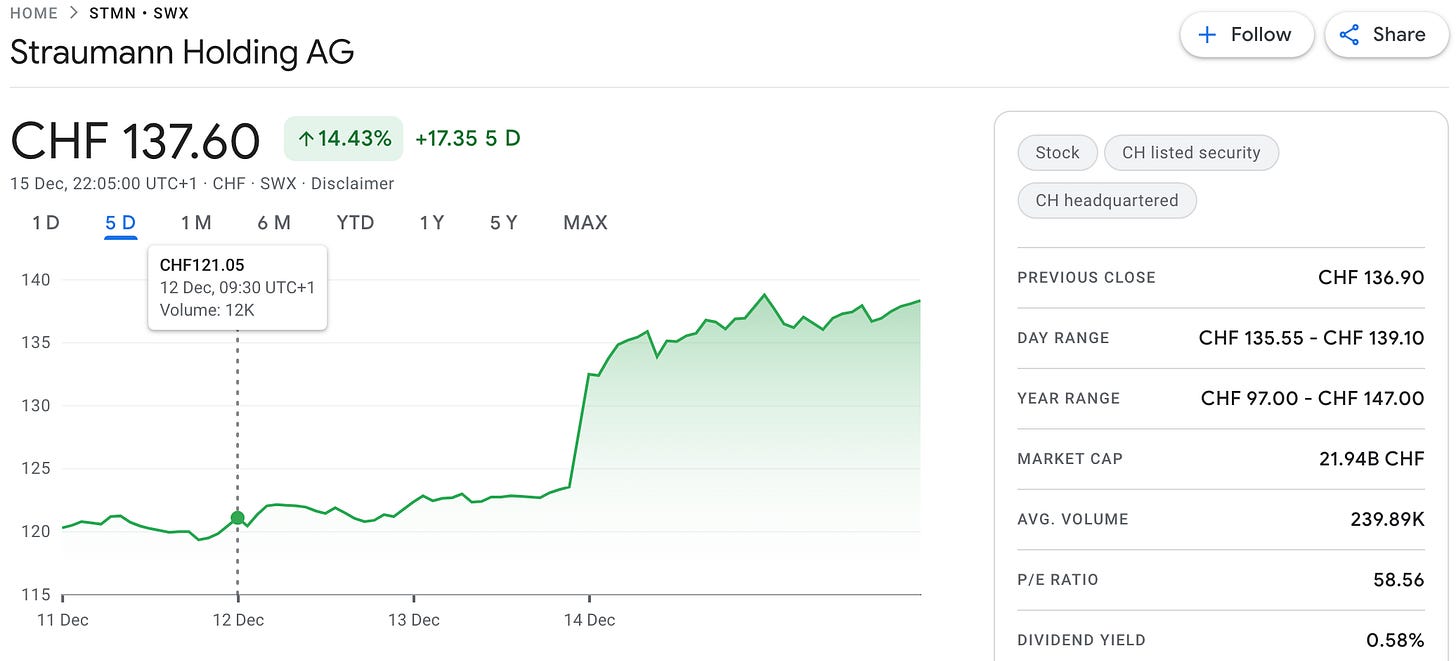

Straumann Holding AG (Ticker: STMN)

As covered in last weeks report, the sell-off of Straumann Holding shares by insiders continued this week.

Interestingly, since the recent insider selling (by non-executive member of the board of directors), the company’s shares have seen an increase of around 14% in the three trading days that followed. This also highlights that not immediately following insider actions can sometimes be even more profitable. Furthermore, as reported by newsbeezer.com — a content repository for news — Bernstein has sustained its outperformance recommendation on Straumann shares, raising the price target from 142 to 150 CHF.

Conclusion

As seen the case of Straumann Holding, insider buys or sells should not be seen as a direct signal to replicate the trade. They serve as one of many sources of inspiration for identifying interesting businesses, as was the case this week with Lalique Group, which has now been added to the watchlist for further exploration.

Stay tuned and subscribe now to ensure you never miss out on the latest insights and analysis👇

Disclaimer: This publication and its authors are not licensed investment professionals. The information provided in this publication is for educational purposes only and should not be construed as investment advice. We do not make any recommendations regarding the suitability of particular investments. Before making any investment decision, it is important to do your own research. RhinoInsight assume no liability for any investment decisions made based on the information provided in this newsletter.